Top UK Stocks and Shares | N Brown Shares | Motorpoint Shares | Helios Towers Shares | Oxford Instruments Shares | Made.com IPO

Top News: N Brown Group warns potential cost of PPI case has grown

Online clothing retailer N Brown Group warned that Allianz Insurance has asked the courts to expand the case it is building against the company’s subsidiary JD Williams.

The two companies have been locked in the early stages of a legal battle since early 2020, when Allianz filed a legal claim regarding all the payments of redress that the insurer has made to N Brown’s customers and the historical sale of insurance products. This has prompted N Brown to make a counter-claim against Allianz.

The dispute stems from JD Williams selling insurance products, such as Payment Protection Insurance (PPI), to its customers when they bought products before 2014, which was underwritten by Allianz. Since then, UK consumers have been able to reclaim billions in PPI refunds and Allianz has already returned significant sums to N Brown customers as a result, which it believes JD Williams should reimburse it for.

‘The claim and counterclaim are extremely complex, and proceedings remain at an early stage, with each party only recently having completed a long disclosure exercise. We continue to gather detailed and factual expert and witness evidence in relation to multiple elements of the claim and counterclaim,’ said N Brown.

The issue is likely to hang over N Brown for some time considering the trial is not pencilled in until March 2022. The pandemic has delayed and disrupted the dispute being resolved, N Brown said.

In November last year, N Brown said the total sum claimed by Allianz at the time was around £29.4 million plus interest, but warned the complexity meant it could not estimate what the potential cost of the litigation could be, which means it has not booked any provisions as of yet.

When it released its annual report earlier this year, N Brown warned ‘the amounts involved are potentially significant’. On Wednesday, it said the most recent application filed by Allianz would add up to £36 million in additional costs if successful.

Where next for BNWG shares?

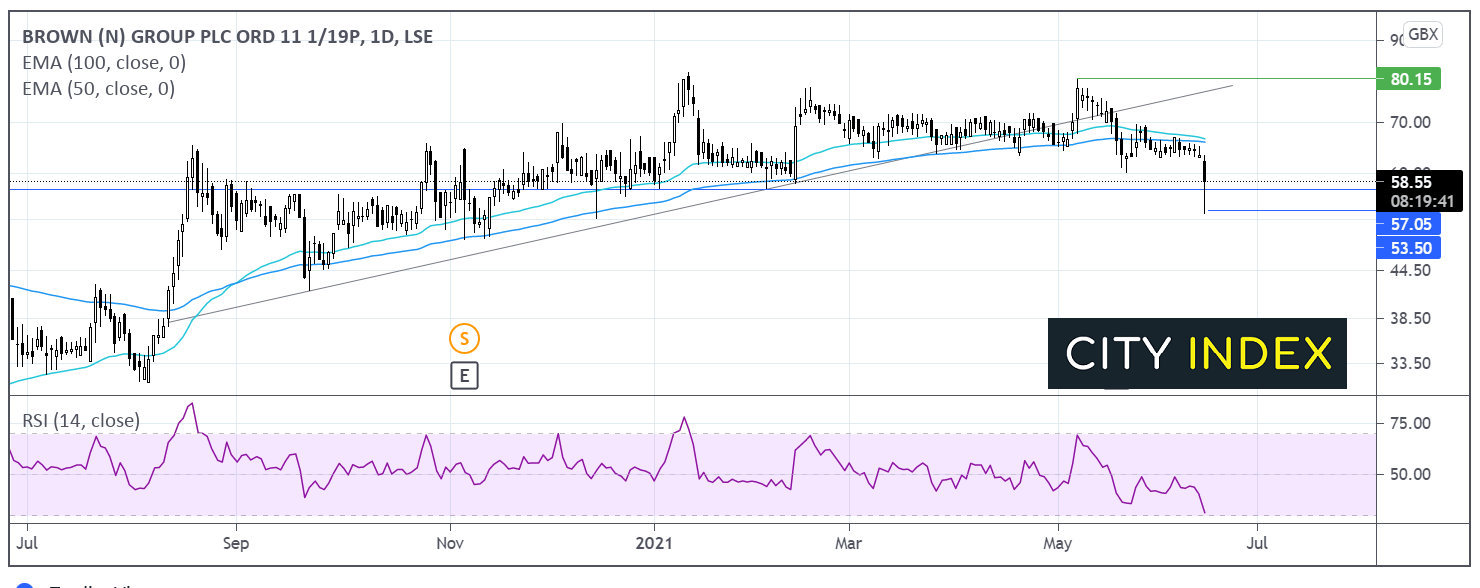

N Brown share price has been trending lower since early May. The share price fell through its ascending trendline dating back to early August. It also trades below its 50 & 100 daily ma.

The RSI trades in bearish territory and is supportive of further losses whilst it remains above 30 the oversold level.

Whilst the share price dropped to a low of 53p, it has regained some pose above 57p a level which has offered both support and resistance on numerous occasions over the past 6 months.

Immediate support is seen at 57p, a breakthrough here could see the daily low of 53.50p retested.

Any recovery would need to retake 66p the 50 & 100 day ma in order to look back towards the May high of 80p.

Motorpoint sets ambitious new targets following a tough year

Motorpoint said it is aiming to more than double revenue over the medium-term by investing in its online operations and opening new branches as it reported lower revenue and profits during a tough year plagued by the pandemic.

Revenue fell to £721.4 million from just over £1.0 billion the year before as its branches were closed for over six months of the year. Around 69% of the 69,000 vehicles sold during the year were therefore made online, including 25,000 on its Auction4Cars.com platform that deals with cars that can’t be sold through its retail or wholesale channels.

Operating profit almost halved to £12.6 million from £22.3 million the year before, with pretax profit at the bottom-line dropping to £9.7 million from £18.8 million.

Motorpoint said demand had been strong since stores reopened in early April, with sales ‘significantly ahead’ year-on-year. Margins have also improved for both retail and wholesale divisions. It said the fact the new car market is suffering from a shortage in chips is driving up demand of nearly-new cars in the short-term.

‘I am delighted with our performance in the year given the external challenges faced as we have transformed our capability by continuing to invest in our E-commerce execution. We now have a fully scaled Home Delivery service, an integrated, end-to-end digital customer journey, additional capacity to grow through our increased preparation and branch presence, and an ambitious growth strategy to more than double revenue and profit in the medium term through increased investment in technology, marketing, data and talent,’ said chief executive Mark Carpenter.

Motorpoint has outlined new targets to deliver overall revenue of £2 billion in the medium-term, with £1 billion of that to come from online. It will increase investment in its ecommerce operations, demonstrated by the recent launch of home delivery, and open 12 new stores. It also wants to improve Auction4cars, which it says has a ‘huge opportunity to disrupt the established vehicle auction market’.

Motorpoint shares were trading up 0.4% this morning at 280.0p, having fallen back after rising to 296.0p in earlier trade.

Helios Towers completes discounted placing to fund M&A deals

Helios Towers said it has raised around $160 million in proceeds following its recent equity offer, which will be used to buy telecoms towers in new and existing markets.

Helios revealed it was raising equity yesterday and this morning announced it had priced its placing at 163 pence per share, below its last closing share price of 172p.

Helios Towers shares were down 4.2% in early trade this morning at 164.4p.

A total of 46.75 million new shares were issued through the placing, while another 1.25 million shares were sold to retail investors through PrimaryBid. Together, that raised $110 million.

Its wholly-owned subsidiary HTA Group also raised $50 million through a tap issuance of its existing unsecured convertible bonds.

Proceeds are set to be used to strengthen its balance sheet and make more acquisitions. It will help fund the deal struck in March to buy assets from Airtel Africa and the one in May to buy towers from Oman Telecommunications Co.

Oxford Instruments to buy German microscopy imaging firm

Oxford Instruments has agreed to buy WITec Wissenschaftliche Instrumente und Technologie for a total of EUR42 million on a cash-and-debt-free basis.

WITec is a leading provider of Raman microscopy imaging, which is used to examine the likes of proteins, cells and organs. The company reported annual revenue of EUR18.2 million in 2020. Notably, Oxford Instruments said WITec’s return on sales can be improved as it is currently lower than its own and will benefit by using Oxford’s global reach.

‘Raman microscopy is an important and widely used technique across academic and commercial customers for fundamental research, applied R&D and quality assurance / quality control. The technique is used in conjunction and alongside our existing characterisation solutions and broadens the capabilities that we can bring to existing customers whilst expanding opportunities into new market areas,’ said chief executive Ian Barkshire.

Notably, EUR5 million of the consideration is conditional on WITec’s performance during the first 12 months after the acquisition closes.

Oxford Instruments will need to secure the green light from German regulators before the deal can be completed but is hopeful the deal can be sealed before the end of September 2021.

Oxford Instruments shares were up 0.7% in early trade this morning at 2252.5p.

Made.com IPO priced at 200p per share

Made.com announced that it has priced its initial public offering in London at 200 pence per share, setting it up to start life as a publicly-traded business with a valuation of around £775.3 million.

The online homeware retailer announced it was planning to list in London at the start of June. It will offer 50 million new shares in the company to raise £100 million. Existing investors will sell an additional 46.9 million shares to bank around £93.8 million in proceeds for themselves.

Made shares started trading today and opened at 193p, according to Reuters.

‘The IPO is an exciting milestone for MADE. I would like to thank everyone who has been a part of our growth journey, especially our employees, as we deliver on our vision of becoming the leading home destination in Europe for digital natives,’ said chief executive Philippe Chainieux.

‘Our successful track record in the UK and internationally has been made possible with the foundations that we have built over the last eleven years - a unique combination of a well-recognised brand, a proprietary, data-driven platform, and a bespoke, vertically integrated supply chain connecting our network of designers, artists and collaborators with our customers,’ he added.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade