Top UK Stocks and Shares | IWG Share Price | Tesco Share Price | Reckitt Benckiser Share Price

Top News: IWG warns Covid-19 is weighing on recovery prospects

IWG shares plunged this morning after it warned that the recovery in occupancy is not taking hold as fast as it had hoped, and that the coronavirus pandemic will have a ‘significant impact’ on its results in 2021.

The company, which owns and operates numerous workspace brands like Regus and Spaces, said it saw positive occupancy momentum in the US during the first quarter of the year but warned occupancy levels elsewhere had not recovered as quickly as expected, partly because of prolonged lockdown restrictions and the emergence of new variants, which will delay its recovery.

‘Accordingly, this will delay the anticipated recovery in our business and, given the operational gearing of the group, is expected to have a significant impact on the group's results for 2021, with underlying group Ebitda for 2021 now expected to be well below the level in 2020,’ IWG said.

Ebitda took a severe knock last year when the pandemic hit, plummeting to just £255.9 million from £455.0 million the year before – and that excludes additional costs related to the virus. Including those costs, adjusted Ebitda plunged to £133.8 million from £428.3 million.

IWG said enquires in the US had now reached pre-pandemic levels. The pipeline of potential new corporate customers is growing, and service revenue is starting to improve once again.

‘These positive trends support the board's view that the prolonged impact of COVID-19 on the group's 2021 results is one of timing and that, as lockdown restrictions ease, the significant actions taken to restructure the group's cost base, together with the unprecedented demand for hybrid working and the group's unrivalled national and international network coverage, will deliver a strong improvement in profitability and cash generation,’ IWG said.

IWG said its expectations for a strong recovery in 2022 remains ‘broadly unchanged’.

Where next for the IWG share price?

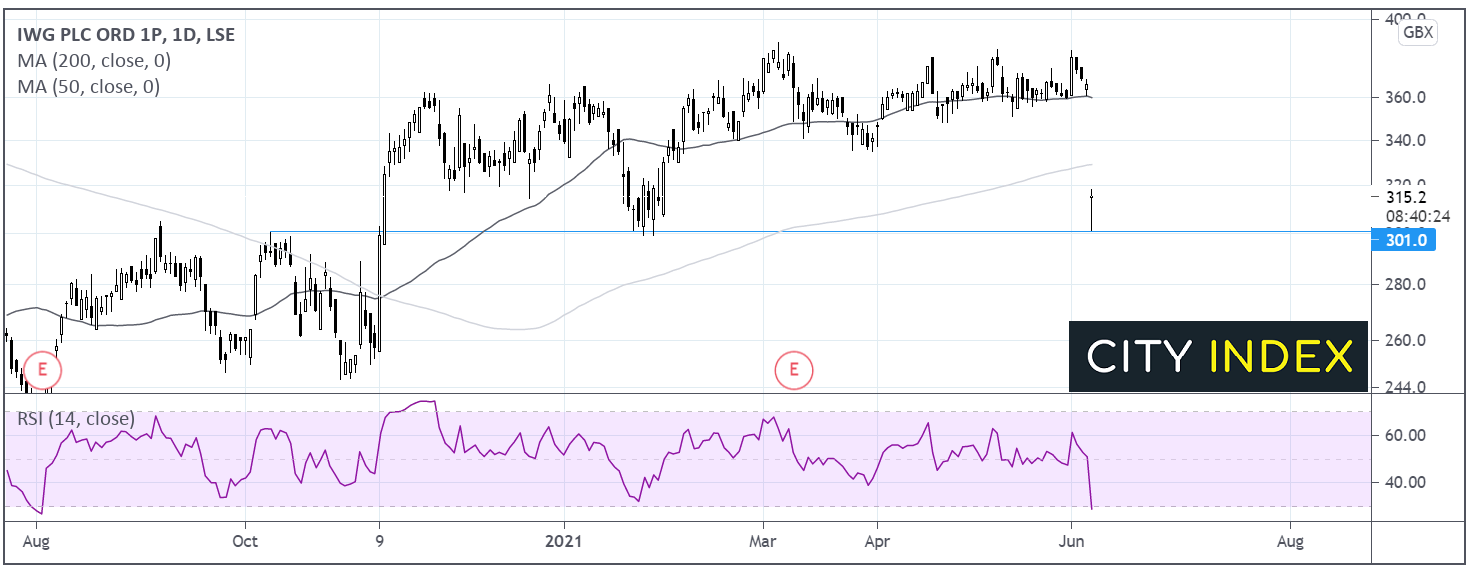

IWG had been trending higher since early October. However, today’s 15% decline has seen the share price fall through its 50 & 200 day ma.

The RSI has fallen into oversold territory below 30 suggesting that there could be some consolidation or even a move higher on the cards before any further selloff.

The price found support at 300p the 2021 low reached in January.

Any recovery in the share price would need to retake the 200 day ma at 330p in order to look towards 350p.

Meanwhile a break below 300p could see a deeper sell off towards 280p a level which provided resistance on several occasions across the second half of 2020.

Reckitt Benckiser sells baby formula and child nutrition business in China

Reckitt Benckiser has agreed to sell its business selling infant formula and child nutrition products in China to Primavera Capital Group as part of its wider plan to rejuvenate growth and create value for shareholders.

Reckitt, renowned for making household brands spanning Dettol cleaning products to Durex condoms, said the deal gives its Infant Formula and Child Nutrition business in China (IFCN China) an enterprise value of $2.2 billion and will deliver around $1.3 billion in net cash proceeds.

Reckitt has structured the deal so that it retains an 8% stake in IFCN China.

Notably, Reckitt said it has had to separate the assets of the wider IFCN business and that the Chinese unit had net assets of $3.4 billion. This means Reckitt will be booking a material loss on the sale of around $2.5 billion. IFCN China reported annual net revenue of £861 million in 2020 and operating profit of £85 million.

‘The transaction follows a comprehensive strategic review of IFCN China announced in February 2021. The transaction is structured as a sale of the entirety of IFCN China, including the manufacturing plants in Nijmegen, the Netherlands and Guangzhou, China,’ said Reckitt.

‘It includes a royalty-free perpetual and exclusive license of the Mead Johnson and Enfa family of brands in China. Following completion of the transaction, Reckitt will continue to own the Mead Johnson and Enfa family of brands globally and will operate those brands in the rest of the world,’ Reckitt added.

Reckitt hopes to complete the deal in the second-half of 2021, assuming it can satisfy authorities and the staff that will be impacted.

Chief executive Laxman Narasimhan said the company remains committed to China, citing that it is the biggest market for Durex and a growing one for other brands like Dettol, Finish and its VMS brands.

Reckitt shares were trading 0.2% higher in early trade this morning at 6505.5p.

Tesco and Carrefour to end purchasing partnership

Supermarkets Tesco and Carrefour have agreed to end their purchasing partnership when the existing deal expires at the end of 2021.

Tesco, the largest supermarket in the UK, and Carrefour, the largest in Europe, entered into a three-year purchasing alliance back in 2018 and have since been buying food and general merchandise together in order to achieve greater scale and lower prices, but said the deal will not be extended.

‘Moving forward, both companies have agreed that they will continue this work independently and focus on their own opportunities, building on the experience and the progress made during the alliance period,’ Tesco said in a short statement.

When the alliance was originally formed it was regarded as Tesco’s response to the potential merger between Sainsbury’s and Asda, which was ultimately blocked by regulators, as well as increasing competition from discount chains Aldi and Lidl and new entrants including Amazon.

No specific reason was given as to why the partnership was being extended.

Tesco shares were trading 0.4% higher this morning at 226.3p, while Carrefour shares were trading 0.5% higher at 1741.5 euro cents.

Sirius Real Estate ups dividend after reporting 47% jump in profits

Sirius Real Estate hiked its dividend and said it was becoming increasingly optimistic about its outlook after reporting a strong set of annual results.

The company, which owns and operates a EUR1.3 billion portfolio of business and industrial parks across Germany, had already published broad numbers for the year to the end of March 2021 in a pre-close update in April. Its annualised rent roll grew by 7.6% year-on-year to EUR97.2 million and it delivered its seventh year of like-for-like rent roll growth of over 5%.

It managed to achieve higher rent for its space, improve occupancy and reported a cash collection rate of over 98%. Enquiries jumped 18.5% while new lettings and its conversion rate remained broadly stable.

Sirius Real Estate revealed this morning that this helped deliver a 47% jump in pretax profit to EUR163.7 million, although this was mainly down to a EUR103.9 million lift in its property valuations.

The company said it has raised its second-half dividend by 10% to 1.98 euro cents, which translates to a 6.4% rise in its total payout for the year to 3.80 cents. That is in line with its policy to pay out 65% of its funds from operations, which grew 9.3% in the year to EUR60.9 million.

Total shareholder return for the year came in at 19.5%, up from 13.1% the year before, thanks to the 15% rise in net asset value and the increased dividends. Its net asset value per share rose 14.2% to 88.31 euro cents at the end of the year from 77.35 cents the year before.

‘Despite the continued degree of market uncertainty as a result of the pandemic, more confidence is breathed into the market every day as the vaccine is rolled out successfully in Germany and across Europe. We have ended the year with a strong balance sheet which will allow us to take advantage of acquisition opportunities as they arise and continue to grow income and capital values through selective investment,’ said chief executive Andrew Coombs.

Sirius Real Estate shares were trading 0.7% lower in early trade this morning at 100.6p.

Empiric Student Property confident of recovery despite low bookings

Empiric Student Property said over one-third of revenue-generating rooms are unoccupied and that current bookings for the new academic year are lower than usual, but said it remains confident in its ability to bounce back this year.

The company said revenue occupancy for the current 2020/21 academic year remains at 65%, in line with its last update. It said cash collection has remained as expected and that physical occupancy sits at around 67%, signalling that many students have decided not to return because of the pandemic.

The fact that current bookings for the new academic year sits at only 40%, which is lower than a typical year before the pandemic, will be more worrying for shareholders. Still, Empiric said that it is seeing the number of bookings accelerate and believes it can recover.

‘We expect the sales cycle for the 2021/22 academic year to be significantly back ended as the benefits of the lifting of restrictions by the UK government take effect. Together with the success of the vaccination programme and the recent UCAS applications, this gives us cautious optimism about a return to increasingly normal levels of occupancy.

Empiric said UCAS applications from UK students is up 11% for the new academic year and highlighted the 17% rise in applications from non-EU countries, with Chinese applications up 21%.

‘The successful vaccination programme, the ongoing lifting of restrictions and the encouraging recent UCAS applications for the 2021/22 academic year, leave us cautiously optimistic about a return to more usual occupancy levels, albeit with sales expected to be significantly back ended for the forthcoming academic year. Furthermore, we remain confident that our strongly differentiated premium accommodation for students and Hello Student brand proposition and offer provide us with a compelling competitive advantage, especially in a Covid-19 affected world,’ said chief executive Duncan Garrood.

The company also announced that it has now completed the sale of its building in Exeter for £11.05 million, in line with its plans to offload around £100 million of non-core assets over the medium-term.

Empiric shares were trading 0.7% lower in early trade this morning at 87.7p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade