Top UK Stocks to Watch: Rio Tinto shares hit record high on bumper payout

Top News: Rio Tinto pays biggest dividend in its history

Rio Tinto said it will pay a record dividend for 2020 after higher commodity prices allowed it book significantly higher margins and profit, sending shares to an all-time high.

The miner said revenue in the year edged up to $44.61 billion from $43.16 billion the year before, but underlying earnings before interest, tax, depreciation and amortisation jumped 13% to $23.90 billion from $21.19 billion. Net earnings jumped even higher, growing 22% to $9.76 billion from $8.01 billion.

The strong results prompted it to pay a total dividend of $5.57 per share, including a special payout of 93 cents. That represents a 72% payout ratio for the full year. That will mean the miner is returning $9 billion in cash to shareholders for 2020, with the final dividend alone worth $6.5 billion.

Rio Tinto follows in the footsteps of peers Glencore and BHP, which also recently reported strong results on the back of higher commodity prices. Rio Tinto makes the bulk of its money from iron ore, which significantly rose in value during the year, alongside the likes of copper.

‘It has been an extraordinary year - our successful response to the COVID-19 pandemic and strong safety performance were overshadowed by the tragic events at the Juukan Gorge, which should never have happened,’ said chief executive Jakob Stausholm.

Stausholm was previously the company’s chief financial officer but was promoted to CEO in December after the Juukan Gorge incident, which saw the miner destroy a sacred aboriginal site whilst it was blasting to make room for its mine expansion in Western Australia and prompted Jean-Sebastien Jacques and a number of other board members to resign.

‘My new executive team and wider leadership of the company are all committed to unleashing Rio Tinto's full potential. We will increase our focus on operational excellence and project development and strengthen our ESG credentials. Working closely with the board, we must earn the right to become a trusted partner for Traditional Owners, host communities, governments and other stakeholders but we all recognise that this will require sustained and consistent effort,’ Stausholm said.

Where next for the Rio Tinto share price?

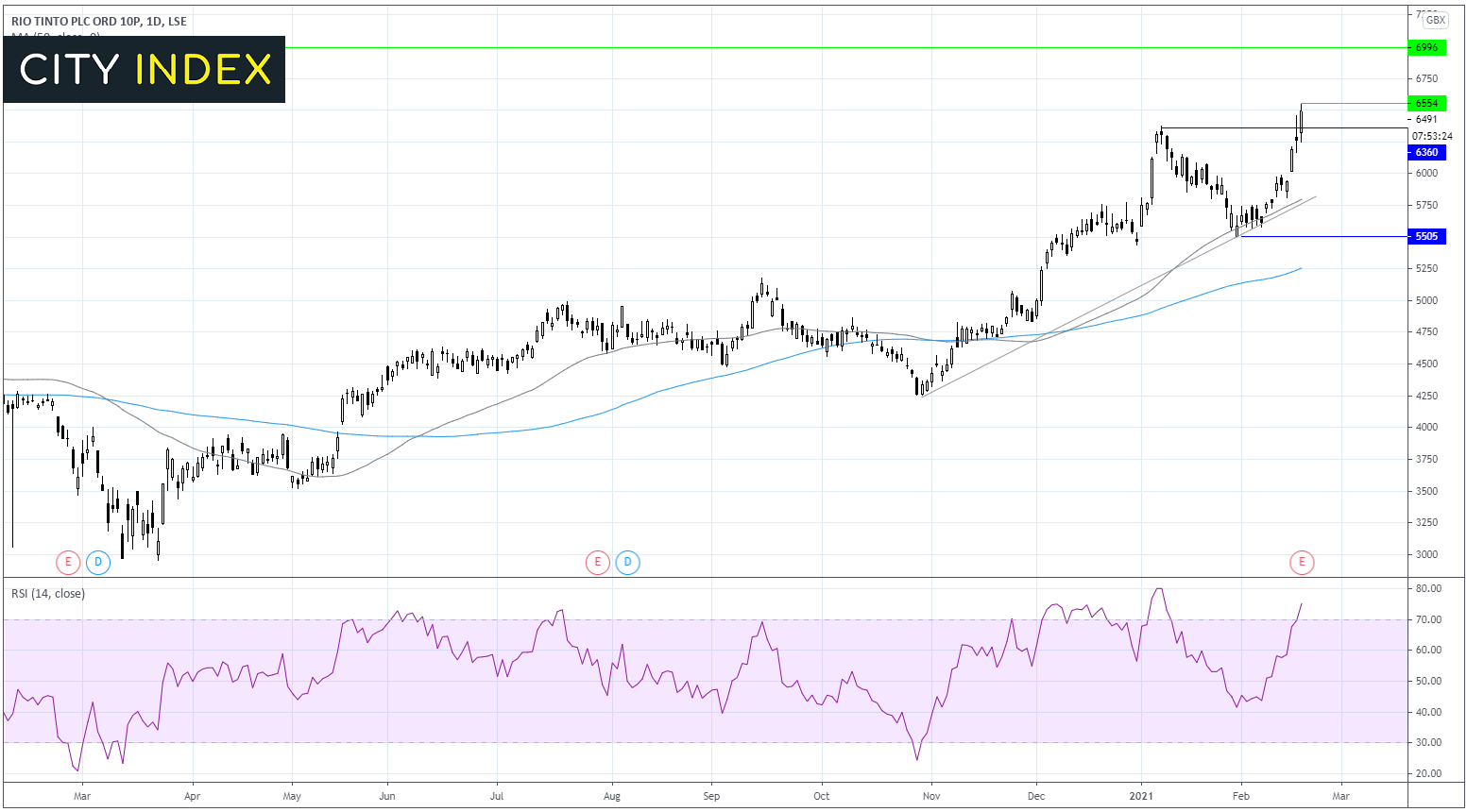

Rio Tinto shares have seen a hard grind higher from the mid-March low. However, the bulls gained momentum from late October hitting an all-time high of 6378 in early January before easing lower.

Today’s 3.5% jump higher has taken the price through 6378 to a fresh all time high of 6553.

Rio trades in an established bullish trend, reflected by trading above its ascending trendline dating back to late October, and above its ascending 50 and 100 sma on the daily chart.

The RSI is above 70 in overbought territory which warrants some caution from the bulls, a period of consolidation or even a pullback could be on the cards.

A breakthrough6553 is needed for the bulls to look towards 7000.

On the flip side immediate support is seen at 6378, however a pullback to strong support at 5750 the confluence of the ascending trendline and 50 sma is still possible whilst keeping the bullish trend intact.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

BAT posts higher earnings despite pandemic headwinds

British American Tobacco, or BAT, said higher prices and growth in new products helped offset headwinds caused by the coronavirus pandemic to post higher earnings in 2020.

The tobacco giant said revenue fell 0.4% to £25.77 billion in year thanks to unfavourable foreign exchange rates and headwinds caused by the pandemic, but that profits from operations jumped 10.5% to £9.96 billion, partly because of better margins.

BAT said revenue from cigarettes was up 2.8% in the year as higher prices offset lower volumes, while its new segment concentrating on areas like vaping and chewing tobacco reported revenue growth of 15%.

‘Last year we increased the number of consumers of our non-combustible products by 3.0 million to 13.5 million, doubling the rate of consumer adoption in the second half of 2020. We have excellent momentum in New Categories, with accelerating volume and value share gains,’ said chief executive Jack Bowles.

BAT is aiming to have 50 million customers using its new non-combustible products by 2030. It said it invested an incremental £426 million into New Categories last year and that it is ahead of schedule with plans to deliver £1 billion in annualised cost-savings by 2022 to help fund further investment going forward. It has locked-in £660 million of savings so far.

The company said cash conversion remained broadly stable during the year and that net cash from operations rose 8.8% to £9.97 billion, prompting it to raise its dividend by 2.5% to 215.6 pence.

BAT said it expects to deliver constant currency revenue growth of 3% to 5% in 2021, and progress closer to its goal of delivering £5 billion in revenue from new products by 2025, from £1.44 billion in 2020. Adjusted earnings per share is expects to grow by a -mid-single figure’ and take further pandemic-induced headwinds and unfavourable exchange rates into account.

It said it expects ‘high single-digit’ growth in adjusted EPS once the pandemic is over.

BAT shares were down 5.7% in early trade at 2591.3.

Imperial Brands appoints Lukas Paravicini as CFO

Imperial Brands said Lukas Paravicini will become its new chief financial officer on August 5, replacing Oliver Tant who will leave the business after a handover.

Paravicini is currently the CFO of agricultural commodities and brokerage group ED&F Man Holdings and has previously worked at dairy exporter Fonterra and food giant Nestle.

‘I am delighted to welcome Lukas to the business. He is a disciplined, results-oriented leader with a proven track record in international consumer goods companies. As well as his impeccable finance credentials, Lukas has considerable operational experience, as well as expertise in driving transformational change including in global shared services in large international organisations. These qualities will be invaluable to Imperial as we implement our new strategy,’ said chief executive Stefan Bomhard.

Imperial Brands shares were down 1.4% in early trade at 1494.3.

AstraZeneca says Lynparza could provide personalised breast cancer treatment

AstraZeneca has said its Lynparza drug could be used to provide personalised treatment for women with hereditary breast cancer after the Independent Data Monitoring Committee (IDMC) recommended the results from its latest trial should be analysed and released early.

This means the Phase III trial will move into early primary analysis. The trial is being run by the OlympiA partnership between Breast International Group, NRG Oncology, the US National Cancer Institute, Frontier Science & Technology Research Foundation, AstraZeneca and MSD.

‘We are delighted that our global academic and industry partnership has been able to help investigate a possible personalised treatment for women with hereditary breast cancer. The most common cause of hereditary breast cancer is an inherited mutation in the BRCA1 or BRCA2 genes which also may cause the disease to develop at a significantly earlier age than is usual,’ said Andrew Tutt, the global chair of the OlympiA trial and professor at the Institute for Cancer Research and Kings College London.

‘The OlympiA trial has allowed us to go beyond using genetic testing to identify patients who are at risk of this disease and explore the potential of Lynparza to prevent disease recurrence for these patients. We look forward to analysing and presenting the full results of the trial at a forthcoming medical meeting,’ he added.

AstraZeneca shares were up 0.2% in early trade at 7339.0.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

TP ICAP shareholders snap up shares in rights issue

TP ICAP said over 98% of all the shares offered under its recent rights issue were taken up by shareholders.

The 2-for-5 rights issue offered 225.3 million new shares to shareholders priced at 140.0 pence and has now closed for acceptances. In total, 221.5 million shares, 98.3% of the total offered, have been bought by investors.

The company announced the rights issue in January to help part-fund the acquisition of Liquidnet Holdings that will create a ‘UK-headquartered, global financial markets infrastructure provider.’

TP ICAP shares were up 0.6% in early trade at 205.2.

IP Group says ApcineteX is bought by Centessa Pharmaceuticals

IP Group said Centessa Pharmaceuticals has purchased one of the companies it is invested in, ApcinteX.

The purchase means IP Group now owns a minority stake in Centessa that is worth £19 million, which is up from the £8 million valuation of its holding in ApcinteX at the end of June 2020.

Centessa is a new business that recently raised $250 million to purchase a number of biotech companies, including ApcinteX, and bring them under one umbrella.

IP Group shares were down 0.5% in early trade at 114.4.

Signature Aviation sells engine repair business for $230 million

Signature Aviation said it has sold its engine repair and overhaul business to StandardAero for $230 million.

The business is a leading engine service provider to airlines and the wider aviation market with hubs in the US, Europe, South America and Asia. It reported underlying earnings before interest, tax, depreciation and amortisation of $29.1 million in 2019 and has gross assets of $358.1 million.

Notably, Signature Aviation said it will only book net proceeds of around $140 million of the deal because of ‘change of control fees but also reflecting purchase price adjustments, income taxes, professional transaction fees and other costs.’

‘We are pleased that we have reached agreement to sell our ERO business to StandardAero, where we believe the business will continue to flourish. We are committed to delivering long-term sustainable value for shareholders and this sale focuses us on Signature Aviation our strong cash generative business. I would like to thank all the ERO employees for their hard work and commitment, during our many years of ownership,’ said chief executive Mark Johnstone.

Signature Aviation shares were down 0.8% in early trade at 401.6.

Greencoat UK Wind raises £198 million in placing

Greencoat UK Wind said it has raised £198 million through a placing to help it pay down debt and fund a new pipeline of investments.

The fund, which invests in renewable energy infrastructure, launched the placing last Friday and priced the offer at 131p per share. A total of 150.8 million new shares will be issued as a result.

‘We are grateful for the ongoing support from our shareholders, which has led to another successful and oversubscribed equity capital raise. Our simple, low risk model continues to deliver and we look forward to maintaining our track record of dependable returns to shareholders,’ said chairman Shonaid Jemmett-Page.

Greencoat UK Wind shares were trading flat in early trade at 131.9.

Mitchells & Butlers extends option over Ego Restaurants

Mitchells & Butlers said it has amended an agreement to extend its option to buy the rest of the Ego Restaurants business that it does not already own.

M&B acquired a 40% stake in the holding company of Ego Restaurants, 3Sixty, in August 2018 for £4 million. It then struck an agreement with the other shareholders on how to develop the business, which included M&B leasing out sites to be converted into Ego Restaurants.

Currently, there are 23 Mediterranean-style family restaurants in the Ego Restaurants portfolio, 13 of which operate from sites leased by M&B.

As part of that initial deal, M&B had the option to buy the other 60% of 3Sixty in August 2021. However, the company has now agreed with the other investors to extend that option so it can only be called after April 1, 2023.

It also said the agreement meant the price it would potentially pay for the 60% stake would be capped at £40 million. 3Sixty currently boasts gross assets of £9 million and made an operating loss of £750,000 in the year to the end of March 2019.

Mitchells & Butlers shares were down 0.5% in early trade at 333.5.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade