Top UK Stocks to Watch: JD Sports to smash profit expectations

Top News: JD Sports to beat profit expectations by over £100 million

Leisure and sportswear retailer JD Sports said it expects to beat expectations in the current financial year as it continues to defy the wider downturn in the retail market.

Despite having to open and shut stores in line with changing lockdown restrictions, JD said demand had remained robust throughout November and December and that revenue in the 22-weeks to January 2 was 5% ahead of the year before. It said customers had ‘readily switched between physical and digital channels.’

As a result, the company said headline profit before tax in the year to January 30 will be ‘significantly ahead of the current market expectations’. It said while the market was expecting a £295 million profit this year, JD is targeting ‘at least’ £400 million. That is 35% ahead of forecasts but still below the £438.8 million reported in the last financial year.

The company said it also expects to grow profits in the new financial year despite the uncertainty going forward. JD said that it was clear restrictions would continue to be a ‘material factor’ for its stores during the first three months of its new financial year.

‘Whilst we are confident that we have the proposition to continue to attract consumers throughout this period, the process to scale down activity in stores and scale up the digital channels, often at extremely short notice, presents significant challenges,’ it said.

‘Under normal circumstances, we would be confident that the results for the forthcoming year to 29 January 2022 would show a strong improvement on the current year. However, given the ongoing uncertain outlook with stores in the UK likely to be closed until at least Easter and closures in other countries possible at any time, our current best estimate is that the group headline profit before tax for the full year to 29 January 2022 will be 5% to 10% ahead of the current year,’ JD said.

JD will release its preliminary results for the full year on April 13.

JD Sports share price: technical analysis

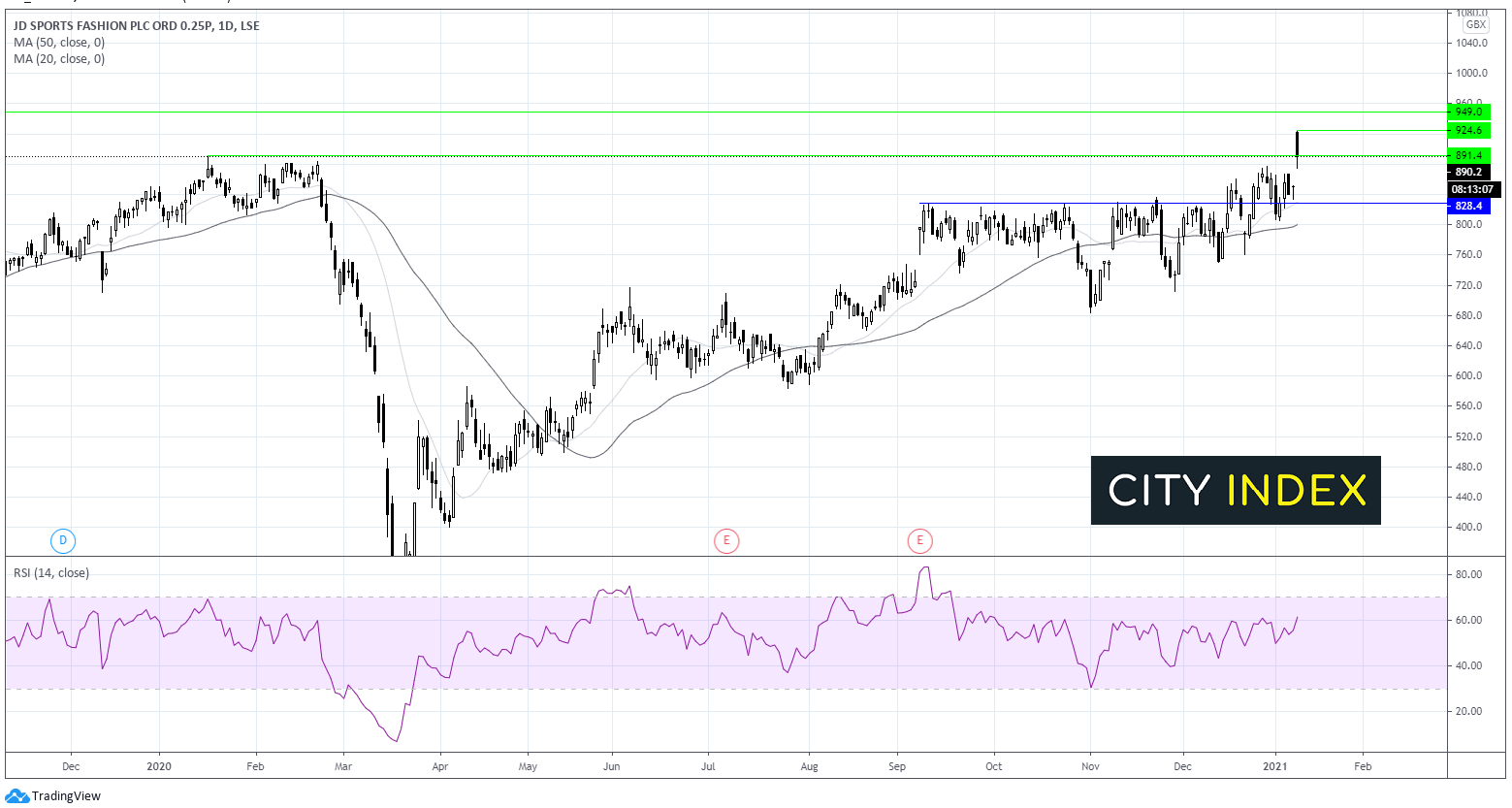

JD Sports shares surged to a fresh all time high on the open of 923 before easing back slightly to the previous all-time high of 890 reached pre-pandemic.

JD Sports trades above its 50 and 20 sma on the daily chart indicating an established bullish trend. The RSI is also above 50 in bullish territory yet below the 70 overbought level suggesting that more upside could be on the cards.

The price is currently testing the previous all-time high of 890. Acceptance above this level could see the price target the fresh all time high of 923, prior to 950 round figure.

Should the price break back below 890, support can be seen at 830 the confluence of the 20 sma on the daily chart and horizontal support, prior to 800 50 sma.

FTSE 100 news

Below is a guide to the top news from FTSE 100 shares today.

British Land reveals impact of new lockdown on retail sector

British Land, which owns offices and shops, said less than one-third of its retail shops are currently open because of the new national lockdown, derailing a partial recovery December.

The company said 73% of its retail stores were open on December 24, and that footfall had been at 76% of the year before between November 30 and December 26. It said like-for-like sales in the stores that were open ran at 81% the year before. Notably, it said there was only a minor difference between different tiers and that open-air retail parks had outperformed.

However, with a new national lockdown now introduced, it said just 32% of its retail shops are now open.

Still, British Land said rent collection levels have continued to rise as it tries to recoup sums that went unpaid during the pandemic. It said it has now collected 72% of the total rent due last September, 73% of June and 49% of March. It has collected 46% of December rent as of Friday, which it said was ‘broadly in line with the collection rates at the same point in the previous quarter, and would again expect collection rates to improve over the coming weeks.’

Notably, rent collection from offices has not been disrupted and British Land has collected 99% of rent due last June, 98% of March and 95% of December.

British Land shares were down 2.3% in early trade at 456.7p.

Smith & Nephew hit as procedures delayed by coronavirus

Smith & Nephew said it expects fourth-quarter revenue to fall 7% as procedures continue to be delayed because of the coronavirus pandemic. The company, which provides surgical devices and wound care products, said sales had been impacted by ‘increased rates of COVID-19 infection from mid-October onwards, particularly in the US and Europe where more procedures were postponed following the reintroduction of restrictions.’

It said areas focused more on elective surgery, such as sports medicine and orthopaedic reconstruction, had been hardest-hit, whilst its wound management and trauma units had been ‘more resilient’.

Annual underlying revenue will be down 12% year-on-year, it said, and the trading profit margin will be ‘substantially down year-on-year’.

Smith & Nephew will release results covering the fourth quarter and the 2020 annual results on February 18.

Smith & Nephew shares were down 3.1% in early trade at 1569.7p

Vodafone adds Cornerstone to Vantage Towers portfolio

Vodafone said it would move its 50% stake in UK towers business Cornerstone into its new European unit Vantage Towers.

Cornerstone is owned 50:50 with Spanish outfit Telefonica and a new agreement means Cornerstone will become the preferred supplier of new sites for both telecoms giants under an eight-year deal starting from January 1, 2021.

Vodafone said it will now transfer its 50% stake in Cornerstone to Vantage Towers, which it spun out last year and is reportedly looking to list in Frankfurt shortly. Cornerstone runs 14,200 macro sites which, when added, will enlarge the Vantage Towers portfolio to 82,000 macros sites. Vodafone said Vantage will be the market leader in nine of out of the 10 markets it operates in.

‘Cornerstone is a great addition to the Vantage Towers portfolio. Cornerstone is exactly the type of high quality grid we like to own: a number one market position, and two strong anchor tenants with network sharing agreements in place for whom we are the preferred supplier. We look forward to working with our anchor tenants to power the UK's digital transformation, enabling the roll-out of 5G networks to benefit business and consumers and ensuring greater mobile coverage for all,’ said Vivek Badrinath, chief executive of Vantage Towers.

Vodafone shares were up 0.5% in early trade at 128.62p.

Entain CEO poached by DAZN

Bookmaker Entain said chief executive Shay Segev has handed in his resignation so he can become the co-CEO of privately-owned sports streaming platform DAZN.

Segev will remain in his role during his six months’ notice, during which the company will look for a replacement. DAZN appears to have wooed Segev with an enticing pay packet, with chairman Barry Gibson stating Entain ‘cannot match the rewards that he has been promised’.

Entain also confirmed that the departure has nothing to do with the recent takeover bid made for the business by US partner MGM Resorts. ‘The board remains unanimous in our view that the proposal significantly undervalues the company and its prospects,’ Gibson said.

Entain shares were down 0.5% in early trade at 1462.5p.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

easyJet secures new financing

easyJet said it has secured a new $1.87 billion loan facility to ‘significantly extend and improve easyJet's debt maturity profile and strengthen easyJet's balance sheet by increasing the level of available liquidity.’

The airline said it is a five-year loan that is underwritten by a number of banks. It is partially supported by the Export Development Guarantee scheme, which means it does come with strings attached. The airline said the loan ‘does not carry preferential rates or require state aid approval, and contains some restrictive covenants including around dividend payments’. However, it stressed the dividend rules are ‘compatible with easyJet's existing dividend policy.’

The company intends to repay some of its short-term debt as a result and intends to pay back its fully-drawn $500 million revolving credit facility and £400 million worth of term loans.

‘"This facility will significantly extend and improve easyJet's debt maturity profile and increase the level of liquidity available. easyJet has taken swift and decisive action, having now secured more than £4.5bn in liquidity since the beginning of the pandemic,’ said CEO Johan Lundgren.

easyJet shares were down 0.9% in early trade at 778p.

Unite Group offers 50% rent discount to students

Student accommodation provider Unite Group said it will let students apply for a 50% discount on their rent for a total of 4 weeks and give them a 4-week complimentary extension to their tenancy agreements at the end of the academic year.

It said students that are checked-in but not living in their accommodation between January 18 and February 14 will be eligible.

Unite Group said the loss in rental income will cause a reduction in earnings by up to £8 million in the 2021 financial year, equal to 2p being knocked off its earnings per share.

‘Universities remain open, unlike the first lockdown, and we continue to have thousands of students living with us as of today. Some students studying specific subjects have already returned to University and more will be returning for face-to-face tuition during January as per government guidelines, while for other students our accommodation is their only home. All our properties across the country remain open and operational,’ aid CEO Richard Smith.

Unite Group shares were down 1.3% in early trade at 995.3p.

Royal Mail appoints Simon Thompson as CEO

Royal Mail said it has appointed non-executive Simon Thompson as its new chief executive with immediate effect as it made several changes to management.

Interim CEO Stuart Simpson, who has been in his role since last May, will leave at the end of January. Keith Williams will revert back to being non-executive chairman after being appointed as executive chairman on an interim basis last year.

Meanwhile, interim chief financial officer Mick Jeavons will take up the role on a permanent basis right away, while Martin Seidenberg, the CEO of its GLS business, will join the Royal Mail board at the start of April.

Royal Mail shares were up 0.2% in early trade at 360.7p.

Capita wins £1 billion contract from Royal Navy

Capita said it has won a contract to provide training services to the Royal Navy and Royal Marines that is worth £1 billion.

Capita will be leading a consortium of companies – including Rayheon UK, Elbit Systems UK, abd Fujitsu – to ‘transform and modernise the Royal Navy’s shore-based training across 16 sites in the UK’.

Capita shares were up 0.3% in early trade at 39.31p.

Direct Line CFO to take a leave of absence

Direct Line’s chief financial officer Tim Harris is taking a leave of absence with immediate effect whilst a family member undergoes medical treatment. He is expected to return to his position later this year.

In the meantime, chief strategy officer Neil Manser will be acting CFO, having previously been deputy CFO and interim CFO of the business.

Direct Line shares were up 1% in early trade at 340.8p.

KAZ Minerals takeover progresses toward completion

Nova Resources said it has received several clearances in relation to its takeover for KAZ Minerals. It said the State Administration for Market Regulation of the PRC, the Ministry of Industry and Infrastructure Development of the Republic of Kazakhstan, and authorities from the Kyrgz Republic had all provided various clearances allowing the deal to progress.

There are still some other conditions that need to be satisfied before the deal can be completed. Nova said it intends to send the offer document to KAZ shareholders by February 4 at the latest.

Nova agreed to buy KAZ in October in a deal worth around £3 billion.

KAZ Minerals shares were up 1.6% in early trade at 703.5p.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade