Top UK Stocks to Watch: Whitbread sales hit by latest lockdown

Top News: Whitbread warns outlook ‘remains challenging’

Whitbread said all of its restaurants and about one-third of its hotels remain closed after the new lockdown restrictions being introduced.

The company is currently operating about two-thirds of its UK hotels but only to provide accommodation to essential and key workers. It warned UK hotel sales were down by 66% in the last five weeks of 2020, with occupancy at just 31%. In Germany, 21 of its 29 hotels are open but under ‘severe restrictions’ and experiencing ‘low levels of occupancy’.

‘We expect the current travel restrictions in the UK and Germany to remain until at the very least the end of our financial year. With the vaccination programme underway, we look forward to the potential gradual relaxation of restrictions from the Spring, business and leisure confidence returning, and our market recovering over the rest of the year,’ Whitbread said.

In the third quarter, total sales across both its hotels and restaurants fell 54.3% but Whitbread said that it had experienced a sharper drop since new restrictions have been introduced. It said sales have been 69.2% lower in the third-quarter to-date.

‘The short-term trading environment remains challenging, and given the ongoing and fast-changing nature of the COVID-19 situation, visibility of expected revenue and cost trends remains very limited,’ it added.

Whitbread said it had net cash of £40 million at the end of 2020 compared to over £196 million at the end of the first half, but it also has cash on deposit of £815 million, a £900 million undrawn facility and access to £300 million of government support to fall back on.

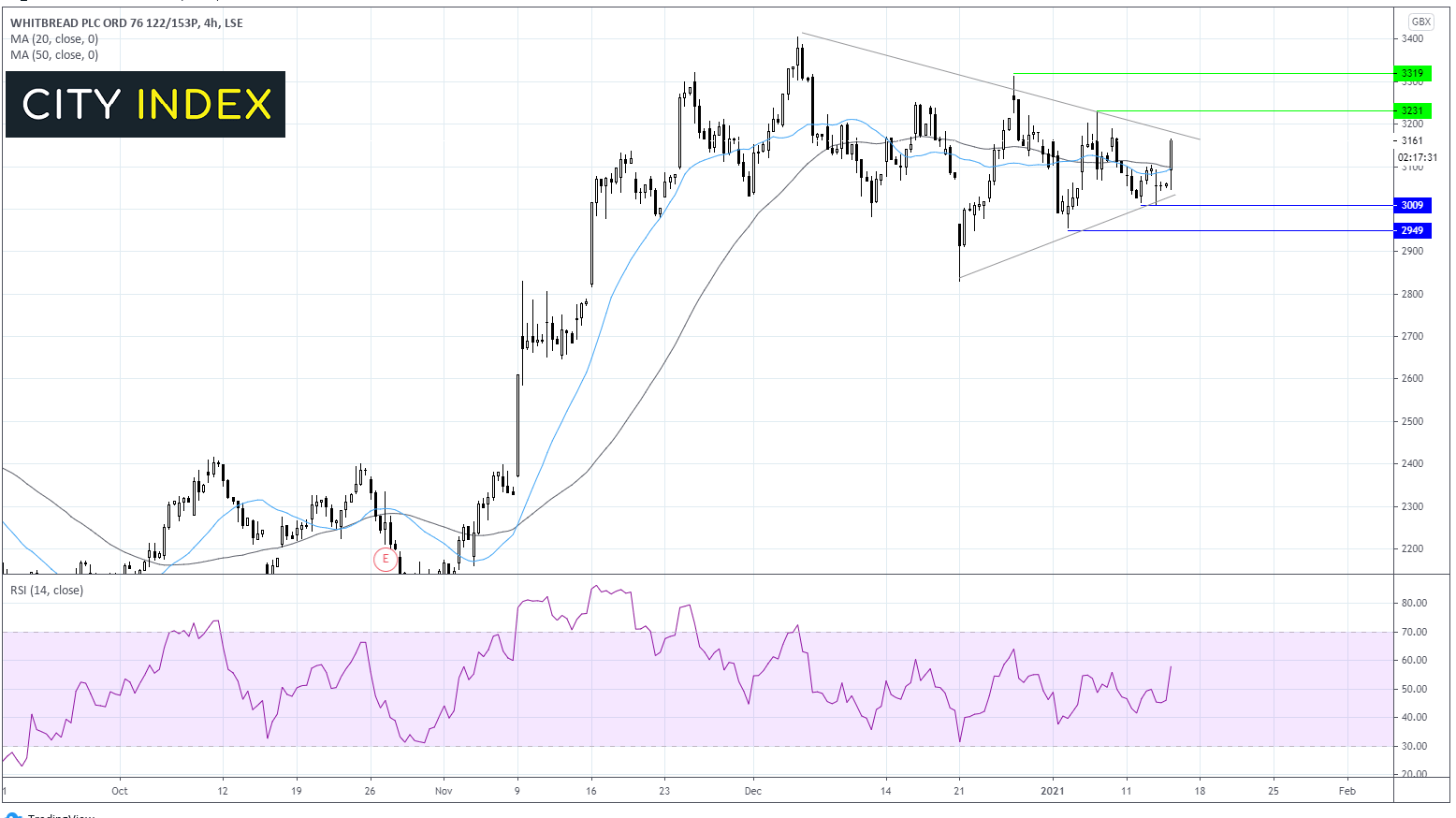

Whitbread share price: technical analysis

Whitbread shares jumped 3% in early trade. The price has formed a triangle pattern, which has seen the price move in a tighter and tighter range since 21st December as the bears and the bulls battle it out prior to a breakout.

Today’s jump higher has seen the price move above its 20 & 50 sma whilst he 20 sma is also attempting to cross above the 50 sma in another bullish signal.

The RSI is also pointing northwards and in bullish territory, favouring further upside.

Bulls would look for a meaningful break above 3180 the upper trend line of the triangle pattern. A break through here could see the price test 3230 last week’s high before 3315 December’s high.

Bears will be looking for a break below 3022 the lower trend line of the triangle, before support at 3000 round number and 2950 and potentially a deeper sell off to 2830 December low.

FTSE 100 news

Below is a guide to the top news from FTSE 100 shares today.

Tesco delivers ‘market-leading Christmas performance’

Tesco said it delivered record sales during the Christmas period but warned higher costs related to coronavirus would prevent it beating expectations.

The UK’s largest supermarket chain said UK sales accelerated from 7.2% in the third quarter to 8.4% over the Christmas period, with LfL sales growth accelerating to 8.1% from 6.7%. Tesco described that as a ‘market-leading Christmas performance’.

‘We delivered a record Christmas across all of our formats and channels. In response to unprecedented demand for online groceries, colleagues delivered over seven million orders containing more than 400 million individual items over the Christmas period,’ said chief executive Ken Murphy.

It highlighted the particular strong growth online, spurred on by lockdown restrictions, revealing sales were up more than 80% in the 19 weeks to January 9, accounting to nearly £1 billion in extra sales.

When taking all of Tesco’s operations into account, including its operations in Ireland and Central Europe, Tesco Bank and wholesaler Booker, Tesco said sales were up 7% in the 19-week period with LfLs up 5.6%.

Tesco warned it would book £85 million in extra costs related to coronavirus. That means annual virus costs will be closer to £810 million than the previous guidance of £725 million.

Tesco said it still expects retail operating profit to be ‘at least at the same level as in 2019/20’ before the repayment of business rates relief is taken into account.

Tesco shares were down 1.2% in early trade at 238.9.

AB Foods warns lockdown could cost over £1 billion in Primark sales

AB Foods warned Primark could lose over £1 billion in sales if stores have to remain closed throughout January and February.

The company said new lockdown restrictions had prompted it to bump-up its estimate from the £650 million it expected in lost sales in its last update in December. It said it intends to partially offset the loss of sales with a 25% cut in operating costs at stores that are closed.

Primark should ‘broadly break-even’ in the six months to February 27, having booked a £441 million profit the year before.

‘The impact of store closures on Primark's performance is significant. We now expect full year sales and adjusted operating profit for Primark to be somewhat lower than last year,’ it warned.

The rest of AB Foods has continued to grow, partially offsetting the weakness from Primark. Its food businesses posted a 7% rise in sales to £2.77 billion during the 16 weeks to January 2 compared to £2.6 billion the year before, but that was not enough to counter the 30% drop in Primark sales to £2.0 billion from £2.9 billion. That meant group sales fell 13% to £4.8 billion from £5.5 billion.

AB Foods shares were up 0.2% in early trade at 2228.

Taylor Wimpey sees sales plunge during pandemic

Taylor Wimpey said it delivered 1,904 homes during 2020, down 46% from the 3,548 homes sold in 2019. It also warned construction had fallen after activity was disrupted during the initial lockdown in the second quarter of 2020, having built 9,609 homes in the year compared to 15,719 the year before.

‘We entered 2020 with a healthy sales rate underpinned by strong demand for our homes and with a focus on driving margin performance. Our operations were inevitably significantly impacted by the shutdown period in the second quarter of 2020, when we acted quickly to put in place the safety measures necessary to operate in a COVID-secure manner. However, the UK housing market has remained resilient and our production and sales have recovered strongly since the shutdown. We expect to report full year 2020 results in line with market expectations,’ said Taylor Wimpey.

The current consensus is that Taylor Wimpey will deliver an annual operating profit of around £293 million. That would be down from £850.5 million in 2019.

Taylor Wimpey said construction has now normalised and that it is now operating normally with coronavirus guidelines in place. It said its total order book at the start of 2021 stood at £2.68 billion, up from £2.17 billion a year ago.

The company reiterated its plan to get its operating margin back to 21% to 22%, and that it intends to declare a final dividend when it releases results on March 2. It also said it will ‘review the special dividend in 2021 for payment in 2022’.

Taylor Wimpey shares were up 0.6% at 162.48.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Just Group shares surge on retirement income sales growth

Just Group said retirement income sales grew 12% in 2020 to £2.14 billion from £1.91 billion the year before.

The company said a 22% jump in defined benefit premiums more than offset a 7% decline in new business for guaranteed income for life.

‘The defined benefit market remains buoyant - this has been the second highest year for market transaction volumes and the industry pipeline is very strong. During the year we have written 23 transactions. Defined Benefit De-risking sales in the second half of the year were over £1 billion, a record six months for the group,’ said Just Group.

‘The market for guaranteed income for life solutions has continued to recover following the COVID-19 related sales disruption in the first half of the year. Sales in the second half were similar to the second half of 2019,’ it added.

Just Group said the growth would feed through to operating profit and that it was a ‘particularly pleasing’ performance in light of the economic environment.

It also said it delivered on its promises to strengthen its capital position during the year and to make its balance sheet less sensitive to the property market. It said it sold £540 million worth of lifetime mortgage balances in December and hedged £280 million worth of lifetime mortgages.

‘Combined, these two transactions are solvency capital ratio neutral, but more importantly they reduce the sensitivity of the group's solvency ratio to any potential future fall in UK property prices,’ it said.

Its Solvency II capital ratio was 145% at the end of June 2020, but this has now improved by 9 percentage points.

Just Group will release annual results on March 11.

Just Group shares were up 15.8% in early trade at 79.9.

Hays takes hit as recruitment market struggles in pandemic

Hays said net fees fell 16% in the final quarter of 2020 as all areas of the business continue to struggle during the pandemic.

The company said net fees fell 16% in Australia and New Zealand and Germany, 20% in the UK and Ireland, and 15% everywhere else. Total like-for-likes fell 19% in the period.

Demand for temporary staff has proven more resilient than permanent positions, with them falling 10% and 25%, respectively.

‘Our markets remain significantly impacted by the pandemic, although encouragingly fees grew sequentially versus the prior quarter, with stronger momentum in both Temp and Perm. Activity in Australia increased after its local lockdown restrictions eased, and we saw improvement in Germany across the quarter with signs of increasing business confidence. Fees in the UK rebounded in both the private and public sectors, the Americas delivered good sequential growth and Asia was broadly stable,’ said chief executive Alistair Cox.

Hays shares were up 2.5% in early trade at 145.

Centrica to beat expectations

Centrica, the owner of British Gas, said it expects to deliver better than expected adjusted earnings when it releases its annual results for 2020 on February 25.

The company said the coronavirus pandemic had continued to weigh on its financial performance, with electricity demand down by around 15% in the second half of the year. However, that has improved markedly from the 30% drop of demand seen in the second quarter when the first lockdown was introduced. It said boiler installations had also recovered but were still trailing 15% from the year before.

‘We remain cautious as we head into 2021, with the return of tighter Covid-19 restrictions in the UK and Ireland expected to put continued pressure on business energy demand and limit services workload. In addition, the related uncertain economic backdrop increases the potential for additional working capital outflow and higher bad debts,’ Centrica said.

Adjusted earnings per share will be ‘ahead’ of the current expectations of 4.8p. Adjusted EPS was 7.3p in 2019.

Centrica also said it reduced net debt by 10% over the course of the year to end 2020 at £2.8 billion. It said further reductions would be made using the £2.7 billion worth of net proceeds from the sale of Direct Energy, with sums also going toward its pension schemes.

Centrica shares were up 3.2% in early trade at 51.07.

Dechra Pharma maintains momentum

Dechra Pharma said trading has continued to be better than expected since its last update, putting it on course to post strong growth during the six months to the end of December.

It said trading meant it was currently on track to beat expectations over the full year. Group net revenue in the first half rose 21%, with strong growth seen in both Europe and North America.

‘The outlook for the full financial year is currently ahead of management expectations despite the continuing macro uncertainty. The group results should continue to benefit from strong market fundamentals as well as lower than expected underlying selling, general and administration costs as a result of COVID-19,’ said the company.

‘However, we expect that a strong pre-Brexit inventory build by customers, leading to an estimated £7 million increase in net revenue in the period, will unwind in the second half. Accordingly, we expect the balance of trading will be first half weighted,’ it added.

Dechra will release interim results on February 22.

Dechra Pharma shares were up 2.3% in early trade at 3581.

CLS Holdings says rent collection remains strong

CLS Holdings said it has collected virtually all the rent due from tenants for the fourth quarter of 2020, with collection rates having improved since October.

The company said it had collected 99% of fourth-quarter rent, up from 97% the year before and 9% ahead of the most recent figure posted in October.

In terms of rents for the first quarter of 2021, it said it had collected 90% of contractual rents, level with 91% the year before.

CLS Holdings shares were up 2.4% in early trade at 219.5.

888 reports record high customer numbers

Online bookmaker 888 said revenue and active customer numbers both hit all-time highs in December, which means it now expects adjusted Earnings before interest, tax, depreciation and amortisation to be ‘moderately ahead’ of previous expectations.

‘This strong trading continues to reflect increased new customer acquisition that started at the end of 2019 and continued throughout 2020, the positive impact of new products launched during the period as well as an acceleration in the shift from retail to online services witnessed across multiple consumer-facing industries,’ 888 said.

888 shares were down 2% in early trade at 307.5.

Synthomer raises guidance as CEO prepares to leave

Synthomer said it expects earnings to be 10% higher in 2020 than previously expected, as it announced its chief executive will leave at some point this year.

The company said it now expects to deliver annual Earnings before interest, tax, depreciation and amortisation of £255 million in 2020, 10% higher than the previous target of £232 million. It intends to release its annual results on March 4.

It said it has continued to see ‘no meaningful disruption’ from the pandemic and that it expects to deliver ‘strong Ebitda growth in 2021’.

Meanwhile, chief executive Calum MacLean will leave the business by January 2022 at the latest, with Synthomer to look for a replacement in the meantime.

Synthomer shares were up 4.5% in early trade at 465.5.

Biffa says improved sales offset by latest lockdown

Waste collector Biffa said it has performed better than expected since it released its first half results, but warned it expects a bigger drop in demand during the latest lockdown than previous ones.

Biffa said revenue in the third quarter was equal to 95% the amount delivered the year before, beating its expectations. However, it said the impact of the new lockdown is ‘expected to be more material than during the second lockdown’. It warned industrial and commercial demand could fall 25% to 30% year-on-year, having only fallen 15% during the last lockdown.

‘The offsetting impacts of stronger than expected trading during the second and third quarters, and lockdown during the final quarter, result in the board's expectations for the full year remaining unchanged,’ Biffa said.

Biffa shares were up 1.1% in early trade at 240.

Hilton Food Group has strong end to 2020

Hilton Food Group said it performed better than expected in the year to January 3.

‘We are pleased to report the group has performed ahead of the board's expectations, with a continuation of the strong year-on-year sales and volume growth driven by both our own expansion as well as the shift to home consumption arising from the Covid-19 pandemic,’ it said.

Hilton Food Group said its outlook remains positive and that it is continuing to look for new opportunities to expand further, with funding already in place to cover the cost of entering its newest markets in Belgium and New Zealand.

Annual results will be released on April 7.

Hilton Food Group shares were up 5.6% in early trade at 1187.

Elementis sees recovery but warns outlook is challenging

Chemicals company Elementis said revenue in the fourth quarter was higher than the third as demand recovers in certain markets, but warned the outlook remains challenging.

It said adjusted operating profit in 2020 should be in line with expectations between $81 million to $83 million, compared to $123 million in 2019.

Chemicals used in personal care products is where demand has been particularly hurt during lockdowns. However, its coatings, energy and talc units were also trading at lower levels in the final months of 2020 than the year before.

‘For 2021, whilst our new business and innovation pipelines are encouraging, we continue to face temporary demand challenges from COVID-19, particularly in Personal Care where we expect performance will recover when social and travel restrictions are lifted,’ it said.

It said it should end 2020 with net debt of around $415 million, down from $454 million at the start of the year.

Elementis shares were down 2.4% in early trade at 112.6.

Safestore ups dividend following strong performance in 2020

Safestore said it was raising its annual dividend by 6.3% after posting strong growth across the board during the financial year to October 30.

The company said revenue rose 7% to £162.3 million while pretax profit jumped more than one-third to £197.9 million – coming in greater than revenue because it booked large gains on investment properties. Underlying earnings were up 7.3% in the year.

Free cashflow also improved by over 12% to £68.8 million, prompting Safestore to raise its dividend 6.3% to 18.6p per share compared to 17.5p in 2019.

Safestore shares were up 2.6% in early trade at 837.8.

Savills remains ‘resilient’ during lockdown

Real estate advisor Savills said it expects underlying results to be at the upper-end of expectations in 2020.

‘Against the backdrop of the COVID-19 pandemic, the group has delivered a resilient full year performance reflecting both the robustness and geographic diversity of our business and the mitigating actions taken by staff across the globe. Thanks largely to excellent performances in the UK, Asia Pacific and Savills Investment Management, reflecting the strength of our less transactional service lines, the group anticipates that underlying results for the year to 31 December 2020 will be at the upper end of the board's expectations,’ Savills said.

The company said the speed at which vaccines are rolled out and restrictions are eased will dictate the rate at which transactional markets recover from here, making it impossible to provide guidance for 2021. It said it expects activity in transactional activity to remain suppressed in the first half of 2021 with hopes of a ‘progressive recovery’ in the second.

Savills shares were up 0.9% in early trade at 989.5.

Wood Group posts sharp fall in revenue and profits

Engineering services provider Wood Group said it generated $7.6 billion in revenue and $620 million to $640 million of Earnings before interest, tax, depreciation and amortisation in 2020.

That is sharply down from the $9.9 billion of revenue and $855 million of earnings delivered in 2019.

The company said it was taking action to protect its margins and said it had also cut $400 million worth of debt during the year. There are still ‘short term’ headwinds to overcome considering its order book at the start of 2021 was 22% lower than the year before at $6.2 billion.

Wood Group shares were down 1.5% in early trade at 347.5.

Network International Holdings beats revenue expectations

Network International Holdings said revenue in 2020 came in better than expected at $284 million, and said underlying earnings should also be ahead of expectations.

Still, that would be down 15% from the $334.8 million reported by the payments firm in 2019.

It said revenue had improved in the final quarter of the year compared to the third, demonstrating that it was recovering and entering 2021 with positive momentum behind it.

Network International Holdings will release annual results on March 8.

Network International shares were down 1.2% in early trade at 343.7.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade