Top UK Stocks and Shares | Boohoo Share Price | Croda Share Price | ITV Share Price

Top News: Boohoo warns of tighter margins and higher costs

Boohoo reported strong growth in sales and profits during its recently-ended financial year as people shifted to online shopping during the pandemic and hopes the boom in demand will continue as the economy reopens.

Revenue was up 41% in the year to the end of February 2021 at £1.74 billion, slightly ahead of Boohoo’s guidance and what was expected by analysts. Pretax profit rose 35% to £124.7 million from £92.2 million the year before, coming in shy of the £134.2 million expected by analysts.

Boohoo said it delivered strong revenue growth across all geographies. UK sales were up 39% and its international sales jumped 44%. Notably, the UK still accounts for over half of all revenue but the international unit now generates 46% of total revenue, up from 45% the year before.

The company ended February with 18 million active customers, 28% more than it had a year earlier.

Boohoo said it expects to deliver annual revenue growth of around 25% in the new financial year, with newly-acquired brands - spanning Debenhams and Oasis to Dorothy Perkins and Burton – contributing five percentage points.

However, it also warned that the reduction in the number of items being returned is expected to unwind going forward as lockdown eases and that shipping and freight costs are on the rise, while investment in newer brands will also dilute its margin.

‘Growth within our established brands remains strong and over the last two years we have achieved a revenue CAGR of 42%. Trading in the first few weeks of the financial year has been encouraging, however, the economic outlook remains uncertain and we expect the benefits seen from reduced returns over the last twelve months to begin to unwind this year, whilst still experiencing significantly elevated levels of carriage and freight costs,’ said Boohoo.

Margins for its established brands is expected to hold steady this year but investment in newer brands will dilute its adjusted Ebitda margin by 50 to 100 basis points this year to 9.5% to 10%.

Over the medium-term, Boohoo is aiming to deliver 25% annual sales growth and an Ebitda margin of around 10%.

Boohoo said it had made ‘significant group-wide progress’ with its Agenda for Change programme that aims to address severe problems with its supply chain in England that came to light last year, including a consolidation of its suppliers and greater transparency over where its clothes come from. Having published a list of UK suppliers in March, it said it will follow with a list of international suppliers later this year.

‘The areas the group is committed to bring to fruition are: enhancing corporate governance; redefining our purchasing practices; raising standards across our supply chain; supporting Leicester's workers and workers' rights; supporting suppliers; and demonstrating best practice in action. Significant progress on the Agenda for Change has been delivered by our teams over the last six months and the group expects to make further great progress in the coming year, with publication of our global supplier list expected by September 2021,’ Boohoo said.

Where next for the Boohoo share price?

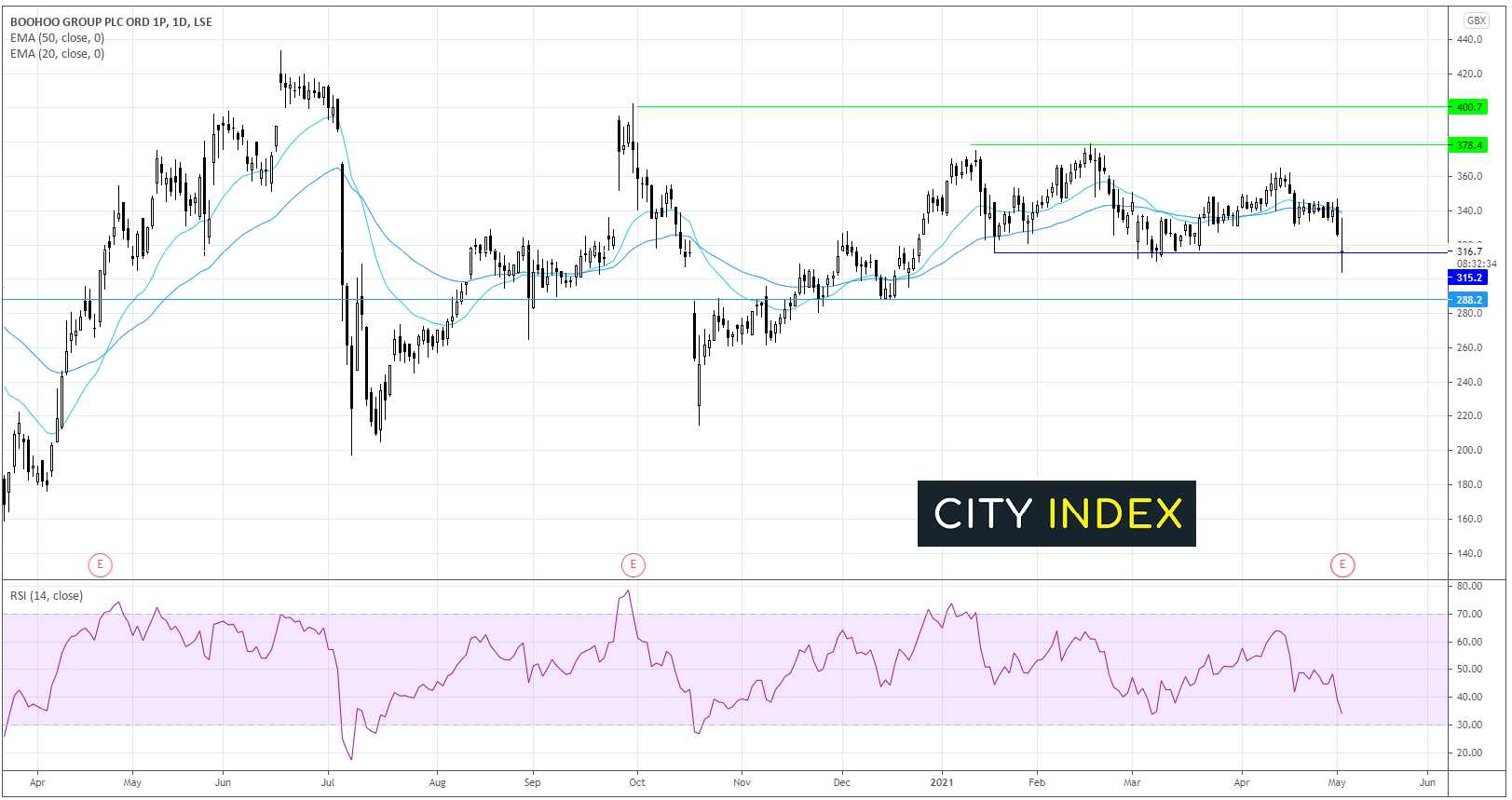

Boohoo has been trading in a holding since early February, capped on the upside by 380p and on the lower side by 320p.

Today’s 2.3% decline has seen the share price hit a yearly low and spike below the lower band of the horizontal channel. This has taken the price below the flat 20 & 50 EMA and the RSI has moved firmly into bearish territory supportive of further downside whilst it remains out of oversold territory.

Bears will be looking for a close below 320p to gain traction towards 290p low December.

Any attempt at a recovery would need to see the price close back within the horizontal channel over 320p in order to make an attempt of 340p the 20 and 50 EMA.

Croda launches review of Performance Technologies & Industrial Chemicals unit

Croda International has launched a strategic review of its Performance Technologies & Industrial Chemicals (PTIC) businesses in order to streamline and refocus the group on its core operations centred on the life sciences and consumer care markets.

PTIC provides products to fast-growing markets for plastics, electric vehicles and other renewable technologies and the business offers ‘industry-leading margins’ and holds pole position in the automotive, polymer and food packaging markets.

Croda said it makes over 80% of its profits from the life sciences and consumer markets, prompting it to consider what to do with the rest of the business. Still, PTIC accounted for around 37% of total sales last year and whilst life sciences grew last year its personal care segment declined.

‘The scope of the strategic review will focus on the businesses and activities within PTIC that do not directly support the consumer care and life sciences sectors. It will consider whether Croda is the best future owner of all the PTIC businesses within the context of opportunities to deploy more capital and resources within PTIC, as well as in consumer care and life sciences,’ Croda said.

‘The review will assess whether the full potential of PTIC can best be delivered under Croda, as a stand-alone business, or via a full or partial divestment. It will consider the extent of the mutual dependencies between PTIC and the rest of Croda, the practicality of all options, whilst prioritising the best interests of all stakeholders, including employees, customers and shareholders,’ it said.

The review should be completed by the end of 2021.

Croda also said the positive trends seen in the second half of 2020 had continued into early 2021, leading to an improved performance and ‘strong’ customer demand across all regions and sectors – including PTIC.

Croda shares were trading 2.6% higher in early trade at 6818.0.

ITV sees rebound in advertising as productions get back up and running

ITV delivered an improved performance during the first quarter of 2021 as its productions started filming again and demand for advertising returned as coronavirus restrictions eased, giving the company confidence that the positive trends seen over recent months will continue.

The company said total external revenue rose 2% year-on-year in the first three months of the year to £709 million from £694 million. ITV Studios reported 9% growth in revenue to £372 million, which helped offset a 3% drop in Media and Entertainment to £484 million.

ITV Studios has now resumed filming the vast majority of productions and while Media and Entertainment is still struggling it has seen improving trends in recent months. For example, advertising revenue was up 68% year-on-year in March and growth is expected to rise to 85% in May and possibly up to 90% in June. ITV said it expects total advertising revenue will be up around 26% in the first half compared to the year before.

Total viewing of ITV was up 1% in the quarter. There was a 5% increase in the number of registered users of its on-demand ITV Hub streaming service, although online viewing was down 11% due to the lack of Love Island in January and February.

‘We have made a good start to 2021 with total revenue and total viewing both up, despite the continuing impact of the pandemic. We finished the quarter strongly with the substantial majority of our shows back in production and a recovery in the advertising market,’ said chief executive Carolyn McCall.

ITV shares were trading 0.5% higher this morning at 124.7.

Direct Line says its well placed as lockdown is eased

Direct Line revealed premiums fell during the first three months of 2021 but said it remains confident of delivering its goals this year.

The insurer said total gross written premiums fell 4.7% year-on-year to £752.3 million from £789.6 million. Its motor division was the biggest drag on results with premiums down over 10%, as fewer people are driving during the pandemic, causing a reduction in premiums, policies and less demand for its Green Flag rescue service. Its home insurance division performed better with 1.8% growth while commercial also performed well with over 16% growth.

‘The first quarter saw similar motor market trends to those at the end of 2020, namely subdued claims frequency, low levels of new car sales and fewer new drivers entering the market. This led to further motor market premium deflation in the quarter. Against this backdrop, we maintained our disciplined underwriting and our 5% reduction in average premium versus Q1 2020 was less than the market reduction. This focus on maintaining the quality of our business leaves us well placed as lockdown restrictions are eased. Looking forward, encouraging early indications suggest that motor market premiums stabilised during April,’ said chief executive Penny James.

‘Elsewhere in the business, we have continued to deliver good growth in Home, whilst Commercial achieved 16% growth. This demonstrates the benefits of our investment in technology and new ways of working as well as the diversification within our portfolio,’ James added.

Direct Line said it still expects to report a combined operating ratio of 93% to 95% this year.

Notably, the insurer said the Financial Conduct Authority is due to release its review on how the insurance sector prices its policies by the end of this month and implemented before the end of 2021, which could bring significant change for the industry.

Direct Line shares were trading 0.6% higher in early trade at 288.7.

Playtech partners with Holland Casino as regulated markets open up

Playtech has signed a new long-term strategic partnership with Holland Casino, the state-owned operator of 14 casinos across the Netherlands.

Playtech will supply the technology Holland Casino needs to launch online, with the online gambling market in the country set to be launched in October.

‘Under the agreement Playtech will become Holland Casino's strategic technology supplier delivering its full turnkey multichannel technology as well as certain ancillary services. The agreement includes its IMS platform, Sports betting, Online Casino, Live Casino, Poker and Bingo products as well as certain operational and marketing services. As part of the agreement Playtech will build a Live Casino facility in the immediate vicinity of one of Holland Casino's existing locations,’ said Playtech.

Playtech shares were trading 2.1% higher this morning at 480.6.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade