Top UK Stocks to Watch: Unilever targets 3% to 5% underlying sales growth

Top News: Unilever protects cash in 2020 as revenue and profits fall

Unilever said it protected its dividend and cashflow in 2020 during a tough year that resulted in lower revenue and profits, but said it intends to return to growth this year.

The consumer goods giant – which owns brands spanning from Domestos bleach to Hellmann’s mayonnaise – said annual revenue fell to EUR50.72 billion from EUR51.98 billion the year before. Unilever said this was primarily down to unfavourable exchange rates, with revenue rising 3.5% at constant currency. Underlying revenue was up 1.9% in the year.

Operating profit fell to EUR8.30 billion from EUR8.70 billion while pretax profit dipped 3.5% to EUR7.99 billion from EUR8.28 billion. Notably, net profit increased 0.8% to EUR6.07 billion from EUR6.02 billion.

‘Early in the year, we refocused the business on competitive growth, and the delivery of profit and cash as the best way to maximise value. We have delivered a step change in operational excellence through our focus on the fundamentals of growth. As a result, we are winning market share in over 60% of our business in the last quarter, on the basis of measurable markets,’ said chief executive Alan Jope.

Notably, its focus on protecting cash delivered free cashflow of EUR7.7 billion in the year, up from EUR6.2 billion in 2019. That allowed Unilever to protect its dividend through the year too and prompted it to raise its fourth-quarter payout by 4% to 42.68 euro cents.

‘Today we are setting out our plans to drive long term growth through the strategic choices we are making and outlining our multi-year financial framework. While volatility and unpredictability will continue throughout 2021, we begin the year in good shape and are confident in our ability to adapt to a rapidly changing environment ,’ said Jope.

It said it intends to focus on high growth areas by making organic investment and through acquisitions, while accelerating its expansion in the US, India and China. It also wants to drive forward its ecommerce and digital sales channels.

As a result, Unilever is targeting to deliver underlying sales growth in the range of 3% to 5% and to increase annual profit growth going forward, while maintaining strong cashflow and delivering over EUR2 billion of annual savings. It said it will spend around EUR1 billion on restructuring in 2021 and 2022 before costs start to fall.

Unilever is targeting net debt to underlying earnings of around 2x, and return on invested capital in the ‘mid-to-high teens’. Net debt stood at EUR20.9 billion at the end of the year, equal to about 1.8x underlying earnings. ROIC came in at 18% in 2020, down from 19.2% in 2019.

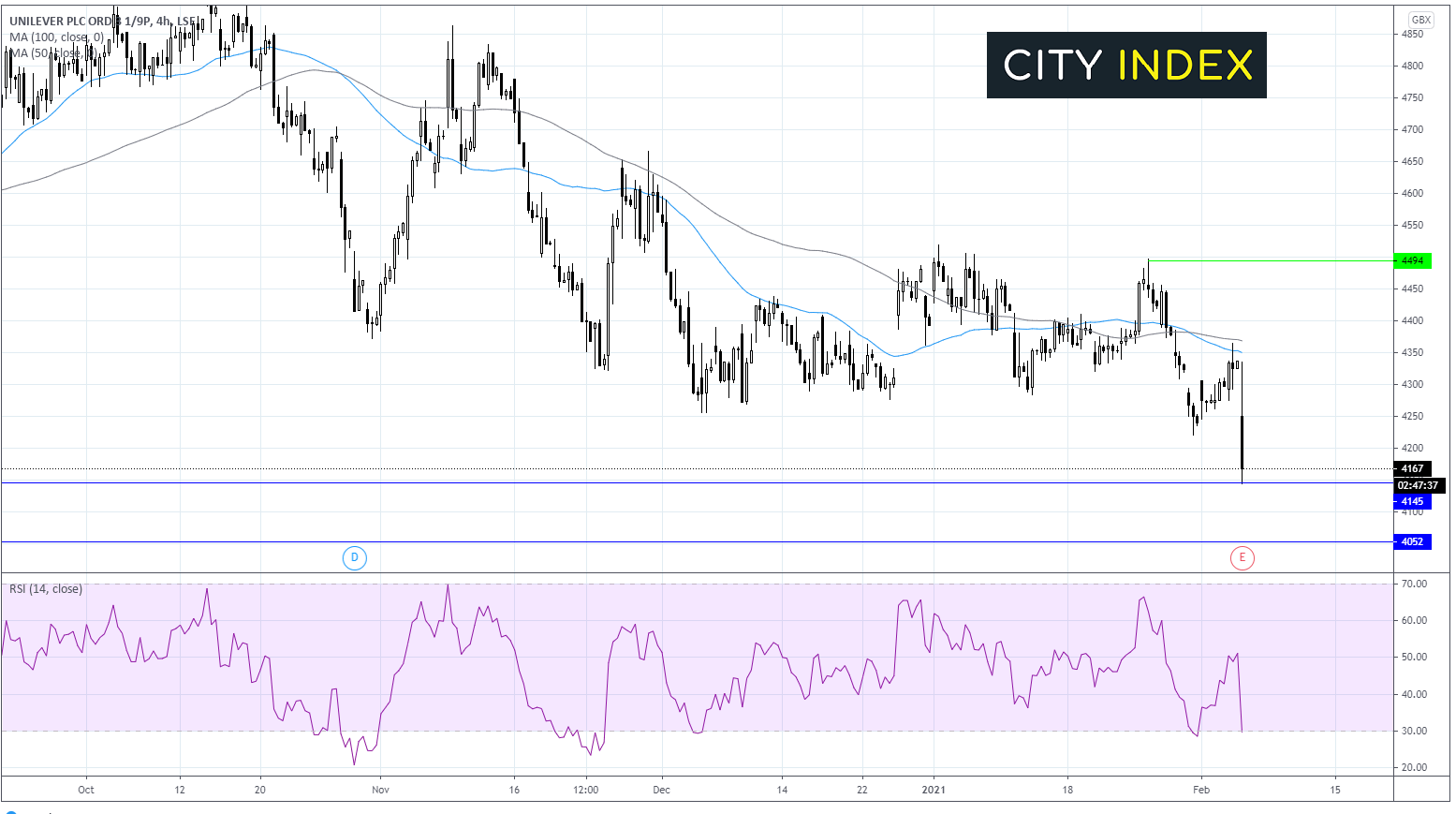

Unilever share price: technical analysis

Unilever shares have been trending lower since mid-October, although the selloff had lost momentum since the start of the year.

On the 4 hour chart Unilever share price trades below its 50 & 100 sma. The 50 sma also crossed below the 100 sma in a bearish signal. The RSI is supportive of further losses, potentially until it reaches over sold territory. Once is reaches 70 on the RSI a slight pullup could be on the cards although the bias remains bearish across multiple time frames.

Immediate support can be seen at 4145, today’s low and the low from July 10. Beyond here the bears could target 4050 low May 22nd, before the psychological 4000 level.

With a long wick at the top of the candle a reversal higher looks unlikely. However, any attempted rebound would need to over come 4350 the 50 sma before targeting 4500, a key level for the bulls.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Royal Dutch Shell sinks to $21.7 billion loss in 2020

Royal Dutch Shell said it sank to an almighty loss of $21.68 billion in 2020 as the coronavirus pandemic weighed on demand and prices.

The humungous loss compares to a $15.84 billion profit in 2019. Adjusted earnings for the year plummeted to $4.84 billion from $16.46 billion the year before.

Shell’s organic free cashflow held up better during the year, dropping to $17.63 billion from $20.11 billion in 2019. Shell declared a fourth-quarter dividend of 16.65 cents, up around 4% year-on-year and in line with the payout made in the third quarter. Shell recommitted to its plans to grow its dividend from the first quarter of 2021, which should rise to 17.35 cents.

‘2020 was an extraordinary year. We have taken tough but decisive actions and demonstrated highly resilient operational delivery while caring for our people, customers and communities. We are coming out of 2020 with a stronger balance sheet, ready to accelerate our strategy and make the future of energy. We are committed to our progressive dividend policy and expect to grow our US dollar dividend per share by around 4% as of the first quarter 2021,’ said chief executive Ben van Beurden.

Capital expenditure for the year was cut to $18 billion from $24 billion in 2019, and below its original budget of $20 billion. Net debt was cut to $75 billion at the end of 2020 from $79 billion at the end of 2019.

Results for the final quarter of the year saw Shell swing to a loss of $4.01 billion from a $965 million profit the year before, while adjusted earnings plunged to $393 million from $2.93 billion. Organic free cashflow plunged to just $871 million in the quarter from $3.92 billion the year before.

Shell intends to update shareholders on its outlook and longer-term plans during a strategy day on February 11.

Shell shares were up 0.2% in early trade at 1268.5.

JD Sports raises £464 million through discounted placing

JD Sports said it has raised £464.2 million by issuing new shares under a placing announced yesterday, priced at a discount of 795.0 pence.

The company has issued 58.39 million new shares – equal to about 6% of its existing issued share capital – as part of the placing. The price was a 2.5% discount from the mid-market closing share price of 815.0p on February 3.

JD Sports announced the placing late yesterday afternoon, stating the funds would help it expand and ‘capitalise on acquisition opportunities as it builds on the success of its international growth strategy’.

‘The directors of the group believe there are a number of potentially attractive acquisition opportunities that will become available in due course and which will continue to support the group's successful global expansion strategy,’ JD Sports said yesterday.

JD Sports shares were down 0.1% in early trade at 815.8.

Barratt restarts dividends as house building reaches record high

Barratt Developments posted growth in revenue and profits in the first half of its financial year as it built more homes and sold them at higher prices, prompting it to restart dividend payments after suspending them when the pandemic erupted last year.

Barratt built 9,077 homes in the six months to the end of December, up from 8,314 the year before. It said this was a record number for an interim period. Meanwhile, the average price of its homes edged up to £319,500 from £312,000. This allowed revenue to jump over 10% to £2.49 billion from £2.26 billion.

It also posted a better adjusted operating margin of 20.3% compared to 19.4%, although its reported margin dipped to 17.0% from 18.6%.

Still, pretax profit for the period edged 1.7% higher to £430.2 million from £423 million.

With results headed in the right direction and net cash jumping to over £1.1 billion from just £433 million at the end of 2019, Barratt said it had decided to restart dividends by making a 7.5p payout.

‘We have also made a solid start to the second half and are now over 95% forward sold for our financial year. Whilst we are mindful of the continued economic uncertainties, the housing market fundamentals remain attractive and our outlook for the full year remains in line with expectations. We will continue to lead the industry in quality and service as we deliver the high quality sustainable homes and developments the country needs, creating jobs and supporting the economic recovery across England, Scotland and Wales,’ said chief executive David Thomas.

Barratt said it expects to complete around 15,250 to 15,750 homes over the full year to the end of June as a whole, in line with previous guidance. It said it had strong forward sales of 14,289 homes at the end of January, a marked improvement from just over 13,000 homes a year ago. Of those forward sales, 11,588 are due to be delivered after the end of March 2021.

Barratt shares were up 2.8% in early trade at 693.7.

BT Group sees revenue and profits fall in 2020

BT Group said revenue and profits both declined in the first nine months of its financial year thanks to the coronavirus pandemic, lower sales of older legacy products and because it sold off businesses in Spain, Latin America and France.

The telecoms giant said revenue fell 7% in the nine months to the end of December to £16.05 billion from £17.24 billion the year before, with pretax profit plunging 17% to £1.59 billion from £1.91 billion. Adjusted revenue was down 6% and adjusted earnings before interest, tax, depreciation and amortisation dipped 5% to £5.60 billion from £5.90 billion.

‘We delivered results in line with our expectations for the third quarter and remain on track to deliver our 2020/21 outlook despite even greater Covid-19 restrictions than previously forecast,’ said chief executive Philip Jansen.

BT Group said its guidance for the full year to the end of March remains unchanged, with Ebitda to be between £7.3 billion to £7.5 billion. For context, that would be down from £7.9 billion in the last financial year.

‘With no material impact expected from the Brexit deal and our resilient results so far this year I remain confident in our EBITDA expectation of at least £7.9bn for 2022/23. Looking further ahead our new Digital unit will enable us to accelerate our digital and business transformation programmes and to deliver digital platforms that bring together best-in-class services for our customers, further securing a brighter and more sustainable future for the group,’ Jansen said.

However, it did adjust the targeted range for normalised free cashflow to £1.3 billion to £1.5 billion. Its previous target range was between £1.2 billion to £1.5 billion. Normalised free cashflow fell 17% in the nine-month period to £830 million thanks to lower earnings and a 5% increase in capex of £3.03 billion.

BT Group shares were down 1% in early trade at 127.05.

Severn Trent says positive momentum continued through winter

Severn Trent said it has continued to deliver a ‘strong operational performance’ and deliver ‘resilient financial results’ since the start of October, keeping it on course to meet expectations for the full financial year.

The water utility company said it had ‘invested wisely and worked tirelessly to outperform’ the wider market, and said it should deliver its ‘best ever performance on a number of measures’ during the current financial year that runs until the end of March.

‘We remain on or ahead of target for almost 80% of our customer performance measures and so we are pleased to increase our guidance for outperformance on Customer ODIs this year from 'at least £25 million' to 'at least £50 million’,’ said Severn Trent.

The company said its outlook for the year remains stable and that its dividend will be in line with expectations.

Severn Trent will release annual results on May 26.

Severn Trent shares were down 1% I nearly trade at 2342.0.

Compass Group profitability improves as sales continue to slide

Food service outfit Compass Group said organic revenue plunged by over one-third during the first quarter of its financial year but said this was an improvement compared to previous quarters.

The 33.7% year-on-year decline in organic revenue in the first quarter of its financial year compared to a 34.1% decline in the fourth quarter of the last financial year and the 44.3% decline reported the quarter before.

Its operating margin has continued to slowly improve, up 2.7% in the first quarter from the year before. That compares to a mild 0.6% year-on-year rise in the fourth quarter and the 4.8% contraction reported the quarter before.

Compass Group said its operations are now running profitably in all regions thanks to cost cutting, resizing operations and renegotiating some of its contracts.

‘Although the news around vaccinations is encouraging, the pace of volume recovery remains uncertain. As we enter the second quarter with varying lockdown measures in place across our key markets, we anticipate that Q2 revenues and volumes will be broadly in line with Q1. Despite this, we expect second quarter operating margin to improve by a further 50-100bps,’ said Compass Group.

‘We are encouraged by the strong pipeline of new business which includes first time outsourcing and share gains, particularly in the more defensive sectors of Healthcare & Seniors, Education and Defence, Offshore & Remote. We are confident in our ability to rebuild our Group underlying margin above 7%, before we return to pre-COVID volumes,’ it added.

Compass Group will release a pre-close trading update for its interim results on March 25 and release the actual results on May 12.

Compass Group shares were up 3.9% in early trade at 1401.0.

AstraZeneca secures Forxiga approval in China

AstraZeneca said it has secured approval for Forxiga to help reduce the risk of heart failure in China.

The pharmaceutical firm said Forxiga was the ‘first SGLT2 inhibitor approved in China for heart failure with reduced ejection fraction in adult patients with and without type-2 diabetes’.

‘There is no known cure for chronic heart failure except for heart transplantation, which is why there is an urgent need for new treatment options that can improve symptoms and help patients live longer. This approval marks another important step forward in our ambition to improve outcomes for millions of people worldwide living with this life-threatening disease,’ said Mene Pangalos, executive vice president of the company’s biopharmaceuticals division.

Forxiga is already approved in the US, Europe, Japan and several other countries.

AstraZeneca shares were up 1.4% in early trade at 7403.0.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Renishaw expects big jump in profits as it drastically cuts costs

Renishaw said revenue suffered a mild dip in the first half of its financial year but profits soared after it resized the business and cut operating costs.

The engineering firm, which focuses on precision measurement tools and healthcare products, said revenue fell to £255.1 million in the six months to the end of December from £259.4 million the year before. Although it delivered strong growth in the APAC region this was offset by falls in revenue in the Americas and EMEA regions.

However, adjusted pretax profit soared to £43.4 million from £14.3 million the year before, ‘primarily due to the reduced operating costs’. Reported pretax profit surged even higher to £63.9 million from £9.9 million after it booked a £20.5 million gain on investments that is excluded from the adjusted figure.

This has given it the confidence to reinstate the dividend at 14p for the period, which will be paid on April 6 to shareholders on the register on March 5.

‘The board remains confident in the long-term prospects for the group due to its strong financial position, the high quality of our people, our innovative product pipeline, extensive global sales and marketing presence and relevance to high-value manufacturing,’ said Renishaw.

‘Whilst the trading environment remains uncertain as a result of the pandemic, we currently have a strong order book, and we are well placed to take advantage of the opportunities presented by any recovery in the global economy. At this stage, we expect full year revenue to be in the range of £515 million to £545 million. Adjusted profit before tax is expected to be in the range of £85 million to £105 million,’ the company added.

For context, Renishaw delivered £510.2 million in revenue in the last financial year and adjusted pretax profit of £48.6 million.

Renishaw shares were down 2.5% in early trade at 5973.0.

Cranswick to beat expectations as momentum builds

Cranswick said the strong revenue and earnings momentum experienced in the first half of the financial year has continued into the third quarter, putting it on course to beat expectations for the full year.

The food company, which sells the likes of pork, gammon, cooked meats and ingredients, said UK retail demand remained strong in the latest quarter covering the 13 weeks to December 26, as consumers continued to eat more at home during lockdown. It said sales were higher year-on-year during the Christmas period but warned UK pig prices had fallen by about 9% year-on-year.

Exports to the Far East fell as expected because more product was shifted to the UK market and because its licenses allowing it to export goods to China from Northern Ireland and Norfolk were suspended temporarily.

‘The licence for the Northern Ireland facility was reinstated on 23 November 2020 and we expect exports to resume from the Norfolk facility in the coming weeks,’ Cranswick said.

Cranswick said it has continued to invest in its assets to help improve capacity and deliver operating efficiencies. It said the lift in capacity at the Eye poultry facility remains on track to increase to 1.4 million birds per week from just 1.1 million at present. This extra capacity should be ready to use by the end of March. It said its new £20 million cooked bacon facility in Hull should also start producing by the end of June.

‘For the remainder of the current financial year the shift towards greater in-home consumption with resulting high demand for our products is expected to continue,’ said Cranswick. ‘Looking ahead, the board is confident that continued focus on the strengths of the company, which include its long-standing customer relationships, breadth and quality of products, robust financial position and industry leading asset infrastructure, will support the further successful development of the group over the longer term.’

Cranswick will release annual results covering the year to March 27 on May 18.

Cranswick shares were up 2.2% in early trade at 3521.0.

Petrofac wins contracts in Oman

Petrofac has been awarded two contracts worth a combined $300 million from Petroleum Development Oman, the firm responsible for producing the majority of Oman’s oil and gas.

One contract is an engineering, procurement and construction deal for the Marmul Main Production Station Gas Compression project. Petrofac will provide turnkey EPC activities over a period of 30 months.

The other is a project delivery contract with Petroleum Development Oman’s partner, Arabian Industries Projects LLC, to work on concession areas in the north of the country. This deal is considerably longer and will last for seven years, with an option to extend it by a further three years.

‘Petrofac has a significant track record in Oman and PDO are a longstanding client. We look forward to building on our strong relationship through these latest contract awards. Both will be delivered by our teams in the Sultanate, with the focus on safety, maximising local and sustainable delivery, and generating In-Country Value,’ said chief operating officer of engineering and construction Elie Lahoud.

Petrofac shares were up 1.4% in early trade at 116.6.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade