Top UK Stocks to Watch: Babcock to book £1.7 billion of impairments

Top News: Babcock books large write-downs but avoids equity raise

Babcock International has warned it will book around £1.7 billion of impairments as it writes-down the value of its assets as part of a strategic review, delaying its return to profitability, but said it doesn’t need to raise any equity.

Babcock said it will focus on being an international aerospace, defence and security company going forward, with other parts of the business set to be sold-off to help raise funds. Babcock said it expects to raise around £400 million through asset disposals over the next year.

The majority of the impairments, which are being booked after reviewing the potential value of future contracts and income, will be one-off and non-cash. The review of the value of its future work is expected to cut its annual underlying operating profit by around £30 million each year.

The Financial Times reported last week that Babcock was set to write-down its assets by up to £700 million, with some analysts expecting it to raise equity.

Babcock intends to restructure the business at a cost of £40 million, which in turn should deliver £40 million of annualised savings. However, it warned that its plans meant it was unlikely to return to profitability in 2022 as previously hoped.

‘We announced a series of reviews in January and promised to report back on our strategic direction, a new operating model and a new financial baseline at our full year results. Today we give you an update on all of these areas. The early results from our reviews show significant write offs and a smaller ongoing reduction in the profitability of the group,’ said chief executive David Lockwood.

‘Through self-help actions, we aim to return Babcock to strength without the need for an equity issue. We are creating a more effective and efficient company through our new operating model and, in line with our new strategic direction, will rationalise the group's portfolio to help strengthen our balance sheet,’ he added.

Where next for the Babcock share price?

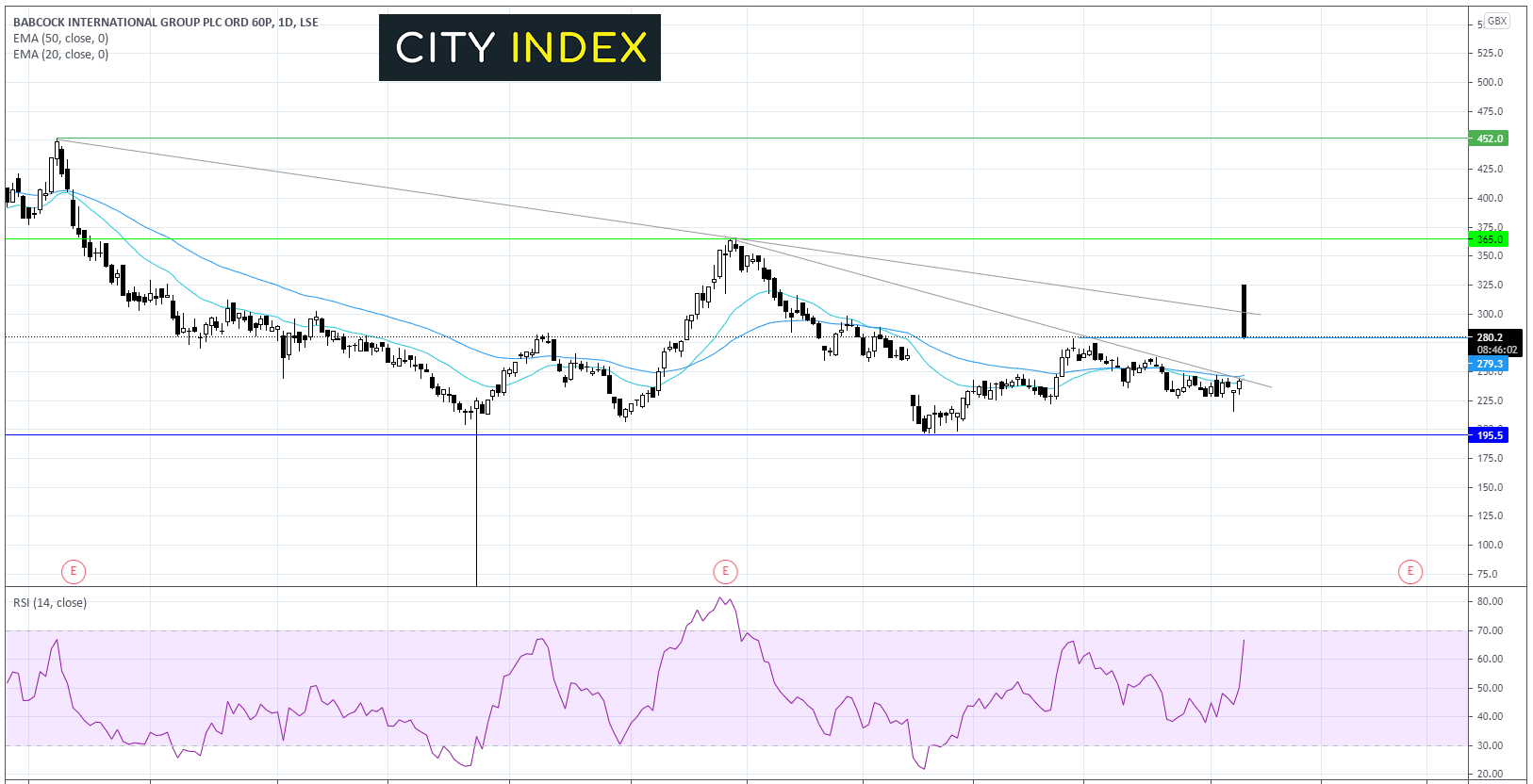

Babcock has been trending lower since mid-June last year. The sellers gained momentum since December 2020.

The share price surged in early trade hitting a high of 325. The price has since eased back to 290 at the time of writing, which represents a 20% jump on the day.

The price has surged above the descending trendline dating back to early December. However, it failed to sustain the move above the 9 month descending trendline.

The RSI is almost in overbought territory, more upside could be on the cards until it reaches 70 on the RSI. Beyond here the share would be in over bought territory and so could consolidate or move lower before any further upside.

Immediate support can be seen at 275 today’s low and the high February 25. Beyond here there is a strong support level at 244 the confluence of the descending trendline and the 20, 50 EMA which could prove to be a tough nut to crack.

On the upside, immediate upside is seen at 325 today’s high before the buyers look towards resistance at 365 December’s high.

JD Sports ups expectations after strong pandemic trading

JD Sports said its full-year results beat expectations thanks to a resilient performance during the pandemic and a strong contribution from its international operations, giving it confidence to raise expectations for this year.

The retailer said revenue rose to £6.16 billion in the year to the end of February 2021 from £6.11 billion the year before, an impressive performance considering its stores were impacted by lockdown.

Headline operating profit before exceptional items – JD’s key profitability figure – fell to £421.1 million from £438.8 million. However, that was considerably better than the £400 million targeted by JD and the £394 million expected by analysts.

Notably, reported pretax profit at the bottom-line dropped to £324 million from £348.5 million, which was worse than expected by the market.

JD said its performance was down to the fact its customers were willing to switch to its online shop when physical stores were shut, and because of its strong performance overseas, particularly in the US.

JD said it will pay a final dividend of 1.44 pence per share.

‘Whilst we must recognise the substantial level of temporary store closures to date and ongoing, we remain confident that we are well placed to benefit from the opportunities that prevail and, at this early stage, our current best estimate is that the group headline profit before tax for the full year to 29 January 2022 will be in the range of £475 million to £500 million,’ said JD Sports.

That new target range is up from £440 million to £450 million previously and has been risen partly because of new acquisitions JD has made.

JD Sports shares were up 1.1% in early trade at 919.7.

Just Eat Takeaway prioritises growth over profits

Just Eat Takeaway said it has continued to deliver an impressive performance after reporting strong top-line growth during the first quarter of 2021, but warned it will continue to prioritise its expansion and gaining market share over profits for the immediate future.

The company said order growth accelerated for the fourth consecutive quarter in the first three months of 2021. Orders surged 79% year-on-year to over 200 million with gross merchandise value increasing 89% to EUR4.5 billion. Just Eat reiterated its belief that annual order growth in 2021 will be considerably better than last year.

‘To capitalise on the strong momentum from its investment programme, the company will continue to invest heavily and prioritise market share over adjusted Ebitda,’ the company said.

Just Eat is investing heavily in several areas. Having started out as a platform and marketplace, it is now making a big push by offering restaurants a delivery service named Scoober that can compete with that of rivals like Uber Eats and Deliveroo. Notably, Just Eat said its marketplace and delivery operations are contributing equally to growth, although its delivery operations are considerably lower-margin.

‘The roll-out of the employed Delivery model accelerated throughout Europe, including expanded London coverage and Birmingham roll-out in the UK, and expansion to Lyon, Bordeaux and Toulouse in France. In Italy, Just Eat was the first food delivery company to sign a Collective Bargaining Agreement with the largest unions for the employment of its couriers,’ Just Eat said.

The UK was the fastest-growing segment of the business with orders up 96%, while demand for its delivery service jumped by almost 700%.

Just Eat shares were up 1.8% in early trade at 7508.0.

Hays sees ‘improving momentum’ as pandemic continues to bite

Hays continued to see the pandemic weigh on the recruitment industry during the first quarter of 2021 as the company posted steep falls in net fees, but said it performed better than expected and is seeing ‘improving momentum’ across the business.

The company said net fees fell 9% year-on-year in the first three months of the year – representing the third quarter of its financial year - and were down 10% on a like-for-like basis. All geographical regions reported large falls in fees, with the UK and Ireland reporting the steepest drop.

‘Despite our markets remaining impacted by the pandemic, we continued to see improving momentum across the quarter and I am pleased to say group fees were ahead of our expectations,’ said chief executive Alistair Cox.

‘This was most evident in our largest market of Germany, driven by increased business confidence and client investments. Australia and the UK saw improvement, particularly in Perm, while fees in the Americas and Asia both grew sequentially, led by the USA and China. Overall, there are clear signs of skill shortages in certain industries, notably Technology and Life Sciences,’ he added.

Hays said the better-than-expected performance has led it to believe annual operating profit this financial year will ‘at least’ £85 million. That would be a stark improvement from the £53.2 million reported in 2020.

Hays shares were up 3.6% in early trade at 165.5.

Revolution Bars hopes for strong recovery as it reopens doors

Revolution Bars said it has opened as many bars as possible as the UK allows punters to be served outside once again, but said it isn’t expecting its recovery to truly take-off until it can start serving indoors again next month.

The company has opened 20 of its 67 bars this week, with the rest to open on May 17 when they can start serving inside. Revolution is hoping for a swift recovery. It said almost 12,000 customers have already placed bookings for the first week of reopening indoors, while ticket sales for events and cocktail masterclasses have also held up well.

Revolution Bars, having made savings and cut rent during the pandemic, believes it is better-placed to benefit when it reopens and deliver a higher margin. The company said it expects demand from its younger clientele, which are less affected by the coronavirus, to be strong and thinks it can benefit from the fact some rivals have not survived lockdown.

The outlook came as Revolution Bars posted its delayed results covering the six months to late December, a period in which it was severely impacted by closures and lockdown restrictions. Sales plummeted to just £21.6 million rom £81.2 million and its bottom-line pretax loss ballooned to £17.7 million from just £1.6 million the year before.

Revolution Bars shares were up 1% in early trade at 30.8.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade