Top UK Stocks to Watch: Burberry ups expectations as sales rebound

Top News: Burberry to beat expectations as trading improves

Luxury fashion brand Burberry said it expects to beat expectations in the current financial year to March 27 after experiencing a strong rebound in sales.

Burberry said sales had performed well since December and that it now expects both revenue and adjusted operating profit to be ahead of expectations.

Consensus estimates compiled by Reuters suggests Burberry will report revenue of £2.3 billion and adjusted operating profit of £309.8 million in the current financial year. That would compare to revenue of £2.63 billion and profit of £433 million in the previous one.

The company’s store sales in the fourth quarter of the financial year are expected to grow by 28% to 36% year-on-year, marking a solid recovery after being hit when the pandemic initially erupted.

When it released its last set of quarterly results in January, Burberry revealed it was reporting strong double-digit sales growth in Asia, driven by China and Korea. That was helping it offset steep falls in Europe and, to a lesser extent, the US, where lockdown rules have caused bigger problems for retailers.

Still, the improvement in the final quarter won’t be enough to offset the weakness earlier in the year and annual revenue will be down 10% to 11%. Its adjusted operating profit margin will be between 15.5% to 16.5% this year compared to the 16.4% delivered in the last financial year.

Burberry will release its annual results on May 13.

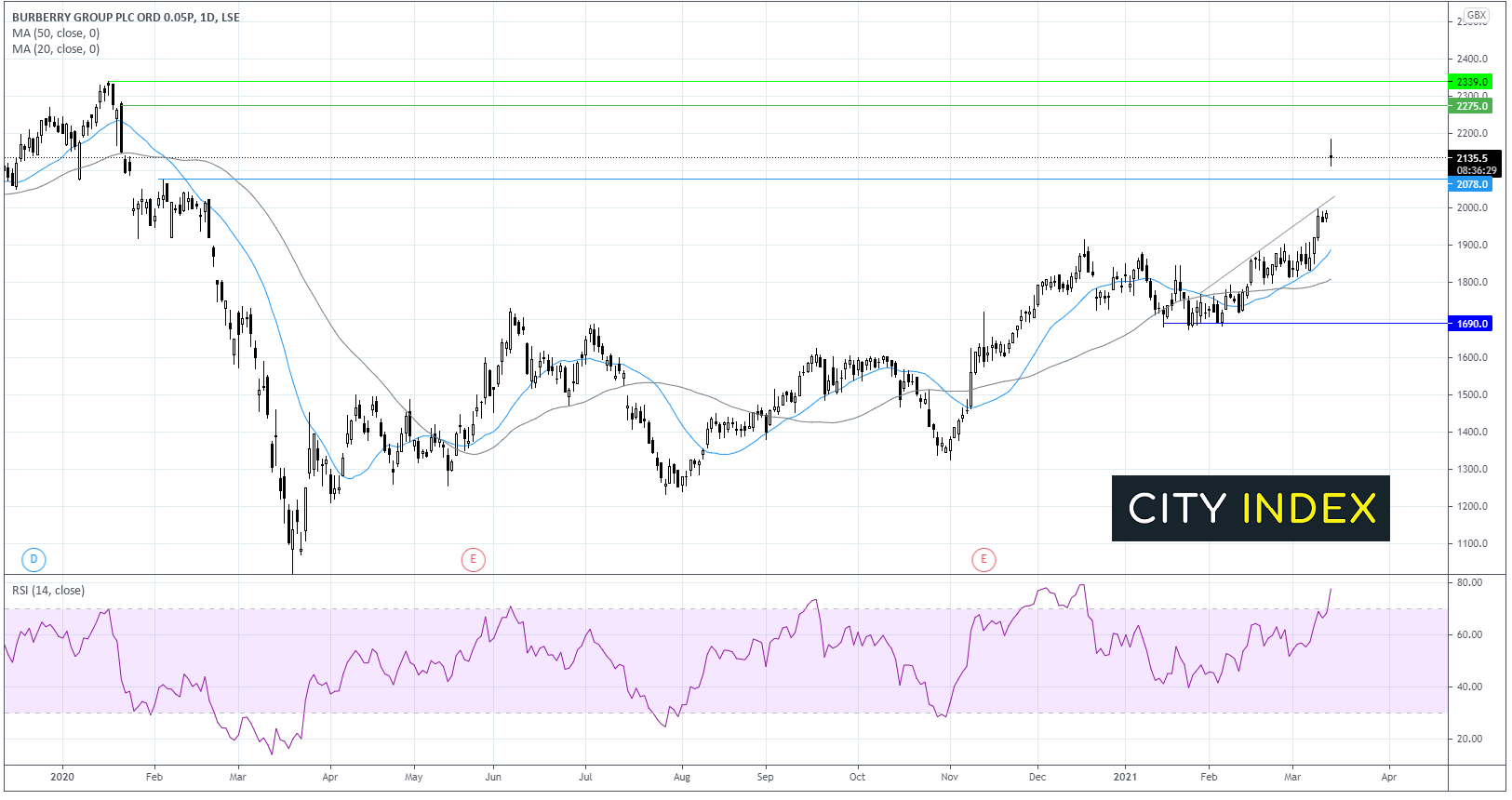

Where next for the Burberry share price?

Burberry has been steadily trending higher since early November. Today’s 7% jump in early trade took the share price to a 13-month high.

It trades above its 20 & 50 sma on the daily chart having broken out above its ascending trendline dating back to late January.

The 20 sma has recently crossed above the 50 sma in a bullish signal. Although, the RSI is firmly in overbought territory so a pull back or consolidation could be on the cards before further gains.

Immediate support can be seen at 2075 resistance February 10 ahead of 2030, the ascending trend line and 1900 the 20 sma. It would take a move below this level to negate the current bullish trend.

Resistance can be seen at 2275 high January 22 ahead of 2340 the all-time high.

JD Sports buys majority stake in Marketing Investment Group

JD Sports has purchased a 60% stake in Marketing Investment Group, a leading footwear and clothing retailer in Central and Eastern Europe.

The company, also known as MIG, was founded in 1989 and runs 410 retail stores across nine countries in the region. Its stores are branded under fascias including Sizeer and 50 Style. It is also the sole distributor of brands like New Era, Lotto and Umbro.

MIG generated around £200 million in revenue during the financial year to the end of January 2021.

The founders of MIG, Andrzej and Zbigniew Grzaka, will own the majority of the other 40% but will have options to sell more of their shares to JD Sports.

JD Sports is hoping to complete the deal by the end of May.

‘This is an exciting acquisition for JD that will further build on the success of our international development strategy, expanding our operations into Central and Eastern Europe,’ said JD’s executive chairman Peter Cowgill.

‘We have observed and admired the development of MIG over a number of years and we are confident that the combination of their highly experienced and knowledgeable management team, together with the expertise of the JD leadership team, will provide the group with strong foundations from which to successfully optimise the opportunities in the region,’ he added.

JD Sports shares were trading 0.4% higher in early trade at 829.0.

Bodycote ups dividend despite large fall in profits

Bodycote has maintained its track record for growing dividends despite profits plummeting in 2020, underpinned by its confidence that it can return to growth in the short-term and capitalise on new growth opportunities in the long-term.

The company, which provides heat treatment services to help improve the quality of metals, alloys and components, said revenue fell 16.9% in 2020 to £598.0 million from £719.7 million in 2019.

Lower revenue and a contraction in its operating margin to 12.6% from 18.7% meant headline operating profit plunged 44% to £75.3 million from £134.9 million.

Bodycote booked £58.4 million worth of exceptional items in the year, weighing further on reported profit. Reported operating profit plummeted to £5.0 million from £128.6 million while profit after tax came in at just £800,000 from £94 million.

Free cashflow fell 14% to £106.1 million from £123.1 million. Bodycote extended its track record for growing dividends to 30 consecutive years by inching up the payout to 19.4 pence from 19.3p in 2019. Bodycote said the dividend ‘reflects the board’s confidence in the group’s future earnings and cash flow potential.’

‘Looking ahead, markets are recovering, though the uncertain timeline for recovery in the civil aerospace market clouds the short-term outlook for this part of the business. Nonetheless, our restructuring programme is now largely complete, resulting in a higher quality business aligned to the growth opportunities we are seeing. The board is confident that Bodycote is well placed to drive growth and take advantage of the upturn in activity across all of its markets as they strengthen,’ said chief executive Stephen Harris.

The company is gearing itself towards a number of ‘megatrends’ within its industry to ensure it has plenty of growth to pursue, such as road transport electrification, point-to-point air travel and the green energy transition.

Bodycote shares were down 1.2% in early trade at 792.5.

Hammerson ‘hit hard’ as pandemic reduces rental income and knocks valuations

Hammerson said it suffered the biggest fall in rental income and recorded the largest decline in UK property values in its history during 2020 as the pandemic caused severe problems for the retail industry.

The company, which rents out retail space in malls and retail parks, saw net rental income almost half to £157.6 million in 2020 from £308.5 million in 2019 as many retail outlets were forced to shut during lockdown.

It also booked a large writedown in the value of its UK properties. The value of its portfolio fell to £6.33 billion at the end of the 2020 from £8.32 billion at the start of the year.

That was the primary cause of the £1.7 billion loss for the year, which swelled from the £781 million loss booked in 2019.

‘As our results show, Hammerson was hit hard. The retail sector, already in the grip of major structural change, has been significantly impacted by the restrictions imposed to tackle the pandemic, and we've also seen an increasing number of retail failures. Combined, this has resulted in the largest fall in net rental income and UK asset values in the group's history,’ said chief executive Rita-Rose Gagne.

Hammerson said it was paying a final dividend of just 0.2 pence per share but allowing investors to get 2.0p if they use the scrip dividend programme to take their payment in new shares rather than cash. It also did that for the interim payout, meaning shareholders can get a 0.4p cash dividend for 2020 or 4.0p in new shares. That compares to a 5.1p cash payout in 2019.

‘Our immediate focus in 2021 is leading Hammerson through Covid-19 to safety. This means further disposals to strengthen the balance sheet, managing refinancing, and sharpening our operations to maximise income. We will then focus on realising the quality of our destinations to drive the business forward. We are currently working on a thorough strategic and organisational review that will map out a route to future growth to transform the business in the context of what will remain a tough economic and structural backdrop,’ said Gagne.

Hammerson shares were up 4.3% in early trade at 34.0.

Berkeley Group stays on track

Berkeley Group Holdings said it has continued to trade well since the start of the second half of its financial year, keeping it on track to deliver on expectations.

The housebuilder said it still expects annual profit to be broadly flat year-on-year in the 12 months to the end of April 2021 from the £504 million reported in the last financial year.

Forward sales should end the year above £1.7 billion, down from £1.9 billion a year earlier. It said the future gross margin from its land bank is estimated to have risen from the £6.4 billion estimate made in the last financial year.

‘Since the half year, Berkeley has continued to trade robustly. The health, safety and well-being of our people remains uppermost in our minds. As the impact of Covid-19 continues to affect all our daily lives, we have maintained appropriate safe operating procedures across our sites, sales centres and offices to keep our customers, communities and construction teams safe, while continuing to deliver for our customers and stakeholders,’ said the company.

Berkeley said the fundamentals of the market remain strong, with interest rates at record lows and under-supply in its core markets in London and the South East of England.

‘Sales reservations have been robust where we have had availability of stock. While enquiry levels have been consistently strong, Berkeley has re-profiled the launch of new developments and phases into the market until the economy opens up post-lockdown and, as a consequence, we anticipate the value of reservations for the current financial year to be around 20% lower than last year. Pricing has been stable over the period and cancellation rates at normal levels,’ said Berkeley.

Looking beyond the current financial year, Berkeley said it expects to deliver a similar level of profitability in the financial year to the end of April 2022 as it will in the current year. It is aiming to deliver its long-term goal for a pretax return on equity of 15% to help underpin its commitment to return at least £280 million a year to shareholders through dividends and buybacks.

Berkeley Group shares were down 4.2% in early trade at 4362.0.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade