Top UK Stocks to Watch: Saga shares rise after beating expectations

Top News: Saga readies to reopen travel business to meet pent-up demand

Saga believes there is ‘significant pent-up demand’ for its travel business when it reopens later this year as it posted better-than-expected results during a tough year that saw its business severely disrupted by the pandemic.

The company reported an underlying pretax profit of £17.1 million in the year to the end of January 2021. That was down from £109.9 million the year before, but was better than the £12.1 million expected by analysts. Saga’s bottom-line pretax loss of £61.2 million was driven by an impairment of its travel business in the first half, but this still improved from the £300.9 million loss booked the year before.

Saga’s insurance business has proven resilient over the last year, but it has not been enough to cushion the blow suffered by its travel business, which has been forced to close for much of the year.

‘Looking ahead, while we are mindful of economic headwinds and the potential ongoing impacts of COVID-19, it is clear that there is significant pent-up demand among our customer base, the vast majority of whom have now been vaccinated and are ready to enjoy post-lockdown freedom,’ said chief executive Euan Sutherland.

‘We look forward to relaunching our brand later in 2021 which will only enhance our ability to unlock the potential in Saga, returning the business to sustainable growth and creating significant long-term value for all our investors and stakeholders,’ he added.

Saga said 2021 will be a ‘period of transition’ from coronavirus and that it is ready to open as soon as the government allows it. Saga did not provide a specific timeframe for when its cruises and tours would restart. It had previously said it was ready to restart operations in May but warned this could be pushed back depending on government guidance.

‘We will continue to prioritise the preservation of cash and manage levels of debt; however, given the continued uncertainty arising from COVID-19, we are not in a position to provide earnings guidance for the 2021/22 financial year. We remain confident that the disciplined execution of our turnaround strategy will unlock the potential that exists within Saga, creating significant long-term value for our investors,’ said Saga.

Where next for the Saga share price?

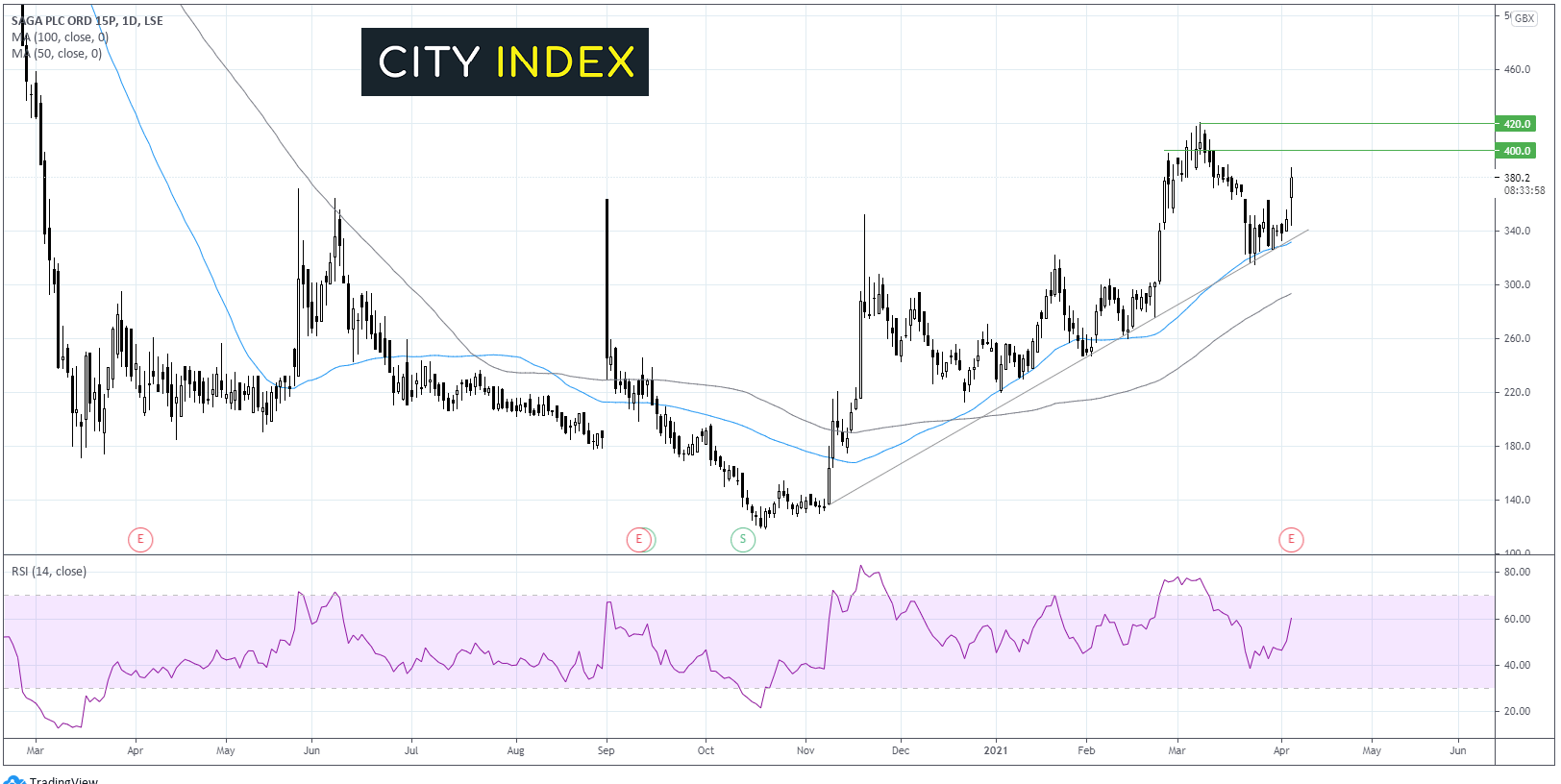

Saga share price has been trending higher since hitting the pandemic low of 118 in October.

The share price trades above its 4 month ascending trendline and above its 50 & 100 sma on the daily chart showing an established bullish trend.

Since hitting a post pandemic high of 420 the bullish move had lost momentum falling back to support on the trendline and 50 sma.

Today the price has jumped over 8% higher in early trade. The long tail on the candle suggests that the is demand at the higher price level.

The RSI is also supportive of further upside.

Immediate resistance can be seen at 387, today’s high ahead of 400 round number and 420 the post pandemic high, still some distance fro the 620 level Saga was trading pre-pandemic.

On the flip side, strong support can be seen at 330 the confluence of the 50 sma and the ascending trendline. A break below here could see the sellers target 300 round number and 100 sma.

Hilton Food Group beats expectations and lifts dividend

Hilton Food Group reported strong growth in revenue and profits in 2020 as more people ate at home during lockdown, prompting it to raise its dividend by over 20%.

Revenue rose by over 50% year-on-year in the 53 weeks to January 3 to £2.77 billion from £1.81 billion, while adjusted pretax profit jumped 23% to £61.1 million from £49.7 million. That was significantly better than expected, with analysts having forecast revenue of £2.47 billion and adjusted profit of £55.2 million.

The company’s reported pretax profit rose 25% to £54.0 million from £43.2 million.

Hilton Food Group raised its dividend to 26.0 pence from 21.4p the year before.

The company, which produces packaging for food sold in shops and supermarkets, has benefited during the pandemic as more people eat at home with restaurants and other outlets closed. It also reported a strong performance from its joint venture in Australia, where volumes more than doubled year-on-year compared to just 8.5% growth in Europe.

‘I am extremely proud of the commitment and resilience shown by the entire Hilton team during 2020 to adapt quickly to the challenges caused by Covid-19 in order to safeguard our people, keep our facilities open and support our customers. This response underpinned a strong performance with both volume and profit growth and we concluded our joint venture transition period in Australia and purchase of the related joint venture assets while marking our one year anniversary of the opening of our Queensland facility,’ said chairman Robert Watson.

‘In Europe we set up a new facility in Belgium during the year to supply Delhaize and continued to further diversify our product offering in the plant-based, seafood and convenience categories. As with all businesses there remain some uncertainties concerning the full impact of Covid-19, including potential recessionary risks, but our robust and sustainable business model and wide geographical spread make us believe we are well placed to meet any future challenges,’ he added.

Hilton Food Group shares were up 4.8% in early trade at 1163.0.

Pharos Energy sinks deep into the red

Pharos Energy said its losses ballooned in 2020 as the coronavirus pandemic weighed on demand and prices of oil, and warned that production from its projects in Egypt and Vietnam will decline in 2021.

The company said revenue fell to $142 million from $189.7 million the year before, while over $235 million worth of impairments booked against its assets plunged the firm deep into the red. Its loss for the year amounted to $215.8 million from $24.5 million the year before and was much worse than what was expected by analysts.

Pharos said production averaged 11,373 barrels of oil equivalent per day in 2020, down from 12,136 barrels per day the year before. Output will fall further in 2021 to around 9,200 to 10,600 barrels per day.

The company did not pay a final dividend as expected after suspending payouts last year and Pharos said this would be kept under review.

Pharos Energy shares were down 3.3% in early trade at 23.5.

Royal Dutch Shell to take $200 million hit from Texas storm

Royal Dutch Shell has warned adjusted earnings will take a $200 million hit in the first quarter of 2021 from the winter storm in Texas, US.

The storm in Texas during February caused chaos across the US state, causing power outages and several deaths.

Shell provided updated guidance for all its individual segments to take the impact of the storm into account.

It said it now expects quarterly production of integrated gas to be between 920,000 to 960,000 barrels of oil equivalent per day, tweaked from its original goal of 900,000 to 950,000 barrels. Upstream output will be between 2.4 million to 2.475 million barrels daily, narrowing from 2.4 million to 2.6 million barrels beforehand.

Royal Dutch Shell shares were up 1.3% in early trade at 1375.5.

Ryanair expects smaller loss than originally expected

Ryanair said it expects to report a slightly narrower loss in its recently-ended financial year than originally expected but warned the outlook remains highly uncertain, especially because of the slow roll-out of vaccinations in Europe.

The airline said the net loss in the year to the end of March 2021 will now be between EUR800 million and EUR850 million, rather than its original expectations for a loss of EUR850 million to EUR900 million. The company said traffic numbers plummeted to just 27.5 million from almost 150 million the year before as the pandemic limits people’s ability to travel.

Ryanair warned that the outlook remains uncertain because of the slow introduction of vaccines across Europe, but it is expecting passenger numbers to start recovering this year.

‘Easter travel restrictions/lockdowns and a delayed traffic recovery into the peak S.21 season, due to the slow rollout in the EU of Covid-19 vaccines, means that FY22 traffic is likely to be towards the lower end of our previously guided range of 80 million to 120 million passengers. While it is not possible (at this time) to provide meaningful FY22 profit guidance, we do not share the recent optimism of certain analysts as we believe that the outcome for FY22 is currently close to breakeven,’ said Ryanair.

Ryanair said its balance sheet remains strong with cash of over EUR3.1 billion at the end of March.

Ryanair will release its annual results on May 17.

Ryanair shares were up 0.4% in early trade at 1692.7.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade