Top UK Stocks and Shares | easyJet Share Price | IAG Share Price | Ryanair Share Price | UDG Share Price

Top News: Airlines and travel stocks in play after UK updates green list

Airline, travel and other stocks reliant on tourism are in play today following the UK government’s update to restrictions on international travel yesterday evening.

A total of 16 places have been added to the UK’s green list, which Brits can travel to from next Wednesday without the need to quarantine on their return. This includes the Balearic Islands, Malta, Madeira, a slew of Caribbean Islands and a number of British Overseas Territories.

Notably, all but one of the new additions remain on the green watch list, which means guidance could change swiftly and with little notice. Malta is the only place on the green list and not on the watch list. This could discourage people to book their holidays, especially after the problems with people racing back from Portugal when it was abruptly removed from the green list in the government’s last update. UK travel secretary Grant Shapps warned it ‘won't be quite like it was in 2019 in the old days’ and that people should expect the list to change, but said the country was ‘moving in a positive direction’.

Holiday firm On the Beach said it will not be taking any new holiday bookings for July or August because of the uncertainty concerning the watch list, according to Sky News. On the Beach shares were trading 0.2% lower in early trade this morning at 348.5p.

The travel industry will welcome the addition of key holiday hotspots like Ibiza and Majorca, but are ultimately disappointed that the majority of Europe remains off-limits. Airline easyJet said the timetable ‘simply isn’t ambitious enough’ while British Airways, part of IAG, warned the industry could not afford ‘another missed summer’.

‘Any extension of the green list is welcome, however small, but we also have to be realistic: this is not yet the meaningful restart the aviation industry needs to be able to recover from the pandemic,’ the chief executive of the Airport Operators Association, Karen Dee, summed up.

The updated list represents progress for the travel industry but is far from ideal. The fact international is a two-way street is significant too. For example, German chancellor Angela Merkel is calling for all Brits to quarantine when entering any country in Europe.

The biggest disappointment was the lack of news on waiving travel restrictions for fully-vaccinated people, with the government stating it would ease the rules for those double-jabbed gradually and in phases.

EasyJet was quick to release a statement to outline it was offering 50,000 extra seats from the UK to the new green list destinations, having added new routes to the likes of Malta. It said it will be one of the largest carriers serving green list countries with over 1 million seats available this summer.

The reaction was mixed this morning. IAG was trading flat while easyJet, Ryanair and Wizz were all trading 0.8% to 1.1% higher. Meanwhile, TUI was down 0.1% and InterContinental Hotels was trading 1.2% lower.

Where next for the easyJet share price?

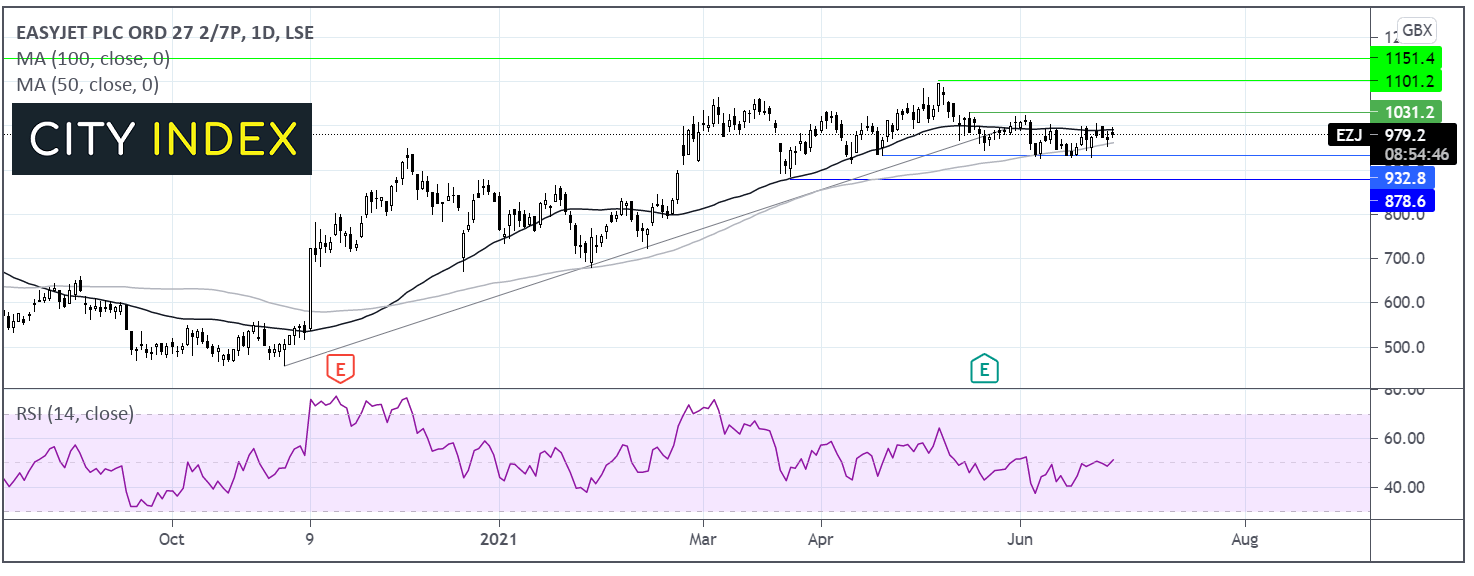

After falling below its ascending trendline dating back to early October in May, the Easyjet share price has traded in a holding pattern, capped on the upside by 1030p and on the lower band by 930p.

The price trades on its 50 sma which is flat and the RSI is also showing a neutral bias at 50 but is attempting to point higher. So far, the 100 sma is offering support at 950p

Traders could wait for a breakout trade. Buyers would be eyeing a move over 1030p towards 1080p the May high and on to 1150p February 2020.

Sellers might look for a break below the 100 sma at 950p before a move below 930p to target 880p the March low.

UDG shareholders push CD&R to raise takeover offer

Healthcare firm UDG Healthcare said Clayton, Dublier & Rice is considering raising its takeover offer for the business after speaking to some of its shareholders.

The two companies agreed on a deal in May, whereby CD&R’s subsidiary Nenelite would purchase UDG for 1,023.0 pence per share in cash, valuing it at around $2.6 billion. That bid was higher than UDG shares had ever traded and priced at around a 30% premium to its average price over the previous three months.

However, UDG said CD&R had spoken to some of its investors and is now considering raising its offer to 1,080.0 pence.

UDG shares were trading 1.3% higher in early trade this morning at 1058.5p.

UDG, made up of healthcare services provider Ashfield and packaging specialist Sharp, said it plans to recommend the higher deal if it is made, having supported the previous offer. Notably, if increased, UDG said it will not be increased again unless CD&R’s bid is challenged by another interested party. It confirmed that it is not talking to any other companies about a deal at present.

The takeover will need approval from shareholders, but UDG has postponed its extraordinary general meeting to give CD&R more time to consider raising its offer.

Notably, CD&R is also currently in the process of trying to buy supermarket chain Morrisons after its initial bid was turned down earlier this week.

Literacy Capital IPO completes to take investor public

Literacy Capital said it has swiftly listed its shares in London only days after unveiling its plans to go public.

A small placing of shares was completed on behalf of some existing shareholders priced at 160p each, but otherwise it has not raised new cash and listed its stock on the Specialist Fund Segment of the London Stock Exchange’s Main Market. A total of 60 million shares have been admitted.

Literacy Capital was founded in 2017 as a ‘permanent capital vehicle’ to make longer-term investments and generate stronger returns. It invests in small, usually family-led businesses, those typically generating between £1 million to £5 million in Ebitda each year.

Its portfolio includes electronic component firm Vanilla, wifi provider Wifinity, vegan subscription box service TVK, boiler insurer Hometree and aluminium product maker AluFold Direct.

‘Literacy Capital is delighted to bring this compelling opportunity to market, providing investors access to a differentiated investment approach to private equity. We believe we have a unique offering, an alternative way of working with founders and owners of small businesses that offers strong, long-term investment support with a social purpose at its centre,’ chairman Paul Pindar said earlier this week.

CMO Group IPO to raise funds to disrupt building materials market

CMO Group has outlined plans to go public by listing on AIM early next month to raise funds to help fund its ambitions to disrupt the building materials sector.

The company is the UK’s only online-only retailer of building materials in a market that is predominantly served offline at present. It sells through a number of websites including Roofingsuperstore.co.uk, Drainagesuperstore.co.uk, cmotrade.co.uk, and Totaltiles.co.uk.

It has over 75,000 products on offer but CMO is asset-light, with the majority of products bought being shipped directly to their door from the manufacturer rather than CMO itself.

CMO Group said it has seen sales grow over 30% year-on-year in the first five months of 2021 and, once the boost from acquisitions is included, the figure rises closer to 70%.

‘The directors believe that there is significant opportunity to continue growing sales organically through a programme of category expansion into new segments, continuous development of its multi-channel marketing strategy to attract and maintain new customers, increased use of artificial intelligence to inform marketing campaigns, personalised customer engagement and increased take-up of its trade offer. This will be supplemented by selective, opportunistic acquisitions that will strengthen existing product categories or provide an entry point for new categories,’ said CMO Group.

CMO Group said it hopes to be admitted to trading in early July.

‘We have enjoyed strong, consistent growth driven by the group's successful customer proposition, first mover advantage and scalable digital platform. Our clear and focussed strategy will enable us to continue to capture further profitable share in an under penetrated market as customers increasingly move online. We will support this through targeted category expansion and a multi-channel marketing plan to drive revenue growth and margin enhancement,’ said chief executive Dean Murray.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade