Top UK Stocks and Shares | NatWest Share Price | Shell Share Price | Unilever Share Price

Top News: NatWest sees ‘reasons for optimism’ over UK economic outlook

NatWest posted better-than-expected results for the first quarter after releasing funds set aside for bad loans and reporting a solid performance from its core brands and loan book.

The bank said operating pretax profit jumped to £946 million in the first quarter of 2021 from £519 million the year before – well ahead of the £722.3 million forecast by analysts. Profit attributable to shareholders of £620 million jumped from £288 million the year before and was also much better than the £409 million expected by the markets.

Total income was down in the quarter to £2.65 billion from £3.16 billion the year before.

Results were flattered by the release of £102 million of funds previously set aside for bad loans, mainly from commercial customers. That represents just a tiny fraction of the £3.2 billion put aside last year. Earlier this week, peers HSBC and Lloyds released £313 million and £323 million of reserves in the first quarter, respectively.

‘NatWest Group's profit in the first quarter of 2021 is a result of a good operating performance in our core franchises as well as modest impairment releases that reflect the better than expected performance of our loan book across the first three months of the year,’ said chief executive Alison Rose.

NatWest said income from its retail and commercial banking arms was down around 8% in the quarter because of the lower yield curve, reduced business activity and lower levels of consumer spending amid the pandemic, but said it managed to offset this with growth on its balance sheet through mortgage lending and higher customer deposits.

‘Defaults remain low as a result of the UK government support schemes and there are reasons for optimism with the vaccine programmes progressing at pace and restrictions being eased. However, there is continuing uncertainty for our economy and for many of our customers as a result of COVID-19. Our capital strength and well-diversified balance sheet means NatWest Group is well positioned to help people, families and businesses to rebuild and thrive,’ Rose added.

Where next for the NatWest share price?

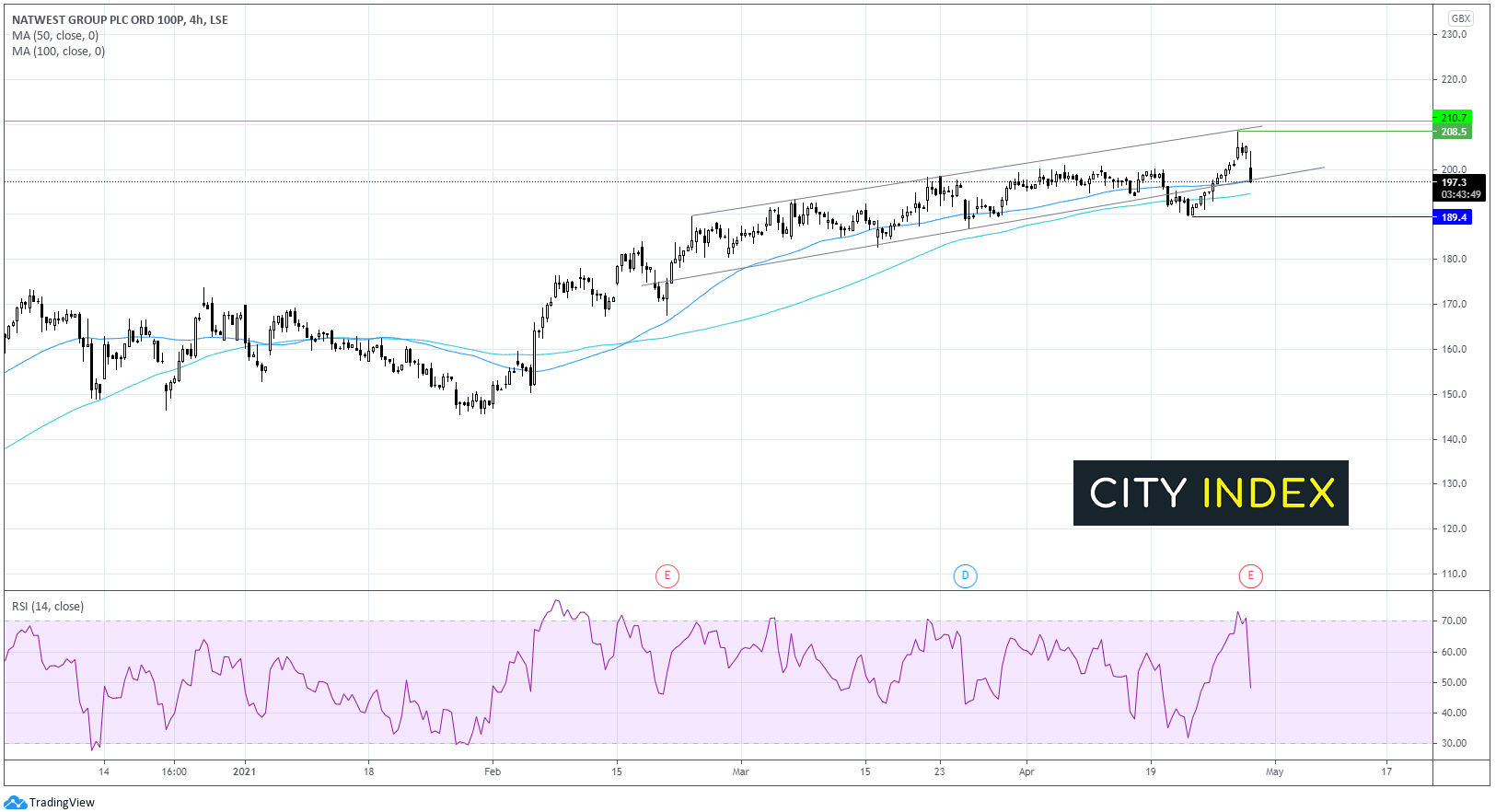

NatWest share price has been trading within an ascending channel since mid-February. After touching a post pandemic high of 208p earlier this week, the price has dropped sharply lower. The RSI has come out of overbought territory and is pointing firmly lower below 50.

The price is testing strong support which is the confluence of the lower band of the ascending trendline and the 50 SMA on the 4-hour chart at 197.5p. A breakthrough here is needed for a deeper selloff to the 100 SMA at 193 and the April low of 189p.

Should the support at 197.5 hold a move above 200p psychological level is needed for the buyers to gain traction, before bringing the post pandemic high of 208p into target.

Shell beats expectations and slashes debt

Royal Dutch Shell beat expectations in the first quarter of 2021 and said it continued to generate ‘sector-leading’ levels of cash as it races to slash debt so it can step-up the level of distributions being made to shareholders.

The oil and gas giant it delivered a strong performance in the period thanks to higher prices, robust production and a solid performance from its chemicals division. That helped offset weaker performances from its refining and marketing businesses.

Shell said adjusted earnings came in at $3.23 billion in the first quarter. That was up from £2.75 billion the year before and considerably higher than the £393 million delivered in the previous quarter, despite being weighed down by a $200 million charge in relation to the winter storm that hit its operations in Texas back in February. It also beat the £3.08 billion expected by analysts.

Its headline figure – current cost of supply earnings – jumped to $4.34 billion from $2.75 billion the year before and turned from a loss in the final quarter of 2020. That also comfortably beat expectations.

Shell generated over $8 billion in cash during the quarter and used $4 billion to cut debt to $71.3 billion at the end of March. It generated a further $3.4 billion from disposals. It is trying to get net debt down to $65 billion so it can increase shareholder distributions to 20% to 30% of its operating cashflow.

In the meantime, Shell investors will continue to receive normal dividends, with the quarterly payout raised by 4% before the results to 17.35 cents.

Shell is under pressure to cut debt and increase returns as quick as possible since its rival BP launched a new £500 million buyback earlier this week after reaching its net debt target far quicker than expected.

Shell shares were trading 1% higher in early trade at 1331.7.

Flutter reports strong online growth across all regions

Flutter Entertainment said it has made a ‘strong start’ to 2021 after revenue jumped by almost one-third in the first quarter, driven by strong online growth.

The gambling company said revenue was up 32% year-on-year at £1.47 billion from £1.12 billion the year before. Virtually all of that is being generated online, with its physical bookmakers in the UK and Ireland having been impacted by lockdown rules. Sports revenue was up 43% year-on-year while gaming revenue rose 18%.

Flutter said average monthly players increased 36% year-on-year in the quarter to almost 7.7 million from 5.6 million.

It reported strong online growth in all regions. UK and Ireland was up 35% and Flutter continued to gain market share. Online revenue from Australia was up 59% thanks to elevated volumes. Investment in its other international operations delivered 7% growth.

‘2021 is off to a strong start for the group. We continued to significantly grow our global player base which in turn drove a 42% increase in our online revenue. At the same time, safer gambling continues to be a key priority across our markets with new measures introduced including our Gamban partnership in the US and development of the planned Affordability Triple Step in the UK,’ said chief executive Peter Jackson.

Meanwhile, the US – the key market to watch at the moment – reported a 135% rise in online revenue in the quarter, setting a new record for revenue and customer numbers.

‘In the US, we continue to lead the market with revenue of almost $400 million in the quarter. We believe that the quality and breadth of our offering remains a key differentiator for FanDuel sports and the key driver of our leadership position. Our US business had over 1.6 million average monthly players in Q1, meaning that it is now twice the size of our Australian business and is quickly closing in on our International division,’ said Jackson.

Flutter said growth in sports revenue should accelerate in the second quarter, partly because it will come up against weaker comparatives compared to last year when most sports were shutdown as the pandemic erupted. However, gaming revenue will face more challenging comparatives.

Flutter also reiterated that it is considering spinning-off a minority stake in its US business FanDuel into its own listing but said it has not yet made a final decision.

Flutter shares were up 0.1% in early trade at 15795.0.

Unilever launches EUR3 billion buyback after ‘good start’ to 2021

Unilever said it expects to deliver growth toward the top end of its target range in the first half of its financial year after making a strong start to 2021 that kept cash coming through the door, prompting it to launch a new EUR3 billion buyback.

The company said revenue declined 0.9% year-on-year in the first quarter of the year to EUR12.3 billion. That was down because of unfavourable foreign exchange movements. Stripping that out, Unilever delivered underlying sales growth of 5.7%. That was made up of a 4.7% increase in volumes and a 1% lift in prices.

‘We are confident that we will deliver underlying sales growth in 2021 within our multi-year framework of 3-5%, with the first half around the top of this range. We expect to increase underlying operating margin slightly for the full year, though with a decline in the first half driven by Covid-19 impacts, higher cost inflation and increased marketing spend over the prior year. Following another year of strong cash flow delivery, Unilever's board has approved a share buyback programme of up to EUR3 billion,’ said chief executive Alan Jope.

The buyback will begin in May and finish before the end of 2021. That is being accompanied by its quarterly dividend of 37.10 pence that will be paid on June 10.

Unilever shares were trading 3.3% higher in early trade at 4210.3.

Smith & Nephew sees key franchises return to growth

Smith & Nephew said its core businesses returned to growth during the first quarter of 2021 after suffering during the pandemic last year, underpinning its guidance to deliver double-digit growth this year as it recovers.

The company, which makes wound care and surgical equipment, was hit when the pandemic erupted as demand for elective surgeries and other medical needs fell. However, things have improved in early 2021, with revenue rising 11.5% year-on-year in the first quarter to £1.26 billion.

Revenue was flattered by favourable foreign exchange rates, two extra trading days and a boost from acquisitions. Still, on an underlying basis that strips all that out, revenue was up 6.2%.

Smith & Nephew said all three of its global franchises returned to growth on an underlying basis. Orthopaedics revenue was up 1.6%, sports medicine was up 10.4% and advanced wound management revenue grew 9.3%.

‘Our first priority for 2021 is to return to growth and recapture our pre-COVID momentum, and we are encouraged by our early progress through Q1. This was driven not only by surgery volumes moving towards more normal levels in many markets, but also the benefits from better commercial execution, acquired assets, and recent product launches,’ said chief executive Roland Diggelmann.

Smith & Nephew reinstated its guidance for the full year to deliver underlying revenue growth of 10% to 13% and a trading profit margin in the range of 18% to 19%. That assumes that conditions improve in the second half as surgeries normalise and the focus on coronavirus wanes.

‘Looking ahead, there is improving visibility as vaccine programmes roll out and healthcare systems reopen. Our approach through 2020 to maintain investment is already demonstrating value and I look forward to seeing further evidence of this as the recovery continues,’ said Diggelmann.

Smith & Nephew shares were trading 5.7% higher in early trade at 1570.5.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade