Top UK Stocks to Watch: LSE begins transformation following Refinitiv deal

Top News: London Stock Exchange Group ups dividend as profits rise

The London Stock Exchange raised its dividend after reporting strong growth in 2020, setting itself up to deliver its strategy after completing the ‘transformational’ acquisition of Refinitiv in early 2021.

Revenue rose 3% to £2.12 billion in 2020. Post-trade revenue rose 7%, information services was up 3%, capital market income was flat and revenue from technology slumped 7%.

Adjusted operating profit was up 5% year-on-year at £1.11 billion while reported operating profit was up 2% at £755 million, with impairments slightly higher than in 2019. Adjusted earnings per share was up 5% at 209.7 pence while reported EPS was up 1% at 120.3p.

LSEG said it has raised its dividend 7% to 75.0 pence from the 70.0p payout made in 2019.

The company completed the $27 billion acquisition of Refinitiv earlier this year, expanding its services from trading into data and giving it the ability to ‘shape the industry’s evolution’.

‘Completion of the acquisition of Refinitiv in early 2021 marked an important milestone in LSEG's history. This transformational transaction brings together two highly complementary global businesses with a shared commitment to Open Access. LSEG is now truly global with a significant presence in North America, Europe, Asia and emerging markets, bringing together exceptional skills and experience at scale,’ said LSEG.

Integration is well under way and will see LSEG focus on three core divisions: data analytics, capital markets and post trade.

Where next for the London Stock Exchange share price?

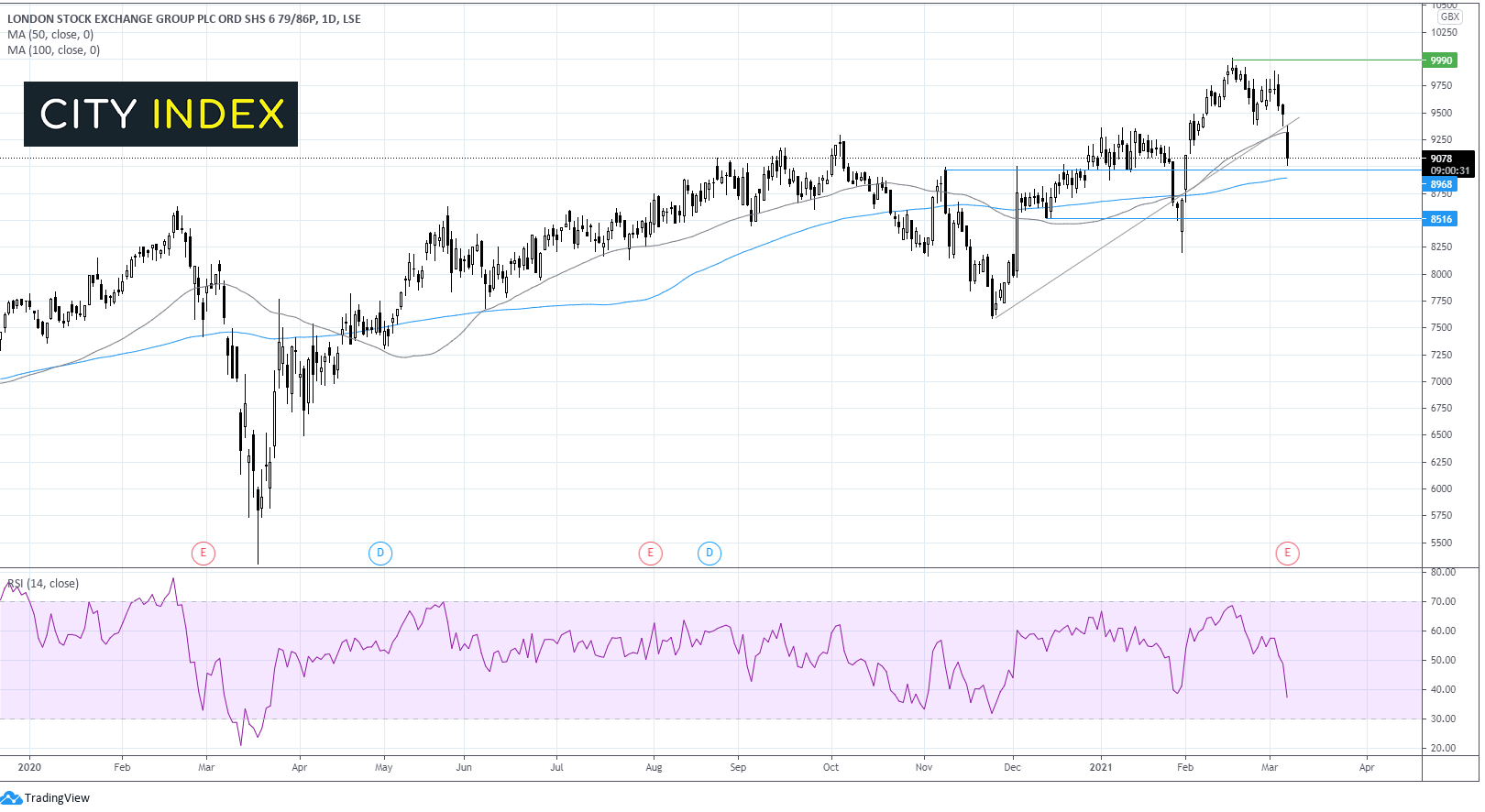

LSEG shares were down 4% in early trade, a move which has seen it fall below a key support level – the confluence of the 50 sma on the daily chart and the ascending trend line dated back to late November.

The RSI is supportive of further losses, in bearish territory but still above oversold conditions.

Immediate support can be seen at 8975 a level which has acted as both horizontal support and resistance. A break-through this level could see the bears test the 100 sma at 8880 before targeting support at 8515.

Any attempt at a rebound would need to overcome strong resistance at 9350 the 50 sma and ascending trend line before the all-time high around of 1000 moves back into focus.

Press: Lloyds Bank plots to become private landlord

Lloyds Banking Group is preparing to diversify itself by becoming a private landlord, according to reports from the Financial Times. The plan comes as the bank looks for new sources of revenue as traditional income is hit by lower interest rates.

Citing unnamed sources familiar with the plans and internal documents, the FT said the plan is known as ‘Project Generation’ and will involve Lloyds buying and renting out new and existing homes across the UK, with its first tenants to appear on its books before the end of 2021.

Lloyds shares were down 1.2% in early trade at 39.92.

Frasers Groups launches review of stores as business rates bite

Frasers Group has criticised the level of business rates relief provided to larger businesses in the UK Budget earlier this week, with the company warning it won’t be able to take on old Debenhams sites and will have to review its entire portfolio as a result.

The company, which owns a string of high street stores spanning Sports Direct to Game, said it was also disappointed by the lack of structural reform of business rates, stating the industry ‘would have expected suitable relief until structural reform is implemented.’

‘The £2 million rates cap on 'businesses' from July 2021 to March 2022, makes it a near worthless support package for large retailers,’ said the company.

‘For Frasers Group this cap will make it nearly impossible to take on ex-Debenhams sites with the inherent jobs created. It will also mean we need to review our entire portfolio to ascertain stores that are unviable due to unrealistic business rates,’ it added.

Frasers Group bought struggling Debenhams in December and was intending to take on some of its physical stores.

‘Frasers Group believes that retailers should pay the fair amount of rates in line with realistic rateable values, but instead we continue to have an unwieldy, overly complex, and out of date business rates regime,’ the company said.

Fraser Group shares were down 1.3% in early trade at 460.8.

Convatec Group forecasts better revenue and margins in 2021

Convatec Group said it decided to keep its dividend flat in 2020 despite reporting a fall in adjusted earnings to demonstrate the confidence it has in its balance sheet and outlook.

Revenue rose to $1.89 billion from $1.82 billion in 2019. Demand for the likes of its advanced wound care products fell as traditional healthcare came under pressure during the pandemic, although revenue from its ostomy care, continence and critical care, and infusion care divisions all grew.

Its adjusted Earnings before interest and tax margin contracted to 18.5% from 19.4%, pushing adjusted Ebit down 1.1% to $350 million from $354 million. However, reported Ebit more than doubled to $211 million from $97 million the year before as over $105 million of one-off costs didn’t repeat.

Convatec kept its dividend flat from last year at 5.7 cents.

‘This is outside our stated policy of 35% to 45% of adjusted net profit but is a reflection of the board's confidence in the future performance of the group, its underlying financial strength, realised distributable reserves position, cash generation and liquidity,’ Convatec said.

Convatec said it expects organic revenue to grow by 3% to 4.5% in 2021, while its adjusted Ebit margin should be between 18% to 19.5% at constant currency.

‘We expect a broadly similar growth performance in ostomy care to 2020 whilst infusion care is expected to deliver strong growth against the tough prior year comparatives. We expect advanced wound care to return to growth whilst continence and critical care will slow as the revenues for critical care decline as COVID-19 recedes against the tough comparatives. The timing and magnitude of the critical care and advanced wound care movements will depend upon the persistence of COVID-19 and how quickly access to healthcare settings normalise,’ said Convatec.

Convatec shares were up 4% in early trade at 195.4.

Unite Group extends discount to students yet again

Unite Group said it has once again extended the discount on rents for students that are not using their accommodation during the pandemic following the government publishing its roadmap out of lockdown.

The student accommodation provider introduced a 50% rent discount for students not using their housing back in January and has now extended it until March 29, aligned with when the government hopes to lift its stay-at-home orders.

This will mean it will be offering the 50% discount for 10 weeks in total. Those eligible for the discount have also been given a four-week tenancy extension.

Unite Group said the 10-week discount will cost it £10 million in rental income, equal to 2.5p of earnings per share. Unite Group said this was lower than previously expected because more students had returned to their accommodation, meaning more are paying full rent. It said about 60% of its students had returned compared to only 50% last month.

Unite Group said it has continued to collect the majority of rent, with 95% of sums due for the 2020/21 academic year already paid.

‘All our properties continue to remain open, as they have throughout the pandemic. Like any private landlord, we do not normally provide refunds for time students choose to spend away from a property during a tenancy. However, we acknowledge that students have faced challenges this year and that's why we have supported them consistently through the pandemic,’ said chief executive Richard Smith.

Unite Group shares were down 1% in early trade at 986.8.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade