Top UK Stocks to Watch: PageGroup shares pop on recovery hopes

Top News: PageGroup sees ‘noticeable improvement’ in early 2021

PageGroup said it expects annual operating profit to bounce back this year after being severely hit during the pandemic as it reported growth in the first-quarter of the year.

The specialist recruiter said it expects full year operating profit to be around £90 million to £100 million in 2021. That would considerably better than the £17 million booked in 2020, when business was hampered by the pandemic, but still considerably below the £147 million profit booked in 2019.

‘Looking ahead, there continues to be a high degree of global macro-economic uncertainty as COVID-19 remains a significant issue and lockdowns have returned in a number of the group's markets. However, and notwithstanding the early stage in the year, the strength of our performance in Q1, and notably in March, has increased confidence in our outlook for the year,’ said chief executive Steve Ingham.

The positive news came as PageGroup said gross profits grew 1% in the first quarter of 2021 to £184.2 million from £182.3 million. That was the result of strong growth in the EMEA and Asia Pacific regions being balanced out by lower profits from the UK and the Americas. Profits were also held back by unfavourable foreign exchange rates, with over 85% of its profits coming from outside the country.

‘I am pleased to report that year-on-year results in each of the three months of the first quarter improved sequentially, continuing the monthly trend since May last year. January and February were down 13% and 10% respectively, compared to 2020, with March growing 31%,’ said Ingham. ‘Significantly, our performance in March was down just 2% on 2019.’

PageGroup warned that it is too early to decide whether the improvement seen in March is the result of pent-up supply and demand or the start of a sustainable improvement in the market, but said it has boosted its confidence.

Where next for the PageGroup share price?

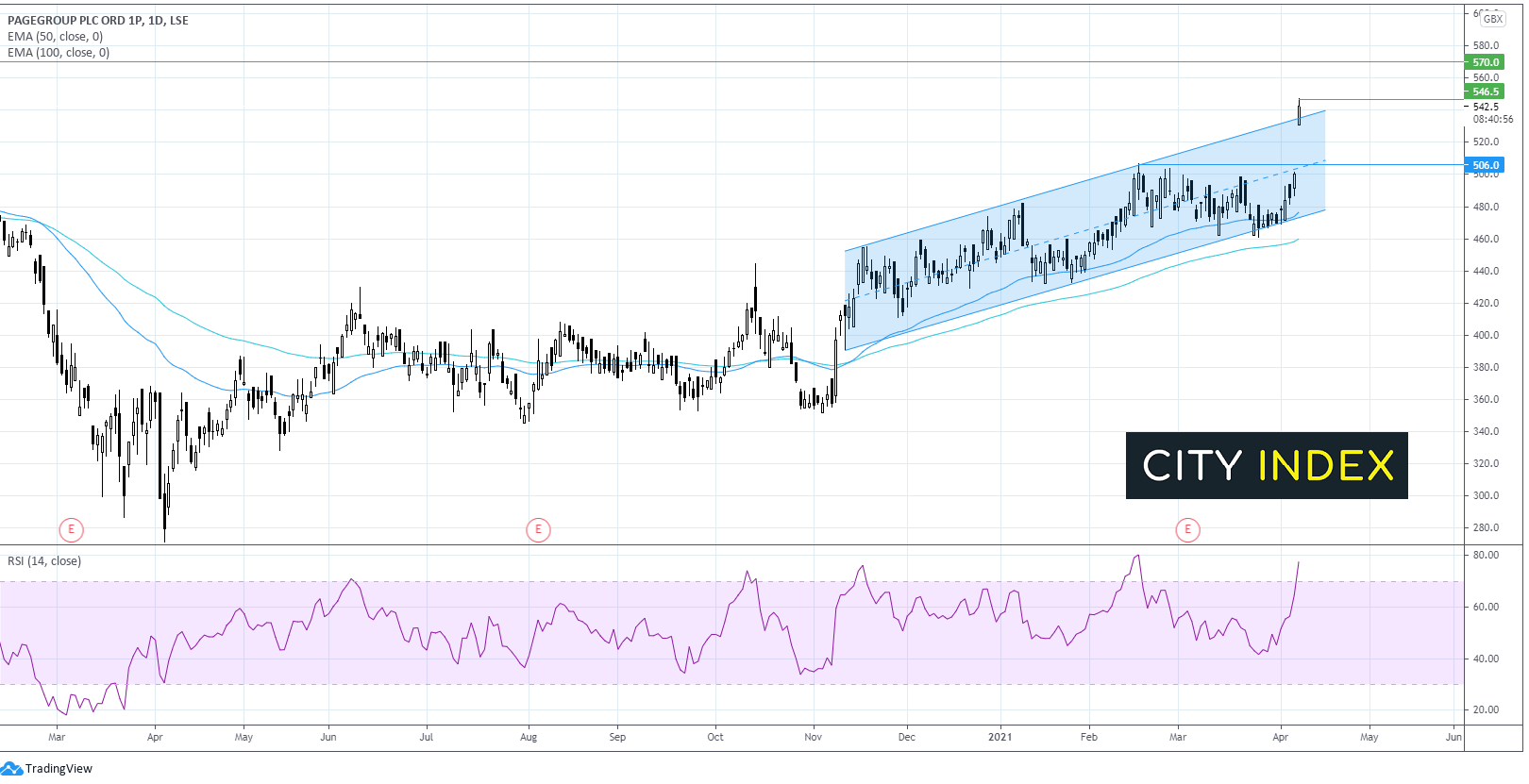

PageGroup has been trending higher since early November, trading within an ascending channel. It also trades above its upward sloping 50 & 100 EMA on the daily chart, indicating an established bullish trend.

The share price has jumped over 7.5% high in early trade, breaking out of the upper band of the ascending channel at hitting a 2.5 year high.

The RSI has moved firmly into overbought territory so a pull back or some consolidation could be on the cards before a further move higher.

Immediate resistance can be seen at 547, today’s high, followed by 570 the high from September 2018.

On the flip side, support can be seen at 505 the previous post pandemic high and the mid-point of the ascending channel. A break below here could negate the near-term bullish trend sand could see the sellers target 475 the 50 EMA.

Frasers Group warns of financial hit as further restrictions ‘almost certain’

Frasers Group has warned it is ‘almost certain’ that the UK retail sector will face further restrictions going forward, which could lead it to book a non-cash impairment of over £200 million against the value of its freehold properties and other assets.

That is double the £100 million impairment it expected to book in February.

‘Frasers Group is continuing to assess the Covid-19 potential impact on asset values. In our ongoing assessment we note the continuing government and government advisor pronouncements regarding "third waves" and normality being "some way off", meaning further restrictions are in our view almost certain,’ said the company on Friday.

‘We also note the Covid-19 affected experiences, estimates, and judgements from other leading retailers,’ Frasers Group added.

The impairments will be booked in the financial year that ends this month and will be in addition to the £125 million of write-downs made against its assets during the first half.

The warning comes as non-essential retailers prepare to reopen their stores on Monday.

Frasers Group shares were trading slightly lower this morning at 496.6.

Rio Tinto finds the billions needed to build Oyu Tolgoi

Rio Tinto said it has come to an agreement with its partner Turquoise Hill Resources to update the funding plan for the Oyu Tolgoi underground project in Mongolia.

The project was short of funding by $2.3 billion but this hole has now been plugged by the new agreement, which replaces a less concrete deal agreed by the companies last September.

The binding deal will see the pair adjust the repayments due under $1.4 billion of existing project finance to align them better with its development plan. They will also look to raise up to $500 million in new senior debt under existing facilities.

Rio Tinto said it has committed to covering any shortfall in funding by providing up to another $750 million worth of debt, while Turquoise has agreed to sell up to $500 million worth of shares in a placing or rights issue if that happens.

‘This agreement and alignment with TRQ represents a major milestone in the continued development of Oyu Tolgoi, which is expected to become one of the world's largest copper mines and a significant contributor to the Mongolian economy for years to come,’ said chief executive Bold Baatar.

Rio Tinto shares were up 1% in early trade at 5804.5.

Avon Rubber sees first-half revenue jump 40%

Avon Rubber said it expects to report an impressive 40% lift in revenue during the first-half of its financial year, driven by strong growth and order intake for its protective gear and a maiden contribution from Team Wendy.

The company said it expects to report revenue of around $122 million in the six months to the end of March, up from just $87 million the year before. Team Wendy, a helmet maker that was purchased last year, contributed $20 million during the first five months of ownership with the rest of the growth coming from strong order intake for its protective gear.

Avon Rubber said its current order book stands at $155 million and that this, combined with its first-half performance, gave it confidence it can meet its expectations for the full-year.

The company will release interim results on May 25.

Avon Rubber shares were up 1% in early trade at 3466.0.

Boohoo to open new warehouse in Daventry to boost capacity

Online fashion retailer Boohoo has signed a long-term lease for a new warehouse in Daventry to help support its expansion plans by providing extra capacity.

The company said the new warehouse will become operational before the end of June and will sit alongside its existing sites in Burnley, Sheffield and Wellingborough. The addition of the new site means Boohoo will have capacity to meet £4 billion worth of annual net sales. Considering Boohoo made annual revenue of £1.23 billion in the year to the end of February 2020, this gives the company plenty of headroom to expand.

‘The new warehouse is scalable, with the group expecting to invest over £50 million in the coming years, increasing capacity and offering the group operational flexibility as it grows. The deal is expected to secure up to 500 jobs and in the future create up to a further 1,000 jobs as capacity increases at the site,’ Boohoo said.

Boohoo shares were down 0.6% in early trade at 341.3.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade