Top UK Stocks and Shares | Barclays Share Price | AstraZeneca Share Price | Darktrace IPO

Top News: Barclays expects UK to experience fastest growth since WW2

Barclays said it delivered a record quarterly profit in the first three months of 2021 and forecast that the UK will experience its fastest economic growth since 1948, but warned it was still taking a ‘cautious view of the impact of the pandemic on the business’.

The bank said total revenue was down 6% year-on-year at $5.90 billion. Its corporate and investment bank saw income drop 1% in the period, as a strong rise in equities was countered by a large fall from fixed income clearing. Income from its retail division was down 22%.

Pretax profit surged to a record of £2.39 billion from just £913 million the year before and came in well ahead of the £1.64 billion expected by analysts. Attributable profit at the bottom line jumped to £1.70 billion from £605 million. The surge in profits was predominantly driven by increased confidence that people and businesses can afford to repay their debt compared to last year when the pandemic erupted.

It set aside over £2 billion to cover potentially bad loans in the first quarter of 2020 but that figure only came in at £55 million this year, well below the £503 million expected by analysts.

However, unlike peers such as HSBC earlier this week, Barclays did not release any of the reserves it has already set aside, implying it is still cautious about its outlook despite forecasting a strong recovery this year.

‘Barclays expects that the full year 2021 impairment charge will be materially below that of 2020 reflecting delinquency experience and an improved economic outlook during the latter part of Q121. If these conditions persist, Barclays would expect to reduce the impairment provision level,’ it said.

That hesitation to release funds, combined with the fact shares had already risen over 4% in the week leading up to the results on the back of positive results from its peers, caused Barclays shares to plunge this morning.

The return on tangible equity rose to 14.7% from just 5.1% the year before, and Barclays said it will deliver ‘meaningful year-on-year RoTE improvement in 2021’. It said it is still targeting an RoTE of over 10% ‘over time’. The CET1 ratio came in at 14.6% in the quarter, versus its target range of 13% to 14%.

‘While evidence of recovery is encouraging, we have continued to take a cautious view of the impact of the pandemic on the business. We remain disciplined on costs, with a cost to income ratio of 61% this quarter. Our capital position remains well above target with a CET1 ratio of 14.6% and we completed our £700 million buyback this month. We will give further guidance on distributions when appropriate,’ said chief executive Staley.

Where next for the Barclays share price?

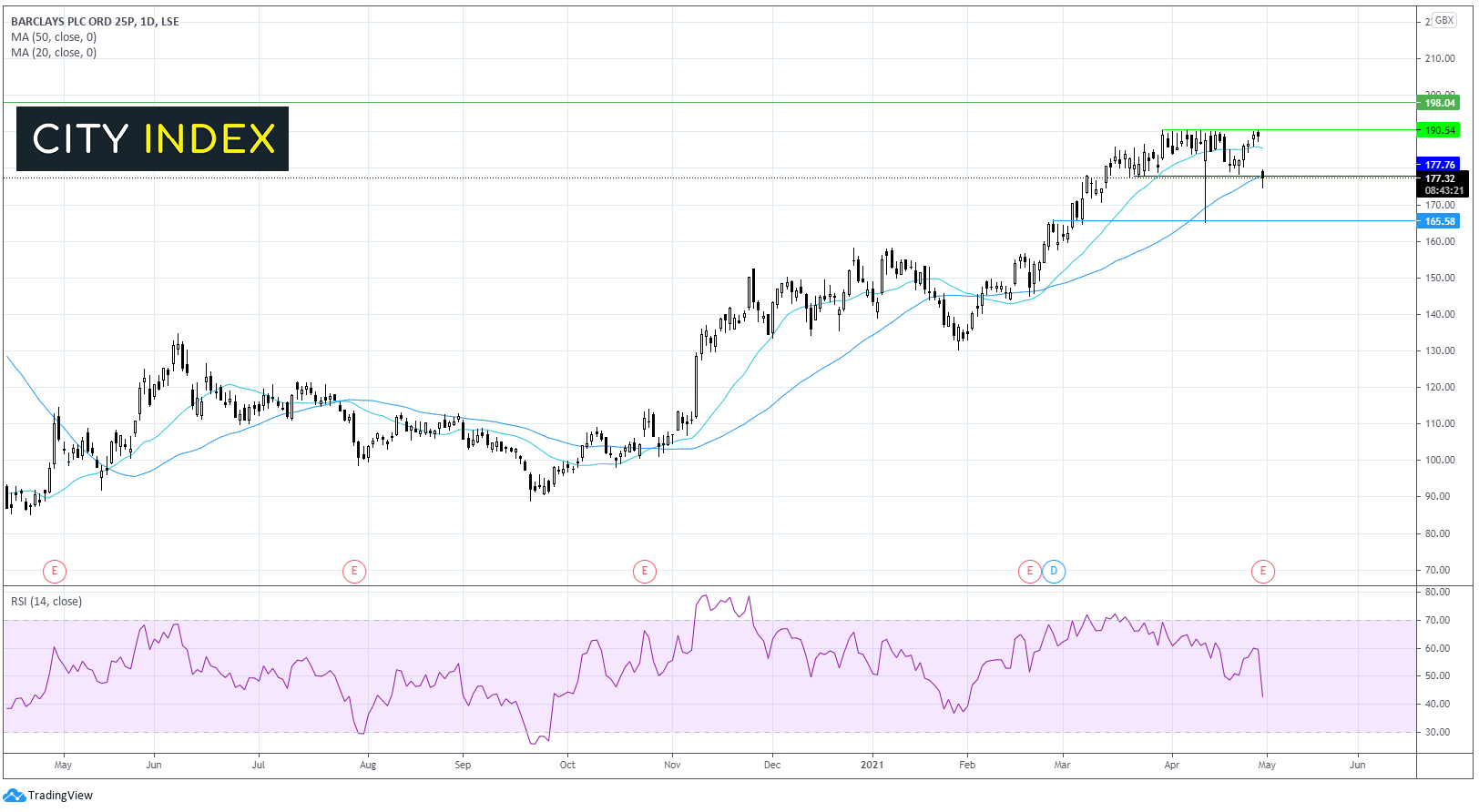

After a strong run up over the past 6 months Barclays was trading in a holding pattern ahead of earnings capped on the upside by 190p and on the lower band by 177p.

The price had dropped 6% in early trade which has taken the price down through its 20 SMA on the daily chart. The RSI is supportive of further losses.

Sellers will be looking for a meaningful move below 177p the lower band of the horizontal channel and the 50 SMA for a deeper selloff towards 165p April’s low.

A close above the 177p lower band support could see the price continue in its consolidation pattern.

AstraZeneca books $275 million in coronavirus vaccine sales

AstraZeneca reported strong growth in revenue and earnings during the first quarter of 2021 whilst also revealing it made hundreds of millions of dollars from selling its coronavirus vaccine.

The company said revenue jumped 15% to $7.32 billion in the first quarter. Notably, that includes $275 million of sales of its coronavirus vaccine. Revenue was well ahead of the $6.96 billion expected by analysts.

Core EPS jumped 55% year-on-year to $1.63 while reported EPS doubled to $1.19. Analysts had expected core EPS of just $1.48 and reported EPS of $1.08.

‘We delivered solid progress in the first quarter of 2021 and continued to advance our portfolio of life-changing medicines. Oncology grew 16% and New Cardiovascular, Renal and Metabolism grew 15%. New medicines contributed over half of revenue and all regions delivered encouraging growth. This performance ensured another quarter of strong revenue and earnings progression, continued profitability, and cash-flow generation, despite the pandemic's ongoing negative impact on the diagnosis and treatment of many conditions,’ said chief executive Pascal Soirot.

‘Given the performance in the first quarter, in line with our expectations, we reiterate our full-year guidance. We expect the impact of COVID to reduce and anticipate a performance acceleration in the second half of 2021,’ he added.

AstraZeneca is aiming to deliver ‘low-teens percentage growth’ in revenue in 2021 and to grow core EPS at a faster rate to a range of $4.75 to $5.00 per share from just $4.02 in the last financial year. Notably, the guidance does not take any sales of its coronavirus vaccine into account nor any contribution that could come from Alexion Pharmaceuticals, which it is in the process of acquiring.

AstraZeneca shares were trading 2.9% higher in early trade at 7610.0.

Smurfit Kappa remains confident on growth despite lower revenue and profits

Smurfit Kappa reported lower revenue and profits in the first quarter of 2021, but said it expects its results to improve this year.

The paper and packaging company said underlying revenue was up 6% in the quarter to EUR2.26 billion. However, that was down from revenue of EUR2.31 billion the year before. Earnings before interest, tax, depreciation and amortisation declined to EUR386 million from EUR424 million after its margin contracted to 17% from 18.3%.

‘The first quarter was remarkable in many ways. We had strong corrugated volume growth in practically every area and all markets in which we operate. With unprecedented industry wide shortages of supply and input cost pressures, paper prices have moved up sharply. We are recovering these input costs in line with our expectations,’ said chief executive Tony Smurfit.

‘Our strong first quarter performance has set the foundation for accelerated revenue and earnings growth as we move through 2021. This performance and these prospects reflect the strength and quality of Smurfit Kappa,’ he added.

Smurfit Kappa shares were trading 2.8% higher in early trade at 3668.0.

Card Factory recovers faster than expected as stores reopen

Card Factory said its performance has been better than expected since it reopened stores in England and Wales earlier this month, installing confidence in the company’s recovery prospects as it reopens outlets in Scotland and Northern Ireland.

Stores in England and Wales were allowed to reopen from April 12 after non-essential retailers were shut down during lockdown. Stores in Scotland reopened earlier this week on April 26, while outlets in Northern Ireland are starting to welcome back customers from today.

Card Factory also said it has agreed to refinance its existing debt with existing lenders and that an update will be published in the ‘coming weeks’. The talks are aimed at avoiding breaching its covenants at the end of May 2021.

Card Factory shares were up 8% in early trade at 84.7.

Darktrace IPO price sets valuation of £1.7 billion

Cybersecurity outfit Darktrace has confirmed the price of its initial public offering will be 250 pence per share, giving it an initial market cap of £1.7 billion – far less than what was expected.

Sky News reported earlier this week that Darktrace would aim for a value of between £2.4 billion to £2.7 billion after slashing its IPO price. Beforehand, Darktrace was touted to earn a valuation closer toward $5 billion, or £3.6 billion. The price is thought to have been reduced following Deliveroo’s poor performance since listing and to help absorb any concerns about one of its major investors.

Conditional trading in Darktrace shares will begin today but unconditional trading will not start until Thursday May 6.

Darktrace said just over 66 million shares will be sold as part of the IPO for a total of £165.1 million. That is comprised of 57.4 million shares being issued by the company to raise proceeds of £143.4 million and 8.7 million shares being sold by existing investors for around £21.7 million.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade