Top UK Stocks and Shares | Ryanair Share Price | Wizz Air Share Price | Gym Group Share Price | QinetiQ Share Price | CMO Group IPO

Top News: Ryanair passenger numbers soar but uncertainty remains

Ryanair said passenger numbers jumped in June as travel restrictions eased and coronavirus vaccines starts to deliver a recovery in the European travel market.

The airline said it carried 5.3 million passengers on around 38,000 flights in June at a load factor of 72%. That was a marked improvement from the 400,000 passengers carried in June 2020 when the pandemic started to bring international travel to a halt.

Notably, it is also almost treble the 1.8 million passengers it carried in the prior month of May at a load factor of 79%, which in turn had increased from only 1.0 million passengers in April at a load factor of 67%.

Together, this means Ryanair carried 8.1 million passengers in the first quarter as a whole at a load factor of 73%.

The outlook for the airline industry seems to be steadily improving, although not quick enough for Ryanair. A travel pass, or digital Covid certificate, is now in place across Europe to help people travel if they are vaccinated, test negative for the virus, or have recently recovered from it.

However, Ryanair’s boss Michael O’Leary told Euronews yesterday that the EU must stop ‘individual countries imposing stupid or ineffective’ restrictions.

‘Merkel's plan, which was to require visitors to Germany from the UK to quarantine for two weeks, made no sense when the UK is the country with the most vaccinated population in Europe. So there's lots of these silly ideas being floated,’ O’Leary said.

‘We do need across Europe to welcome UK visitors to the tourism destinations of Portugal, Greece, Italy and Spain, because without them, you know, the European Union would be an awful lot poorer,’ he added.

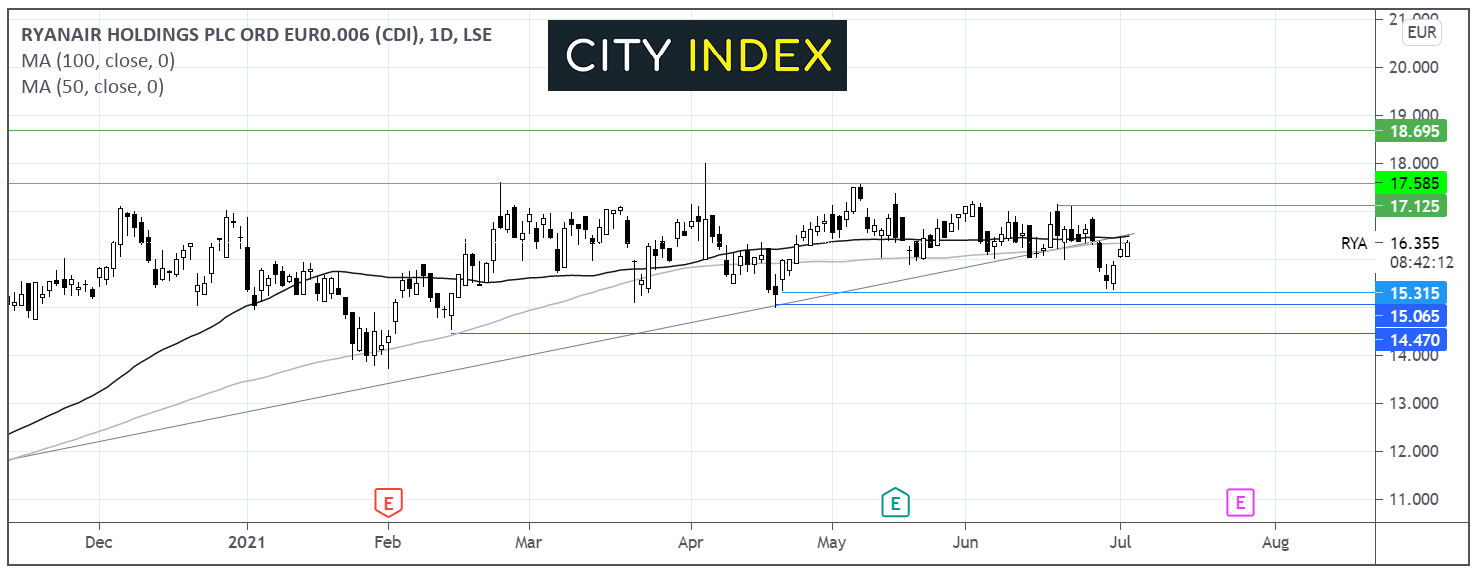

Where next for the Ryanair share price?

The Ryanair share price has been trading in a holding pattern for most of this year. Earlier this week the price broke below is ascending trendline dating back to May last year, it also broke below its 50 and 100 day ma.

The price found support at 15.35 earlier this week and rebounded higher.

The MACD appears to be forming a bullish crossover which could keep buyers hopeful of further gains.

The price is testing resistance at 16.40 the confluence of the 50, 100 dma and the ascending trendline – this could prove a tough nut to crack. A break above here is needed in order to test resistance at 17.1 last week’s high. It would take a move over 17.60 for the bulls to look to break higher towards 18.70 a level last seen in 2017.

Meanwhile, failure to break above the 16.40 level could see the price edge lower back towards 15.35 the weekly low ahead of 15.00 the April low. A break below here could bring 14.5 into focus.

Wizz Air sees passenger numbers jump 80% month-on-month in June

Meanwhile, Wizz Air said it carried over 80% more passengers in June compared to May as restrictions were eased.

The low-cost airline said it offered 2.4 million seats during June but only carried 1.55 million passengers, resulting in a load factor of 64%. That was much better than the year before when results were heavily hampered by the pandemic and it carried just 502,253 passengers at a load factor of 52.2%.

More importantly, the results improved significantly compared to the previous month of May, when it carried 832,538 passengers at a load factor of 66.1%.

On a rolling 12-month basis to the end of June, Wizz Air carried 12.4 million passengers at a load factor of 64.4%. That improved from the 11.4 million passengers and load factor of 63.8% reported in the 12 months to the end of May.

The airline said it opened its sixth base in Italy after launching a new one in Naples, where it will offer 18 new international and domestic routes using two Airbus A321 aircraft that will be deployed in August and September. Notably, that will add eight new services that are not currently available from Naples.

It will also add one additional A321 aircraft to its Tirana base in Albania, adding two new routes from this month. One of them will fly to Barcelona in Spain and the other to Cologne in Germany.

Wizz Air shares were trading marginally higher in early trade this morning at 4739.0p.

Gym Group raises equity to fund aggressive expansion

The Gym Group has raised £31.2 million from its discounted placing that was launched yesterday to help fund plans to open a number of new gyms across the country as it revealed business has improved since sites reopened in April.

The company sold 11.35 million new shares at 275.0 pence each, representing a 3.5% discount to its closing share price yesterday. The new shares issued are equal to around 6.8% of the company’s issued share capital prior to the placing.

Gym Group shares were trading 1.1% lower in early trade this morning at 282.3p.

‘Our new gym pipeline is the strongest it has ever been and we thank shareholders for their support in today's successful placing which allows the Company to accelerate its rollout to 40 new sites over the next 18 months. Gyms have an essential role to play in the nation's physical and mental health and growing our portfolio will widen access to affordable fitness for more communities across the UK,’ said chief executive Richard Darwin.

Gym Group is acting now because it sees an opportunity in the property market, with commercial properties currently offering ‘favourable commercial terms’ as retailers close down during the pandemic and landlords desperately seek replacement tenants or buyers.

Opening 40 new sites over the next 18 months marks a significant acceleration for the business, which has typically opened between 15 to 20 new stores each year in the past. Notably, Gym Group has identified up to 80 suitable sites that could be converted into gyms or small-box format outlets. It currently has 187 gyms in operation but thinks it can ultimately double the size of its network of sites.

The placing has also unlocked revised terms for its existing £100 million banking facility to give the company ‘greater flexibility to enable delivery of the accelerated pipeline rollout.’

‘The Gym Group has a strong track record of returns from opening gyms consistently delivering 30%+ return on invested capital pre-Covid for sites when they reach maturity (two years after opening),’ said the company.

Gym Group said trading had improved since sites reopened in April. It said it had 734,000 members at the end of June compared to only 547,000 at the end of February when sites were closed and memberships were frozen.

‘The summer months are historically quieter times for gyms and as a result the Company tends to see limited net gains in overall membership levels during this period. The company anticipates steady membership levels during this period with increases expected in September/October alongside further release of restrictions and a return to offices and universities with further growth expected in the January/February 2022 trading peak,’ said Gym Group.

QinetiQ poaches CFO from solar developer Lightsource

QinetiQ said its chief financial officer David Smith is retiring later this year and will be replaced by Carol Borg, who is leaving a global solar developer to join the London-listed security and defence contractor.

Smith will step down at the end of November, when Borg will formally take up her role. However, Borg will join the company on October 11 to allow time for an orderly handover.

Smith has been chief financial officer of QinetiQ since 2017 and the company said he had been ‘instrumental in enabling the company through transformative change that has resulted in five consecutive years of growth.’

Borg is currently the chief financial officer of solar developer Lightsource bp and in the past she has held senior positions at wind power giant Vestas.

‘We are delighted to bring Carol on-board as the next chief financial officer of QinetiQ. Carol brings broad and proven experience of both operational and financial management. She has extensive experience as a strategic business partner in diverse and complex international organisations, and is an individual of the highest calibre,’ said chairman Neil Johnson.

QinetiQ shares were up 0.4% in early trade this morning at 345.3p.

CMO Group IPO to complete next week

CMO Group has priced its initial public offering on London’s AIM market, stating it will earn an initial valuation of £95 million as it starts life as a public-traded business.

The online-only building materials retailer said it has sold 20.7 million new shares in the company at 132.0 pence for £27.3 million through a placing. It sold an additional 13.4 million shares for £17.7 million on behalf of existing shareholders.

It said shares are expected to start trading on the morning of July 8 and it will have a free float of around 45% upon admission.

‘Today marks a significant landmark in CMO's corporate journey and will provide the company with the platform to continue to deliver our growth ambition,’ said CMO Group.

The company is the UK’s only online-only retailer of building materials in a market that is predominantly served offline at present. It sells through a number of websites including Roofingsuperstore.co.uk, Drainagesuperstore.co.uk, cmotrade.co.uk, and Totaltiles.co.uk.

CMO Group said it has seen sales grow over 30% year-on-year in the first five months of 2021 and, once the boost from acquisitions is included, the figure rises closer to 70%.

‘CMO has an exciting opportunity ahead as we continue to capitalise on our first mover advantage and digital platform to further increase market share as customers increasingly move online for their building materials requirements. We are particularly encouraged by the strong demand we have experienced from high calibre institutional investors which is clear validation of CMO's market opportunity and strong future growth potential,’ added chief executive Dean Murray.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade