Top UK Stocks to Watch: Posting parcels pays off for Royal Mail

Top News: Royal Mail forecasts over 50% profit growth

Royal Mail shares jumped this morning after the company forecast a large jump in profit as its parcels business experiences tremendous growth during the pandemic.

The company said it expects adjusted operating profit to be ‘well in excess of’ £500 million in the financial year to the end of March 2021, compared to just £325 million in the last financial year. Revenue growth will also be ‘significantly beyond the top end’ of its £380 million to £500 million guidance range.

Revenue in the nine months to the end of December rose 13.5% to £9.31 billion. The trend of declining letter revenue, down 16%, and rising parcel revenues, up 37%, continued. Its international parcel delivering unit, GLS, also grew strongly with volumes up 23% and revenue up 24%.

Royal Mail said the third quarter covering the holiday period was the ‘busiest quarter for parcels in Royal Mail's history’ as it delivered 496 million parcels. However, it admitted the increased demand and lost workers who are isolating meant service had been compromised.

‘At Royal Mail our busiest day during the quarter saw 32% more parcels delivered than our busiest day during the first national lockdown in 2020. Given these record volumes, we recognise that at times our service during the period was not always as we would have wished,’ said non-executive chair Keith Williams.

‘But thanks to the efforts of our team, the retention of around 10,000 of the 33,000 flexible workers from the Christmas peak, and the introduction of new processes, we have been making encouraging progress. We are resolutely focused on delivering a comprehensive service despite the challenging circumstances,’ he added.

Where next for Royal Mail shares?

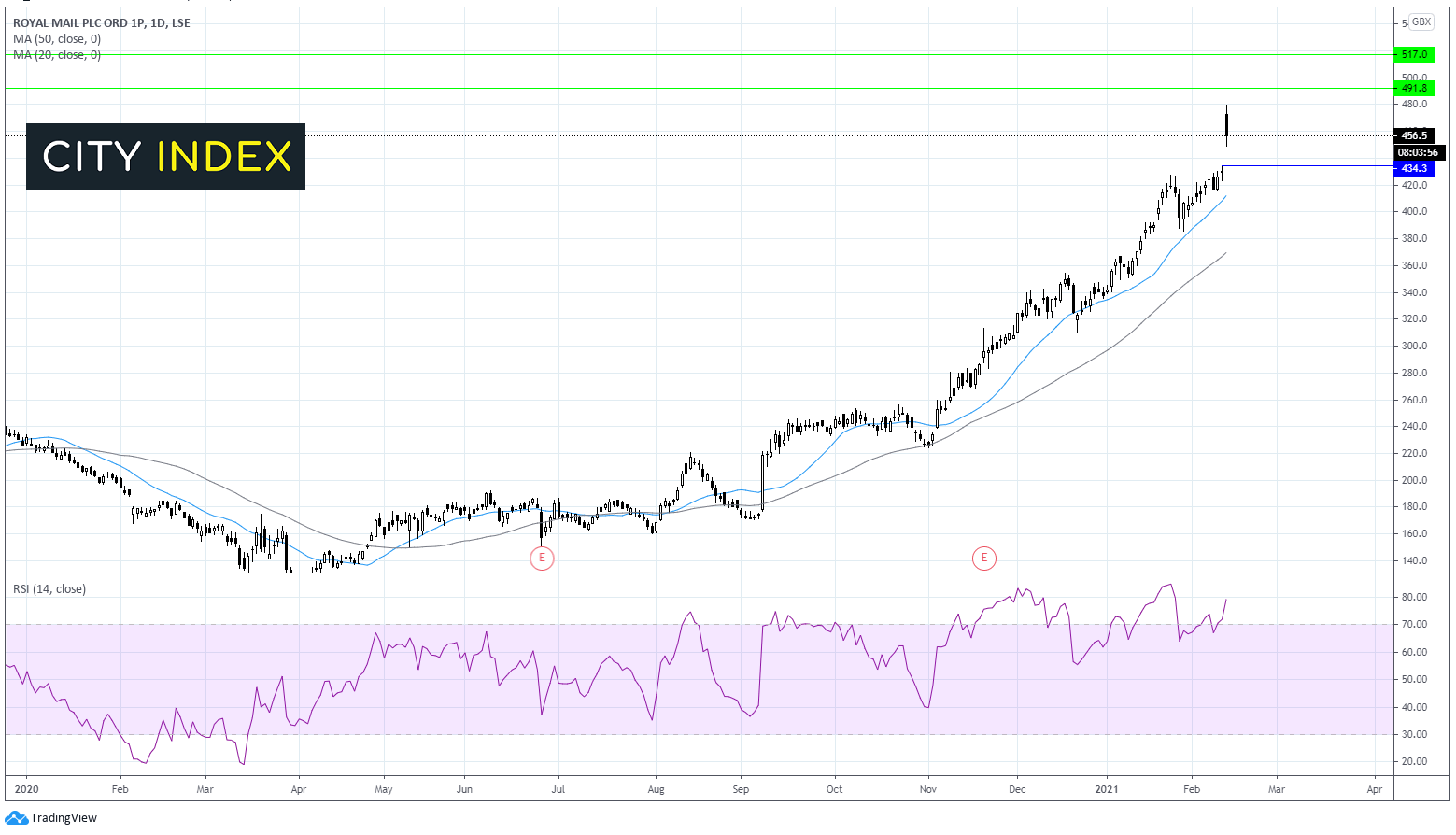

Royal Mail shares have been on an upward trajectory since early September. The share price trades comfortably above its ascending 20 & 50 sma on the daily chart showing an established bullish trend.

The RSI is deeply into overbought territory at 79.2 suggesting that bulls should be cautious before placing aggressive buy bets, a pullback could be on the cards before any additional moves higher.

Immediate resistance is seen at 480 today’s high. A break beyond this level could see 490 come into focus, a level last seen in October 2018 before 500 round number and 517 a swing high from July 2018.

Immediate support is seen at 434 yesterday’s high. Should the bears break down this level support could be seen at 410 the 20 sma which has offered strong support over the past 5 months. A breakthrough the 50 sma at 370 could negate the current bullish trend.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Shell outlines new strategy to reduce emissions

Royal Dutch Shell has laid out its strategy to drive down carbon emissions and boost shareholder returns by transitioning away from producing oil and gas and concentrating more on creating electricity, biofuels and renewable energy.

The company said its carbon emission peaked in 2018 and that oil output peaked in 2019, with both set to gradually fall as it transitions to cleaner forms of energy.

It intends to direct around $5 billion to $6 billion a year - around a quarter of its annual investment - into new growth areas. These include its Marketing arm that trades commodities like lubricants and homes its portfolio of electric vehicle charging points. Investment will also be directed into its biofuels business that produces fuel out of the likes of sugar cane, allow it to double the amount of electricity it generates, and build on its developments with hydrogen.

Between $8 billion to $9 billion a year will be spent on its transition areas, such as gas - which Shell sees as a vital commodity to bridge the gap until renewables are more reliable – as well as refining chemicals and other products.

That leaves the upstream business producing oil, which will continue to receive large annual investment of around $8 billion but gradually reduce output by around 1% to 2% each year.

‘Shell’s aim is to build material low-carbon businesses of significant scale by the early 2030s. Upstream will continue to deliver vital energy supplies, which will help to generate the cash and returns needed to fund shareholder distributions while accelerating investment in the growth businesses to capture new market opportunities,’ the company said.

Shell said it intends to reduce net debt to $65 billion from around $75 billion at present, after which it will aim to distribute 20% to 30% of operating cashflow to shareholders each year through dividends and buybacks. That will also help it deliver a new progressive dividend policy aiming to grow the annual payout by ‘around 4%’ each year. Last week, Shell recommitted to its plans to grow its dividend from the first quarter of 2021, which should rise to 17.35 cents.

It will also aim to sell off $4 billion worth of assets each year, helping fund returns and progress its transition.

Tight controls over costs will also aide its ambitions. Shell said annual capital expenditure will be between $19 to $22 billion each year over the near-term, and that operating expenses will be no higher than $35 billion.

Shell reported annual earnings for 2020 last week, revealing it sank to an almighty loss of $21.68 billion in 2020 as the coronavirus pandemic weighed on demand and prices. The humungous loss compared to a $15.84 billion profit in 2019, while adjusted earnings for the year plummeted to $4.84 billion from $16.46 billion the year before.

Shell shares were down 1% in early trade at 1288.2.

RELX ups dividend as core businesses continue to grow

RELX said its core businesses continued to grow in 2020, allowing it to raise its dividend, despite its smaller exhibitions unit being hampered by the pandemic.

The company, which provides analytics and decision tools, said its three core business areas serving the scientific, technical and medical (STM), risk and business analytics, and legal industries had continued to grow in 2020. Revenue rose 2% to £6.74 billion while adjusted operating profit jumped 4% to £2.24 billion.

‘We expect each of our three largest business areas, STM, Risk and Legal, to deliver another year of underlying revenue and adjusted operating profit growth in 2021, similar to pre-Covid-19 trends. The timing and pace of recovery in Exhibitions remains uncertain,’ said RELX.

Its smaller business serving the physical exhibitions market, only accounting for around 5% of revenue, suffered a 71% fall in sales to £362 million as the pandemic meant many events could not go ahead, and swung to an adjusted operating loss of £164 million from a £331 million profit the year before.

RELX’s focus online also helped, with electronic sales rising 4% and more than offsetting a 14% decline in print sales and a 73% plunge in face-to-face meetings.

‘Early in the year we decided that it was important not to curtail investment in our three largest business areas to offset any potential shortfall in financial performance from Exhibitions. Accordingly, we continued to invest behind our strategic priorities, the organic development of increasingly sophisticated information-based analytics and decision tools that deliver enhanced value to our customers, and we continued to make targeted acquisitions that support our organic growth strategies. Throughout 2020 the three largest business areas continued to perform well, with our focus on analytics driving good growth in electronic revenue,’ said chief executive Erik Engstrom.

Although adjusted profits rose, they fell on a reported basis. Pretax profit dropped to £1.48 billion from £1.84 billion in 2019.

RELX raised its dividend for the year to 47.0 pence from 45.7p, but it confirmed that it does not intend to resume share buybacks this year after suspending when the pandemic erupted in 2020.

RELX shares were up 1.6% this morning at 1801.5.

AstraZeneca shares rise after beating expectations

AstraZeneca shares were rising this morning after the company narrowly beat expectations in 2020 and said it expects faster growth in earnings in 2021.

AstraZeneca said revenue rose 10% at constant currency in 2020 to $26.61 billion, ahead of expectations for $26.32 billion. Core earnings per share jumped 18% to $4.02, just below the market forecast of $4.03. Reported EPS of $2.44 beat expectations of $2.42.

Growth was driven by a 10% jump in product sales, with a particularly strong performance from its new medicines in emerging markets. Oncology also delivered double-digit growth.

‘Additional investment in new medicines continued to fuel our rapidly growing oncology and biopharmaceuticals therapy areas. Tagrisso's future was enhanced with its first regulatory approval in early, potentially-curable lung cancer and further national reimbursement in China in advanced disease. Farxiga again expanded its potential beyond diabetes, while tezepelumab promised real hope for patients suffering from severe asthma. Thanks to the focus on an industry-leading pipeline and consistent execution, I am confident that we will continue to deliver more progress for patients and sustained, compelling results,’ said chief executive Pascal Soirot.

AstraZeneca reaffirmed its commitment to its progressive dividend policy and left its payout unchanged at $2.80.

AstraZeneca said it expects revenue to grow by a ‘low-teens percentage’ in 2021 and that this year would see ‘faster growth’ in core EPS to $4.75 to $5.00.

Notably, the guidance does not incorporate any impact from its coronavirus vaccine. AstraZeneca intends to start separately reporting sales of its vaccine on a quarterly basis going forward.

AstraZeneca shares were up 2% in early trade at 7386.0.

Coca-Cola HBC gains market share in tough climate

Coca-Cola HBC said volumes and revenue declined in 2020 as the pandemic disrupted the hospitality market, but said it adjusted well to outperform its peers and gain market share.

The firm, a bottling partner of the Coca-Cola Company, said annual like-for-like volumes fell 4.6% in 2020 while revenue dropped 12.7% to EUR6.13 billion. Volumes improved in the second half and were down just 0.7% in the final quarter, while sales in stores grew strongly but not enough to offset the fall from the trade channel.

‘The improved second-half trading was driven by a return to growth in the at-home and greater resilience in the out-of-home, despite a resurgence of infections in many of our markets towards the end of the year,’ said chief executive Zoran Bogdanovic. ‘Partnering closely with The Coca-Cola Company team on rigorous prioritisation of our joint market investments, coupled with our rapid adaptation of the route-to-market and excellent execution, resulted in strong value share gains in both Non-alcoholic ready-to-drink and Sparkling across the majority of our markets.’

Operating profit dropped 7.8% to EUR660.7 million while net profit fell 15% to EUR414.9 million.

Free cashflow held up well, rising over 12% to EUR497 million in the year, allowing it to up its dividend by 3.2% to 64 euro cents.

‘While the economic outlook remains uncertain, we are clear on the opportunity and direction for our business and are investing to strengthen our capabilities which will drive our long-term performance, underpinned by further advances on sustainability. Looking to 2021, we will continue adapting fast in a dynamic market and partnering with our customers to drive a strong recovery in FX-neutral revenues, along with a small increase in EBIT margin,’ said Bogdanovic.

Coca-Cola HBC shares were up 4.2% in early trade at 2345.5.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Polypipe raises £96 million to help fund ADEY acquisition

Polypipe said it has raised £96.3 million by conducting a premium-priced placing that also attracted investment from its board of directors.

The placing was announced late yesterday to help part fund the £210 million acquisition of London Topco, the owner of ADEY, the provider of filters and chemicals that help prolong the life of boilers and heating systems. The rest of the funding is coming from its existing debt facilities.

The company has issued 18.7 million new shares priced at 515 pence each, a slight premium to its last closing share price. The new shares account for 8.2% of the company’s total issued share capital before the placing was conducted.

Notably, several directors purchased shares under the placing. Chairman Ronald Marsh bought 25,273 shares, chief executive Martin Payne bought 17,995 shares, chief executive Paul James bought 1,941 shares and non-executives Lisa Scenna and Kevin Boyd also participated.

Polypipe shares were up 6% in early trade at 549.0.

LXI REIT ups dividend target as rent collection holds up

Property investor LXI REIT said it is targeting a higher annual dividend after ‘successive quarters of strong rent collection and rental growth’.

It is now targeting to pay an annual dividend of 6.0 pence per share for the 12-month period starting on April 1. That is up from its previous annual target of 5.75p. It will be paid in three quarterly instalments of 1.5p per share.

Importantly, it said this assumes that rent collection rates remain as expected and that the payout can be fully covered by net rental income.

LXI REIT also declared a dividend of 1.44p for the latest quarter covering the last three months of 2020, which will be paid on March 26 to shareholders on the register on February 26.

LXI REIT shares were broadly flat in early trade at 125.4.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade