Top UK Stocks and Shares | Berkeley Group Share Price | Persimmon Share Price | Vodafone Share Price | Joules Share Price | Aviva Share Price

Top News: Berkeley Group confident London can flourish again

Berkeley Group said it remains committed to London and that the capital will bounce back from the pandemic as it revealed profit returned to growth during a tough year.

Revenue rose 14.7% in the year to the end of April to £2.20 billion from £1.92 billion the year before. It delivered 2,825 homes during the year at an average price of £770,000. That compared to the 2,723 homes delivered the year before at a price of £677,000.

Berkeley Group had previously said profits would be broadly flat from the £503.7 million booked in the last financial year, but surprised the markets with pretax profit of £518.1 million this morning. That was also ahead of the £516.5 million forecast by analysts. Although the return to growth will be welcome, profits are still way below the £775.2 million delivered in the 2019 financial year.

Basic earnings per share rose 4.5% to 339.4 pence from 324.9p.

Berkeley Group reaffirmed its commitment to return at least £280 million to shareholders each year through to 2025 via dividends and buybacks, but it is likely to return considerably more to investors in the new financial year. The company dished out £145.5 million in dividends during the year and a further £188.6 million in buybacks for a total of £334.1 million, which was up from £280.3 million the prior year.

It said it intends to return £222 million of scheduled returns in the new financial year and a further £228 million of surplus capital this September through a new share scheme that will be followed by a share consolidation.

Berkeley shares have significantly underperformed its peers over the past year, partly because of concerns has greater exposure to London at a time when people are leaving cities, but said it remains committed to the capital and believes this ‘does not represent a permanent structural shift’ and that the trends will eventually reverse and benefit Berkeley due to a lack of housing supply. Berkeley currently produces around 10% of all new private homes built in London.

Berkeley Group said it expects annual output to rise by 50% by 2024/25 compared to 2018/2019 levels. The fact 23 of its 29 long-term complex regeneration projects are now in production will go a long way to supporting that ambition.

‘We ended the year in great shape, with net cash of £1.1 billion, cash due on forward sales of £1.7 billion and the estimated future gross margin in our land holdings increased to £6.9 billion, with a further £0.6 billion in the near-term pipeline,’ said chief executive Rob Perrins.

‘This is a very strong platform from which to continue serving the most under supplied housing markets in the country once the disruption caused by the pandemic dissipates and London is again able to flourish as a global destination for culture, entertainment, education, recreation and business,’ he added.

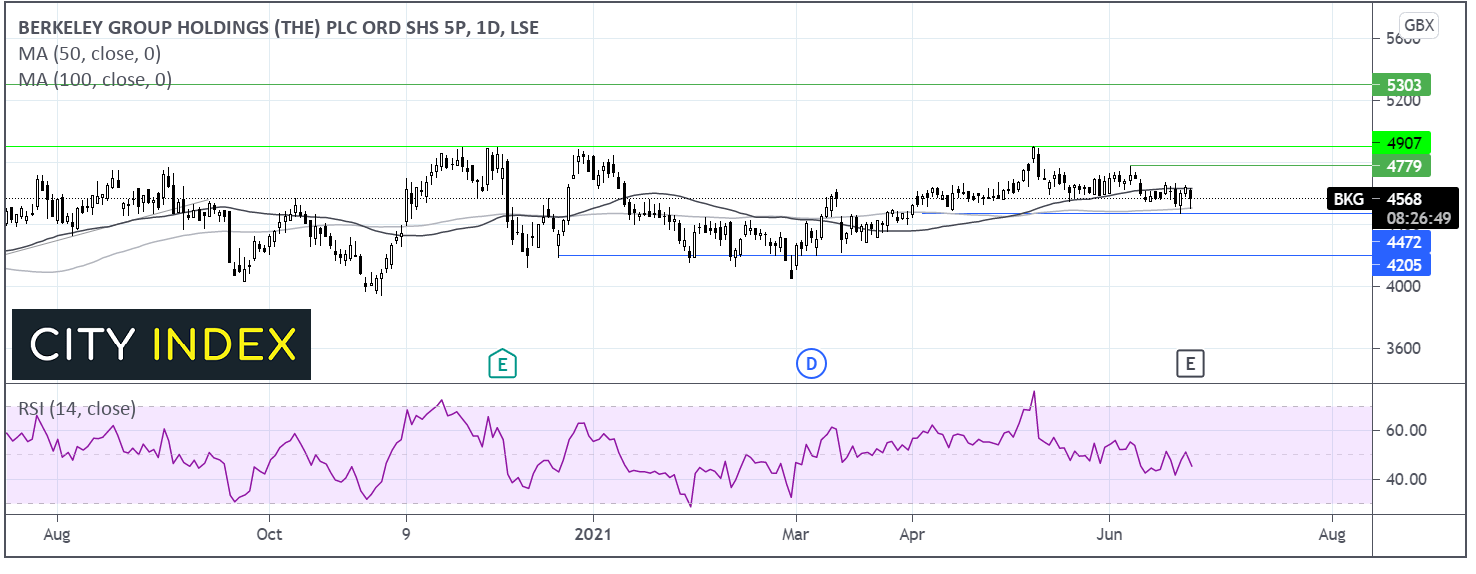

Where next for the Berkeley Group share price?

Berkeley Group share price trades between its flat 50 & 100 sma in a broadly neutral position. The price has been trading in a tight range since early April capped on the upside by 4900 and on the lower band by 4450p.

The RSI has turned southwards and moved into bearish territory suggesting that there is more downside to come.

A break below 4500 the 100 sma and 4450p the lower band of the horizontal channel could see the sellers pick up traction and head towards 4195/4200 zone, an area which offered support several times across the start of the year.

Any recovery in the share price would need to retake the 50 sma at 4625p and 4700p the June high, before testing the upper band at 4900p. Beyond here bulls could look towards 5300p the December 2019 high.

Persimmon and Aviva strike deal over leaseholds with CMA

The Competition & Markets Authority said it has secured landmark commitments from Aviva and Persimmon that should help thousands of leaseholders across the UK.

The CMA launched enforcement action against four housing developers last year, as well as companies that had bought a large number of freehold sites and then leased them out. The other three developers are not listed and named Brigante Properties, Abacus Land and Adriatic Land.

Aviva has pledged to remove all leasehold contracts that were doubling the amount of ground rent payable by leaseholders every 10 to 15 years and are now linking any increases to RPI. The doubling clause in contracts meant many leaseholders struggled to sell their properties on. Aviva is also repaying homeowners who were affected by the doubling clause in the past.

Meanwhile, housebuilder Persimmon has promised to allow leaseholders the option to buy the freehold of their property at a discount and will also make payments to previous customers who have bought their property.

Notably, Persimmon stopped selling leasehold properties back in 2017 so this applies to historic purchases.

‘This addresses concerns raised by consumers with the CMA, and local Trading Standards, that they were led to believe they could buy their freehold at a certain price, only to find out later that this price had increased by thousands of pounds with no warning. It also means those individuals who have already bought their freehold will receive a refund, meaning they don't miss out,’ the CMA said.

Persimmon is also planning to make it clearer to customers about the annual costs of buying a home and will give prospective buyers more time to exchange contracts once they have reserved a property after the regulator complained it was too short and not giving buyers enough time to weigh up their options.

Persimmon, in its own statement, said it was extending its existing Right to Buy scheme that allows leaseholders to buy their freehold at below market value and said the ‘informal voluntary undertakings agreed today largely extend existing schemes Persimmon has in place and have been made without any admission of wrongdoing or liability.’

‘This is a real win for thousands of leaseholders - for too long people have found themselves trapped in homes they can struggle to sell or been faced with unexpectedly high prices to buy their freehold. Now, they can breathe a sigh of relief knowing things are set to change for the better,’ said CMA chief executive Andrea Coscelli.

‘It's good that Aviva and Persimmon have responded positively to this investigation, enabling these issues to be fixed for leaseholders. But our work isn't done. We now expect other housing developers and investors to follow the lead of Aviva and Persimmon. If not, they can expect to face legal action,’ Coscelli added.

Persimmon shares were trading 1.5% lower in early trade this morning at 2992p, while Aviva shares were down 0.5% at 414.6p.

Vodafone’s European network goes green

Vodafone said its entire European network – from its networks and data centres to its retail stores and offices – will be 100% powered using electricity generated from renewable sources from next month, marking a major step toward its goals to be more environmentally-friendly.

‘From 1 July 2021, Vodafone's customers across Europe can be reassured that the connectivity they use is entirely powered by electricity from renewable sources. This is a major milestone towards our goal of reducing our own global carbon emissions to net zero by 2030, helping our customers reduce their own environmental footprint and continuing to build an inclusive and sustainable digital society in all of our markets,’ said chief executive Nick Read.

The achievement forms part of Vodafone’s ambition to be a net-zero carbon emissions business by 2030, and for its wider value chain to follow by 2040. Originally, Vodafone was aiming to have its European network powered by renewables by 2025 before accelerating its efforts last year.

Vodafone said it intends for its operations across Africa to go green by 2025.

Vodafone shares were trading 0.7% higher in early trade this morning at 131.44p.

Joules Group delivers impressive growth despite lockdowns

Clothing and homeware firm Joules Group said it delivered strong growth and returned to profit in the recently-ended financial year as its strong digital offering cushioned the blow from the lost sales in-store during lockdown.

The company said revenue rose 4% in the year to the end of May to £199.0 million rom £190.8 million the year before. While it was a tough year for physical store sales, Joules Group benefited from its strong digital offering, growing customer numbers and the added contribution from the acquisition of Garden Trading Co in February.

Retail revenue, which combines sales made in store and online, rose 9% in the year as the 41% fall in own-store sales was more than offset by a 48% rise in sales on its own websites.

‘The impact of the coronavirus pandemic on the lives of consumers, the level of disruption and pace of change in the retail sector over the past 12 months has been truly unprecedented. I am delighted that, against this backdrop, Joules has been able to deliver a very solid financial performance and strong strategic progress. This outcome primarily reflects, firstly, the strength and relevance of the Joules brand to an increasing number of customers and, secondly, the increasing importance of our digital proposition both to customers and within our business model, with approximately 77% of our retail sales now generated online,’ said chief executive Nick Jones.

Joules said pretax profit before exceptionals should be in the range of £5.5 million to £6.5 million. That will be welcomed considering it booked a £2 million loss the year before, and is well ahead of analyst expectations.

Despite the positive news, Joules Group shares plunged 9.4% in early trade this morning at 266.0p. Still, the stock has risen over 50% since the start of 2021 alone.

Joules has been encouraged by the performance of its stores since they reopened in April. Sales in the first eight weeks since reopening the doors are higher than pre-pandemic levels. Meanwhile, Garden Trading has performed better than expected in the first few months of ownership, with revenue 78% higher year-on-year.

Joules Group ended May with net cash of £4.7 million and £39 million of headroom within its existing credit facilities.

‘As we move into the new financial year, Joules is now a stronger and more diversified business than ever before. The continued success and growth of our Friends of Joules digital marketplace and our strengthened position in the home, garden & outdoor sector following the acquisition of Garden Trading means that we now offer significantly more products across more categories and provide our customers with more choice and reasons to shop with us. As a result of the strength of the Joules brand and the increasing diversification of the Group's digital-led business model, we believe that the Group is very well positioned to continue to deliver its ambitious growth plans,’ Jones said.

Liontrust Asset Management hikes dividend after stellar year

Liontrust Asset Management said it has hiked its dividend after almost doubling the amount of assets under management during its recently-ended financial year, in which it also delivered stellar growth in revenue and profits.

Revenue in the year to the end of March increased 54% to £164.0 million from £107.0 million the year before. It ended the period with assets under management of £30.9 billion, almost double the £16.1 billion on the books a year earlier. Notably, that has increased further to £33.27 billion by June 18.

The independent fund manager said adjusted pretax profit increased 69% to £64.3 million from £38.1 million the year before, with reported pretax profit more than doubling to £34.9 million from £16.5 million.

Liontrust said it will pay a final dividend of 36.0 pence, taking the total payout for the year to 47.0p, up 42% from the 33.0p paid out last year. That hike came as net inflows jumped 30% to £3.49 billion from £2.69 billion. Dividends have now grown by an average of 33% per year since 2017.

‘Liontrust has strong momentum and is well positioned to continue growing. We have excellent investment teams, with impressive long-term performance and investment processes. This has received extensive independent recognition over the past year,’ said chief executive John Ions.

‘We have successfully been diversifying our product range and distribution to ensure we can continue the increase in net flows,’ he added.

Liontrust shares were trading 1.6% higher in early trade this morning at 1652.0p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade