Top UK Stocks to Watch | Taylor Wimpey Shares | L&G Shares | Morgan Sindall Shares | Ferrexpo Shares | THG Shares

Top News: Taylor Wimpey to hit top end of expectations in 2021

Housebuilder Taylor Wimpey said it will hit the top-end of expectations this year as it capitalises on the favourable market conditions by building a record number of homes as completions bounced back after being hit last year by the pandemic.

Revenue soared to £2.19 billion from only £754.6 million the year before, when construction was hit by the outbreak of the pandemic. Taylor Wimpey built 7,303 homes in the first six months of 2021 compared to just 2,771 the year before. That marks new first-half records for both revenue and completions, supported by the fact a number of houses due to be finished in the fourth quarter of 2020 were pushed into this year due to delays.

Profit before tax and exceptional items of £412.5 million turned from a £29.8 million loss the year before and came in well ahead of the £312 million expected by analysts. The company turned to a pretax profit at the bottom-line of £287.5 million from a £39.8 million loss.

Taylor Wimpey shares were up 4.5% in early trade this morning at 172.45p, although they remain some 25% lower than the before the pandemic.

Earnings benefited from improved margins of 19.3%, having generated negative 2.1% last year. More importantly, that margin has surpassed pre-pandemic levels of 18% in the first half of 2019.

‘We have a clear purpose to deliver high-quality homes and create thriving communities and a strategy to ensure the long term sustainability of the business. We now expect to deliver 2021 full year group operating profit of £820 million, above the top end of consensus, with UK completions (excluding joint ventures) expected to be towards the upper end of our guidance range of 13,200 to 14,000,’ said chief executive Pete Redfern.

For context, that would be a significant improvement from 2020 when Taylor Wimpey delivered £300.3 million in operating profit after building fewer than 10,000 homes.

Taylor Wimpey’s sales rate in the first half was 0.97 versus 0.70 a year earlier, supported by favourable market conditions, low interest rates and government support. It has orders for 10,589 homes on its books worth some £2.71 billion, which is lower than a year ago but healthy enough for it to achieve its goals.

Taylor Wimpey also said that any increase in input costs was being more than offset by the increases in house prices this year. Average prices for private homes was up around 6.5% from the year before at £327,000.

Taylor Wimpey will pay an interim dividend of 4.14 pence, in line with the final payout made in 2020. That is worth around £151 million in total and investors can expect to be paid a similar amount later this year considering it is trying to make two equal payouts and return a minimum of £250 million per year. The company said it will review what to do with any excess cash at the end of the year.

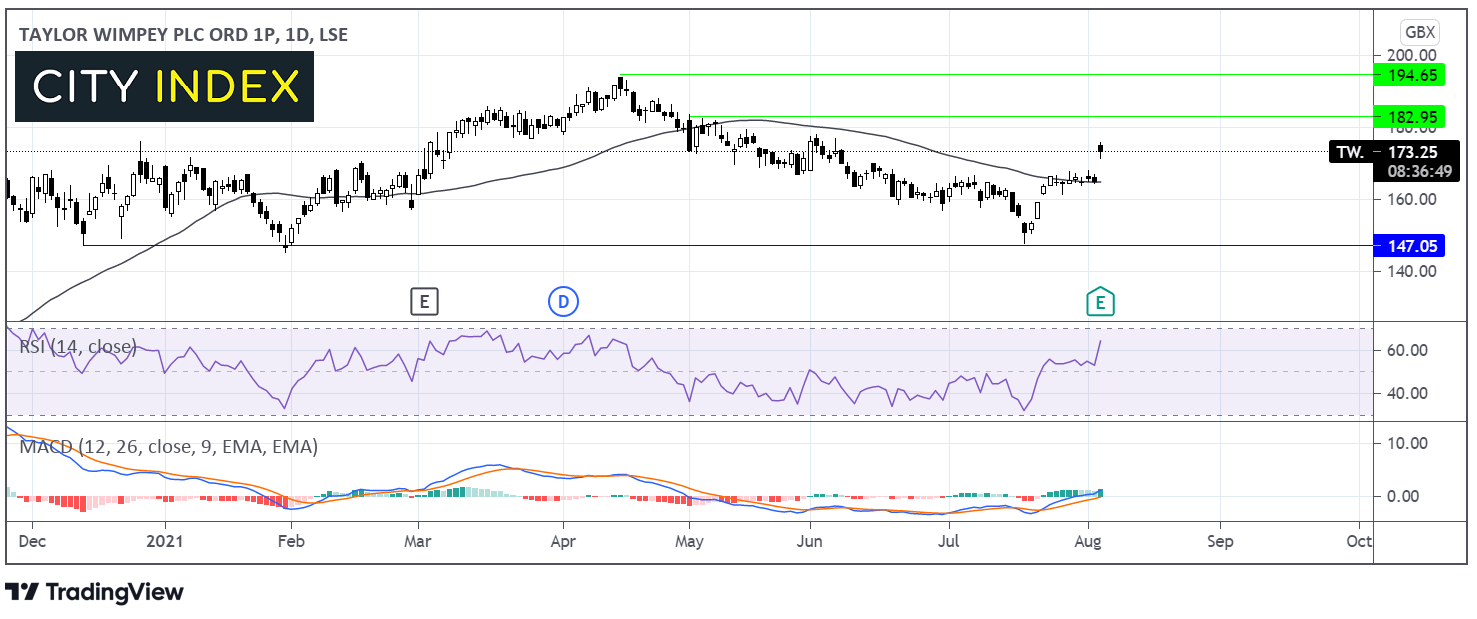

Where next for the Taylor Wimpey share price?

Taylor Wimpey is extending gains above its 50 dma. The bullish MACD and RSI supports further upside whilst remaining out of overbought territory.

Resistance can be seen at 182p the May high. A break above here could open the doors to 195p the post pandemic high hit mid-April.

On the downside support can be seen at 165p the 50 dma. A break below this support could see sellers target 147p the July low.

Legal & General ups dividend and eyes double-digit profit growth in 2021

Legal & General said it is on course to deliver double-digit growth in profits this year as it met expectations in the first half and raised its dividend.

Operating profit climbed 14% year-on-year to £1.07 billion from £946 million the year before, and was bang-on what was expected by analysts. Profit after tax leapt to £1.06 billion from just £290 million, as its return on equity surged to 22% from only 6.3%. EPS increased 21% to 17.78 pence from 14.74p.

Its pension risk transfer business reported new business premiums of £3.1 billion compared to £3.4 billion the year before, and L&G said it has already won a further £2 billion for the second half. Its investment management arm saw net flows of £27.4 billion compared to just £6.2 billion last year, with assets under management up 7% to £1.3 billion.

Meanwhile, L&G Capital more than doubled its operating profit to £250 million from just £123 million the year before.

The company said it was aiming to deliver ‘double-digit growth’ in operating profit over the full year, having previously said it was looking to a be a leader in the post-pandemic economic recovery.

L&G raised its interim dividend by 5% to 5.18p.

L&G shares were trading 1.1% higher in early trade this morning at 266.9p.

Morgan Sindall raises dividend as profits soar past pre-pandemic levels

Morgan Sindall reported a significant jump in profits during the first half of 2021 and said they have surpassed pre-pandemic levels, prompting it to hike its dividend by more than 42%.

The construction and regeneration specialist said revenue rose 14% year-on-year to £1.55 billion and adjusted pretax profit jumped to £53.1 million from £15.7 million. Reported pretax profit followed to £52.4 million from £13.6 million.

The improvement from last year, when the pandemic hit, will be welcomed but investors will be more pleased that revenue and profits have breezed past the pre-pandemic levels. Revenue was 10% higher and pretax profit was up over 46% compared to the first half of 2019.

The strong performance prompted Morgan Sindall to hike its interim dividend to 30.0 pence from 21.0p the year before. Cash generation remained strong and it ended June with £337 million in net cash compared to only £114 million a year ago.

Morgan Sindall shares were down 3.9% in early trade this morning at 2368.0p, having hit a new all-time high during yesterday’s session.

‘As ever, we are extremely focused on our cash generation and cash position. Maintaining a strong balance sheet including a substantial net cash position provides a significant competitive advantage for us. It enables us to continue making the right decisions for the business and to best position us in our markets for continued sustainable long-term growth,’ said chief executive John Morgan.

‘We've had a very strong first half in which we've upgraded our profit guidance three times,’ Morgan added. ‘Today's results, combined with the current visibility for the rest of the year, gives us every confidence of another strong performance by the group in the second half.’

Ferrexpo hikes dividend as it benefits from higher output and prices

Iron ore pellet producer Ferrexpo has bumped-up its interim dividend by over 200% after production more than doubled in the first half, allowing it to reap the benefits of higher prices.

Revenue soared 74% year-on-year to $1.35 billion. Ferrexpo’s production mix contained more higher quality pellets, allowing it to capitalise on the fact iron ore pellet prices more than doubled year-on-year during the first half.

With prices more than outpacing a 14% rise in production costs, earnings soared. Underlying Ebitda surged to $868 million from $352 million and profit after tax rose to $661 million from $250 million.

‘Today's strong interim financial results reflect our multi-year investment programme in our assets, which has enabled us to not only take full advantage of the current strength of the iron ore market through our high grade iron ore products, but also deliver these results alongside excellent safety performance and continued progress in cutting carbon emissions,’ said non-executive chairman Lucio Genovese.

Net operating cashflow also improved to $661 million from $258 million last year, giving it the funds it needs to hike its dividend more than 200% to 39.6 cents from 13.2 cents and repay its pre-export finance facility early. It ended June with $213 million in net cash, up from only $4 million at the end of December.

‘Looking ahead, we are at an exciting time in the group's development. We are currently undertaking expansion work that will deliver growth in the near-term, having invested US$93 million in growth capex in the first half, and we are already looking ahead to our next phase of growth,’ Genovese said. ‘On product quality, we have secured our first long-term contract for our latest product offering, high-grade (67% Fe) direct reduction pellets, which represent the future of global steel production as economies worldwide seek to decarbonise, and we also continue to cut our own carbon emissions.’

Ferrexpo shares were down 5.5% in early trade this morning at 467.5p, having fallen since briefly touching all-time highs last week.

THG ups expectations after buying Cult Beauty

THG has agreed to acquire a UK-based online beauty retailer named Cult Beauty for £275 million, which will boost the company’s revenue and earnings in 2021.

The company said Cult Beauty has around 300 brands available on its platform – 200 of which are not already available on the THG platform. The firm boasts 1.7 million customers and has 1.6 million Instagram followers.

‘Cult Beauty's first-to-market reputation makes the brand an exciting fit for our THG Beauty division. When retailing brands to consumers THG Beauty will run with two unique fascias within our main continents: THG will principally service customers within North America via our Dermstore and Lookfantastic brands, while in the UK, Europe, Asia and the Rest of the World the key brands will be Lookfantastic and Cult Beauty,’ said THG’s executive chairman and CEO Matthew Moulding.

Cult Beauty is expected to contribute £60 million of sales and £3 million of adjusted Ebitda to THG’s results before the end of 2021.

THG raised its full year guidance to take the acquisition into account. It is now expecting to deliver £2.18 to £2.23 billion in annual revenue in 2021, up 38% to 41% at constant currency year-on-year. It was previously aiming to grow annual revenue by 30% to 35%.

THG shares were trading 3.4% higher in early trade this morning at 600.75p, marking its highest level in almost three weeks.

In 2022, which will be the first full year of ownership, THG is expecting Cult Beauty to contribute £140 million in sales and £10 million in adjusted Ebitda.

‘We anticipate fully migrating Cult Beauty onto the THG Ingenuity platform by the end of the year (within the first six months of acquisition), giving the brand access to the global digital features to underpin significant future growth,’ Moulding said.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade