Top UK Stocks and Shares | Dunelm Share Price | Ferguson Share Price | Premier Foods Share Price | Experian Share Price | Severn Trent Share Price

Top News: Dunelm expects profits to soar past expectations

Homewares and furniture retailer Dunelm said it will significantly beat expectations when it releases annual results following a strong performance since reopening its stores last month.

Total sales during the first seven weeks of the fourth quarter of its financial year were 59% higher than pre-pandemic levels, as customers have flocked back to stores since they were reopened on April 12. Meanwhile, the business built online and for its click-and-collect during lockdown has continued to pay off and deliver ‘good growth’.

‘This high sales growth reflects the strength of our customer proposition and a variety of other factors including pent up demand following the extended store closure period, a buoyant homewares market and some benefit from the unseasonably cold Spring weather,’ said Dunelm.

Dunelm said it has performed significantly ahead of expectations in the five weeks since stores reopened and, as a result, it is now expecting to report annual pretax profit of over £148 million - well above the upper-end of analyst estimates of £128 million to £134 million. That would compare to the £109.1 million profit delivered in the last financial year.

Dunelm has been one of the most resilient retailers during the pandemic, with sales rising 23% and profits jumping by more than one-third during the first half of its financial year as strong online sales helped cushion the blow from stores being closed for much of the period.

Where next for the Dunelm share price?

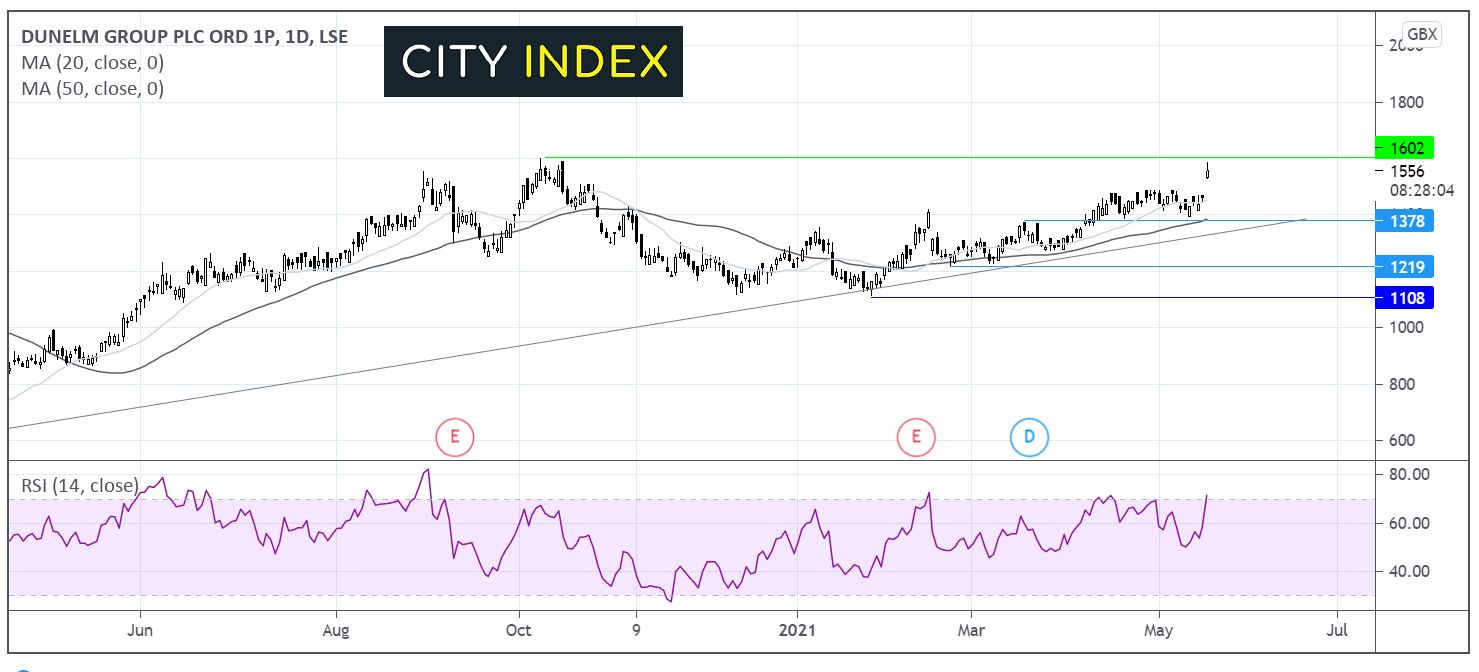

Dunelm trades above its ascending trendline dating back to the mid-March 2020 low. It trades above its 20 & 50 sma on the daily chart indicating an established bull trend. The RSI has tipped into overbought territory so some consolidation or a pullback could be on the cards before any further move higher.

The daily high at 1585p could offer some resistance on the way up. A move over the all-time high of 1601p is needed for further gains.

A break below 1375p the 50 sma and horizontal support could negate the near term uptrend and prompt a deeper selloff to 1220p.

Ferguson shares pop after raising outlook as US economy reopens

Ferguson shares hit a new all-time high this morning as it raised expectations for the full year after performing better than anticipated in the third quarter, driven by the reopening of the US economy.

The plumbing and heating specialist said revenue jumped 24.5% in the three months to the end of April, representing the third quarter of its financial year, to $5.91 billion. Organic growth in the US, its key market, was over 20% thanks to higher prices and weaker comparatives last year when the pandemic started to bite.

Ferguson said demand in the US has continued to improve as lockdown restrictions have continued to ease. Trading profit was up over 65% year-on-year at $579 million thanks to better margins and lower costs.

‘Ferguson has brought forward its Q3 announcement as we delivered strong revenue and profit growth ahead of expectations. Our associates continued to provide outstanding service and support to our customers in the face of increasing supply chain pressures leading to product availability concerns,’ said chief executive Kevin Murphy.

‘We were pleased with the strong earnings growth and margin expansion arising from continued operating efficiencies and pass through of acute price inflation as the US economy re-opens,’ he added.

Ferguson said the strong performance has prompted it to raise its expectations for the full year. It is now aiming to deliver an annual trading profit between $2.00 billion and $2.10 billion. That would be a significant improvement from the $1.66 billion reported in the last financial year.

Ferguson shares hit a new all-time high this morning after jumping 4.1% higher in early trade to 9633.0.

‘We are well positioned to manage through the near term though we are mindful of the ongoing effect of inflation on sales and gross margins and its potential adverse impact on operating costs. Looking ahead, we are confident in our strategy and we remain committed to investing in our talented associates, world class supply chain and digital capabilities to better serve our customers,’ said Murphy.

Premier Foods reinstates dividend after 13 years

Premier Foods reported strong double-digit growth in revenue and profits during its recently-ended financial year and said it is reinstating its dividend after 13 years as it managed to get debt down to manageable levels.

The company, known for brands spanning Ambrosia custard and Bisto gravy to Mr Kipling cakes and Oxo cubes, said revenue grew over 10% in the year to April 3 to £947.0 million. Adjusted pretax profit was 23.5% higher at £117.9 million. On a reported basis, pretax profit more than doubled to £122.8 million from $53.6 million the year before.

Premier Foods said it grew faster than the wider market over the year and capitalised on growth by launching new branded products and upping spending on TV advertising. Its online performance also improved with sales more than doubling.

‘Throughout the year, we continued to drive our branded growth model, launching a series of new product ranges, including many healthy options such as Sharwood's low sugar stir fry sauces and increasing marketing investment with six of our major brands benefitting from TV advertising. This, along with a robust performance from our supply chain, ensured we delivered growth ahead of the market. Sales of our brands online more than doubled and our continued focus on this channel led to further market share gains. In overseas markets we are now clearly seeing the benefits of last year's change in strategy with double digit growth in each quarter and 23% in the full year,’ said chief executive Alex Whitehouse.

Premier Foods said it is reinstating its dividend after 13 years. That is because it has reduced debt after repaying some of its bonds early and saving it some interest. Investors will be paid 1.0 pence per share.

Premier Foods shares were trading 0.8% higher in early trade at 103.9.

‘This has been an outstanding year for the business with very strong financial metrics across the board. We have reduced our leverage to 1.9x Ebitda, repaid £190 million of our floating rate bonds saving approximately £10 million in interest costs and entered into a transformational new pensions agreement. As a result, we are pleased to be reinstating dividend payments for the first time in 13 years. We have also just completed the refinancing of a new revolving credit facility with a refreshed bank group, extending maturity to at least 2024, and are today announcing the launch of a new fixed rate bond,’ said Whitehouse.

Premier Foods said it hopes growth will continue this year and that profits will further benefit from lower financing costs thanks to the lower level of debt, which is also allowing it to consider expanding in the UK and overseas.

Experian expects revenue and earnings growth to accelerate

Data specialist Experian, best known for providing credit scores, reported higher revenue and profits in its recently-ended financial year and said it is off to a ‘good start’ to the new year and expects growth to accelerate.

Revenue from ongoing activities rose 4% to $5.35 billion in the year to the end of March, rising by 4% on an organic basis. That was ahead of the $5.31 billion expected by analysts. Growth was driven by North and Latin America, which helped offset declines elsewhere.

It highlighted the performance of its Consumer Services division which delivered 17% organic revenue growth. The division added 28 million new free members in the year and now has 110 million in total, mostly in the US and Brazil. Revenue from its B2B business was flat year-on-year.

Benchmark Ebit – Experian’s key metric – came in flat year-on-year at $1.38 billion and at the top end of the company’s guidance range. Pretax profit was up 14% at $1.07 billion and basic earnings per share increased 18% to 88.2 cents.

Experian kept the dividend for the year flat at 47 cents.

‘We are off to a strong start to FY22 and expect Q1 organic revenue growth in the range of 15-20% which gives us every confidence of another successful year ahead. For the year, we expect organic revenue growth in the range of 7-9%, total revenue growth of 11-13% and strong Ebit margin accretion, all at constant currency,’ said chief executive Brian Cassin.

Experian shares were trading 1.6% lower in early trade this morning at 2594.0.

Severn Trent to raise £250 million to fund new projects

Severn Trent said it is raising £250 million in equity to help fund the development of six new projects as it posted annual results revealing a fall in revenue and profits.

The water utility company said it plans to conduct a placing, subscription and a retail offer of new shares that will represent up to 5% of its existing issued share capital to raise £250 million.

The company put forward proposals for six projects in the Severn Trent area earlier this year. These involve improving the security of water supplies, decarbonising water, replacing pipes, improving flood defences, installing smart meters and other environmental improvements.

Regulator Ofwat endorsed all six projects earlier this month and awarded Severn Trent with a £624 million Green Recovery Award. The money raised from the equity sold will be used to fund these projects over the next four years.

‘The projects will drive regulatory capital value growth significantly ahead of previous expectations, on which the company will earn a future return, whilst maintaining its current capital structure,’ Severn Trent said.

Shareholders will need to approve the equity raise at the annual general meeting pencilled in for July 15.

The news came as Severn Trent reported annual results for the year to the end of March, revealing revenue and profits both declined as expected. Revenue was down 0.9% at £1.82 billion due to lower consumption by the likes of businesses during lockdown but the company will be able to recover that lost revenue over the next two years.

Adjusted profit before interest and tax was down over 17% as anticipated to £473 million.

Severn Trent had already said before the results that it would pay a dividend of 101.58 pence for the year, which was confirmed this morning.

The new projects could significantly improve the outlook for Severn Trent. The inclusion means that regulatory capital value real growth will be closer to 10.4% this year compared to just 3.8% without them.

Severn Trent shares were trading 1.1% lower in early trade this morning at 2478.5.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade