Top UK Stocks to Watch: Spirax Sarco beats expectations and ups dividend

Top News: Spirax Sarco Engineering well positioned for 2021

Spirax Sarco Engineering said a better than expected performance in 2020 and improved outlook for this year leaves it well positioned for 2021, prompting it to raise its dividend.

The company said revenue fell 4% in 2020 to £1.19 billion from £1.24 billion the year before. That was predominantly driven by lower sales from its steam engineering and thermal solutions businesses. Watson-Marlow, its pumps and fluid control business, saw increased demand from the pharmaceutical and biopharma sectors as they raced to develop vaccines last year.

‘Following a stronger than anticipated fourth quarter, we are very pleased with the group's performance in 2020, given the unprecedented circumstances caused by the COVID-19 pandemic. These results demonstrate our ability to adapt to the changing requirements of our customers, the diverse nature of our end markets and the resilience of our business model,’ said chief executive Nicholas Anderson.

‘The improved outlook for industrial production growth, strong order book, robust prospects for Watson-Marlow and continued investments leave us well-placed for 2021,’ he added.

Adjusted pretax profit fell 5% to £261.5 million from £274.5 million. Profit edged up 1% on a reported basis to £240.1 million from £236.8 million. That beat expectations for adjusted profit of £248.8 million and reported profit of £232.8 million.

Cash conversion improved to 102% from just 84% the year before, and net debt was reduced to end the year at £229 million, equal to 0.7x its annual earnings.

The dividend for the year will be 118.0 pence, up from 110.0p in 2019.

Spirax Sarco said forecasts suggest global industrial production will grow by 7% in 2021 and that organic revenue should rise by the same amount. Meanwhile, electric thermal solutions is expected to benefit from a larger-than-normal order book that is expected to add at least £8 million in annual sales. Watson-Marlow also ended the year with a larger order book that should materialise this year, building on the surge in demand from the pharmaceutical sector.

However, it did warn that cash conversion will start to return to previous levels of around 80% as it continues to invest in the business.

Where next for the Spirax Sarco share price?

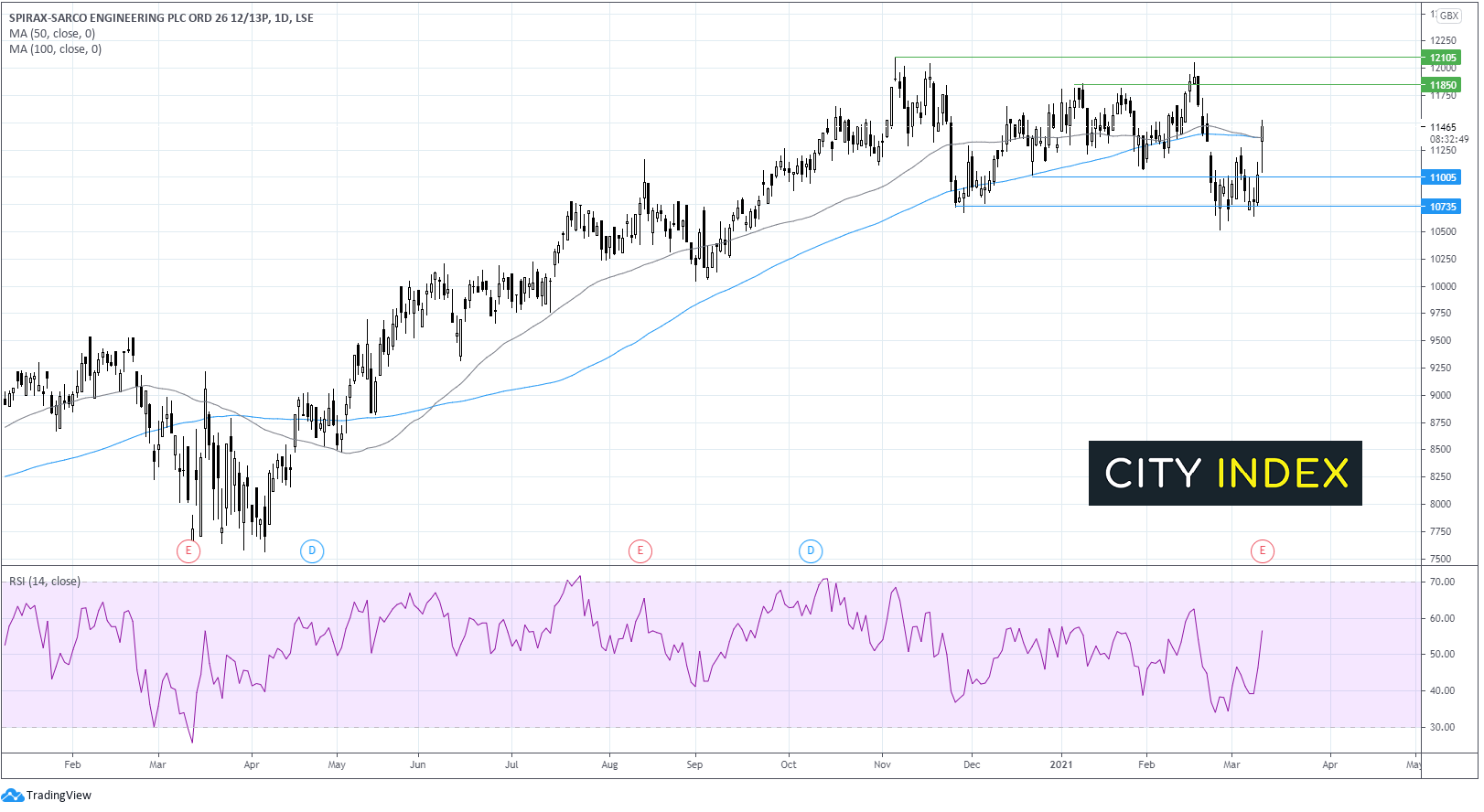

The share price saw a strong run up from mid-March lows to the November all-time high. Since then, Spirax Sarco’s share price has traded with a more neutral bias.

Spirax Sarco’s share price has jumped over 4% in early trade. This move higher has pushed it through its 100 & 50 sma on the daily chart at 11375. The bulls will be looking for a close over this level to confirm the bullish move.

Today’s jump has also boosted the RSI into bullish territory, suggesting that there could be more upside to come.

Immediate resistance can be seen at 11850 the Jan high, before bulls target 12105 the all-time high.

On the flip side failure to hold 11375 could see the share price look to test support at 11005 low Dec 21st. A breakthrough here could open the door to horizontal support at 10745 a level which has offered support several times of the past few months.

Just Eat Takeaway.com expects appetite to continue growing in 2021

Just Eat Takeaway.com said it had an ‘exceptional year’ in 2020 as people ordered more takeaways during lockdown and that it expects the high level of order growth to continue accelerating in 2021.

The company said it processed 588 million orders last year, up 42% from 2019. That fed through to revenue, which soared 54% higher to EUR2.4 billion from EUR1.6 billion.

Adjusted Earnings before interest, tax, depreciation and amortisation grew 18% to EUR256 million from EUR217 million in 2019. The reported loss ballooned to EUR151 million from EUR115 million.

‘To capitalise on the strong momentum from its investment programme, the company will continue to invest to drive further growth and market share gain, in line with the fourth quarter of 2020. Management expects further order growth acceleration for the full year of 2021 compared with 2020,’ Just Eat said.

‘Just Eat Takeaway.com is the clear market leader in the UK, in terms of orders. In addition to strong growth in marketplace orders, the growth rate of its delivery business is multiple times the growth rate of its competitors. This has been further demonstrated in the first two months of 2021, with UK orders up 88% and Delivery orders up more than 600% compared with the first two months of 2020. Given recent trading and the investment programme, management expects to increase market share in the UK in 2021,’ the company added.

Just Eat Takeaway shares were down 2.1% in early trade at 6969.0.

Balfour Beatty reinstates dividend and ups share buyback after tough 2020

Balfour Beatty has reinstated its dividend and enlarged its share buyback programme despite reporting lower profits in 2020.

The company, which builds and manages major infrastructure projects around the world, said revenue inched up to £8.59 billion in 2020 from £8.41 billion the year before.

Profit from operations fell to £63 million from £159 million, while pretax profit plunged to £48 million from £138 million. That saw basic earnings per share drop to 4.4p from 19.0p in 2019. Profits were partly hit by the company’s decision to repay the funds received from the UK government under the Job Retention Scheme.

Balfour Beatty said it would pay a dividend of 1.5p in 2020, down from 2.1p in 2019 after the interim payout was scrapped last year. This is part of a new sustainable dividend policy unveiled today. Balfour Beatty said it intends to target a payout ratio of 40% of underlying profits after tax and that surplus cash is returned through buybacks.

Balfour Beatty launched a new £50 million share buyback programme in January, but said this morning that it was raising the size to £150 million.

The company said it ended the year with a record order book worth £16.4 billion compared to only £14.3 billion at the end of 2019.

‘Our leading positions in large growing infrastructure and construction markets, record year end order book and £1.1 billion Investments portfolio provide confidence in future cash generation. This underpins our new capital allocation framework which demonstrates Balfour Beatty's commitment to deliver enhanced returns to shareholders,’ said chief executive Leo Quinn.

Balfour Beatty said it expects underlying profits from operations to be broadly level with 2019 in 2021.

Balfour Beatty shares were down 0.6% in early trade at 290.4.

Legal & General maintains dividend after volatile year

Legal & General said its diversified business model helped it put in a resilient performance during a tough year plagued by low interest rates and market volatility, allowing it to maintain its dividend and stick to its long-term growth ambitions.

The UK pensions and insurance provider said operating profit was broadly flat in 2020 at £2.21 billion. Its Retirement business reported profit growth of 10% while its Investment Management unit experienced 3% growth. However, that was offset by a 24% decline from General Capital and a 40% fall from General Insurance.

‘The strength of our diversified business model meant we were able to weather the volatility of 2020 with three of our five businesses delivering growth,’ Legal & General said.

Profit after tax was down 12% to £1.60 billion from £1.83 billion the year before, driven by the impact of lower interest rates on its insurance business and the impact of market movements.

Return on equity fell to 17.3% from 20.4% the year before, which Legal & General described as ‘resilient in light of market volatility’. Cash generation and capital generation both stayed broadly flat year-on-year at around £1.5 billion.

Legal & General decided to keep its dividend for the year flat at 17.57 pence.

Cash generation more than covers the £1.0 billion worth of dividends paid for the year. The company is aiming to generate £8 billion to £9 billion in cash over a five-year period to fund total dividends worth £5.6 billion to £5.9 billion.

‘Legal & General delivered a robust and resilient performance for all stakeholders, providing stability to our people, customers and shareholders. Our balance sheet remains strong, with the Solvency II coverage ratio currently over 190%, and trading remains consistent with delivering our growth ambitions which are supported by six long term growth drivers. Our commitment to Inclusive Capitalism, ESG and investing in climate change means we intend to play an important role in the post pandemic recovery,’ said chief executive Nigel Wilson.

Legal & General shares were up 0.2% in early trade at 281.7.

Hill & Smith expecting ‘good recovery’ in 2021

Hill & Smith’s dividend has more than doubled despite reporting lower revenue and a steep fall in profits in 2020 as it is increasingly confident about its prospects following a strong recovery in the second half of the year.

Revenue fell 5% in 2020 to £660.5 million from £694.7 million in 2019. That was hit by the closure of its businesses in France, India and the UK when the pandemic erupted last year, although these all reopened and experienced a strong recovery in the second half. Its US business managed to perform well throughout the year.

‘Given the extent of disruption around the world as a result of the COVID-19 pandemic, Hill & Smith delivered a robust performance in 2020 with year end results ahead of the current analyst forecast range. The 2020 trading performance and ongoing recovery as we enter 2021 demonstrates the strengths of the group's business model, our choice of resilient end markets, the international mix of businesses and the decentralised operating model with high quality teams who were able to respond quickly to local market conditions as they unfolded during the year,’ said the company.

Underlying pretax profit was down 21% at £62.6 million from £79.4 million. The decline was much more severe on a reported basis, down 43% to £35.5 million from £61.8 million the year before. That resulted in basic earnings per share more than halving to 30.2 pence from 61.1p.

‘Despite the disruption caused by the pandemic, the group remained profitable throughout the year and our US businesses, which represented 41% of group revenues, have proved particularly resilient, delivering similar levels of revenue and profit to the prior year,’ Hill & Smith said.

Cash generation remain strong and net debt was reduced by over £69 million during the year to end 2020 at £146.2 million compared to £215.3 million a year earlier.

‘Our organic and acquisitive growth plans are underpinned by a strong balance sheet as well as positive dynamics in our key end markets given the long term requirement to upgrade infrastructure in a sustainable way. We expect to see a good recovery in trading in 2021,’ said the company.

The dividend for the year will be 26.7 pence, more than double the 10.6p payout made in 2019. However, that is flattered by the fact it cancelled the final payout for 2019. Dividends were reinstated at the halfway point of 2020.

Hill & Smith said it has made a ‘good start’ to 2021 after organic revenue and profit both grew in the first quarter.

‘We expect to see a good recovery in trading in 2021, albeit we remain mindful of the potential ongoing disruption of COVID-19, higher raw material prices and foreign exchange fluctuations on our financial performance for the full year,’ Hill & Smith said.

Hill & Smith shares were up 2.4% in early trade at 1350.0.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade