Top UK Stocks and Shares | SSP Share Price | Ryanair Share Price | IAG Share Price | Rolls Royce Share Price

Top News: SSP Group expects upturn in travel in 2021

SSP Group said the recovery in travel has started but remained cautious about the speed at which trading can return to pre-pandemic levels as it reported heavy losses in the first half of its financial year.

The company, which operates food and beverage outlets at major travel locations around the world, said revenue plunged 79% in the six months to the end of March to £256.7 million, with like-for-like sales plummeting by a similar rate.

That caused SSP to report a pretax loss of £299.7 million, considerably wider than the £34.3 million loss booked the year before. Its basic loss per share of 48.6 pence widened from an 8.0p loss.

SSP reported a free cash outflow of £140.9 million in the first half, averaging a burn of around £23 million per month, which was slightly better than the £25 million to £30 million that was expected.

The company, having strengthened its balance sheet following a rights issue in April, said the recovery in travel has now started and that trading has improved since the year end, led by domestic travel in the UK and the US. Still, SSP stuck to its guidance that like-for-like revenues will not return to pre-pandemic levels until 2024, signalling investors will need to patient when it comes to the recovery.

‘Currently, sales are down approximately 70% against 2019 and for the third quarter as a whole, we expect them to be down approximately 75% against 2019,’ SSP said.

SSP said it has reopened 250 units since the end of March, meaning it has around 1,150 in operation at present. SSP said it hopes to have 1,200 to 1,500 units operating over the summer if current trends continue.

‘Whilst the short-term outlook remains highly uncertain, we remain positive about a further upturn in both domestic and leisure travel across the remainder of the current financial year. We anticipate that the profit conversion on the lower sales, compared with pre-Covid levels, will continue to be in the region of 25% during the second half of the financial year,’ said SSP.

Where next for the SSP share price?

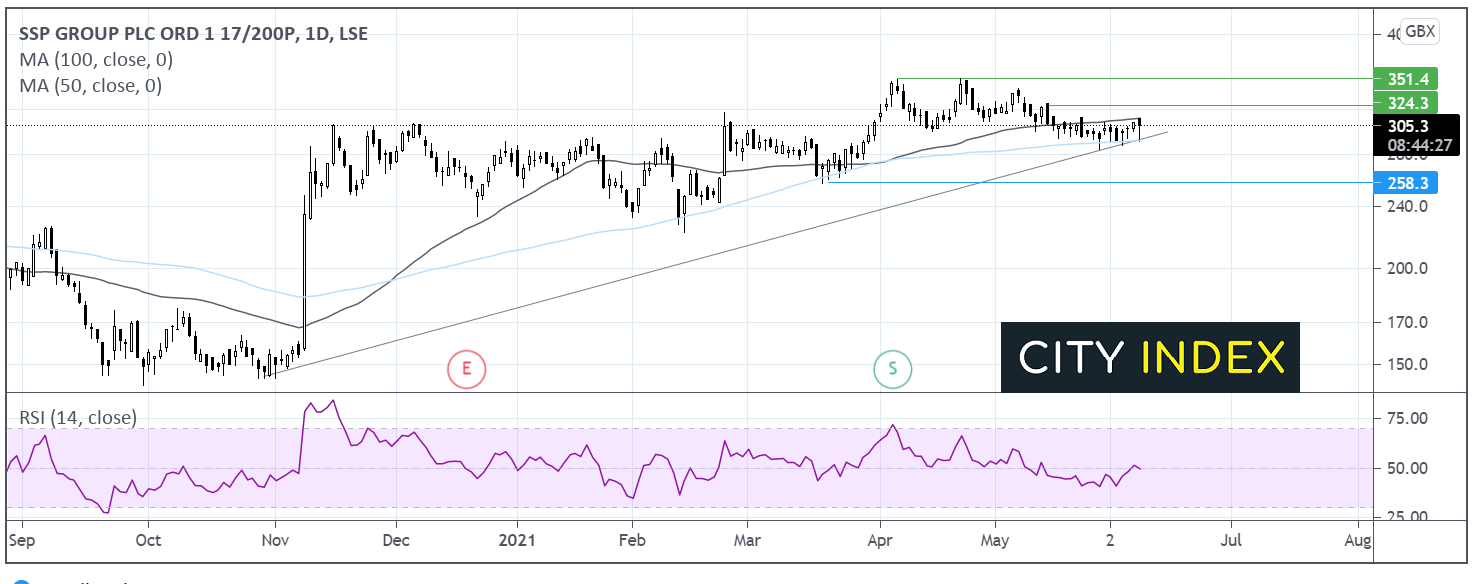

SSP share price trades above its ascending trend line dating back to early November. The share price hit resistance in April at 350p forming a double top reversal pattern.

However, the move lower is finding support at the multi month ascending trendline and the confluence with the 100-day ma at 290p which could prove a tough nut to crack.

A deeper selloff would need to break through support at 290p in order to target 260p the March low.

On the flip side, any recovery would first need to retake the 50-day ma at 314p in order to target 324p the May 18 high and 350p.

CMA takes action against Ryanair and BA over refunds

The UK’s Competition & Market Authority has launched an investigation into whether Ryanair and British Airways have broken consumer law by failing to offer refunds to customers for flights that they were not legally allowed to take.

The formal investigation has been launched after the CMA started looking into allegations that consumers were being wrongfully denied refunds last year. The regulator said both airlines avoided giving out refunds to people who had booked flights that they could not legally take because of lockdown rules and travel restrictions. Instead, British Airways – which is owned by International Consolidated Airlines - offered vouchers or the ability to rebook flights, while Ryanair only offered the latter option.

‘The CMA is concerned that, by failing to offer people their money back, both firms may have breached consumer law and left people unfairly out of pocket. It is now seeking to resolve these concerns with the companies, which may include seeking refunds, or other redress, for affected customers,’ the regulator said.

Both airlines have been notified and will now be given the opportunity to respond. The CMA’s chief executive Andrea Coscelli showed sympathy with the industry as it has been decimated by the pandemic, but said ‘people should not be left unfairly out of pocket for following the law’.

‘Customers booked these flights in good faith and were legally unable to take them due to circumstances entirely outside of their control. We believe these people should have been offered their money back,’ she said.

Ryanair shares were trading 0.5% higher in early trade at EUR16.65, while IAG shares were up 1.1% at 201.4p.

Rolls Royce appoints Anita Frew as new chair

Rolls Royce has announced that Anita Frew will formally takeover the chair role from Ian Davis at the start of October.

Frew will join the board as a non-executive director and chair designate at the start of July before formally taking up the role from Davis, who will be retiring after nearly nine years as chairman, at the start of October.

Frew is currently the chair of specialty chemical company Croda. She is also a non-executive of mining giant BHP Group and she recently left her role at Lloyds Banking Group, where she was deputy chairman and a senior independent director. In the past, Frew has also held board roles at the likes of Victrex, WPP Group and the Royal Bank of Scotland.

‘The company conducted a comprehensive search and Anita emerged as the outstanding candidate. She brings a wealth of experience from two decades of Board appointments both in the UK and internationally and her skills, and reputation with investors and government institutions will be invaluable to the group. I am delighted to welcome Anita to the board and as chair designate,’ said Rolls Royce.

Frew joins at a critical time for Rolls Royce, which has been hard hit by the pandemic as it disrupts global travel. The company, which makes much of its money depending on how long its airplane engines are up in the air, said last month that flying hours were running at just 40% pre-pandemic levels in the first four months of 2021. Still, the company is hoping to start generating positive cashflow once again by the end of this year as it cuts costs and the recovery in travel starts.

Rolls Royce is expected to publish its interim results for 2021 on August 5.

Rolls Royce shares were trading 0.3% higher this morning at 111.8p.

IP Group set to pay inaugural dividend after AGM

IP Group is set to pay its inaugural dividend next week if shareholders vote in favour of the payout at its annual general meeting later today.

The company, which invests in life sciences, deeptech and cleantech companies, said earlier this year that its portfolio had matured enough to allow for a ‘modest but growing dividend’. If approved, the first payout of 1p per share will be paid on Wednesday June 16. That will cost £10.1 million in cash, with another £500,000 being satisfied through a scrip dividend programme.

Notably, IP Group is also asking shareholders for permission to be able to buy back up to 10% of its shares in issue today. However, IP Group has said it will only repurchase stock at a discount to its hard net asset value at the time.

‘Any decision to repurchase shares would be undertaken in light of other potential capital investment opportunities for the benefit of stakeholders and remains subject to regular review,’ IP Group said.

Many of IP Group’s investments have delivered material progress in 2021. The company booked £65 million in cash and saw its NAV boosted when its investee biopsy company Inivata was bought by NeoGenomics. It also booked a £20 million gain on its investment in Waveoptics after it was bought by social media giant Snap, the owner of Snapchat.

Elsewhere, keep an eye on Oxford Nanopore after the company raised funds ahead of an anticipated IPO this year. IP Group has a 14.5% stake in the business and Oxford Nanopore could be targeting an initial valuation of around $3 billion, according to reports. Meanwhile, Centessa Pharmaceuticals completed an IPO on the Nasdaq last month.

IP Group shares were trading 0.3% higher at 120.3p this morning.

Clinigen Group lowers guidance but eyes strong growth in 2022

Clinigen Group has warned earnings will come in lower than previously expected tis year as the pandemic continues to weigh on its performance.

Clinigen shares were trading 20% lower in early trade this morning at 675.5p, wiping out all the gains booked since March.

Clinigen warned that hospitals were giving fewer treatments for oncological illnesses and delaying clinical trials. It said one of the biggest impacts has been to Proleuki, where demand has been significantly weaker than expected in recent months. Proleuki is indicated for metastatic melanoma and metastatic renal cell carcinoma in the US and being used in clinical trials across the country. It is the biggest-selling product in Clinigen’s commercial medicine portfolio.

‘The group believes it is prudent to expect this reduced level of demand for Proleukin to remain until revitalisation efforts into new indications alongside novel cell therapies are successful and normal Hospital and Cancer Centre Services have resumed,’ Clinigen warned.

Clinigen said net revenue is still expected to come in line with targets, but that earnings will come in lower than hoped. Adjusted Ebitda in 2021 is now expected to come in between £114 million to £117 million.

That would be considerably lower than the £131 million of adjusted Ebitda delivered in 2020.

However, Clinigen said it is confident is can deliver ‘double digit Ebitda growth’ in 2022.

‘Clinigen is continuing to support COVID-19 projects across the business, is gaining further share in its Service end-markets, has made faster-than-expected progress on the launch of Erwinase and the Group remains confident that Proleukin demand will return and exceed pre-COVID levels in the future,’ Clinigen said.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade