Top UK Stocks to Watch: Rolls Royce reports bigger loss than expected

Top News: Rolls Royce eyes recovery after hefty loss

Rolls Royce plunged to a worse-than-expected loss during 2020 as the collapse in air travel hit the company hard, but said it was hoping to start recovering in the second half of this year.

Revenue in 2020 plunged to £11.82 billion rom £16.58 billion in 2019, mainly thanks to the airline industry being severely constrained during the pandemic. Rolls Royce makes a large amount of money by servicing engines, but this has struggled since air travel collapsed.

‘The impact of the COVID-19 pandemic on the group was felt most acutely by our Civil Aerospace business. In response, we took immediate actions to address our cost base, launching the largest restructuring in our recent history, consolidating our global manufacturing footprint and delivering significant cost reduction measures,’ said chief executive Warren East.

The company reported an underlying pretax loss of £4 billion, swinging from a £583 million profit in 2019. That was considerably worse than the £3.1 billion loss forecast by analysts.

Rolls Royce reported negative free cashflow of £4.18 billion in the year. Rolls Royce said it is aiming to return to positive free cashflow during the second half of 2021 and hopes to deliver at least £750 million in 2022 – although warned this would be dependent on the speed of the recovery in the airline industry.

Still, it is expecting to report burn through £2 billion during 2021 on the assumption that its large engine flying hours will equal around 55% of 2019 levels, up from 43% in 2020.

Rolls Royce has enough cash to cover the expected burn this year, with liquidity of £9.0 billion. This is made up of £3.5 billion in cash and £5.5 billion in credit facilities. This was significantly bolstered during the year after it completed a £2 billion rights issue and secured over £5 billion of new credit from its lenders.

Rolls Royce is unsurprisingly not paying a dividend but can’t restart payouts until 2023 at the earliest because of the conditions attached to some of its new loans.

Where next for the Rolls Royce share price?

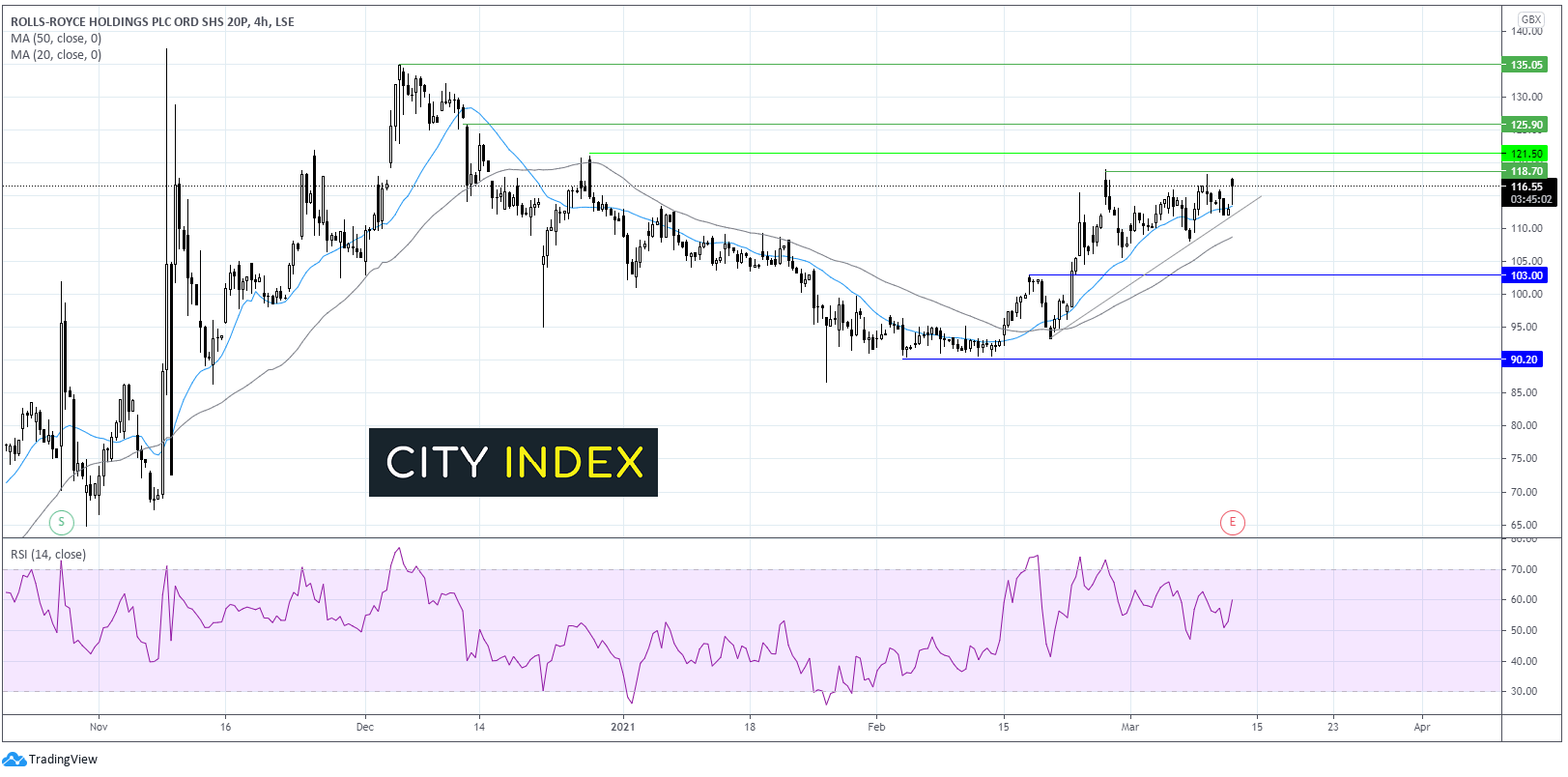

After trending southwards since mid-December Rolls Royce bottomed out at 90 in early February and has been trending higher since.

The share price trades above its 20 & 50 sma on the 4-hour chart and above its ascending trendline dating back to mid-February indicating a bullish move.

However, the RSI is showing a bearish divergence which raises questions over Rolls Royce’s ability to move much higher.

The bulls would need to see a break above 119p a level which has capped the upside since late February. A move beyond here could see horizontal resistance at 121.50 tested on the way to 125 high 11th December.

On the downside, immediate support can be seen at 113, today’s low, the 20 sma and the ascending trend line. A breakthrough there could open the door to 108 the 50 sma and horizontal resistance turned support from the turn of the year. A breach of this level could negate the current bullish trend and see more sellers jump in.

Morrisons hits expectations and ups dividend

Morrisons said it has raised its dividend after meeting expectations in its recently-ended financial year, showing that additional pandemic-induced costs severely dragged down profits.

The supermarket said revenue was up 0.4% in the year to the end of January at £17.6 billion while like-for-like sales excluding fuel and VAT was up 8.6%.

Pretax profit before exceptionals and the repayment of £230 million worth of business rates relief came in at £431 million – within its guidance range of £420 million to £440 million. Including the repayment of relief, pretax profit before exceptionals more than halved to £201 million from £408 million.

Once exceptional one-off costs such as impairments and write-downs are included, pretax profit was down 62% to £165 million from £435 million. This included £290 million worth of Covid-19 related costs, such as extra payroll, staff bonus and the price of introducing extra safety precautions in its stores.

Cashflow suffered during the year as profits fell and it felt the impact of lower fuel sales during lockdown, stockpiling and faster payments being made to suppliers. Net debt rose during the year to end January at £3.16 billion from £2.45 billion a year earlier.

Still, Morrisons raised its final dividend by 5.6% to 5.11 pence, taking its full-year ordinary payout to 7.15p, up from 6.77p the year before.

Morrison said it expects pretax profit before exceptionals to be higher this year and that strong free cashflow should allow it to reduce debt.

‘Our business has reacted and responded very well throughout the pandemic, and both our absolute and relative trading performance has been consistently strong. We are confident we can continue our momentum into the new year, and expect both profit growth and a significant reduction in net debt,’ said Morrisons.

Morrisons shares were down 0.8% in early trade at 175.7.

WPP ups dividend and launches buyback despite entering red

WPP has significantly raised its dividend and launched a new share buyback programme despite swinging into the red during 2020.

The advertising giant said revenue fell 9.3% in 2020 to £12.00 billion from £13.23 billion in 2019. Like-for-like sales were down 7.3%. Revenue less pass through costs, its preferred topline measure, was down 10% to £9.76 billion from £10.84 billion.

Underlying pretax profit was down almost 24% to £1.04 billion from £1.36 billion. On a reported basis, WPP sank to a £2.79 billion loss from a £1.21 billion profit in 2019.

‘While revenue was significantly impacted as clients reduced spending, our performance exceeded our own expectations and those of the market throughout the year. There is no doubt that the actions we took during the previous two years to transform and simplify the business and reduce debt - to a 16-year low at the end of 2020 - played a crucial role in the strength of our response,’ said chief executive Mark Read.

WPP said it expects like-for-like revenue less pass through costs will grow by a ‘mid single digits percentage’ in 2021, having come in at -8.2% in 2020, while its headline operating margin should be between 13.5% to 14.0% compared to the 12.9% delivered last year.

WPP said its final dividend for the year will be 14.0 pence, which takes the full year payout to 24.0p. That compares to just 5.7p in 2019, when WPP suspended the final payout as the pandemic erupted. It has since introduced a new policy aimed at paying out 40% of headline diluted earnings per share – which came in at 59.9p in 2020.

WPP is also resuming its plan to buyback £620 million worth shares using proceeds from disposing of Kantar after delaying it last year. This will start with £300 million worth of shares being bought over the next three months.

‘In December 2020, we outlined our plans to continue to transform our business, to accelerate our growth and to put purpose at the heart of what we do. We see many areas of attractive growth for WPP, from the permanent shift to ecommerce, the digitisation of media and the need from our clients to convert brand purpose into action,’ said Read.

‘The past 12 months have demonstrated the importance and impact of communications. The demand from clients for simple, integrated solutions that combine outstanding creativity with sophisticated data and technology capability is only set to grow and, while uncertainties remain around the impact of the vaccine roll-out and economic growth, we continue to expect 2021 to be a year of solid recovery,’ he added.

WPP shares were down 0.5% in early trade at 910.8.

Marshalls reinstates dividend and raises expectations for 2021

Marshalls shares popped this morning after the company reinstated dividends despite reporting significantly lower profits in 2020, underpinned by improving market conditions and a buoyant outlook.

The paving and concrete specialist said revenue in 2020 fell to £469.5 million from £541.8 million. Sales were hit during the first half when lockdown was first introduced but recovered strongly in the second half, with sales returning to growth in the final quarter of the year.

Lower revenue pushed Earnings before interest, tax, depreciation and amortisation down to £57.6 million from £103.9 million. Adjusted operating profit slumped to £27.2 million from £73.7 million and adjusted pretax profit plunged to £22.5 million from £69.9 million.

Pretax profit came in at just £4.7 million on a reported basis.

Marshalls said it was reinstating dividends by making a final payout of 4.3 pence. The company said it will continue to pay dividends on the basis that the payout can be covered 2x by earnings in 2021 and beyond. Earnings per share, excluding impairments and one-off costs, came in at 8.6p in 2020.

‘Trading has started strongly in 2021. At the end of February, sales are up 7 per cent and orders are up 12 per cent compared to same period in 2020. The CPA's winter base case scenario predicts an increase in UK market volumes of 14.0 per cent in 2021 and 4.9 per cent in 2022. Despite wider market uncertainty, the underlying indicators in our main growth markets of New Build Housing, Road, Rail and Water Management remain positive,’ said chief executive Martyn Coffey.

‘Although market demand remains uncertain, we remain focused on developing future growth opportunities and delivering the strategic objectives in our 5 year Strategy. Our strategy continues to be underpinned by strong market positions, focused investment plans and an established brand. Marshalls' liquidity is strong and will support our investment priorities going forward,’ he added.

Marshalls shares were up 5.7% in early trade at 738.3.

Royal Dutch Shell appoints Andrew Mackenzie as new chairman

Royal Dutch Shell said it has appointed Andrew Mackenzie as its new chairman to replace Chad Holiday, who is stepping down after six years in the role.

Mackenzie joined Shell last October and will take up his new role on May 18, 2021, when Shell is due to hold its annual general meeting and Holiday stands down.

Mackenzie was previously the chief executive of mining and commodities giant BHP Group before leaving in 2019 and joining Shell’s board a year later. Before that, he was the head of industrial minerals and diamonds at Rio Tinto for three years after completing a 22-year career at BP.

Shell shares were up 0.3% in early trade at 1502.6.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade