Top UK Stocks to Watch: Sage shares surge as subscriptions grow

Top News: Sage Group delivers growth at top end of expectations

Sage Group said it performed in line with expectations in the first quarter, sending shares higher in early trade. The software company said organic revenue was up 1.4% year-on-year in the three months to the end of December at £447 million as strong recurring revenue growth offset weakness elsewhere.

The company said recurring revenue grew 4.7% to £408 million, offsetting a 24% decline in other revenue to £39 million. Sage is transitioning to a subscription-based model focused on growing recurring revenue and the decline in other revenue is in line with the year before.

Recurring revenue benefited from 11% growth in subscriptions, a strong performance by its Future Sage Business Cloud Opportunity products and growth in demand for cloud-related services and products.

Notably, recurring revenue growth has slowed from the 10.7% growth reported in the first quarter of the previous financial year and is also below the 8.5% growth it reported over the financial year to the end of September as a whole.

However, it is within the upper end of its target to grow recurring revenue this year by 3% to 5%, with its performance weighted toward the second half.

‘We have continued to deliver against our strategy in the first quarter, growing recurring revenue in line with our plan for the year, supported by good demand for Sage Business Cloud solutions. Accordingly, we reiterate our guidance for the full year, as set out in our FY20 results announcement. While the pandemic increases uncertainty in the near term, we continue to expect that our investment in Sage Business Cloud will drive the growth and long-term success of Sage,’ said chief financial officer Jonathan Howell.

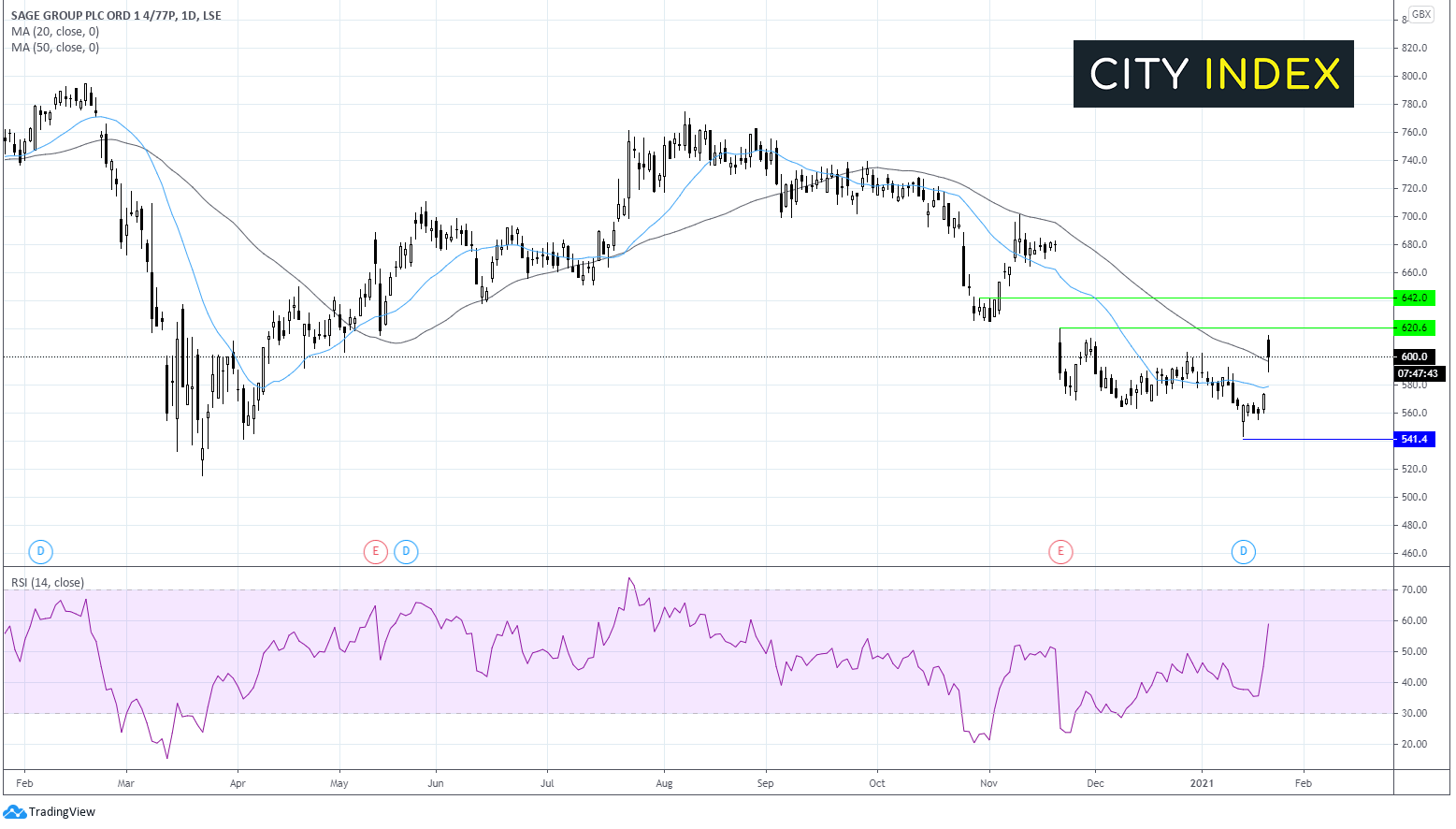

Sage Group share price: technical analysis

Sage Group shares surged higher in early trade hitting a 2-month high.

The price has been on a downward trend since early August with a series of lower highs and lower lows. It traded below its 20 & 50 sma and was in bearish territory on the RSI,

However, today’s jump has seen the price push back over the downward sloping 20 sma and the 50 sma on the daily chart. The RSI has also turned sharply higher.

A close above the 50 sma at 600p would be supportive of further gains. Immediate resistance can be seen at 620p (20 November) beyond here the bulls could be challenged at 640p

On the downside a break back below 50 sma at 600p could see a test of 576p 20 sma ahead of 540p (swing low January).

FTSE 100 news

Below is a guide to the top news from FTSE 100 shares today.

Entain sees strong growth online as it appoints new CEO

Bookmaker Entain said online activity has continued to experience strong growth whilst its retail stores suffer during lockdown.

The company said net gaming revenue was broadly flat in 2020 but reported 7% growth in the final three months of the year, putting it in a good position as it enters this year. Online net gaming revenue was up 27% in the year and up 41% in the final three months of 2020, representing its 20th consecutive quarter of double-digit growth.

‘In an exceptionally challenging year, our strong performance has been driven by a business model that is highly diversified across a wide range of products, brands, territories and channels. Q4 has been another successful period for us, and we are particularly pleased with the momentum that we are seeing in the US. BetMGM continues to go from strength to strength and is now live in 11 states, plus Michigan will be launching online tomorrow,’ Entain’s outgoing CEO Shay Segev said.

Entain said it still expects annual earnings before interest, tax, depreciation and amortisation of £825 million to £845 million in 2020 and for net debt to equal around 2.1x that sum.

Separately, Entain said it has appointed independent non-executive director Jette Nygaard-Andersen as its new chief executive with immediate effect. Current CEO Shay Segev steps down immediately but will remain available during a transition period until July 8.

Nygaard-Andersen has been on the board since 2019 and Entain said she brings ‘significant experience to the CEO role that reflects the evolution of Entain into an entertainment focused company.’ She has over 20 years’ experience in management and operational roles in ‘media, entertainment, sport and digital businesses’, the company said.

Entain surprised the market earlier this month when it said Segev was stepping down just seven months into the job.

In addition, chief financial officer Rob Wood has appointed as deputy CEO and will now hold both roles, while chief operating office Sandeep Tiku will also be given a board position ‘later in the year’.

Entain shares were down 1.1% in early trade at 1254.5.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Ibstock to ‘modestly’ beat expectations

Ibstock said business has continued to improve since its last update in October and that it expects to report annual adjusted earnings before interest, tax, depreciation and amortisation ‘modestly above’ its £50 million target.

While welcome news for investors, that is still down from £122 million in 2019. Revenue will fall 23% to £315 million. Sales have been hit by lockdowns and restrictions hampering construction activity but improved as the year went on, with second-half revenue trailing just 10% the year before. Plus, sales volumes for solid clay bricks and concrete grew year-on-year in the final quarter.

‘Activity in the final quarter benefited from better than expected demand in both new build housing and the Repairs, Maintenance and Improvement markets through our builders' merchant customers, particularly in the latter part of the period,’ it said.

Margins have also improved after Ibstock completed a restructuring last year that adjusted its cost base and capacity, and said both its core divisions are boasting profitability ‘close to the underlying levels achieved in the prior year periods.’

Cashflow was also ahead of expectations and allowed net debt to fall to £70 million from £103 million at the end of June.

‘Looking ahead, we are encouraged by recent market trends in the industry and the resilience of demand from our house builder and merchant customers. Whilst we remain mindful of ongoing uncertainties, including those related to the future impact of COVID-19 and the expected changes in the Help-to-Buy and stamp duty rules, the good momentum achieved through the end of 2020 provides us with a strong platform for progress in the current year,’ Ibstock said.

Annual results for 2020 will be released on March 10.

Ibstock shares were up 7.2% in early trade at 211.1.

Pets at Home continues to reap reward of being essential

Pets at Home said revenue has continued to grow as shops remain open, keeping it on course to hit targets this year.

Revenue grew 18% to £302 million in the 12 weeks to December 31 while like-for-likes increased 17.6%. Retail stores, veterinary services and its omnichannel segment all reported strong double-digit growth in the period.

Pets at Home said it maintains guidance for the full year that it will make underlying pretax profit of at least £77 million, having raised its target earlier this month.

Pets at Home shares were up 1.8% in early trade at 407.7.

4imprint’s recovery gains momentum

4imprint said its performance has continued to recover after being hit by the pandemic but warned it is still far from returning to pre-pandemic levels.

The company, which makes and markets promotional products, said order intake in the fourth quarter that ended on January 4 was equal to 70% of the year before. That has improved from 60% when it released its last quarterly update in October.

4imprint said annual revenue was around $560 million, down 35% from the year before. Underlying pretax profit should be in line with the company’s targets, it said. Notably, in its last update in October it said it was ‘too early to provide any forward guidance at this point’.

The company ended the year with net cash of $39.8 million, down from $41.1 million the year before.

‘Although pandemic-related uncertainty remains a challenge, the board is proud of the resilience and flexibility demonstrated by the group's people and business operations, leaving 4imprint well placed to capitalise on the opportunities presented by recovering markets,’ it said.

Annual results will be released on March 16.

4imprint shares were up 4.5% in early trade at 2360.0.

Countryside properties builds more homes as it clears backlog

Countryside Properties said it built more houses during the first quarter of its financial year as it continues to clear the backlog of work that was disrupted during the initial lockdown in 2020.

Countryside Properties said it built 1,280 homes in the 13-weeks to December 31 compared to 1,097 the year before, a number of which were originally due to be built between July and September.

The housebuilder said it was around 80% forward-sold for 2021 and that its net reservation rate in the quarter fell to 0.53 from 0.81, reflecting its strong forward order book that has been carried over from 2020. Average selling prices were up to £404,000 from £394,000 the year before.

Countryside said it ended 2020 with net cash of £91 million, a marked improvement from having net debt of £62 million a year earlier.

‘We enter the second quarter with good visibility which underpins our delivery for the full year. Whilst some economic uncertainty remains as a result of the COVID pandemic and new UK-EU trading arrangements, the outlook for the group remains positive given sustained levels of strong demand for our homes across all tenures,’ said Countryside.

‘All our construction sites remain open in line with our health and safety guidelines and our sales teams are operating on an appointment only basis. Build programmes remain on track for the full year and we anticipate further growth in the number of open outlets in the second quarter. We remain focused on delivering exceptional customer service, continuing to operate at HBF 5-star builder status. Overall, we remain on track to deliver our full year plans,’ it added.

Countryside shares were up 0.7% in early trade at 429.3.

Close Brothers says positive trends have continued

Merchant banking group Close Brothers said things have continued to improve since its last update and that it has performed well during the year-to-date.

‘The group has delivered a strong performance in the current market conditions, with high new business volumes in the lending businesses, solid net inflows in Asset Management and a very strong trading performance in Winterflood,’ it said.

Its Common Equity Tier 1 capital ratio stood at 14.8% at the end of December compared to 14.1% at the end of July, still comfortably above the minimum threshold.

Close Brothers said its banking loan book grew 6.5% in the last five months of 2020 to £8.1 billion. Its asset management division reported annualised net inflows of 5.4%, while Winterflood delivered ‘a very strong trading performance’.

‘Winterflood's year-to-date operating profit is substantially ahead of the prior year comparative period, and closer to the level achieved in the second half of the 2020 financial year. Winterflood is well positioned to continue trading profitably in a range of conditions, but due to the nature of the business, it remains sensitive to changes in the market environment,’ said Close Brothers.

The company will release interim results covering the six months to the end of January on March 16.

Close Brothers shares were up 3.8% in early trade at 1468.0.

Tate & Lyle promotes Vivid Sehgal to CFO

Ingredients company Tate & Lyle said Vivid Sehgal will takeover as chief financial officer later this year.

Seghal, currently CFO designate, will become CFO at the start of May but will take up his seat on the board at the beginning of March. Current CFO Imran Nawaz announced he was stepping down last October to become the new CFO of supermarket Tesco.

Seghal was previously the CFO at automotive propulsion company Delphi Technologies and medical tech firm LivaNova. He has also held senior management positions at Allergan, Gillette and GlaxoSmithKline.

Tate & Lyle shares were up 1.6% in early trade at 671.2.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade