Top UK Stocks to Watch: Dunelm restarts dividends as profits jump

Top News: Dunelm resumes dividend as demand holds up

Dunelm reported strong growth in revenue and profit during the first half of its financial year as demand held up over the final months of 2020, allowing it to continue generating cash and reinstate its dividend.

The homeware company said sales rose 23% in the 26 weeks to December 26 to £719.4 million. That, combined with a slightly better gross margin or 52% versus 51.5% the year before, allowed pretax profit to jump over 34% to £112.4 million.

Dunelm said it had continued to generate growth despite having to shut stores for some of the period because of lockdown. It said it had continued to gain market share and outperform its peers.

Notably, online sales more than doubled after it successfully scaled up to increasing demand and now accounts for 35% of total sales.

‘Sales were particularly strong in the first quarter, before we had to navigate the various restrictions which impacted the remainder of the period. These restrictions have become more severe in the second half of our financial year, with all but one of our stores currently closed, although we continue to serve customers through our digital channels, which have significantly advanced during the last year,’ said chief executive Nick Wilkinson.

Free cashflow improved significantly to £98 million from £63.9 million the year before, pushing it into a net cash position and allowing it to restart dividends with a 12.0 pence payout. It ended the period with net cash of £140.9 million compared to a net debt position of £67.7 million a year ago.

‘Beyond the near-term uncertainty, we have never been more confident about the future. Dunelm is a market leader with a challenger brand mentality, in a large and growing segment. We have a clear runway to grow active customers and their frequency across our total retail system and to realise our long-term ambitions,’ said Wilkinson.

Where next for the Dunelm share price?

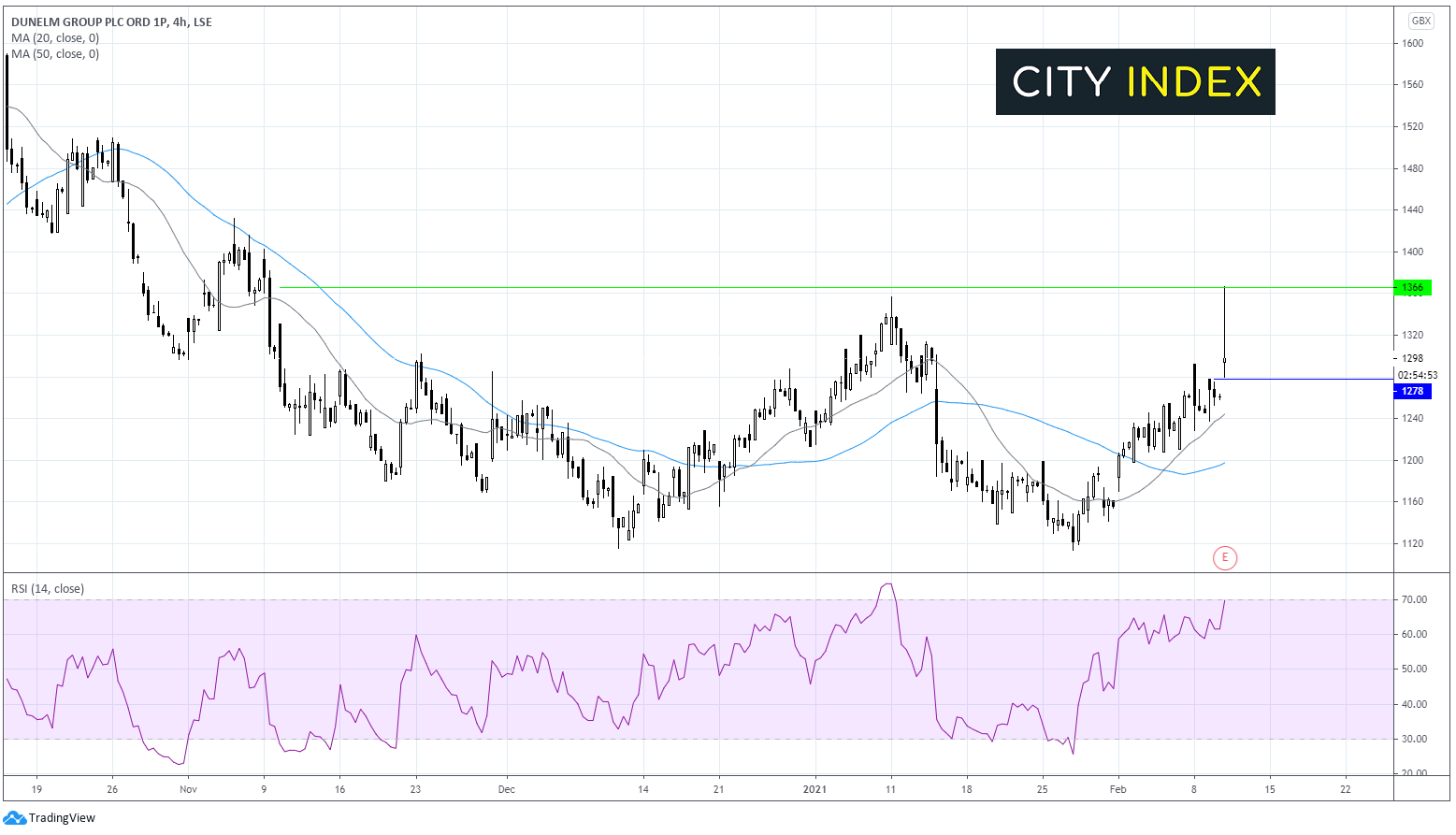

Dunelm shares have been trending lower since mid-October before finding support at 1115 in December 2020. This level has continued to offer support, whilst 1360 has capped the upside over the last three months. The Price rebounded off 1115 in late January and has been trending higher since.

Dunelm has jumped higher in early trade today, gapping higher from yesterday’s close of 1260, to a daily high of 1365.

The price has since eased back to 1295 and the long wick on the candle suggests weakness in the price at those higher levels.

That said the share price trades above the 20 & 50 sma indicating a bullish trend, furthermore the 20 sma crossed over the 50 sma another bullish signal, and the RSI in in bullish territory so a steady advance could still be on the cards.

Immediate resistance sits at 1360/5 today’s high. Whilst support is seen at 1280 today’s low ahead of the 20 sma at 1240 which has offered strong support across February. Should the bears breach this level 1200 comes into focus and a breakdown of this level could negate the near-term bullish bias.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Smurfit Kappa ups dividend after earnings beat expectations

Smurfit Kappa said it beat expectations as it posted lower revenue and earnings for 2020, which it described as the ‘most challenging year in recent memory’.

The packaging firm said revenue in the year fell 6% to EUR8.53 billion and that earnings before interest, tax, depreciation and amortisation fell 9% to EUR1.51 billion. This was better than its guidance to deliver Ebitda between EUR1.46 billion to EUR1.48 billion.

The company said its European business performed well, with demand picking-up in the second half of the year, while its business in the Americas also reported its highest ever Ebitda margin.

Notably, pretax profit managed to jump 10% to EUR748 million thanks to considerably lower finance costs. That was partly driven by a 32% reduction in net debt to EUR2.37 billion, which brought down net debt to Ebitda to 1.6x compared to 2.1x a year earlier.

Notably, free cashflow also remained strong and rose 23% to EUR675 million, prompting Smurfit Kappa to raise its final dividend for the year by 8% to 87.4 euro cents.

‘While there remains some uncertainty on the impact and duration of COVID-19, the year has started well with the continuation of the demand trends seen during the last quarter. Reflecting the board’s confidence in this performance and prospects for the business looking forward, the board is proposing an increase in the final dividend of 8% to 87.4 cent per share,’ said the company.

Smurfit Kappa shares were up 1.8% in early trade at 3597.0.

AstraZeneca completes sales of Crestor in Europe

AstraZeneca said it has completed the sale of the rights to Crestor and other associated medicines in Europe to Grunenthal.

The deal, which did not include the rights in the UK and Spain, will see AstraZeneca bank $320 million. It could receive up to another $30 million in future milestone payments.

AstraZeneca said the rights included in the deal delivered sales of $136 million and a pretax profit of $98 million in 2019.

Notably, AstraZeneca is due to release fourth-quarter and annual results for 2020 on Thursday. You can find out what to expect by reading our AstraZeneca earnings preview.

AstraZeneca shares were broadly flat in early trade at 7307.0.

Persimmon says cladding issues only impacts small number of buildings

Persimmon said the issues surrounding unsafe cladding placed on buildings will have a minimal impact on the company as it mostly builds houses rather than high-rise buildings.

Housing minister Robert Jendrick is expected to unveil extra funding later today to help people who have been left with unsafe cladding surrounding their buildings, building on the £1.6 billion of funds made available by the government last year. It is not clear how much extra funding will be made available, but a committee of MPs suggested the total cost of the crisis – which caused the Grenfell fire in 2017 – could be up to £15 billion.

Persimmon said it does not tend to build high-rise buildings nowadays as it predominantly builds individual homes. However, it has built them in the past and has accepted cladding issues need to be resolved, prompting it to book a £75 million provision in its 2020 results to help contribute toward the cost of any work on buildings that may be affected.

‘At Persimmon we believe we have a clear duty to act to address this issue. So today we are setting aside £75 million towards any necessary cladding remediation and safety work in 26 developments we built. Where we still own the building we will act. Where we no longer own them we will work with the owners to make sure they meet their legal responsibilities and duty. If the owner does not step up then we will act to remove uncertainty and anxiety for residents and make the buildings safe,’ said chairman Roger Devlin.

Persimmon shares were down 1.1% in early trade at 2751.0.

WPP buys Brazilian software outfit DTI Digital

WPP has purchased Brazilian software engineering firm DTI Digital for an undisclosed sum as part of its recently-revealed plan to expand in faster-growing areas of the market.

DTI Digital helps companies digitise and improve the efficiency of stuff like back-office functions, data collection and automating supply chains. WPP said the company has ‘agile methodology and design thinking’ that means it can ‘quickly and effectively scale up its expert development teams, comprising more than 600 software engineers, in response to client needs.’

WPP said the purchase will allow it to provide end-to-end digital transformation services in Brazil and elsewhere. The company makes around $300 million in annual revenue.

‘Our clients are looking for fully integrated solutions that combine creativity with cutting-edge technology to help them adapt and respond to the rapidly shifting business environment. I am delighted to welcome DTI Digital to WPP and look forward to working together to deliver transformative results for our clients,’ said chief executive Mark Read.

WPP shares were up 0.9% in early trade at 820.5.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Redrow reinstates dividend as revenue and profits jump

Redrow said it built a record number of houses in the first half of its financial year, helping it to capitalise on its strong order book and ‘resilient demand’ and allowing it to reinstate its dividend.

The housebuilder said it built 3,650 houses in six months to December 27, up 20% from just 2,554 the year before. Revenue also rose 20% to £1.04 billion from £870 million.

‘We have seen a strong sales market during the first half driven by a combination of pent-up demand from the first national lockdown, the introduction of the Stamp Duty holiday and the impending end of the Help to Buy scheme for existing home owners,’ said chief executive Matthew Platt.

Pretax profit increased 11% to £174 million from £157 million the year before.

Reservations remain strong and were up 6% to £819 million in the period. Its order book grew 8% to £1.3 billion and it is now 95% forward sold for the rest of the financial year.

Redrow ended the period with £238 million in net cash, compared to £126 million of net debt at the end of June. Redrow said it was reinstating the dividend with a 6.0 pence per share payout thanks to its strong cash position and order book.

‘The acceleration of changing buyer trends, which are completely aligned to Redrow's strategy, point to a positive outlook for the business. Our private forward sold position of £750 million beyond the end of both the original Help to Buy scheme and the Stamp Duty holiday, demonstrates the resilience of our target market and the desirability of our product and the places we create. These fundamentals mean we can look confidently to the future and fulfilling our ambitions to rebuild and grow the business,’ said Pratt.

Redrow shares were down 3.6% in early trade at 550.0.

Grainger keeps collecting rent in tough times for tenants

Landlord Grainger said it has still collected the vast majority of rent from its tenants despite the problems posed by the pandemic.

The company, which focuses on providing rental houses at the mid-market price point, said it has collected 98% of all rent due during the first four months of its financial year to the end of January. Notably, only 42 tenants, equal to less than 0.5% of its total residential customers, are on rental payment plans and residential rental arrears remain low at 1.9%.

‘I am pleased to report that Grainger continues to perform well despite the ongoing challenges posed by lockdown restrictions. Our mid-market price point, coupled with our market-leading operational platform, are proving invaluable during these testing times, with rent collection at 98%,’ said chief executive Helen Gordon.

It also reported like-for-like rental growth of 2.4%. Grainger said its forward sales pipeline remains strong and that pricing was ahead of valuations by around 1% to 2%.

‘While we have seen a delay in the anticipated recovery of occupancy in our PRS portfolio, particularly in London, due to the new restrictions imposed since the Christmas period, we are seeing strong levels of new enquiries among prospective PRS customers, albeit with the majority of interest focused on move-in dates in the Spring, pointing to a strong lettings market when restrictions are lifted,’ said Gordon.

‘Our PRS pipeline activity remains broadly on track, and leasing of our scheme in Milton Keynes has gone well, in line with underwriting. The for-sale housing market continues to be buoyant. Our sales performance of ex-regulated tenancy properties has been notably strong, with high volumes ahead of valuations,’ she added.

Grainger will report interim results on May 13.

Grainger shares were down 0.7% in early trade at 267.9.

Syncona: Autolus public offering raises $100 million

Syncona said one of the companies in its portfolio, Autolus Therapeutics, has raised $100 million by selling American Depositary Shares in the US at $7 each.

Syncona has invested $25 million as part of the offering and now owns 19.5 million shares in Autolus, giving it a stake of 26.2%.

‘Our strategy is to work closely with our portfolio companies and fund them over the long-term as they seek to take product candidates to approval. We are excited by the potential of Autolus' AUTO1 product candidate for the treatment of adult acute lymphoblastic leukaemia to become a stand-alone treatment for patients. We believe the business is well positioned to deliver this programme through its pivotal trial and progress its pipeline of next-generation T-cell therapies,’ said Syncona’s chief executive Martin Murphy.

Notably, Autolus has also given the underwriters the option to purchase a further 2.1 million ADSs at the same price within the next 30 days.

Syncona shares were up 2.0% in early trade at 261.0.

PureTech: Vor Biopharma IPO raises $200 million

PureTech said Vor Biopharma, a cell therapy company helping cancer patients that it founded, has completed an initial public offering on the Nasdaq.

The IPO saw Vor Biopharma raise $203.4 million by selling shares at $18 each. PureTech owns 3.2 million shares of the business, giving it an 8.6% stake after the IPO.

Separately, PureTech said it has sold 1 million shares in another company it founded, Karuna Therapeutics, for a total of $118 million. PureTech still owns 2.4 million shares, equal to a 9.0% stake in Karuna, which is a clinical-stage biopharma business developing medicines for psychiatric and neurological conditions. The company intends to deploy the funds into more of its wholly-owned businesses.

PureTech shares were down 0.7% in early trade at 375.5.

IP Group’s North American business raises $50 million

IP Group said its North American subsidiary, IP Group Inc, has raised $50 million and secured a new blue-chip investor in the US.

IP Group Inc creates early-stage companies pursuing breakthrough areas of technology and helps universities across the US commercialise their discoveries. It funds their development by taking money from its parent company, IP Group, and from third-parties.

IP Group has invested $10 million into IP Group Inc, which has raised another $40 million from a new, unnamed US blue-chip investor. IP Group Inc has now raised $63.5 million during the last 12 months, with IP Group injecting $15 million of that. IP Group now owns a 61.3% stake in IP Group Inc.

IP Group shares were broadly flat in early trade at 105.7.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade