Top UK Stocks and Shares | Lamprell Share Price | UDG Share Price | Novacyt Share Price | Revolution Beauty IPO | Bridgepoint IPO

Top News: Lamprell preserving cash and preparing to raise equity

Lamprell shares plunged this morning as the company warned it needs to raise $120 million to $150 million by the end of September – potentially all in equity – and is preserving as much cash as possible in the meantime.

The company said its net cash of $112 million at the end of 2020 had dwindled over during the last six months, leaving it short of the cash it needs to complete existing projects in development or invest in the business. It warned that it was deferring all payments to creditors until new funding is secured.

It said it plans to raise the funds by the end of the third quarter. This will be either all in equity or a combination of both debt and equity. It is currently in talks about securing a new $90 million facility, backed by export credit agency support, from its existing banks but said there is no certainty they will materialise even though it expects them to be approved.

It will be raising a smaller round of equity to cover the funding gap in the meantime until that larger pile of funds can be secured.

‘The timing and quantum of the equity raise is dependent upon market conditions and the outcome of the group's negotiations with the banks. If the group is unsuccessful in concluding the facility with the banks, the group will be obliged to raise capital through equity in the amount of $120 to $150 million in order for it to meet its ongoing liabilities,’ Lamprell said.

‘Should the group be unable to secure the capital raise, either through the project-related debt and/or equity, there is significant risk that the group will be unable to meet its contractual obligations as they arise/fall due,’ Lamprell warned.

The funds would be used to ensure it can deliver two rigs currently being built for a customer and fund the outstanding investment to be made into its joint venture in Saudi Arabia, its new strategy focused more on the renewables sector, and the upgrade to its digital capabilities.

It comes after Lamprell restructured itself into three new business units - one serving the renewables industry, another oil and gas, and the third focusing on its digital products and services.

The news came as Lamprell reported its delayed results for 2020, revealing revenue rose to $338.6 million from $260.4 million. It turned to Ebitda of $3.9 million from a $64.6 million loss the year before. However, it remained in the red at the bottom-line with a loss after tax of $53.4 million, compared to the $183.5 million loss in 2019.

It revealed in January that trading was steadily improving in 2021 after being heavily disrupted by the pandemic and said that had continued this morning, stating Ebitda was running at roughly breakeven. It said its order backlog supports another year on annual revenue growth in 2021, with $470 million worth of work already secured this year.

Where next for the Lamprell share price?

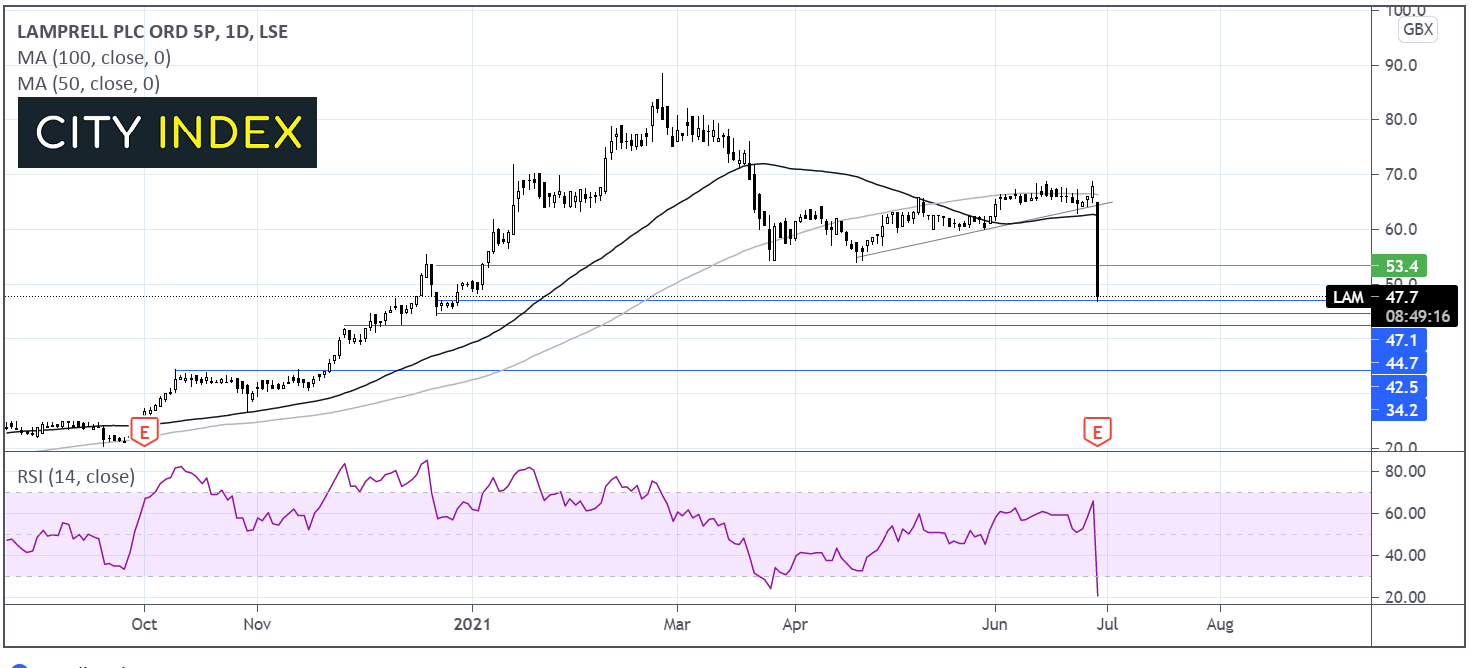

The Lamprell share price has fallen through its ascending trendline dating back to mid-April and through its 50 & 100 sma on the daily chart in a clearly bearish chart.

The share price is deeply in oversold territory so some consolidation or a slight move higher could be on the cards. However, the timing of such a move is unclear.

The drop lower has taken the share price through several key levels. Immediate support can now be seen at 46.8 the daily low and the year to date low. A breakthrough this level could see 44.5p the low December 21 tested ahead of 42.6 the high November 24. A move below 34.2 would see all of the gains across the year wiped out. It would take a move back over 53.4p to give the buyers hope.

UDG shareholders successfully squeeze CD&R for higher takeover offer

UDG Healthcare said Clayton, Dublier & Rice (CD&R) has raised its takeover offer for the business one final time to 1,080 pence per share, which has been recommended by the UDG board.

UDG and CD&R originally reached a deal back in May, whereby CD&R’s subsidiary Nenelite would purchase UDG for 1,023.0 pence per share in cash, valuing it at around $2.6 billion. That bid was higher than UDG shares had ever traded at the time and priced at around a 30% premium to its average price over the previous three months.

However, it was revealed last week that some major UDG shareholders had been squeezing CD&R to raise its offer. The increased offer bumps up the value of UDG, which owns healthcare services provider Ashfield and packaging specialist Sharp, to £2.75 billion. The company boasted a market cap of £2.69 billion before markets opened this morning.

UDG shares were trading 0.6% higher in early trade this morning at 1071.5p, slightly below the improved offer.

Major UDG investors including Allianz Global Investors and Kabouter Management, which together own an 11.4% stake in UDG, are backing the deal.

Importantly, CD&R’s latest offer is final and will not be revised again, unless a rival bid for UDG is made by another company. UDG confirmed it is not in talks with any other potential bidders.

Notably, CD&R is also currently in the process of trying to buy supermarket chain Morrisons after its initial bid was turned down last week.

Novacyt launches two new Covid-19 lateral flow tests

Testing and diagnostics firm Novacyt announced it plans to launch two new antigen lateral flow tests to expand its portfolio of coronavirus products and capitalise on new opportunities.

The company said the new tests ‘are small, instrument-free and contain all the components required for safe sample collection, preparation, testing, interpretation of results, and disposal for convenient use by healthcare professionals or patients in home settings.’

The first test is called the Pathflow Covid-19 Rapid Antigen, a self-test that can detect coronavirus from oral samples and provide results within just 15 minutes. The test has recorded a sensitivity of over 90% and a specificity of over 99% from over 300 samples.

‘The test offers mass screening for home, travel, events, and workplace markets. Novacyt expects to make this LFT available as a CE Marked product shortly,’ Novacyt said.

The second is a Pro version of the same test and the major difference is that samples are taken from the nose or throat instead of the mouth to provide results within the same timeframe of 15 minutes. Novacyt said this test has been made available immediately.

Both tests are being produced by an original equipment manufacturer under an agreement with its Micogen Bioproducts division.

‘Throughout the pandemic we have continued to launch new products to ensure our COVID-19 portfolio remains at the forefront of our industry. These two antigen LFTs will support our customers as the market continues to evolve towards private testing and we believe they will become a useful entry point to our existing range of PCR COVID-19 tests,’ said chief executive Graham Mullis.

‘With the potential for a flu season starting in the northern hemisphere in a few months it will be important to know whether a person has flu or SARS-CoV-2 and having access to quick results are critical to patient treatment and containing the spread of the COVID-19 virus,’ he added.

Novacyt shares were trading 3.6% higher this morning at 356.25p.

Novacyt is expecting demand for private coronavirus testing, such as from workplaces or the travel market, to continue to grow going forward and drive revenue growth over the shorter-term, but said it is still evolving Novacyt into a ‘major diagnostics player’ that isn’t just known for coronavirus tests.

Novacyt released annual results for 2020 last week which revealed revenue and profits both surged higher as demand for its coronavirus testing products took-off. Progress has continued this year, with first quarter sales rising to £88.4 million from £40.8 million the year before. However, around half of that revenue came from the Department of Health & Social Care, which is currently in dispute about a contract awarded to Novacyt.

Barratt Developments poaches CFO from Countryside Properties

Countryside Properties said its chief financial officer Mike Scott has handed in his resignation in order to take up the same role at the company’s larger peer Barratt Developments.

Countryside said it would provide a leaving date for Scott in due course, but that the search for his successor has already started.

Scott started at Countryside as financial controller back in 2014 and was part of the team that oversaw the company’s IPO in 2016.

‘Mike has a deep understanding of the housebuilding industry and we are delighted that he has agreed to bring his very relevant financial and operational expertise to Barratt. Mike will work closely with our experienced management team to reinforce Barratt's position as the country's leading housebuilder, whilst driving further value creation through a continued focus on our medium-term targets,’ said Barratt chairman John Allan.

Barratt’s CFO Jessica White is leaving the business tomorrow and chief executive David Thomas, who previously held the CFO role for six years until 2015, will take over responsibilities in the meantime until Scott formally joins the board.

Countryside shares were up 1.6% in early trade this morning at 487.4p while Barratt shares were up 1.5% at 713.2p.

Revolution Beauty Group plans to go public next month

Revolution Beauty Group has outlined plans to launch an initial public offering on AIM next month in order to raise funds to fuel its growth ambitions.

The company, which has products in over 11,000 stores spanning Superdrug and Boots in the UK to Ulta and Target in the US, said it will be issuing new shares to raise funds for the company as well as allowing existing shareholders to offload some of their stake. The company has not provided an idea on price or valuation, but said Jupiter Asset Management was providing a cornerstone investment worth £90 million as part of the offering.

‘We have delivered exceptional growth, with a revenue CAGR of over 99% from inception to FY19. Our differentiated business model brings together both online and retail revenues, while our manufacturing and consumer feedback strategy enables us to bring new products to market quickly. This means that Revolution Beauty can quickly respond to the megatrends driving the global mass beauty industry. All of this together with our broad geographic presence and extensive product ranges, means Revolution Beauty is well-positioned to take advantage of the significant opportunities for expansion in a compelling growth market,’ founder and chief executive Adam Minto said.

In the 14 months to the end of February 2021, Revolution Beauty Group reported £157.6 million in revenue and Ebitda of £13.1 million.

Revolution Beauty said it is able to bring new products to market quicker than rivals, with the potential for a new idea to evolve and be on the shelves within just 16 weeks. Around 80% of products are currently sourced from Asia with the rest coming from the UK and Europe.

Bridgepoint IPO to offer exposure to mid-cap companies in private hands

Bridgepoint, an investor in private equity and credit, has announced plans to go public in London and raise up to £300 million to help fund its growth plans.

The company claims to be the ‘leading middle market private markets firm in the world’. The middle market refers to mid-sized companies, many of which tend to still be in private hands.

‘Bridgepoint operates across the middle market at scale, providing access for some of the world's most experienced investors to attractive growth businesses through its unique local insight and expertise and its well-resourced platform. We have delivered strong and consistent returns for investors and shareholders through different economic cycles,’ said chairman William Jackson.

Bridgepoint said its assets under management has grown quickly over the years and driven a significant improvement in results. Operating income rose to £191.8 million in 2020 from £144.8 million in 2018 while underlying Ebitda increased to £66.1 million from £43.3 million. It said ‘further profitable growth has been achieved’ during the initial months of 2021.

‘The company has been on its own journey of growth and diversification, increasing its total assets under management from EUR9 billion in 2011 to EUR27.4 billion as of 31 March 2021. Today, Bridgepoint has an increasingly global footprint across Europe, North America and Asia. We expect this strong growth to continue in the near and longer-term as we continue to develop our existing strategies and further broaden our platform,’ Jackson said.

In addition to private equity, Bridgepoint has built a significant presence in the private credit market after acquiring EQT Credit in 2020. The firm is now one of the top 10 private credit investors in Europe.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade