Top UK Stocks and Shares | Ocado Share Price | Sainsbury's Share Price | Purplebricks Share Price

Top News: Ocado says pandemic has changed grocery landscape ‘for good’

Ocado said earnings more than trebled during its recently-ended financial year as it continues to benefit from the shift to online grocery shopping, but said increased investment could hold back earnings from growing in the new year.

Revenue rose 21.4% in the 26 weeks to May 30 to £1.3 billion, driven by growth from both its grocery and Solutions business that helps other firms with their ecommerce offerings. Ebitda more than trebled to £61.0 million.

Despite the significant improvement, revenue was way below what was expected by analysts and earnings were lower than the £65.7 million forecast. Ocado as a whole remained in the red at the bottom-line with a pretax loss of £23.6 million, but that was an improvement from the £40.6 million loss booked the year before.

Its online grocery arm, which works with Marks & Spencer, delivered 19.8% revenue growth in the period and saw earnings jump by over 58%, driven by the fact Ocado is delivering industry-leading margins. It ended the period with 777,000 active customers, up from 639,000 the year before.

‘As we head towards a post Covid-19 future, it is increasingly clear that the landscape for grocery worldwide has changed, for good. Over the last eighteen months, we have shown that the Ocado model works even in the most challenging and fluid of environments. That ours is a proven model in online grocery has been again demonstrated by the strong performance of Ocado Retail, the historic core of the Ocado business, which has led the market in customer experience, increasing sales by 20% in the period, thanks to a significant increase in customer numbers, while continuing to show sustainable and industry-leading profitable growth,’ said chief executive Tim Steiner.

Its UK Solutions business reported 13% revenue growth and a 6.4% increase in earnings, with the Bristol CFC now scaling faster than any site built before. Its International Solutions arm remained in the red but revenue leapt to £26.1 million from only £1.6 million the year before as centres for the likes of Groupe Casino in France and Sobeys in Canada start to take-off.

Separately, the company announced Ocado Solutions has struck a partnership with Auchan Retail to help develop the online business of its Alcampo brand. Auchan is one of the world’s largest grocers that is active in 13 countries and owns the Alcampo brand in Spain that has 310 stores and books around EUR4.5 billion in revenue each year. An acceleration in online shopping has encouraged Alcampo to build its online offering, with the partnership to see Ocado build a CFC in Madrid from 2024. More centres are to be announced in the future. Ocado’s software will also be deployed to help run the new digital operations.

Although business is going well, Ocado warned that it expected its Solutions arm to contribute £30 million less in Ebitda over the next year than previously thought. This is mainly because the cost of integrating Kindred Systems has increased and due to higher levels of investment in the UK and internationally. Still, it said the strong performance from its grocery arm means it is leaving its expectations for the new year unchanged.

Where next for the Ocado share price?

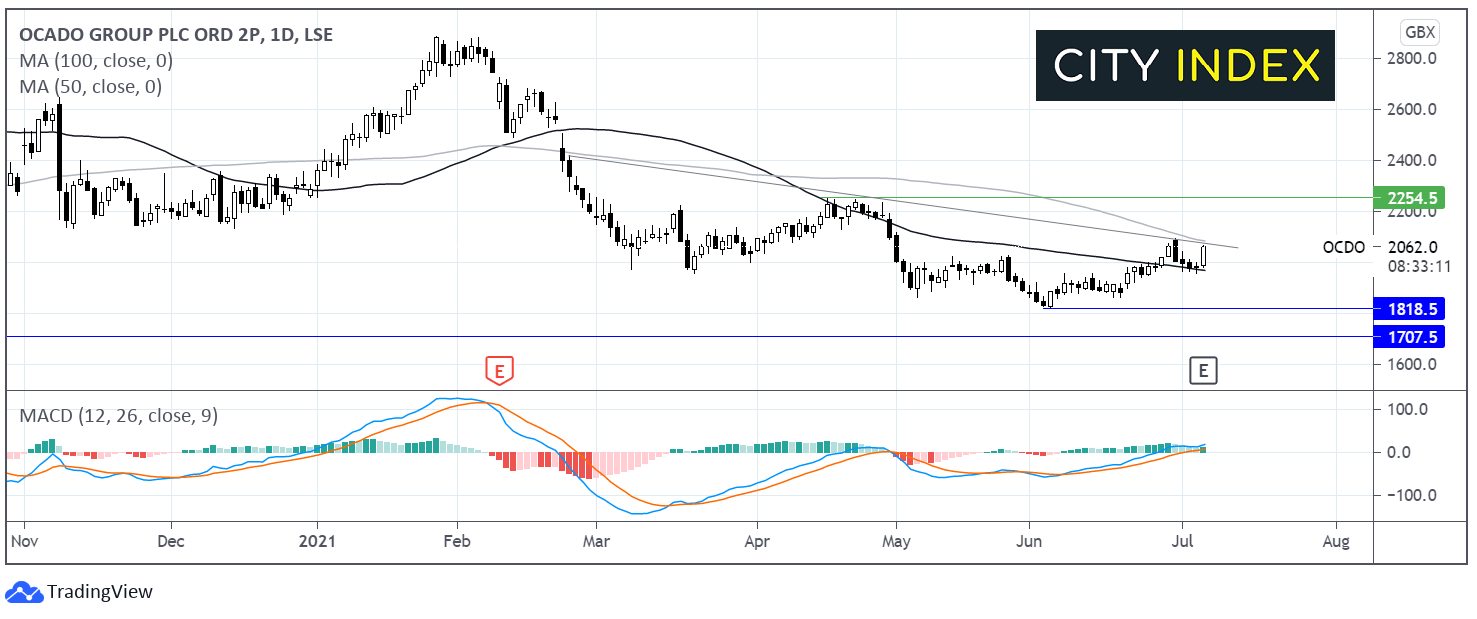

The Ocado share price reached an all-time high in late January at 2886p. The price has been trending lower since.

The price found a floor at 1820p in early June and has been attempting a recovery since. The price has moved back over its 50 day ma which now offers support.

Buyers are now targeting 2080p; the 100 sma and the descending trendline dating back to late February. A move above this level would negate the current downtrend and could see buyers gain traction towards 2250p the April high.

Failure to break above 2080p could see the price retrace to the 50 sma at 1970p and support at 1820p. A break below here could see 1705p come into play, a level last seen in April 2020.

Sainsbury’s raises guidance after outperforming in first quarter

Sainsbury’s said sales of groceries, general merchandise and clothing were all better than expected during the first quarter, prompting it to raise its guidance for the full-year.

Total like-for-like and reported sales were up 1.6% excluding fuel in the 16 weeks to June 26. Notably, sales were still running 10.3% higher than two years prior, before the pandemic hit, demonstrating that whilst sales are still running markedly ahead of pre-pandemic levels that growth is slowing as supermarkets start to come up against tough comparatives from last year when demand exploded.

Grocery sales rose 0.8% year-on-year and clothing sales jumped 57.6% as people refreshed their wardrobes as lockdown eases. General merchandise sales were down 1.4% as a decline at Argos offset an impressive rise in merchandise sales inside Sainsbury’s supermarkets.

‘Sales of grocery, general merchandise and clothing were all higher than our expectations throughout the quarter. Grocery sales benefited from higher in-home consumption due to continued COVID-19 restrictions. In addition, we continued to outperform competitors and grow market share, reflecting improved value, more innovation and better customer service as we make strong progress in putting food back at the heart of Sainsbury’s. General merchandise sales were lower than last year’s elevated levels but ahead of our expectations, despite global supply challenges which are likely to continue for the remainder of the year,’ said the supermarket.

Sainsbury’s said it now expects to deliver annual underlying pretax profit of at least £660 million, up from its previous goal of just £620 million. That would compare to the £356 million delivered in the last financial year and the £586 million booked the prior year before the pandemic hit.

Sainsbury’s said its performance has encouraged it to accelerate investment into the business to improve value for customers. This includes a new £50 million investment to help lower prices on targeted products and everyday essentials.

Sainsbury’s shares were trading just 0.1% higher this morning at 278.7p, but they still trade at their highest level since February 2019. That has also been partly driven by the bidding war that looks set to erupt for rival Morrisons, which now has at least three potential suitors. This has prompted theories that Sainsbury’s and other supermarkets could become takeover targets as private equity firms look to tap-into the UK grocery market.

Purplebricks beats expectations as it unveils ‘2.0’ strategy

Purplebricks reported significantly higher earnings than expected during its recently-ended financial year as the company embarks on what it calls ‘Purplebricks 2.0’ that aims to scale-up the business and evolve it into a more mature organisation.

The online estate agency said revenue rose 13% in the year to the end of April to £90.9 million from £80.5 million the year before. Adjusted Ebitda more than quadrupled to £12.0 million from £2.9 million and it escaped the red at the bottom-line by turning to an £6.8 million profit from operations compared to a £5.7 million loss the year before.

The results were significantly better than expected, with analysts having forecast revenue of £88.0 million and adjusted Ebitda of just £2.6 million.

‘The group has started the new financial year in a strong position, with a very clear understanding of its operational barriers to success, and with multiple strategic levers in place to drive its growth. The group's new pricing structures, including a Money Back Guarantee and a simplified two-tier proposition, are launching in July 2021,’ said the company.

‘The market for sales is buoyant at the moment, with fall through rates at their lowest in a long time, but with the very healthy demand currently outstripping new supply volumes. We expect supply and demand to return to more of a balance post Summer,’ it added.

The company said Ebitda in the new financial year will be broadly flat but said its strategy should accelerate growth in revenue over the coming years. Purplebricks said it had around 4.6% market share based on the number of properties sold during the year, a slight dip from the 5.1% reported the year before. However, Purplebricks said it continues to pursue a 10% slice of the market over the medium-term.

‘Once these initiatives have been successfully rolled out, the group will accelerate its marketing strategy to grow instructions and share. As a result of these strategic changes, the board expects Purplebricks to be able to deliver annual revenue growth in excess of 20% in the medium-term, with confidence in the group's ability to deliver against its growth strategy,’ Purplebricks explained.

Purplebricks shares were down 2.5% in early trade this morning at 83.50p.

Assura grows portfolio as development activity hits record levels

Assura, which invests and develops in primary care properties, said it continued to grow its portfolio during the first quarter of its financial year and that development activity has reached record levels.

The company said it ended the first quarter to the end of June with a portfolio of 610 properties that combined have an annualised rent roll of £123.5 million. It added 12 new properties in the period after developing one and buying 11 more for a total cost of £53.0 million. Meanwhile, it sold off 11 properties for a total of £15 million, which it said was above book value.

Assura also said that current development activity, with 17 sites currently under construction at a total cost of around £99 million, currently sits at record levels. That is up from £72 million at the end of March.

It said its acquisition and development pipelines have both grown over the last three months. It now has an acquisition pipeline worth around £58 million and said these should be purchased within the next three to six months. That is up from a £46 million pipeline at the end of March. Meanwhile, it has 19 schemes worth £121 million within its development pipeline where it expects to begin work within the next 12 months compared to only £111 million three months earlier.

Assura said it has also strengthened its financial position following the issue of its £300 million sustainability bond in June, which allowed it to end June with net debt of £954 million.

Assura shares were trading 0.5% higher in early trade this morning at 75.3p.

IPO News: Bridgepoint aims for Main Market as Lords Group eyes AIM listing

In IPO news this morning, Bridgepoint confirmed it plans to list on the main market of the London Stock Exchange and said it will issue new shares to raise £300 million. It will float at least 25% of the business and said it expects to qualify for the FTSE UK indices.

The company, which invests in private equity and credit, first unveiled its IPO plans on June 29. The company claims to be the ‘leading middle market private markets firm in the world’. The middle market refers to mid-sized companies, many of which tend to still be in private hands.

Bridgepoint said its assets under management has grown quickly over the years and driven a significant improvement in results. Operating income rose to £191.8 million in 2020 from £144.8 million in 2018 while underlying Ebitda increased to £66.1 million from £43.3 million. It said ‘further profitable growth has been achieved’ during the initial months of 2021.

Meanwhile, Lords Group, which distributes building materials across the UK, has said it plans to list on AIM by issuing 54.7 million new and existing shares at 95.0 pence each. It has completed a placing to raise £30 million for the company and £22 million for existing shareholders, but both are conditional on shares being floated on AIM.

Lords Group shares will begin trading on AIM on July 20 and it will start life as a publicly-traded business with a market cap of around £150 million. Around 34.5% of the business will be floated upon listing.

Lords Group’s core business is supplying building materials, DIY goods and plumbing and heating products to a network of merchants and online businesses in the UK from its 24 distribution sites. It currently generates annual revenue of around £288 million but aims to grow this to £500 million by 2024.

‘The company is seeking admission in order to raise new equity to provide flexibility to accelerate its growth organically and through acquisitions, as well as to enable the selling shareholders to sell a proportion of their current shareholding. The group will seek to continue its growth through a variety of organic and inorganic strategies, including geographic reach, product expansion, the active expansion of e-commerce platforms and the continued investment in its logistical capability,’ said the company.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade