Top UK Stocks and Shares | British American Tobacco Share Price | RWS Share Price | Paragon Banking Share Price

Top News: British American Tobacco ups guidance in ‘pivotal year’

British American Tobacco said it still expects 2021 to be a ‘pivotal year’ for the business as it continues to push its vaping and heated tobacco products, delivering a record number of new customers and prompting it to raise its guidance for the full year.

The tobacco giant, like the wider industry, is concentrating on the shift toward new areas like vaping from traditional combustible cigarettes and tobacco. BAT is the owner of vaping brand Vuse and heated tobacco product glo, which are spearheading its portfolio of next-gen products.

BAT said it added 1.4 million new customers of its next-generation products in the first quarter alone to hit a total of just under 15 million.

It said Vuse was now ‘approaching global leadership in vapour’ with 31.4% value share of the market in the top five markets. It is also the leader in 16 US states. Meanwhile, glo has continued to gain volume share in Japan, Europe and elsewhere, while the new glo Hyper has also performed well since being launched.

‘We continue to expect 2021 to be a pivotal year for the business, with accelerating New Category revenue growth, a clear pathway to New Category profitability by 2025, and leverage reducing to 3x by year end,’ BAT said.

The momentum being built in its new category of products, the faster than expected acquisition of new customers, and accelerated investment has prompted BAT to upgrade its full year guidance this morning. It is now aiming to deliver revenue growth of over 5% at constant currency, up from its previous target of 3% to 5%. Adjusted EPS is expected to grow by mid-single digits at constant currency.

BAT is aiming to convert at least 90% of its operating cashflow this year and end with net debt at around 3x adjusted Ebitda.

Where next for the BAT share price?

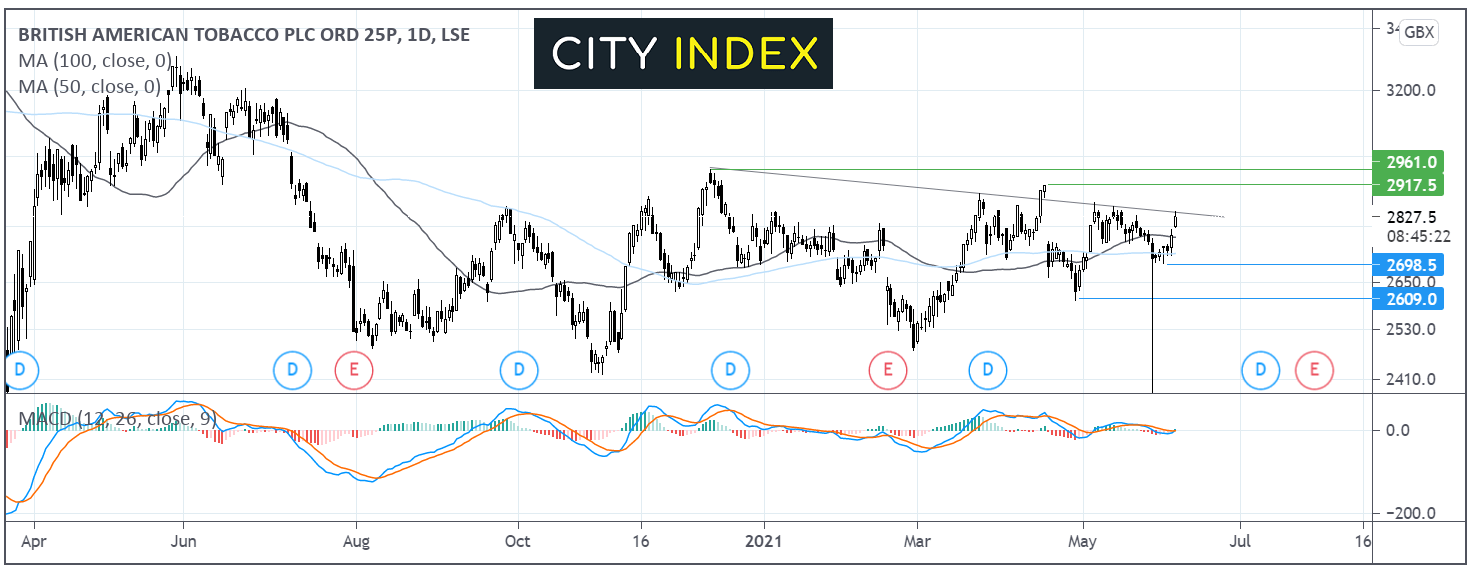

British American Tobacco share price trades below its descending trendline dating back to early December.

It trades over its 100 daily ma and today’s jump higher has taken it above the 50 daily ma. The MACD appears to be forming a bullish cross over keeping the buyers hopeful.

The move higher needs to break above the descending trendline at 2840p also today’s high in order to advance towards 2915p high April 15 and 2961p the post pandemic high.

Failure to retake the descending trendline could see sellers push the price back towards 2775p the 50 sma and on to 2720p the 100 sma. A move below 2700p could see the sellers gain traction.

RWS Holdings CEO resigns after overseeing transformative SDL acquisition

RWS Holdings said revenue almost doubled in the first half of its financial year, driven by its acquisition of SDL to create a new powerhouse in the language market, as it announced the departure of its chief executive Richard Thompson.

RWS said Thompson will step down as CEO after nine years with the business to pursue other interests. He led the transformative acquisition of SDL and oversaw a ten-fold increase in organic revenue growth during his time with the business. He will leave on July 25 and be replaced by Ian El-Mokadem, who was most recently the CEO of ship management firm V.Group.

RWS shares were trading 5.1% lower in early trade this morning at 612.3p, marking its lowest level since the start of April.

The news came as RWS reported a 92% increase in revenue during the six months to the end of March to £326.4 million. Stripping out the boost from acquisitions, revenue stayed broadly flat at £170.5 million compared to £169.7 million the year before.

Adjusted pretax profit jumped 53% to £50.5 million, again boosted by acquisitions, but still grew when they were excluded. Reported pretax profit was down 7% to £24.0 million.

The acquisition of SDL means RWS is now the ‘largest provider of language services and language technology in the world’. The company is still being integrated and RWS is now targeting synergies of at least £33 million, more than double the original £15 million target.

Elsewhere, RWS said its Life Science and Moravia divisions delivered a ‘strong performance’ whilst its IP Services business has ‘improved significantly’ since the start of the financial year.

RWS said it raised its interim payout to 2.0 pence from 1.75p the year before to reflect the confidence it has going forward. That was partly driven by the fact it ended the period in a net cash position of £11.8 million compared to a net debt position of £34.5 million a year earlier.

RWS said trading has be in line with expectations since the end of March but said foreign exchange headwinds suffered in the first half look set to continue into the second.

Paragon Banking Group delivers record profits

Paragon Banking Group delivered record profits in the first half of its financial year as trading volumes increased, margins improved and impairment charges declined, and said it continues to build momentum as the economy recovers from the pandemic.

Paragon Banking shares were trading 6.7% higher in early trade this morning at 543.5p, marking its highest level since late 2019.

The specialist bank, which focuses on lending to those typically underserved by high street banks, said underlying profit jumped 45% in the six months to the end of March to £82.9 million, with reported pretax profit soaring 69% to £96.4 million.

New lending levels rose 45% and is now ‘just below pre-pandemic run-rate’ while pipelines for buy-to-let and development finance both grew at double-digit rates. Retail savings deposits grew almost 25% to £8.6 billion.

‘The six months to March 2021 saw a strong recovery in our trading volumes following the Covid-driven reductions in the second half of 2020, with the business trading efficiently through the latest lockdowns and restrictions. Volumes have increased, margins widened, and impairment charges reduced during the period,’ said Paragon.

‘The group's net interest margin has been widening over a number of years due to a changing business mix, stable yields and a developing savings deposit franchise. The loan portfolio has demonstrated strong resilience, but despite this, uncertainties remain about the prospects for SMEs and retail customers once government Covid support schemes are unwound. The group has therefore taken a prudent approach and as such impairment coverage levels have been maintained. Notwithstanding this continued cautious approach, the six months to March 2021 generated our highest ever interim operating profit,’ Paragon added.

The strong set of results prompted Paragon to pay an interim dividend of 7.2 pence, representing half of the final payout made in the last financial year. No interim payout was made last year as the pandemic erupted. The bank also announced it is launching a new share buyback that will see it repurchase up to £40 million worth of stock.

‘The markets in which we operate have seen healthy quarter-on-quarter improvements in activity and our business has been building momentum, whilst maintaining our traditional prudent risk appetite. The Group has a strong capital base, high levels of liquidity and is well-positioned to capitalise on any opportunities that may emerge in the future,’ Paragon said.

Dechra Pharmaceuticals to beat expectations

Dechra Pharmaceuticals said it expects annual revenue to come in above market expectations this year as costs are coming in lower than expected, the inventory that built up ahead of Brexit unwinds and lockdown restrictions are eased.

‘Consequently, the group now expects full year revenue to be ahead of current consensus expectations, with trading likely to be distributed more evenly than previously guided between the first and second halves of the financial year,’ said Dechra, which is known for making pharmaceuticals for animals.

Dechra shares were trading 2.1% higher this morning at 4232.0p, marking a new all-time high for the stock, which has risen over 50% over the past 12 months.

A consensus compiled by Reuters shows analysts are currently expecting Dechra to report annual revenue of £589.4 million in the current financial year to the end of June 2021, which would be up from £515.1 million the year before.

Dechra had previously said its results would be weighted to the first half because of the inventory unwind, but said on Tuesday that it is ‘increasingly confident’ that the strong performance in the first half will continue throughout the second.

Dechra plans to release its pre-close numbers for the current financial year on July 12.

Oxford Instruments grows confident as order book grows

Oxford Instruments reported higher revenue and improved profitability during its recently-ended financial year and said a larger order book provides confidence going forward.

The company, which makes high-tech products and systems used by industrial customers and scientific researchers, said revenue edged up to £318.5 million in the year to the end of March from £317.4 million the year before.

Adjusted operating profit jumped 13.3% to £56.7 million, toward the top end of its guidance range. That was boosted by an improved margin of 17.8% compared to 15.9% the year before. Adjusted pretax profit was up 12.9% to £55.9 million.

The results were even stronger on a reported basis, with operating profit soaring 33% to £53.0 million and pretax profit jumping almost 35% to £52.2 million.

The company said orders from both industrial and academic customers grew during the year while margins improved thanks to its Horizon strategy. It noted that strong order growth in Asia and North America was partially offset by a modest decline in orders from Europe.

Oxford Instruments will be paying a 17.0 pence dividend for the year as a whole. It did not pay a dividend in the last financial year as the pandemic started to bite, but the latest payout is well above the 14.4p paid the year before.

‘Our robust performance, strong order book and breadth of attractive end markets demonstrate the resilience of our business model, positioning us well for good progress in the year despite anticipated currency headwinds and the ongoing uncertainties as global economies look to recover from Covid,’ said chief executive Ian Barkshire.

The order book at the end of the period was 13.2% higher than the year before at £198.1 million, providing greater visibility for the new financial year.

Oxford Instruments shares were trading 0.9% higher this morning at 2152.5p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade