Top UK Stocks to Watch: Micro Focus shares pop on deal with Amazon

Top News: Micro Focus strikes deal with Amazon Web Services

Micro Focus International has struck a commercial agreement with the largest cloud-computing company in the world, Amazon Web Services, possibly leading to the tech giant investing in the London-listed firm.

The two companies will collaborate on the modernisation of mainframe applications and workloads of large companies to the AWS Cloud. Micro Focus will supply technology that will help large businesses looking to shift their business-critical applications to running on the cloud rather than their own networks.

‘This important strategic agreement between Micro Focus and AWS combines our technology leadership position in Application Modernisation with the world's most comprehensive and broadly adopted cloud provider,’ said chief executive Stephen Murdoch.

‘The modernization of mainframe applications and workloads into cloud environments is increasingly becoming an imperative in the digital transformation programmes of large enterprises worldwide, and this collaboration has the potential to drive new customer adoption and growth within our Application Modernisation and Connectivity (AMC) Product Group for an extended period,’ he added.

Notably, Micro Focus said it has issued warrants to an Amazon subsidiary that allows the tech giant to buy 15.9 million shares in the business for 446.60 pence each. The warrants will vest depending on how much revenue the commercial agreement generates based on pre-determined targets.

‘Full vesting of the warrants requires the commercial agreement to deliver a material impact on both AMC and total group revenues,’ Micro Focus said.

Where next for the Micro Focus share price?

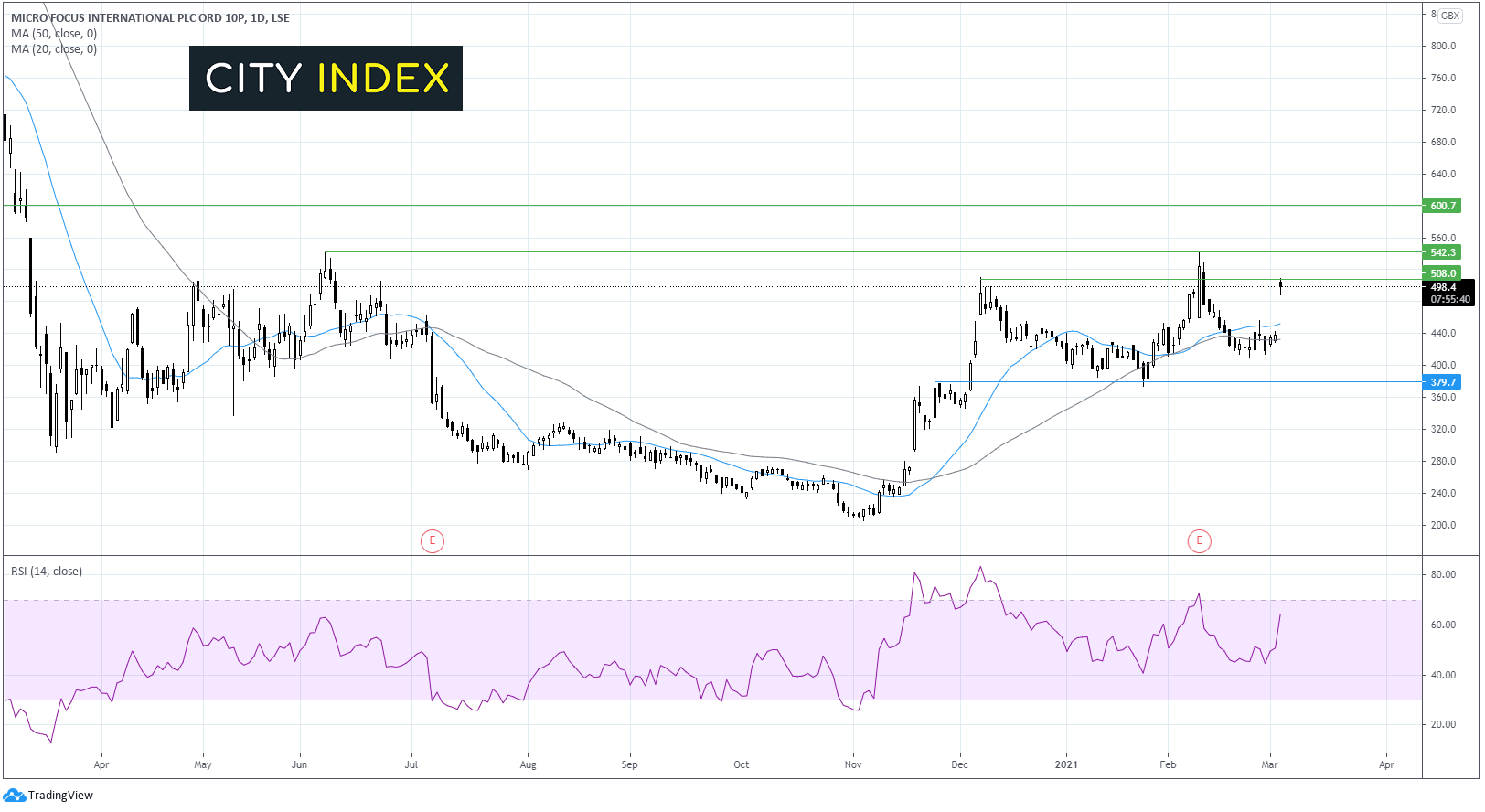

After trending higher from early November momentum had slowed and the Micro Focus share price appeared to be awaiting fresh direction.

Today’s 13% surge higher has seen the share price jump above its 20 & 50 sma on the daily chart. The RSI has also moved from a neutral position into bullish territory but is not yet overbought so is supportive of further gains.

Near term resistance can be seen at today’s high 509 a level which capped gains in December. A move beyond here could see 542 come into focus -a level which has capped gains in mid-February and again in early June 2020. A move above this level could see the bullish move gain momentum.

On the flip side support can be seen at 450 and 430 the 20 sma and 50 sma respectively. It would take a move below 380 for more bears to jump in.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Persimmon profits fall on lower completions

Persimmon said revenue and profit both declined in 2020 because it built fewer houses, prompting it to cut its dividend, but said completions and payouts should return to normal over the coming years.

The housebuilder said it constructed 13,575 homes during 2020 compared to 15,885 in 2019. Although a higher selling price helped partly offset the lower number of completions, revenue dropped to £3.33 billion from £3.65 billion the year before.

The decline in completions was down to the disruption caused by the pandemic.

The underlying gross margins on new homes tightened to 31.0% from 33.1%. Underlying pretax profit plunged to £863.1 million from £1.04 billion the year before. On a reported basis, pretax profit fell to £783.8 million.

The company’s order book grew 15% during the period to end the year at £2.3 billion, with demand being underpinned by low interest rates, government support measures and ‘good’ mortgage availability.

Persimmon said it expects construction levels to return to pre-pandemic levels in 2022.

‘Reflecting the consistent outlet levels anticipated through the year, in the first half of 2021 we expect to deliver new home completion volumes approaching the levels seen during the first half of 2019, with similar delivery in the second half. We anticipate the group's margin will reflect the return to delivering an increased proportion of homes to our Housing Association Partners from 2021,’ said the company.

‘We are targeting a full return to 2019 levels of new home completions in 2022. From 2023, with a stable market, we expect our enhanced quality, service and efficiency capabilities to provide the opportunity to grow further. We are focused on bringing more outlets into production to support these targets,’ Persimmon added.

The dividend for the year was cut to 110 pence per share from 235p in 2019. Persimmon said it is aiming to return 235p in 2021, and that it hopes to return a further 110p in surplus capital during the year.

Persimmon shares were up 2.6% in early trade at 2806.0.

Avast expects another year of growth in 2021

Avast said it expects revenue to continue growing in 2021 after delivering a strong performance in 2020.

The cybersecurity company said adjusted billings experienced 1.2% growth to $922 million in 2020, with organic growth of 7.1%. Adjusted revenue was up 2.3% to $892.9 million with organic growth of 7.9%.

Adjusted Earnings before interest, tax, depreciation and amortisation was up 2.6% to $495.5 million and adjusted net income was up 12% to $360.2 million.

However, earnings fell on a reported basis with operating profit down 2.7% to $335.4 million and net income falling by almost 32% to $169.6 million. That was because certain none-off gains booked in 2019 did not repeat and because of considerably higher finance costs year-on-year.

Avast said its total dividend for the year has been raised 8.8% to 16.0 cents per share.

Avast said it expects to deliver organic revenue growth of 6% to 8% in 2021. Its adjusted Ebitda margin is expected to remain broadly flat this year, while cashflow is expected to benefit from lower capital expenditure and financing costs.

Avast shares were down 3.6% in early trade at 449.3.

DS Smith pleased with building momentum

DS Smith said the positive trends and momentum experienced in the first half of its financial year have continued into the second, putting it on course to meet expectations.

The packaging company said like-for-like corrugated box volumes has accelerated since the end of the first half, boosted by the busy holiday season and ‘encouraging signs of recovery from our industrial customers’.

‘Our Northern European and North American regions have seen the most positive performance, reflecting continued strong growth with our largest customers and increasing utilisation of our plant in Indiana,’ said DS Smith. ‘Our North American business continues to deliver significantly improving results as a consequence of good domestic volume growth, with corresponding reduced exports of paper, and increasing pricing.’

DS Smith warned that input costs had increased but that it had capitalised on the high demand by passing them through to customers. It said it has started to recover these additional costs through higher prices and that this will be reflected in full during the 2022 financial year.

The company said cash generation remains strong and that cash conversion should be over 100% for the full year.

DS Smith shares were up 1.3% in early trade at 408.1.

Rio Tinto chairman resigns in wake of cave destruction

Rio Tinto said its chairman Simon Thompson will step down from his role when the miner holds its 2022 annual general meeting.

The chairman said he was proud of the company’s achievements in 2020 but that this was ‘overshadowed by the destruction of the Juukan Gorge rock shelters at the Brockman 4 operations in Australia’, adding that ‘as chairman, I am ultimately accountable for the failings that led to this tragic event.’

Senior independent directors Sam Laidlaw and Simon McKeon will lead the search for his successor.

Rio Tinto shares were up 0.4% in early trade at 6475.0.

Polymetal raises dividend after record earnings in 2020

Polymetal International said revenue and earnings both jumped in 2020 thanks to higher gold and silver prices, prompting it to hike its dividend and make a special payout to shareholders.

The miner said revenue rose 28% in 2020 to $2.86 billion from $2.24 billion the year before. Gold sales were up 2% year-on-year while silver sales fell 13% - but both metals saw their prices climb 27% during the year.

With costs either flat or lower compared to the year before, adjusted Earnings before interest, tax, depreciation and amortisation surged 57% higher to $1.68 billion from $1.07 billion in 2019. Meanwhile, net earnings hit a record high of $1.08 billion from just $483 million the year before.

Polymetal said it will pay a final dividend of 89 cents per share, made up of a 74 cent final dividend and a 15 cent discretionary payout. That will mean it is returning 100% of free cashflow in the year and that the total dividend is for $1.29 per share, up 57% from 82 cents in 2019.

Polymetal shares were up 2.1% in early trade at 1469.8.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Hiscox sinks to loss in 2020 but eyes recovery

Hiscox said it sank into the red during 2020 because of the pandemic, but said it is now switching its focus to the recovery opportunities this year with hopes it can restart dividend payments.

The company said gross premiums remained flat year-on-year at $4.03 billion and that net premiums edged higher to $2.75 billion from $2.65 billion in 2019.

However, Hiscox sank to a pretax loss of $268.5 million from a $53.1 million profit the year before because of the impact of the coronavirus pandemic, with its Covid-19 reserves at $475 million.

Hiscox London Market delivered an ‘outstanding performance’ with profits quadrupling year-on-year, while Hiscox Retail reported milder growth. However, this was offset by a weaker performance in other parts of the business and a fall in investment returns.

‘Our long-held strategy of balancing big-ticket lines and retail earnings has provided resilience in 2020. In 2021, our priorities will switch from resilience to opportunity as we are well-placed to make the most of the best conditions in the London Market in many years and the structural shift to digital across all our lines,’ said chief executive Bronek Masojada.

Its net asset value per share sank to 689 cents from 768.2 cents.

Hiscox said it is not paying a dividend for 2020 after suspending payouts last year, but said it intends to restart payouts in 2021 if it can. Management have pledged not to take any bonuses until dividends resume.

Hiscox shares were down 10.5% in early trade at 877.8.

Biffa ups expectations after robust performance

Biffa said it has traded better than expected during the second half of its financial year as the latest lockdown had a less severe impact on results than expected, putting it on course to deliver results ‘well ahead’ of expectations for the full year.

The waste management company said net revenue in the third quarter was just 3% lower year-on-year and that the fourth quarter is expected to be down around 8%. It said volumes from industrial and commercial customers was running at 80% the previous year during the fourth quarter, having improved from the 70% to 75% range reported in January. All other parts of the business have performed in line with expectations.

‘Strong management of receivables and cash collection has materially reduced the need for provision for doubtful debts, resulting in a provision release in the final quarter. As a result, underlying Earnings before interest and tax for FY21, whilst still materially impacted by the pandemic, is now expected to be well ahead of the board's previous expectations, in the range of £42-44 million,’ said Biffa.

Biffa reports results for the year to March 26 on May 26.

The company also announced it has completed the acquisition of Company Shop Group, which redistributes food and household products, for £82.5 million, with a deferred consideration of up to £5 million.

Biffa shares were up 6.8% in early trade at 273.3.

888 Holdings appoints Mendelsohn as permanent chairman

888 Holdings said chair designate Jonathan Mendelsohn will take up the role on a permanent basis at the end of March, when he will formally takeover from Brian Mattingley who is leaving to become the chairman of Playtech.

‘I would like to thank Brian for his extensive contribution to the group, and for the time we have spent together to ensure a smooth handover of responsibilities, and I wish him well in his new opportunity. I am looking forward to continuing to work with the board and the management team to deliver the Group's growth strategy and generate further stakeholder value,’ said Mendelsohn.

888 shares were up 3.9% in early trade at 312.8.

Sequoia Economic Infrastructure raises £110 million

Sequoia Economic Infrastructure Income Fund has raised £110 million by issuing 104.5 million new shares in the business at 105.25 pence each.

‘We are delighted with the support from our shareholders, particularly given the significant turbulence across global fixed income markets over the last week. The new proceeds will be used to repay drawings under our debt facilities, thereby allowing our Investment Adviser to re-draw on these facilities as it deploys selectively into our pipeline of investment opportunities,’ said chairman Robert Jennings.

Sequoia Economic Infrastructure shares were down 0.4% in early trade at 105.3.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade