Top UK Stocks to Watch: JD Sports splashes out $495 million on DLTR

Top News: JD Sports to buy US outfit DLTR

JD Sports said it has conditionally agreed to purchase athletic footwear and streetwear apparel retailer DLTR for a total of $495 million.

DLTR was originally named Downtown Locker Room before changing its name in 2017 and merging with Sneaker Villa. JD Sports said $100 million of the consideration will be used to pay down DLTR’s debt.

The acquisition is subject to certain requirements but is expected to be completed before the end of March.

‘The acquisition of DTLR, with its differentiated consumer proposition, will enhance the group's presence in the north and east of the United States complementing not only our existing JD and Finish Line fascias but also the recent acquisition of Shoe Palace which is based on the West Coast,’ said JD. DLTR has 247 stores across 19 states.

DLTR delivered annual earnings before interest, tax, depreciation and amortisation of $45.6 million in the 12 months to February 1, 2020, and a pretax profit of $1.6 million. The company had gross assets worth $293.7 million at the start of February 2020.

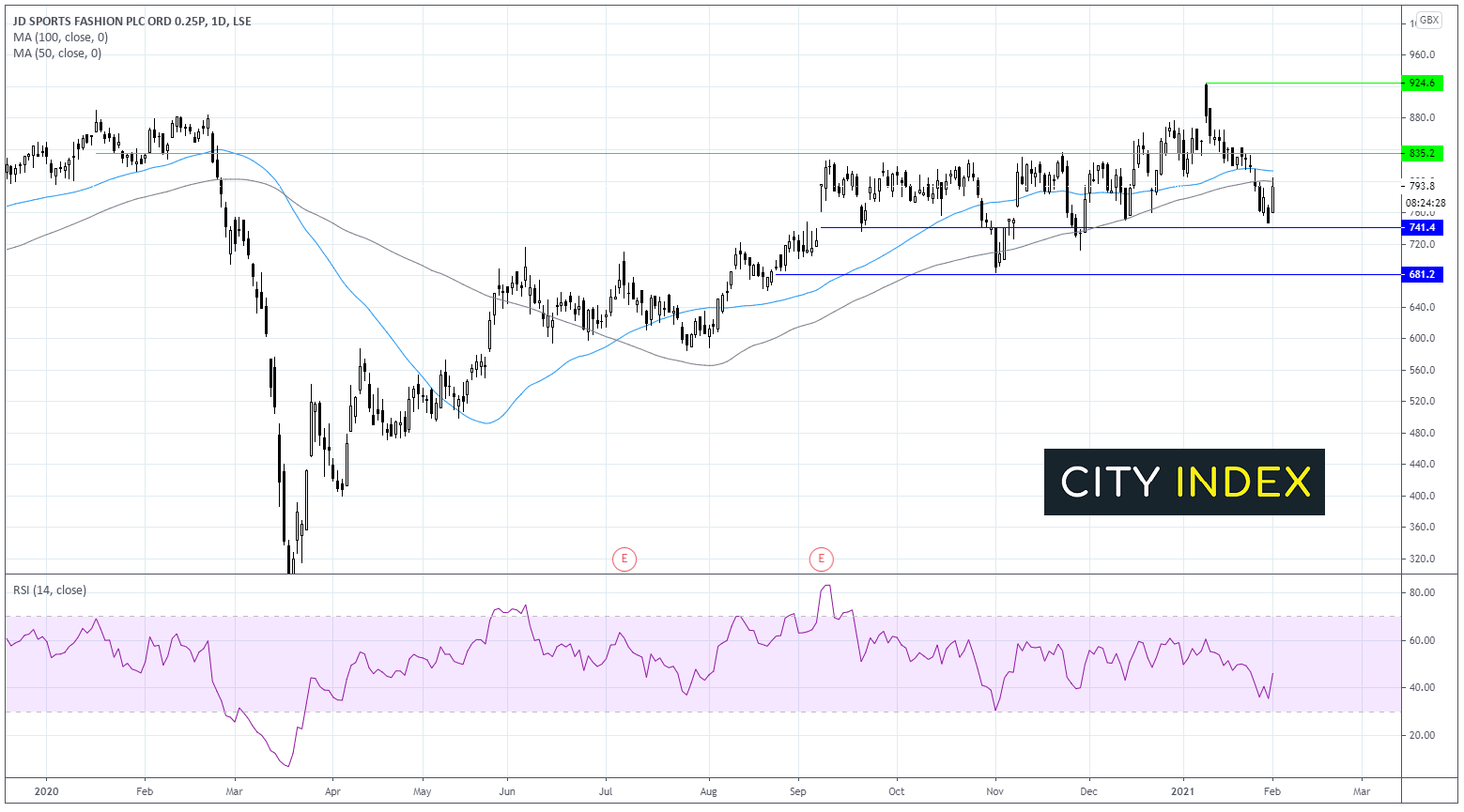

JD Sports share price: technical analysis

JD Sports shares have been trading mostly range bound since September capped by the lower band at 740 and by an upper band at 835.

Whilst the price did briefly push above the upper band at the start of the year to a high of 925, failure to hold this price indicated weakness at these levels.

Today’s jump higher of over 5% has seen the price rebound off the lower band of 740 attack its 100 sma on the daily chart on 800.

A break above this level could see the 50 sma tested at 815, prior to another test of the upper band at 835.

A failure to push over 800 could see the price continue to fall to once again test 740 a key level for the bears. A break through 740 could see the start of a deeper selloff to 680.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

AstraZeneca confirms EU approval for coronavirus vaccine

AstraZeneca confirmed that its coronavirus vaccine developed with Oxford university has secured approval to be used in adults in the EU following reports it had been given the green light last Friday.

The company said there should be a 12-week interval between the first and second dose of the vaccine.

‘Today's approval underscores the value of AstraZeneca's COVID-19 vaccine, which is not only effective and well tolerated, but also easy to administer and, importantly, protects fully against severe disease and hospitalisations,’ said chief executive Pascal Soirot.

AstraZeneca shares were up 0.2% in early trade at 7515.0.

Hargreaves Lansdown adds record number of new clients

Hargreaves Lansdown said it won a record number of new clients during the second half of 2020 as it performed strongly during the volatility in financial markets thanks to the pandemic, US elections and Brexit.

The company said it secured 84,000 new clients in the last six months of the year alone, ending 2020 with 1.49 million active clients.

‘As our client numbers continue to grow, we are finding that younger people are taking a greater interest in investing for the future, with the average age of our clients continuing to fall. COVID-19 has underpinned the importance of financial resilience and Hargreaves Lansdown is well placed to support clients with their saving and investment needs across their lifetimes,’ said chief executive Chris Hill.

It said it won £3.2 billion in net new business in the period, up 40% from just £2.3 billion the year before, and that assets under management climbed 16% year-on-year to £120.6 billion at the end of December.

Revenue increased 16% to £299.5 million and pretax profit jumped 10% to £188.4 million from £171.1 million the year before.

Hargreaves Lansdown said it has raised its interim dividend by 6% to 11.9 pence from 11.2p.

Hargreaves Lansdown shares were down 2.2% in early trade at 1667.8.

LandSec confirms latest quarterly dividend

Land Securities Group confirmed it will pay a dividend of 6.0 pence per share for the third quarter of its financial year after it restarted payouts earlier this year.

LandSec was one of many companies that suspended dividends during the initial months of the pandemic in 2020, but it resumed payouts last month when it paid 12.0p to cover the first two quarters of the financial year to the end of March 2021 – equal to 6.0p per quarter. It said on Monday that the latest quarterly payout will be made on March 30 to shareholders on the register at the close of trade on February 26.

The announcement comes ahead of LandSec’s annual results being released on May 18.

Importantly, LandSec also said that its last update on January 12 that claimed it had collected 82% of rent due between March 25 and December 24, 2020, from office tenants in Central London was incorrect and that this figure was actually much lower at 70%.

LandSec shares were up 2.3% in early trade at 625.7.

Ferguson completes sale of Wolseley UK

Ferguson said it has formally completed the sale of its plumbing and heating distribution business Wolseley UK to Clayton, Dubilier and Rice.

Ferguson announced it had agreed to sell the business to the private investment firm last month for a total of £308 million – virtually all of which is expected to be returned to shareholders through a special dividend.

‘Ferguson expects to provide further details regarding the arrangements for payment of this special dividend with the half year results on March 16, 2021,’ said Ferguson on Monday.

Ferguson shares were up 1.5% in early trade at 8638.0.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Euromoney buys The Jacobsen for $12.25 million

Euromoney Institutional Investor has acquired global B2B information services provider The Jacobsen for $12.25 million.

The Jacobsen is a price reporting agency that provides price assessments and forecasts for a number of commodities, primarily in North America. This includes prices for animal fats, feeds, vegetable oils and feedstocks for low-carbon fuels. Euromoney said the firm intersects the agriculture and new energy markets and that the unit reported sales of $2.4 million in 2020.

‘This is a highly complementary, strategic bolt-on acquisition for the group's PRA business which accelerates its 3.0 strategy. The Jacobsen adds scale to Fastmarkets' position in agriculture following the recent acquisition of AgriCensus. The combination of complementary prices and markets alongside Fastmarkets' investment in technology, systems and people will underpin the growth of the businesses,’ said Euromoney.

‘Low-carbon intensive fuels and the intersection of new energy and agriculture present attractive market opportunities, underpinned by a shift to renewable energy. In addition to Fastmarkets' price coverage of the battery raw materials that are essential for electric vehicle growth, the acquisition of The Jacobsen expands our presence in the US biofuel markets,’ it added.

Euromoney shares were up 0.1% in early trade at 968.0.

Virgin Money UK confirms appointment of new CFO

Virgin Money UK said Clifford Abrahams will join the company as its new chief financial officer and executive board member on March 8.

The company announced the appointment last November but had to wait for regulatory approval, which has now been secured.

Virgin Money UK shares were up 1.2% in early trade at 132.2.

Other news

Below is a guide to the top news from the rest of the London Stock Exchange today.

ASOS buys Topshop and other brands from Arcadia

ASOS said it has acquired the Topshop, Topman, Miss Selfridge and HIIT brands from Arcadia Group for a total of £265 million, as it looks to revive them online among its youthful customers.

ASOS had revealed it was in exclusive discussions about purchasing the brands – but not the stores – from Arcadia Group last month. Notably, ASOS already sells the brands through its website.

‘We are extremely proud to be the new owners of the Topshop, Topman, Miss Selfridge and HIIT brands. The acquisition of these iconic British brands is a hugely exciting moment for ASOS and our customers and will help accelerate our multi-brand platform strategy. We have been central to driving their recent growth online and, under our ownership, we will develop them further, using our design, marketing, technology and logistics expertise, and working closely with key strategic retail partners in the UK and around the world,’ said ASOS chief executive Nick Beighton.

ASOS said the brands made revenue of around £265 million in 2020, down from over £1 billion before the pandemic hit in 2019.

About 40% of all sales are sold through individual brand websites with the rest coming from retail partners. Geographically, the brands make about half of their sales in the UK with the rest coming from overseas, with strong brand presence in the US and Germany.

ASOS said the acquisition will boost its margin and deliver a double-digit return on capital in the first full year of ownership in 2022. In 2021, any incremental boost to earnings will be offset by ‘initial ramp up costs’. ASOS said it will book around £20 million in one-off restructuring and transaction costs.

ASOS shares were up 1.9% in early trade at 4646.0.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade