Top UK Stocks and Shares | Serco Share Price | Alphawave Share Price | Ted Baker Share Price

Top News: Serco upgrades guidance as Covid-19 work keeps outsourcer busy

Serco said it has upgraded its guidance for the full year as it remains busy working on the UK’s Test and Trace programme and said its joint venture with Engie has won a major new contract that could be worth billions.

The company said it is now expecting underlying trading profit in 2021 to be at least £200 million. That is up from its previous target of £185 million and compares favourably to the £163.1 million profit delivered in 2020.

‘The strong performance we saw at the beginning of the year has continued. All of our four divisions have traded in-line or ahead of their budgets in the first five months of the year. In the UK in particular, volumes on both our Testing and Tracing contracts have continued to be strong and we now think it likely that demand for these services will continue for longer in the second half than we previously anticipated,’ Ted Baker said.

Serco also announced that its joint venture with Engie has won new contracts to work on UK defence infrastructure. The initial work is worth £900 million but could be worth up to £3.4 billion over seven years. This will not benefit profits this year.

The venture, VIVO Defence Services, is equally-owned by both companies. It will manage facilities and provide services to defence sites in the South West and Central regions of the UK. Core work will start in February 2022 before ramping up throughout the year.

Where next for the Serco share price?

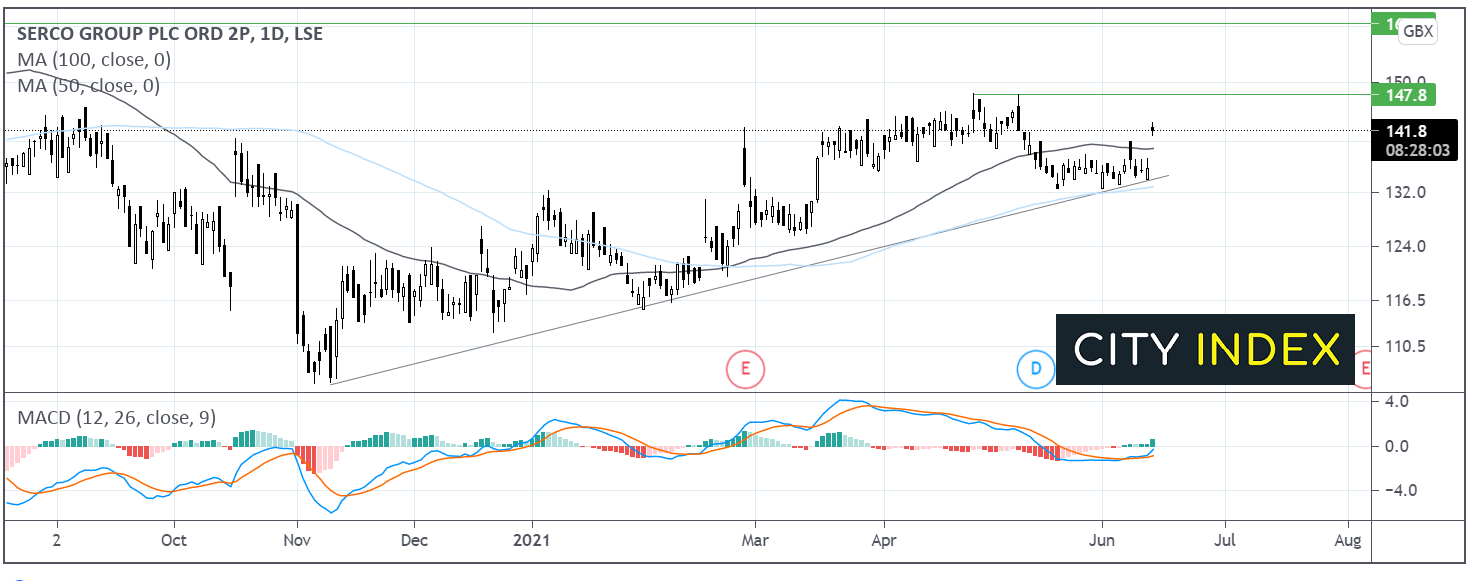

After a period of consolidation. Serco is on the rise. Serco trades above its ascending trend line dating back to early November. It trades above its 100 sma and has retaken its 50 sma after rebounding off trendline support at 134p.

The MACD is showing a bullish crossover keeping buyers optimistic of further gains.

Resistance can be seen at 147p. A move above here could open the door to 160p a level which capped gains several times last July.

On the downside support can be seen at 138p the 50 sma and 134p the confluence of the 100 sma and the ascending trend line which could prove a tough nut to crack.

Alphawave delivers record performance in first update since listing

Semiconductor designer Alphawave IP Group said it delivered its strongest-ever performance in the first half of its financial year as it reported record bookings in its first trading update since going public earlier this year.

The company said bookings had reached over $190 million since the start of the year, representing its ‘strongest-ever first half performance’. The figure is impressive considering bookings amounted to just $75 million in the entirety of the last financial year.

Importantly, $15 million of the total bookings are royalties, which Alphawave is keen on increasing to bring in more recurring and reliable income.

‘I am pleased that we have delivered another record quarter of bookings in 2021 driven by several strategic design wins with new and existing Tier 1 North American customers in 5G wireless communication products for our core IP and product IP offerings,’ said president and chief executive Tony Pialis.

‘In addition, Alphawave IP was selected by one of the largest hyperscaler companies in the world to provide its solutions. The team has done a great job continuing to execute on our business goals while successfully completing our IPO on the London Stock Exchange in May and raising $500 million in proceeds to fund the group's continued growth and global expansion,’ he added.

Alphawave shares were trading 3% higher in early trade this morning at 323.0p.

Ted Baker reveals sales still being hammered by lockdown restrictions

Ted Baker revealed that the pandemic continues to heavily weigh on its financial performance but said it is in a much stronger position than it was a year ago.

Revenue plunged to £352.0 million in the year to January 25 from £630.5 million the year before as the pandemic hit the retail sector hard. The fact Ted Baker is mainly a bricks and mortar retailer and relies on occasion wear and formal clothing has made it particularly vulnerable.

Ted Baker has had to up its digital game in response to the pandemic. Ecommerce sales were up 22% in the year to £144.9 million and accounted for over 40% of total sales. Still, it was not enough to offset the weaker performance in store, which hit both retail and wholesale income.

This caused it to turn to an underlying operating loss of £49.7 million from a £18.4 million profit. At the bottom-line, Ted Baker’s pretax loss ballooned to £107.7 million from £77.6 million.

Although grim, the results did beat expectations. Analysts had expected revenue of £344.8 million and a larger operating loss of £66.3 million.

‘While the impact of COVID-19 is clear in our results and has amplified some of the legacy issues impacting the business, Ted Baker has responded proactively and is in a much stronger place than it was a year ago. During the period, we delivered robust cashflow generation, fixed our balance sheet, refreshed our senior leadership team and today we are upgrading our financial targets for the second time since outlining our new strategy last summer.’ Said chief executive Rachel Osborne.

Ted Baker said the pandemic has continued to weigh on the business since the start of the new financial year, with lockdown restrictions still in place across nations including the UK, Europe and Canada. Revenue in the first 12 weeks to April 24 was down 19.9% and there has also been a marked slowdown in digital sales, which were up just 4.5%.

The company ended the year with £66.7 million in net cash. Although that was bolstered by an equity raise and the sale of the UBB building during the year, the company said this came in better than expected thanks to positive cash generation.

Ted Baker shares were trading 1.7% lower in early trade this morning at 164.1p.

John Menzies expands into Chinese cargo market

John Menzies said it has agreed to invest £3.4 million to buy a minority stake in Chinese firm Guangzhou JFreight Aviation Logistics Supply Chain Co, marking its entry into the country’s cargo market.

The investment is being made by way of a joint venture, which will see Menzies manage and operate a new cargo terminal at the Guangzhou Baiyun International Airport, which is one of the world’s busiest airports. The terminal will have the capacity to handle 120,000 tonnes of cargo each year and Menzies said it will start by focusing on the goods being sent through the fast-growing ecommerce market in the country.

‘This investment creates a strong platform for Menzies in this attractive growth market and represents clear delivery against the company's strategic objectives of optimising its portfolio with a greater focus on cargo and expanding its geographical footprint into new markets,’ said the company.

‘I am delighted to be able to announce this expansion in the Chinese cargo market. We are very pleased to have found a great partner in JFreight and I look forward to developing our relationship with them as we move forward,’ said chairman and chief executive Philipp Joeing.

John Menzies shares were trading 2.1% higher in early trade this morning at 346.0p.

Draper Esprit to raise equity as new investments gain momentum

Draper Esprit reported stellar results during its first year under the leadership of CEO Martin Davis and said it is raising equity so it can make more investments to capitalise the growing demand for tech.

The venture capital firm said it ended March with a net asset value of 743 pence, up from 555p the year before. On a total basis, net assets grew to £1.03 billion from £660 million. The value of Draper’s portfolio jumped to £984 million from £703 million the year before. The 51% surge in fair value of its portfolio was well ahead of the 10% growth delivered the year before and markedly ahead of its 20% target.

Total income surged to £288.8 million from £52.0 million, leading to significantly higher profits. Its operating profit before tax soared to £267.5 million from £40.4 million.

‘Our financial year and my first full year as CEO demonstrated the strength and flexibility of the Draper Esprit model in market conditions at two extremes. Despite market shock in the first half, our scale and maturity gave us room to focus on the needs of our portfolio companies and structuring ourselves for growth. Our close relationship to our portfolio and industry insight enabled us to accelerate into the digital transformation catalysed by the pandemic,’ said chief executive Martin Davis.

‘Our investment team increased its cadence in the second half, deploying significant funds into existing portfolio companies and new, as intended when we raised equity in October. We look to the future with confidence that our model positions us well for opportunities in a transformed world,’ he added.

To help drive its investment strategy, Draper Esprit said it is raising £111 million by issuing equity so it has ‘additional investment firepower’. This will see 13.9 million shares sold for around 800 pence per share, a 7.7% premium to its net asset value at the end of March. The equity offering is significant as the new shares are equal to a 10% stake in the business. The CEO and other directors plan to participate.

‘By deploying more capital into our portfolio companies and new investments, taking part in and leading larger rounds and continuing to grow our fund of funds strategy, we will be able to expand our platform even further. We can then reward a wider group of investors who for so long have found it hard to invest in fast-growing privately owned technology companies,’ said Davis.

Draper Esprit said it will move to the premium segment of the Main Market and have a secondary listing on Euronext Dublin to reflect the growth and maturity of the business. This should be completed within ‘the next couple of months.’

Draper Esprit shares were trading 1.7% lower in early trade this morning at 825.0p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade