Top UK Stocks to Watch: Greggs eyes recovery after booking first loss in 36 years

Top News: Greggs to continue expanding after swinging to loss

Greggs said it entered the red for the first time in 36 years in 2020 as sales suffered during lockdown, but said it saw a ‘progressive recovery’ in the second-half and that trading had been better-than-expected since the start of 2021.

The baker said sales fell to £811.3 million in 2020 from £1.16 billion in 2020, predominantly as lockdown kept people at home and reduced footfall near its locations. Like-for-like sales in its own stores was down over 36% year-on-year.

That caused Greggs to post a pretax loss of £13.7 million from a £108.3 million profit in 2019. The loss was booked despite the fact Greggs has received financial support from the government in the form of furlough and business rates relief.

Revenue was in line with guidance while the loss was slightly better than company’s guidance for a £15 million loss.

Greggs said it saw trading improve during the second-half of 2020 and that it has been better-than-expected since the start of 2021. Still, like-for-like sales were down 28.8% in the 10 weeks to March 13. Excluding Scotland, where all stores are temporarily closed to walk-in customers, like-for-likes were down 22.4% year-on-year.

A bright spot for the business has been in delivery, which has been ‘particularly strong’ and accounted for 9.6% of its total sales in the first 10 weeks of 2021. It said delivery and wholesale channels, as well as the introduction of click & collect services, had helped prop up sales during lockdown.

The company said it was intending to open 100 net new shops this year to demonstrate the confidence in its long-term prospects, building on the 84 net openings in 2020.

‘Greggs has made a better-than-expected start to 2021 given the extent of lockdown conditions and is well placed to participate in the recovery from the pandemic. It has a clear strategy to extend its digital capabilities and to grow further in new locations, channels and dayparts. These opportunities will benefit all of its stakeholders in the years to come,’ said chief executive Roger Whiteside.

Greggs is not paying a dividend for the year as expected as it preserves cash to weather the storm.

‘In order to recommence a dividend distribution, the company will need to return to a level of profitability and cash generation sufficient to support its investment programme whilst maintaining appropriate liquidity,’ said Greggs.

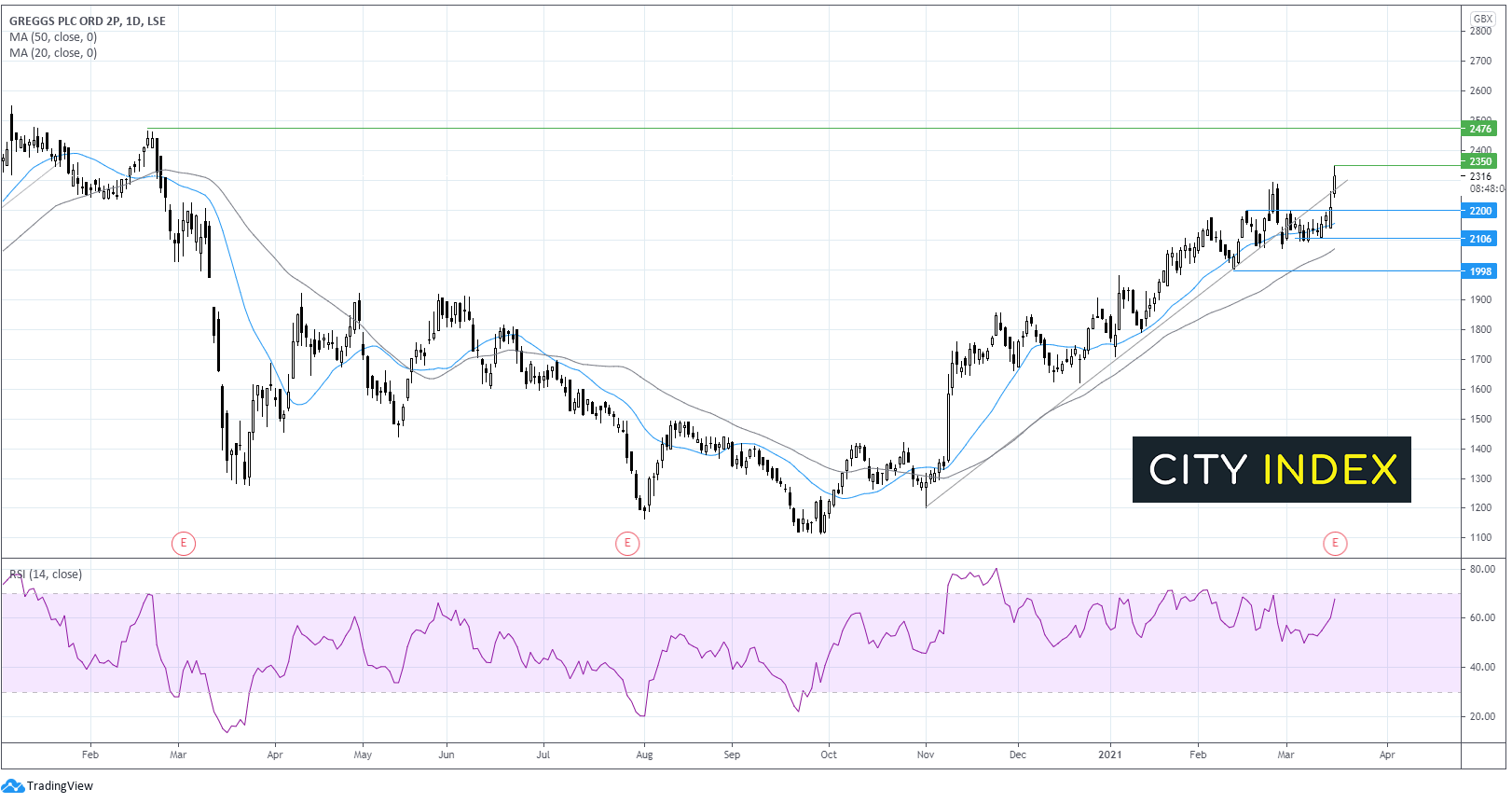

Where next for Greggs shares?

Greggs has been trending higher since mid-November. It saw a period of consolidation from mid-February, slipping below the ascending trendline. However, with today’s 4.5% jump high Greggs trades above its 20 & 50 sma and the 3-month ascending trend line.

The RSI is also supportive of further gains before reaching overbought territory.

Immediate resistance can be seen at 2350, the session high and a fresh 12 month high. A move beyond here could open the door to 2475 the pre-pandemic high.

On the flip side, support can be seen at 2290 the trend line support and high Feb. 25. A break below this level could see sellers target 2100 a support which has more or less held across the past month. A break below this level could see sellers gain momentum towards 2000.

AstraZeneca to provide 500,000 doses of coronavirus antibody treatment

AstraZeneca said it has tweaked an existing supply agreement with the US government to supply up to 500,000 additional doses of its potential antibody treatment, AZD7442, which is in late-stage development for the prevention and treatment of Covid-19.

The pharmaceutical giant signed an initial agreement with the US government back in October 2020, when it agreed to supply an initial 100,000 doses. That deal gave the US the option to buy more, which has culminated in further orders. The latest addition of 500,000 doses means AstraZeneca is supplying 700,000 doses in total to the US.

The value of the deal to supply the US is now worth around $726 million in total, but contingent on it being given emergency approval by the US Food & Drug Administration.

‘The long-acting antibody combination has the potential to offer almost immediate protection to those who are not able to be vaccinated, to both prevent infection or treat the disease in patients already infected with the virus. The US government's support is critical in helping accelerate the development of AZD7442, which we believe will be an important tool in the fight against COVID-19,’ said chief executive Pascal Soriot.

AstraZeneca shares were trading 2.6% higher in early trade at 7142.5.

Ferguson ups dividend and launches buyback as profits grow

Ferguson said it has raised its dividend and a launched a new share buyback after reporting strong growth in revenue and profits during the first half of its financial year.

The plumbing and heating specialist said revenue rose 4.2% in the six months to the end of January 2021 to $10.3 billion from just $9.89 billion the year before. Pretax profit jumped almost 18% to $739 million from $628 million.

An interim dividend of 72.9 cents will be paid. That will be paid in May, when shareholders will also receive a 180 cent special payout following the disposal of its UK operations. Investors are also being rewarded with a new $400 million share buyback programme.

Notably, the sale of its UK arm means Ferguson now derives virtually all of its revenue from North America, which prompted it to launch an additional listing in the US last week.

‘Since the start of the third quarter, we have continued to trade well, generating high single digit organic revenue growth. While the outlook for the second half remains very uncertain, we expect to generate above market revenue growth in good residential markets aided by increasing inflation,’ said chief executive Kevin Murphy.

‘However, we expect this to be partially offset by increasing supply chain pressures, transportation costs and the reversal of temporary cost reduction actions taken during the initial stages of the lockdown starting in April of last year. We are well positioned to manage through this environment and we will continue to invest in talented associates and digital capabilities to serve our customers and take advantage of market opportunities,’ he added.

Ferguson shares were trading 0.5% higher in early trade at 9065.0.

FCA starts criminal proceedings against NatWest Group

The Financial Conduct Authority has initiated criminal proceedings against National Westminster Bank, part of NatWest Group, for money laundering offences.

The accusations relate to alleged failures to comply with money laundering regulations when dealing with a UK incorporated customer between November 2011 and October 2016. The FCA claims around £365 million was paid into the account, £264 million of which was in cash, and that NatWest failed to ‘adequately monitor and scrutinise’ this activity.

NatWest was first notified of the investigation back in July 2017 and the bank has been working with the FCA since. The bank will appear at Westminster Magistrates’ Court on April 14. No individuals are being charged.

This is the first time the FCA has sought a criminal prosecution under the 2007 money laundering rules and the first time it has pursued a bank. Notably, the UK taxpayer has a 62% interest in NatWest.

‘NatWest Group takes extremely seriously its responsibility to seek to prevent money laundering by third parties and accordingly has made significant, multi-year investments in its financial crime systems and controls,’ said the bank.

NatWest shares were trading 1.2% lower in early trade at 186.02.

Unite Group reinstates dividend despite tough 2020

Unite Group has reinstated its dividend and said it is positioned to deliver a ‘rapid recovery in earnings’ as the UK economy reopens and students return to university.

The company, which provides accommodation to university students, said revenue rose to £215.6 million in 2020 from £156.2 million in 2019. However, earnings fell to £97.3 million from £110.6 million, or to 25.5 pence per share from 39.1p.

The hit to earnings was caused by reduced occupancy levels as some students stayed away during lockdown, as well as the acquisition of Liberty Living, which forced it to forgo rent due during last year’s summer term.

Its pretax loss swelled to £120.1 million from the £101.2 million loss reported in 2019. The loss was caused by a £178.8 million fall in value to its property portfolio and a £384.1 million impairment.

Still, Unite Group said it had decided to reinstate its dividend with a 12.75 pence payout. Despite no interim payout being made, the dividend for the year is still up from 10.25p in 2019. Unite Group said the payout represents half of its earnings per share compared to just 26% in 2019, and that it aims to increase its payout ratio as earning visibility improves.

Unite Group said it has collected 95% of rent due for the current academic year and that weekly rents have also grown by about 1.1% from the previous year. It expects strong demand for the next academic year although reservations have been delayed because of coronavirus. Still, it is expecting occupancy of 95% to 98% in the 2021/22 academic year and for rents to grow by 2% to 3%.

‘Despite uncertainty created by Covid-19, Brexit and the review of Higher Education funding, we remain well positioned for a rapid recovery in earnings. Positive progress with Covid-19 vaccinations in the UK will enable a full reopening of the UK economy. Moreover, the early strength of applications data and reservations for the 2021/22 academic year are supportive of a return to full occupancy and positive rental growth,’ said Unite Group.

‘We are also confident in the medium-term outlook for earnings growth, driven by a return to sustainable 3% per annum rental growth, our substantial secured development pipeline and further opportunities to deploy capital into new development and University partnership opportunities at attractive returns,’ it added.

Unite Group shares were trading 1.6% higher in early trade at 1014.0.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade