Top UK Stocks to Watch: Demand drops at Moneysupermarket during pandemic

Top News: Moneysupermarket.com aims to increase switching as demand drops

Moneysupermarket.com Group said revenue and earnings declined in 2020 as the pandemic hit demand for its travel and credit producys, but said it has maintained the dividend because it remains confident in its long-term prospects.

Shares in the comparison site jumped this morning, partly driven by optimism about plans to expand its products and improve engagement with customers to improve switching habits by wielding the power of data.

Revenue fell 11% in 2020 to £344.9 million due to ‘exceptional COVID-19 related market conditions’. This particularly hit demand for travel insurance and TravelSupermarket as people stayed at home. The company said revenue fell 4% when its travel businesses were stripped out.

Adjusted earnings before interest, tax, depreciation and amortisation fell 24% to £107.8 million due to a combination of lower revenue and a lower gross margin because of ‘poorer conversion’ in its unit that offers credit products.

The company said the wide range of consensus expectations for adjusted Ebitda of between £96.4 million and £128.8 million in 2021 demonstrates how much uncertainty is plaguing its outlook, but that it expected to deliver earnings toward the lower end of that range.

‘Reaching the upper end of the consensus range will require strong and rapid recovery in both Money and travel related channels,’ the company said.

Moneysupermarket.com said it ended the year with £23.6 million in net cash and that it had maintained its dividend at 11.71 pence per share, ‘reflecting our confidence in our longer-term growth prospects and continued robust cash generation.’

‘We have again helped millions of UK households save on their bills, while providing indispensable financial advice throughout the COVID-19 pandemic,’ said chief executive Peter Duffy. ‘The business is resilient, and our dividend reflects our confidence for the future.’

‘Our job now is to encourage consumers to engage with us more and save on more of their bills. We will use our data better so consumers find our sites easier to use and are reminded when there are savings available to them,’ he added.

Moneysupermarket.com is evolving its strategy and looking to encourage users to switch more products more regularly. It said it is looking to broaden its offer either by developing new products or acquiring new businesses.

‘Stronger execution against this strategy is needed to deliver the full potential of the group. We have begun to make changes to drive greater accountability and faster decision-making. Improving our data infrastructure and capabilities will also drive long-term advantage, and we are making good, early progress in this area,’ the company said.

Where next for Moneysupermarket.com shares?

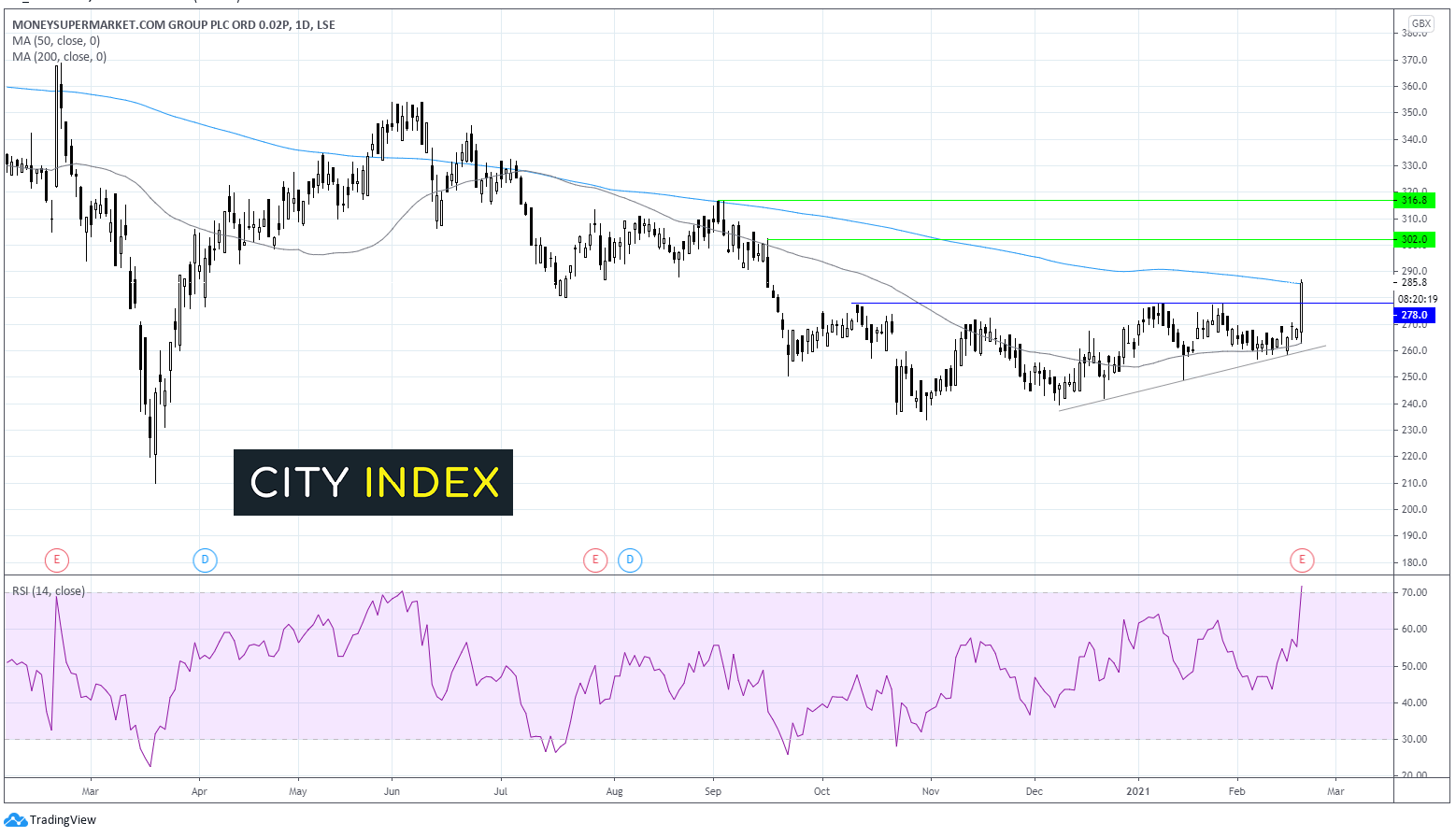

Moneysupermarket.com shares jumped over 6% in early trade, charging through resistance at 277 which has capped the upside since early October.

The price is currently testing resistance at 285 the 200 sma. A close above this level is needed for the bulls to push on towards 300 round number and mid-September high.

However, it is worth noting that the RSI has just tipped into overbought territory so some consolidation or even an ease back in the price could be expected towards resistance turned support at 277 before further moves higher.

Failure to break through the 200 sma could see the price rebound lower. A move back below 277 could see 262/0 come into play, the 50 sma and the ascending trendline support dating back to early December. The bears would be looking for a break below this level for the selloff to gain traction.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Barclays beats expectations and launches £700 million buyback

Barclays said it intends to launch a £700 million buyback as it posted annual results for 2020 that showed the bank beat expectations.

The bank said group income rose 1% in the year to £15.9 billion, as a surge of interest in trading caused a 22% rise in income from its investment banking arm to offset a 22% decline in income from its retail business that suffered from fewer card payments as people stayed at home during the pandemic.

It said it remained profitable during every quarter of the year and delivered a pretax profit of £3.1 billion in 2020. That was down from £4.4 billion in 2019 but was well ahead of the £2.8 billion expected by analysts.

Barclays said it would return 5.0 pence per share as a result, made up of a 1.0p full year dividend and a £700 million share buyback that will be launched before the end of March.

The bank’s common equity tier 1 (CET1) ratio at the end of the year was 15.1%, up 130bps from a year earlier, bolstered by the cancellation of the 2019 dividend when the pandemic erupted early last year and the Bank of England banned payouts.

Group return on tangible equity was 3.2% in 2020 and Barclays said it remains committed to growing that to 10% over the medium to long term.

‘Barclays remains well capitalised, well provisioned for impairments, highly liquid, with a strong balance sheet, and competitive market positions across the Group. We expect that our resilient and diversified business model will deliver a meaningful improvement in returns in 2021,’ said chief executive James Staley.

Barclays shares were down 3.6% in early trade at 148.86.

Smith & Nephew maintains dividend despite fall in revenue and profits

Smith & Nephew said it has decided to keep its dividend for 2020 flat despite reporting a steep fall in revenue and profits because of the coronavirus pandemic, reflecting its confidence in the business and its strong balance sheet.

The company, which makes surgical devices and wound care products, has been hit during the pandemic as hospitals come under strain and postpone non-essential surgeries, depressing demand for its products.

Revenue in 2020 fell over 11% to $4.56 billion from $5.13 billion in 2019. That, combined with a drop in its operating margin to 6.5% from 15.9%, saw operating profit plunge to $215 million from $815 million. Trading profit fell to $683 million from $1.16 billion.

Notably, its performance improved slightly as the year went on and some countries started to resume elective surgeries, with fourth-quarter revenue down just 5.8% year-on-year.

Smith & Nephew said cashflow from its operations fell to $972 million in 2020 from $1.37 billion in 2019 while trading cashflow declined to $690 million from $970 million.

The company will pay a dividend of 37.5 cents per share, level with the year before, ‘reflecting confidence in the business and strength of the balance sheet’.

‘In 2020 we continued to strengthen Smith+Nephew through increased investment in R&D, new product launches and strategic acquisitions in our higher growth segments. We achieved this while also managing unprecedented disruption from COVID-19. The resilience of the business and strength of the balance sheet also meant we are able to maintain our progressive dividend policy,’ said chief executive Roland Diggelmann.

The company said returning to revenue growth was its top priority in 2021 and that it was prepared to respond to the pandemic. It expects the virus to weigh on the business for the first half of the year and said it was uncertain about the timing or the pace of the recovery thereafter.

‘We start 2021 with three clear priorities: to return to top-line growth and recapture momentum; to drive further operational improvement; and to continue to respond effectively to COVID-19. We will build on the progress we are starting to make in areas where we have recently invested and introduced innovation. We will again invest more in R&D and I am excited by the pipeline of new technologies approaching launch, and by the potential of our recent acquisitions,’ Diggelmann said.

Smith & Nephew shares were down 5.5% in early trade at 1481.80.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Indivior puts litigation matters behind it and eyes a return to profit in 2021

Indivior said a strong recovery in the latter stages of 2020 was not enough to offset weakness earlier in the year and a flurry of costs related to litigation matters, causing it to post lower revenue and swing to a loss, but said it hopes to return to profit this year.

Net revenue in the final quarter of the year jumped 39% to $185 million and it turned an adjusted net profit of $26 million compared to a $37 million loss the year before. The reported net loss narrowed to $13 million from $55 million.

Annual revenue fell 18% to $647 million and adjusted net profit fell 66% to $59 million. It sank into the red and reported a net loss of $148 million compared to a $134 million profit in 2019.

The reported losses were partly driven by $244 million of costs related to litigation matters, as well as higher costs as it invests in its opioid injection treatment SUBLOCADE.

‘Critically, we materially de-risked the business with resolution of the Department of Justice and Reckitt Benckiser matters and we took decisive strategic alignment actions which place Indivior on a clear path towards realizing the transformational potential of SUBLOCADE,’ said chief executive Mark Crossley.

‘Accelerating the growth of SUBLOCADE remains the biggest potential driver of value creation. We are committed to delivering clear, measurable progress in FY 2021 against our SUBLOCADE peak annual net revenue goal of $1 billion+ and organic revenue diversification strategies,’ he added.

Indivior said the pandemic had weighed on healthcare systems, limiting their ability to provide care in other areas like opioid addiction, but that it expects this to recover in the second half of 2021 as the pandemic eases.

It is aiming to deliver $625 million of net revenue this year but said this could be as low as $565 million if restrictions remain in place beyond June. Its adjusted gross margin will suffer a ‘mid-to-high single digit percentage’ decline this year but return to the mid-80s in 2022. It said it expects to deliver positive adjusted pretax profit this year.

Indivior shares were down 2.4% in early trade at 145.05.

Hays to resume dividends and makes special payout despite pandemic hit

Recruitment specialist Hays said its first half results were significantly impacted by the pandemic as the jobs market deteriorated, posting steep falls in revenue and profits, but said it has started to see signs of a recovery and that dividends will resume this year.

Net fees in the six months to the end of December fell 24% to £422.8 million and operating profit plunged 75% to £25.1 million. Pretax profit plummeted 78% to £21.2 million.

Hays said all of its businesses had seen an improvement in trading as the first half progressed after being severely hit during the pandemic.

Notably, cashflow from operations remained resilient and only suffered a minor 1% dip to £64.6 million. Hays said its cashflow had been much stronger than it expected and that it will resume dividends by making a payout when it releases its annual results for the financial year to the end of June.

Plus, an additional £150 million of ‘surplus capital’ will be distributed to shareholders via special dividends paid out in two phases, starting with a £100 million payout declared in August when it releases its annual results.

Hays shares were down 0.4% in early trade at 157.4.

Carnival extends suspension to Australian cruises

Carnival said P&O Cruises Australia has extended its pause on operations until June 18 but said it remains ‘increasingly confident in the restart of cruising in Australia’.

The company has been taking a cautious approach to restarting cruises and has delayed the date on several occasions. Sture Myrmell, the president of P&O Cruises Australia, said the business was taking ‘the realistic and pragmatic approach we have adopted previously’.

‘We know from our contact with guests and through our social media channels that they, like us, can't wait to be cruising again and our crew can't wait to again be delivering exceptional cruise holiday experiences,’ the president said. ‘We once again thank our guests for their patience and understanding and for their unwavering loyalty to Australia's homegrown cruise line.’

P&O said it would contact the customers that will be affected.

Carnival shares were down 1.2% in early trade at 1391.5.

Primary Health Properties reaps benefits from helping NHS during pandemic

Primary Health Properties said rental income and profits both improved in 2020 as the company continues to help the NHS during the pandemic, with many of its facilities currently being used as vaccination centres and providing extra space for hospitals.

Net rental income in 2020 jumped over 13% to £131.2 million and adjusted earnings rose more than 22% to £73.1 million. On a per share basis, adjusted earnings rose 5.5% to 5.8 pence from 5.5 pence. At the bottom-line, it reported a profit of £112 million compared to a £71.3 million loss in 2019, when it booked a large amount of non-cash losses.

The company said it was returning £73.3 million to shareholders with a 5.9 pence dividend, fully covered, compared to £59.4 million in 2019 when it paid a 5.6p payout.

‘We have continued to support the NHS in the UK, HSE in Ireland and our GP occupiers throughout the COVID-19 pandemic which has highlighted the demands on health systems around the world. Many of our primary care facilities and occupiers are now in the front-line of delivering Covid-19 vaccines,’ said chief executive Harry Hyman.

‘We continue to see demand for extra space to help enable the redirection of activities out of hospitals. The need for modern, integrated, local primary healthcare facilities is becoming ever more pressing in order to relieve the pressures being placed on hospitals and A&E departments,’ he added.

Primary Health Properties shares were up 0.2% in early trade at 148.4.

Hochschild Mining to ramp-up production after being hit by stoppages

Hochschild Mining said a steep fall in output of gold and silver in 2020, partly caused by pandemic-induced stoppages, caused revenue and earnings to fall but said it expects production to improve significantly this year.

The miner said silver production dropped 42% in 2020 to 9.8 million ounces while gold output fell 35% to 175,000 ounces.

Revenue in the year dropped 18% to $621.8 million and adjusted earnings before interest, tax, depreciation and amortisation fell 21% to $270.9 million. Profit from continuing operations plunged 51% to $20.4 million because of exceptional costs but the decline was more mild at 41% to $36.2 million when they were stripped out.

Hochschild said it is paying a final dividend of 2.335 cents per share, meaning it is returning $32.6 million to shareholders for 2020 as a whole. The final payout for 2019 was suspended before payouts were resumed last year.

Notably, while the company suffered from work stoppages during the pandemic, it made a strong recovery in the latter stages and said it produced 24.9 million silver equivalent ounces in 2020, at the top of end of its guidance range. It also produced at a lower cost than expected, helping boost margins.

Production this year should soar to 31 million to 32 million silver equivalent ounces.

Hochschild shares were trading 4.5% higher in early trade at 227.6.

Grainger appoints Robert Hudson as CFO

Grainger has appointed Robert Hudson as its new chief financial officer. Hudson was previously the chief finance and operations officer at St Modwen Properties before becoming interim chief executive until the firm got a new CEO last November.

Hudson has 26 years of experience in the finance and real estate sectors, having worked for the likes of British Land and Experian in the past. He will start ‘later this year’ and succeeds Vanessa Simms, who has already signalled her intention to step down this year.

Grainger shares were down 0.9% in early trade at 269.8.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade