Top UK Stocks and Shares | Greggs Share Price | Burberry Share Price | Serco Share Price | NatWest Share Price | JD Sports Share Price

Top News: Greggs hopes to return to pre-pandemic profits in 2021

Baker Greggs said trading has been stronger than expected since its last update in early May which, if it continues, will put it on course to significantly beat expectations this year.

The company said like-for-like sales growth since early May had ranged from 1% to 3% higher than the same period in 2019, before the pandemic hit. That marks a significant improvement considering like-for-likes were down 3.9% versus pre-pandemic levels in the initial weeks after stores reopened.

‘Greggs last reported trading performance on 10 May, at which point we had seen a strong recovery in sales levels following the easing of restrictions on non-essential retail across the UK. Since then we had expected to see increased competition as cafes and restaurants were allowed to compete more effectively with our largely take-out offer,’ Greggs said.

‘In recent weeks the impact of pent-up demand for retail has reduced but, nonetheless, like-for-like sales growth in company-managed shops has remained in positive territory ranging between one and three per cent when measured against the same period in 2019,’ Greggs added.

Greggs said the speed of the recovery was faster than forecast and, if it continues, will have a ‘materially positive impact’ on its results for the full-year. It intends to provide further insight into its performance in it releases its interim results on August 3.

Earlier this year, Greggs said profits ‘could be around 2019 levels’, implying the better-than-expected performance could put the baker on course to deliver growth beyond pre-pandemic levels in 2021. Greggs turned to a pretax loss of £13.7 million when the pandemic hit in 2020 from a £108.3 million profit in 2019.

Where next for the Greggs share price?

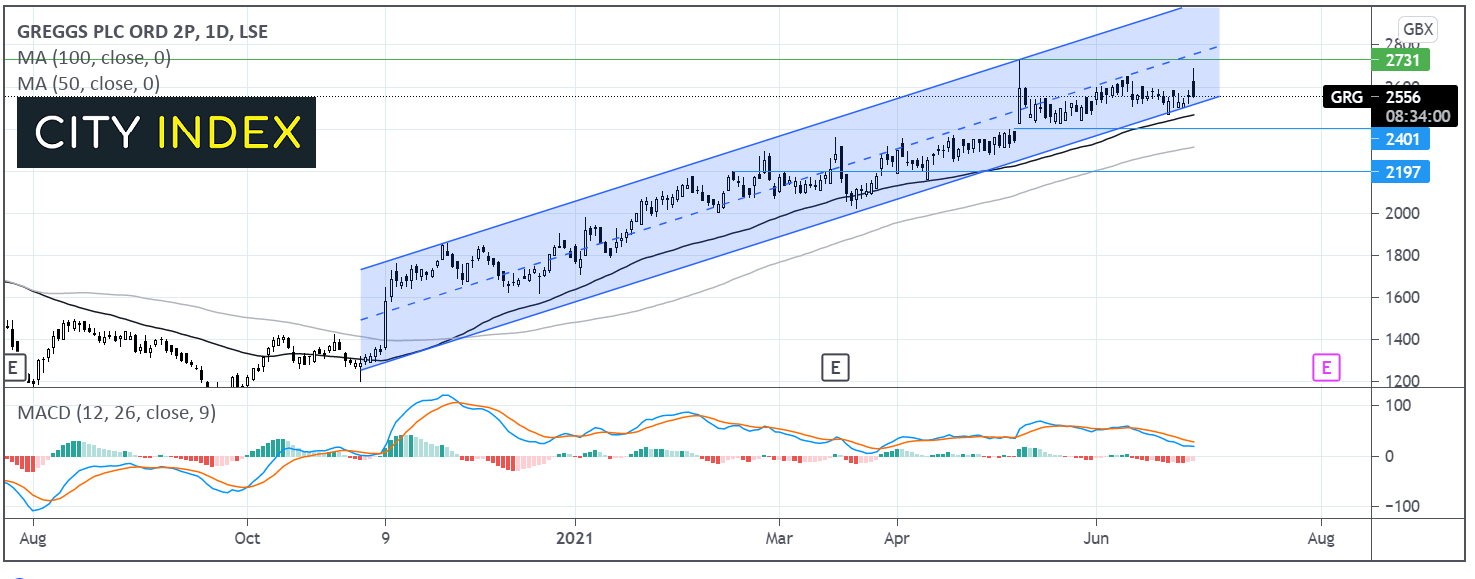

Greggs has been trending higher since early November. The share price trades above its 50 & 100 sma on the daily chart and within a multi-month ascending channel showing an established bullish trend.

The MACD reveals a receding bearish bias which keeps the buyers optimistic.

Whilst the share price opened sharply higher today, those gains have quickly been pared. Immediate support can be seen at 2515p the lower band of the ascending channel and then 2470p the 50 sma. It would take a move below this level to negate the near term up trend, potentially opening the door to 2315p the 100 sma.

Any move higher will need to retake 2685p today’s high ahead of 2750p the all time high and the mid point of the ascending channel.

Burberry CEO resigns to return to Italy

Marco Gobetti, the chief executive of luxury brand Burberry, will leave the business at the end of 2021 in order to pursue a new opportunity that will allow him to return to his home country of Italy.

The news sent Burberry shares down 7.6% in early trade this morning at 2072.0p.

Burberry will search for a successor in the meantime, with Gobetti to work closely with chairman Gerry Murphy to ensure an orderly transition until a replacement is found.

‘It has been an incredible privilege to serve as Burberry's CEO and lead such a hugely talented team. As a group, we have elevated and strengthened the brand and the business, while continuing to be a force for good. With Burberry re-energised and firmly set on a path to strong growth, I feel that now is the right time for me to step down,’ said Gobbetti.

Gobbetti was appointed CEO back in July 2017 and ‘led the transformation of every aspect of our business and built a new Burberry’ over the past three years.

Serco wins contract to run testing centres for up to £322 million

Serco has won a new contract from the UK government to continue providing regional, local and mobile coronavirus testing centres across England and Northern Ireland.

The outsourcer said the contract will last for 12 months with the possibility for it to be extended by a further six months. The contract could be worth up to £322 million in total, but Serco warned ‘the actual amount could differ materially from this as the contract is designed to be flexible, matching services to the demand for testing over the coming months.’

‘Serco will provide test site operations, asset administration support, cleaning and security services at around 20% of sites in England and Northern Ireland, including a mixture of drive-through and walk-in testing centres, as well as mobile testing units,’ the company said.

Serco said the new contract does not impact its guidance about the expected contribution from its testing centres for this year. That comes after Serco in June raised its underlying trading profit guidance for 2021 by £15 million to around £200 million.

The news sent Serco shares up 1.6% in early trade at 133.4p.

JD Sports unit buys majority stake in Deporvillage

JD Sports Fashion’s joint venture Iberian Sports Retail Group has agreed to buy an 80% stake in Spanish online retailer Deporvillage for up to EUR140.4 million.

Back in 2018, JD Sports merged its businesses in the Iberian Peninsula with Portuguese firm Sport Zone to create the Iberian Sports Retail Group, in which it owns a 50.02% stake.

Iberian Sports Retail Group has conditionally agreed to buy an 80% stake in Deporvillage for up to EUR140.4 million, of which EUR40.4 million will not be paid until the end of 2021 and is dependent on how it performs in the meantime. Notably, the remaining 20% of Deporvillage will continue to be owned by its two founders, Xavier Pladellorens and Angel Corcuera, who will continue to lead the business as chief executive and chief purchasing officer, respectively.

‘Based in Manresa in Catalonia, Deporvillage is an online only retailer focussing on the sale of specialist sports equipment principally for cycling, running and outdoor,’ said JD Sports.

‘The acquisition of Deporvillage, when completed, will enhance the group's authenticity in key sports categories, significantly increase its digital capabilities in the sports equipment market and will complement the ongoing positive developments in the group's existing Sprinter and Sport Zone fascias,’ it added.

Deporvillage was launched in Spain back in 2010 but has since expanded by launching country-specific websites in Italy, France, Portugal, Germany and the UK. It generated EUR117.8 million in revenue and a pretax profit of EUR7.7 million in 2020 and ended the year with gross assets of EUR51.1 million.

JD Sports shares were trading 1.4% lower in early trade at 945.1p.

Glencore to buy Cerrejon coal mine from partners BHP and Anglo American

Glencore has agreed to take full control of the Cerrejon thermal coal mine in Colombia after striking deals to buy stakes from its two joint venture partners Anglo American and BHP Group.

Currently, the three companies own an equal slice of the project but Anglo American and BHP Group both announced they wanted to exit the venture as part of their efforts to move away from coal.

BHP has snapped at the opportunity to take full control and will pay $588 million in total, with $294 million being paid to each partner. The transaction is expected to be completed in the first half of 2022, once regulatory approvals have been secured.

BHP believes it can earn back the costs of the acquisition within two years, stating that the cash generated by the mine and the phased approach to payments ‘reduce the effective aggregate cash consideration to approximately $230 million’, the company said.

BHP said it considered its commitment to climate change when considering what to do with Cerrejon. It plans to gradually phase out the operation by 2034, with production to fall steeply from 2030 onwards. However, BHP did not rule out selling the asset to another company that may choose to extend the life of the mine in the future.

‘Glencore has been involved with Cerrejon for more than 20 years. We know the asset well and believe that we are the most responsible steward for Cerrejon at this stage of its lifecycle,’ said Glencore CEO Ivan Glasberg. ‘Disposing of fossil fuel assets and making them someone else's issue is not the solution and it won't reduce absolute emissions.’

‘We are confident we can manage the decline of our fossil fuel portfolio in a responsible manner that is also consistent with meeting the goals of the Paris Agreement, as demonstrated by our strengthened total emission reduction targets,’ he added.

Anglo American said the sale means it has now divested from the last of its thermal coal operations.

Shares in all three companies were trading marginally lower in early trade this morning.

NatWest sells bulk of commercial lending operations to Allied Irish

NatWest Group said it has signed definitive deals to offload the majority of Ulster Bank’s commercial lending operations to Allied Irish Banks as part of its phased withdrawal from the Republic of Ireland.

A non-binding agreement was signed in February and binding deals have now been signed. This covers the sale of around EUR4.2 billion worth of gross performing commercial lending and associated undrawn exposures of around EUR2.8 billion. Risk-weighted assets in relation to the balances total around EUR4.0 billion.

NatWest shares were up 0.6% in early trade this morning at 208.05p.

‘On completion, it is estimated that a small gain on disposal will be recognised, based on the net carrying value of the lending as at 31 December 2020. The exact impacts of disposal will depend on movements in the book between now and transfer, the timing of which remains uncertain,’ NatWest said.

Around 280 members of staff will transfer from Ulster Bank to Allied Irish Banks as part of the deal.

Wood Group draws line under Amec Foster investigations

John Wood Group said it has agreed to pay $177 million to settle a number of investigations carried out into the legacy Amec Foster Wheeler business.

Officials in the UK, US and Brazil had been investigating claims that bribery and corruption were used by Amec Foster Wheeler when dealing with third parties in the past. Wood Group will make the payment to settle all outstanding issues with the UK’s Serious Fraud Office, the US Securities & Exchange Commission and a number of regulatory offices in Brazil.

Wood Group purchased Amec Foster Wheeler in a £2.2 billion deal back in 2017, but the investigations were linked to activities conducted in November 2014 - before the purchase was completed.

‘The investigations brought to light unacceptable, albeit historical, behaviour that I condemn in the strongest terms. Although we inherited these issues through acquisition, we took full responsibility in addressing them, as any responsible business would,’ said chief executive Robin Watson.

‘Since our acquisition of Amec Foster Wheeler, we have cooperated fully with the authorities and have taken steps to further improve our ethics and compliance programme from an already strong foundation. I'm pleased that, subject to final court approval in the UK, we have been able to resolve these issues and can now look to the future,’ he added.

The payments will be made in phases, starting with a $62 million payment in the second half of 2021. The remainder will be paid off in instalments in 2022, 2023 and 2024.

‘The amount and payment plan are as disclosed and provided for in Wood's financial statements for the year ending 31 December 2020, published in March 2021,’ the company clarified.

The outcome of the investigations needs to be approved by the courts in some countries but, once attained, it should draw a line under the problems with the legacy Amec Foster Wheeler business.

Wood Group shares were trading 1.5% lower in early trade this morning at 219.3p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade