Top UK Stocks to Watch: Aston Martin shares pop on recovery hopes

Top News: Aston Martin sinks deeper into the red but has high hopes for the future

Aston Martin’s losses widened in 2020 as sales fell during the pandemic but said it has seen an improvement and is on track to almost quadruple revenue over the coming years.

The luxury carmaker said revenue fell 38% in 2020 to £611.8 million in 2020 from £980.5 million in 2019. Retail sales fell 32% as dealerships struggled during lockdowns while wholesale sales also took a hit from Aston Martin’s pre-pandemic decision to reduce the number of cars held at dealerships. It said it expects to have finished de-stocking dealerships by the end of March, ahead of its original expectations.

Notably, Aston Martin said it saw an improved performance in the final quarter of the year after launching the DBX, while it shipped 1,171 cars to dealerships in the quarter to meet demand. The fourth quarter was by far the strongest of the year and delivered a ‘material improvement’ from the third, implying the launch of the DBX is having a dramatic impact on the business.

Still, the DBX has not been enough to offset the weakness for the majority of the year. Adjusted Loss before interest, tax, depreciation and amortisation of £70.1 million compared to a £118.9 million profit the year before, while its adjusted operating loss widened to £224.9 million from £9.9 million.

On a reported basis, the operating loss widened to £322.9 million from £52 million, while its pretax loss ballooned to £466.0 million from £119.6 million.

Aston Martin is aiming to shift 6,000 wholesale units in 2021, almost double the 3,394 shifted in 2020. It is aiming to get that up to 10,000 units by 2024 or 2025. It said earnings will be heavily-weighted to the second half of the year when it releases the new variant of the DBX and new specials. It is aiming to deliver an adjusted Ebitda margin in the ‘mid-teens’, marking a significant improvement from the losses booked last year.

Aston Martin said it remains on track to deliver annual revenue of £2 billion and adjusted Ebitda of £500 million by 2024/2025.

‘For 2021, the first full year of the plan, we expect to see the first steps towards improved profitability. The benefits of initial efficiency actions will start to be delivered and through "Project Horizon", the company is seeking to further optimise its structure and processes to deliver a level of operational excellence in line with the updated product and business plan,’ Aston Martin said.

Where next for the Aston Martin share price?

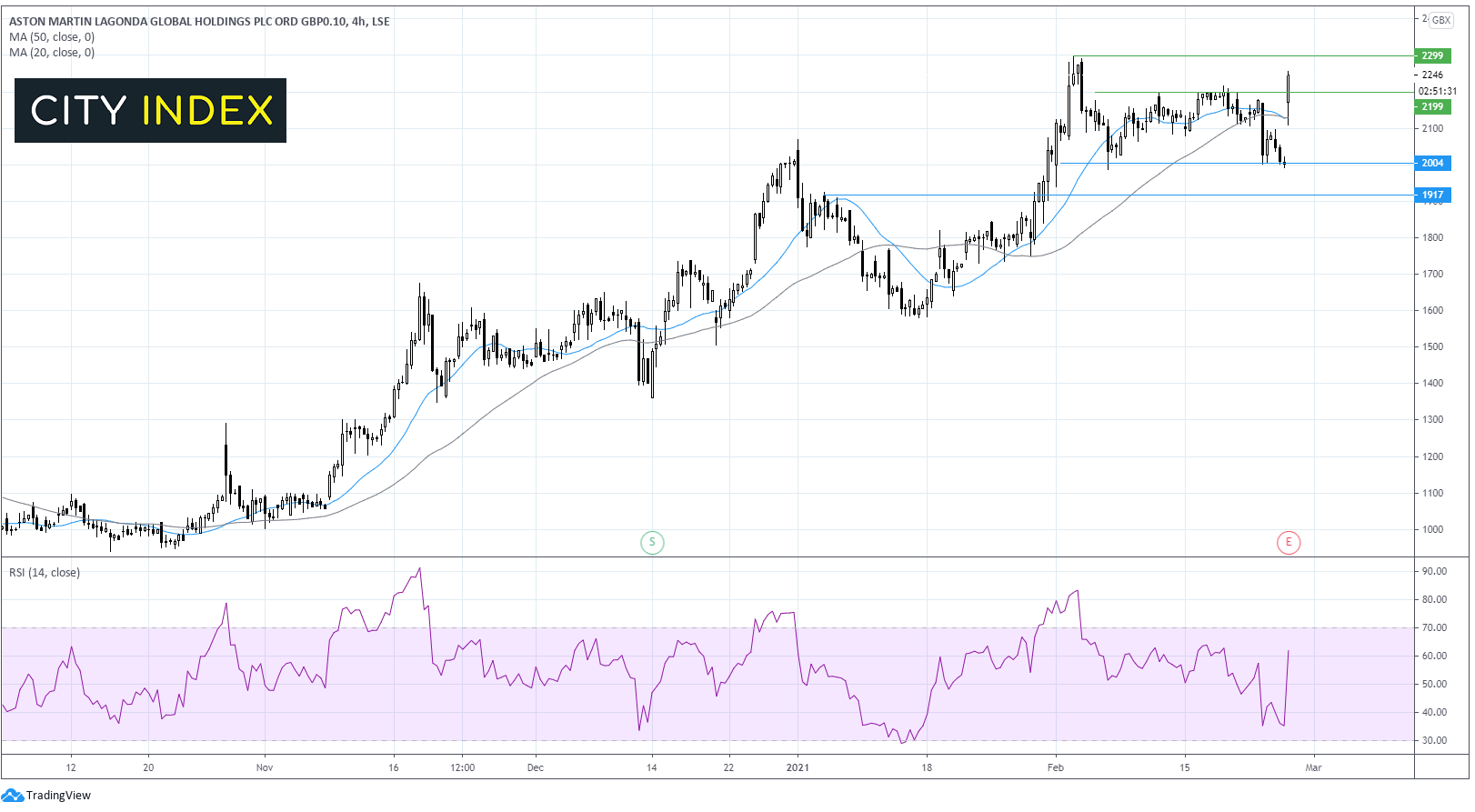

Aston Martin shares have been trading in a holding pattern since the start of the month, consolidating after strong gains across the past 4 months.

Today’s 10% jump sees the share price attempting to break out of the upper band of the horizontal channel at 2200. The RSI is supportive of further gains.

A meaningful move above 2200 could open the door towards 2300 the yearly high before the bulls target 2530 the pre-pandemic February 2020 high.

On the flip side, immediate support can be seen at the confluence of the 20 & 50 sma on the 4 hour chart at 2130. Should the bears break down this level then support at the lower band of the horizontal channel at 2000 could be tested. A breakthrough this level could see the selloff gain momentum towards 1915 resistance turned support in early January.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Standard Chartered resume dividends despite profit hit

Standard Chartered has reinstated its dividend with a 9.0 cent payout and launched a $254 million share buyback despite reporting lower revenue and profits in 2020.

The bank said income fell 3% in 2020 to $14.8 billion and that its net interest margin fell 31 basis points to an average of 1.31%.

That, combined with larger write-offs of bad loans worth $2.3 billion compared to just $906 million in 2019, weighed on profits. Adjusted pretax profit plunged 40% to $2.50 billion from $4.17 billion and profit at the bottom-line more than halved to $1.14 billion from $2.46 billion.

It said it expects credit impairments to fall this year compared to 2020.

‘We are weathering the health crisis and geopolitical tensions very well, our strategic transformation continues to progress and our outlook is bright. We remain strong and profitable, although returns in 2020 were clearly impacted by higher provisions, reduced economic activity and low interest rates, in each case the result of COVID-19,’ said chief executive Bill Winters.

‘The progress we were making up to the onset of the COVID-19 pandemic in every key financial and strategic metric gives us confidence that we can achieve our ambition to deliver a double-digit RoTE. By 2023 we expect to deliver at least 7% RoTE, higher if interest rates normalise earlier than anticipated, through strong operating leverage and disciplined capital management,’ he added.

Standard Chartered said it is in a strong financial position and is returning the maximum amount the regulator will allow to shareholders.

‘Overall income in 2021 is expected to be similar to that achieved in 2020 at constant currency given the full-year impact of the global interest rate cuts that occurred in 1H'20, which will likely cause 1H'21 income to be lower than last year. The FY'21 net interest margin should stabilise at marginally below the 4Q'20 level of 1.24%. Our performance in the opening weeks of this year gives us the confidence that we are on the right track with strong performances in our less interest rate-sensitive Financial Markets and Wealth Management businesses. We expect income to return to 5-7% growth per annum from 2022,’ said the bank.

Standard Chartered shares were down 4.6% in early trade at 486.5.

BAE hikes dividend and forecasts further growth in 2021

BAE Systems has more than doubled its dividend for 2020 and will make an extra payout to account for postponed returns as it reported stronger sales and revenue.

The defence company said it would pay a 23.7 pence dividend for 2020 compared to just a 9.4p payout in 2019. Shareholders will also be paid an additional 13.8p for 2019 that was previously deferred, taking the total payout to 37.5p.

Revenue in 2020 edged up £19.27 billion from £18.30 billion the year before, with operating profit following higher to £1.93 billion from £1.89 billion. Basic earnings per share, however, fell to 40.7p from 46.4p.

BAE said free cashflow remained strong in the year after rising to £1.36 billion from just £850 million the year before. However, once a £1 billion pension contribution was taken into account, free cashflow fell to £367 million.

The order book stood at £36.3 billion at the end of December, down slightly from £37.2 billion a year earlier. That was despite the fact its order intake increased to £20.91 billion from £18.44 billion and its steady order backlog of £45.2 billion.

BAE said it expects sales to grow by 3% to 5% this year or by 5% to 7% at constant currency. It said around 80% of its expected sales this year are already in the backlog and that strong growth from its Air and Electronic Systems divisions, partly boosted by new acquisitions, will help offset continued weakness from the Aerospace unit.

BAE is expecting underlying earnings before interest, tax and amortisation of 6% to 8% in 2021, or over 10% at constant currency, while underlying EPS should increase by 3% to 5%. Free cashflow is expected to exceed £1 billion.

BAE shares were up 1.6% in early trade at 501.5.

Hikma raises dividend as it expects another year of growth

Hikma Pharmaceuticals said it has hiked its dividend for 2020 after reporting growth in revenue and operating profits, and said it expects to deliver further growth this year.

Revenue rose 6% in the year to $2.34 billion from $2.20 billion as all three of its business – injectables, generic drugs and branded – reported higher income during the year. Injectables remained the driver with double-digit growth, generics delivered better margins and branded saw higher revenue but a tighter margin.

Underlying operating profit rose 11% to $566 million from $508 million, and jumped 17% on a reported basis to $579 million from $493 million. Underlying profit attributable to shareholders increased 12% to $408 million but plunged 11% on a reported basis to $431 million thanks to unfavourable foreign exchange rates and higher taxes.

Hikma said it expects revenue from injectables to grow at a slower rate in 2021 within the ‘mid-single digits’ and a core operating margin of 38% compared to 38.6% in 2020. Generic revenue is expected to be in the range of $770 million to $810 million and a core operating margin of ‘around 20%’, compared to the $744 million in revenue and margin of 21.6% delivered in 2020. Lastly, branded revenue should deliver growth in the mid-single digits at constant currency.

The company said cashflow had remained strong and that net debt was low, equal to just 0.9x its core earnings, allowing it to hike its dividend by 14% to 50 cents per share from 44 cents in 2019.

Hikma shares were down 7.6% in early trade at 2238.5.

Anglo American eyes ‘sector leading’ growth to boost revenue and margins

Anglo American said earnings took a knock and cashflow more than halved during 2020, but said it is continuing to improve the business and focus on areas where it can generate higher returns.

The miner said revenue in 2020 edged up 3% to $30.90 billion from $29.87 billion the year before. Underlying earnings before interest, tax, depreciation and amortisation dipped 2% to $9.80 billion from $10.00 billion despite its mining Ebitda margin improving to 43% from 42%.

Underlying Ebitda increased from its copper, platinum group metals and iron ore operations, partly thanks to higher prices, but that failed to offset falls from its De Beers diamond unit and nickel projects. However, the scaling back of coal was the main reason why earnings fell as the unit deliver underlying Ebitda of just $35 million compared to $1.83 billion the year before.

Profits at the bottom-line plunged 41% to $2.08 billion from $3.54 billion. Underlying EPS fell 8% to $2.53 whilst reported EPS plunged 40% to $1.69.

Attributable free cashflow almost halved to $1.2 billion. Anglo American said it was hiking its final dividend by 53% to 72 cents from 47 cents the year before. However, its total dividend for the year of $1 per share is down from $1.09 in 2019.

‘Our balanced investment programme is driving material business improvement, while also delivering margin-enhancing and sector leading volume growth of 20-25% over the next three to five years, that includes first copper production from Quellaveco in 2022. Together with our P101 and technology work, we are on track to deliver our targeted $3-4 billion annual run-rate of incremental improvement by the end of 2022, also taking us towards our longer term target of a 45-50% mining Ebitda margin,’ said chief executive Mark Cufitani.

‘Looking further out, we benefit from a sequence of high returning growth options, mainly in copper, PGMs, and now also crop nutrients. Our business is increasingly positioned to supply those products that are fundamental to enabling a low carbon economy and catering to global consumer demand trends. Combined with our integrated approach to technology and sustainability - also helping us reach carbon neutrality across our operations by 2040 - we are well positioned to meet the expectations of our full breadth of stakeholders,’ he added.

Anglo American shares were up 4% in early trade at 2976.0.

AB Foods shows the benefits of diversification

AB Foods said its grocery, sugar, agriculture and ingredients businesses performed well in the first half of the financial year and should beat expectations, helping counter weakness from Primark which continues to suffer during lockdown.

The company said revenue and profits from the four food-based division will come in better than expected during the 24 weeks to February 27. However, with Primark stores still shut because of lockdown, its retail division lost around £1.1 billion in sales. It said demand was ‘strong’ when stores were open during the period ‘given the circumstances’.

It is expecting Primark to report first-half sales of around £2.2 billion and an adjusted operating profit ‘marginally above break-even’.

‘As a consequence of the restrictions placed on Primark we expect sales, adjusted operating profit and adjusted earnings per share for the group to be lower than last year. The lower profitability of Primark will result in an increase in the group's effective tax rate this year to some 30%,’ AB Foods warned.

Things are looking up with the UK preparing to gradually exit lockdown over the coming months.

‘We are looking forward to the reopening of the Primark estate. As of today, we have likely reopening dates for 233 stores in addition to the 77 stores already open, so that 83% of our retail selling space should be trading by 26 April. Our stores will be offering exciting seasonal ranges for spring/summer and we have been placing orders for merchandise with a long lead time for the autumn/winter season. We expect the period after reopening to be highly cash generative,’ said the company.

AB Foods said its net cash position was £650 million at the end of the period versus £801 million a year earlier. The company warned it will report a cash outflow of around £900 million in the first half, of which £650 million relates to Primark store closures.

AB Foods shares were up 0.5% in early trade at 2448.0.

Mondi ups dividend despite drop in revenue and profits

Mondi said it has raised its dividend by 5% for 2020, despite reporting lower revenue and profits, because it is increasingly confident about its long-term growth prospects and financial position.

The packaging company said revenue fell 8% in 2020 to EUR6.66 billion from EUR7.26 billion in 2019, as lower prices and unfavourable exchange rates offset higher volumes.

Underlying earnings before interest, tax, depreciation and amortisation dropped 18% to EUR1.35 billion, underlying operating profit dropped 24% to EUR925 million and reported operating profit was down 29% to EUR868 million.

Pretax profit at the bottom-line decreased 30% year-on-year to EUR770 million from EUR1.1 billion.

Operating cashflow fell 9% to EUR1.48 billion and Mondi managed to reduce debt to EUR1.79 billion from EUR2.20 billion. Net debt equals 1.3x underlying Ebitda, giving it the confidence to raise its dividend by 5% to 60 euro cents.

Although conditions are tough because of the pandemic, Mondi is continuing to invest through the cycle in order to emerge as a stronger business that can deliver better growth and profitability by capitalising on the shift to online shopping.

‘Our capital investment programme to generate value accretive growth, enhance our cost competitiveness and deliver sustainability benefits is progressing well. In January 2021 we commissioned our investment in Steti (Czech Republic), dedicated to producing speciality kraft paper for e-commerce and retail shopping bags. We also started up a new 300,000 tonne kraft top white machine at Ruzomberok (Slovakia) and we are moving forward with the previously announced major capital investment projects at Syktyvkar (Russia) and Richards Bay (South Africa),’ said Mondi.

‘Expansionary projects are also underway at a number of our converting packaging operations, enhancing our production capabilities and product offering to further support our customers. We continue to evaluate further opportunities for value accretive growth and remain excited by the possibilities offered by our platform,’ Mondi added.

Mondi shares were trading broadly flat in early trade at 1800.8.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Morgan Sindall dividend almost triples

Morgan Sindall said its dividend for 2020 will be almost three times higher than the payout made the year before as cash generation remained strong and it enters 2021 ‘well set for growth’.

The construction group saw revenue dipped 1% in 2020 to £3.03 billion but profits suffered much larger slides. Adjusted operating profit was down 26% to £68.5 million and adjusted pretax profit decreased 29% to £63.9 million.

On a reported basis, operating profit was down 28% to £65.4 million and pretax profit was down 31% to £60.8 million.

Morgan Sindall said cash generation remained strong and that it ended the year in a good financial position, with net cash of £333 million compared to just £193 million at the end of 2019. The company said its average daily net cash increased significantly to £181 million from £109 million. It said it had repaid any amounts borrowed under the furlough scheme, deferred taxes were up to date and that it was no longer receiving any government support.

It has reinstated its medium-term targets that were abandoned during the pandemic and said its final dividend of 40 pence per share takes its total payout for 2020 to 61p. That compares to just 21p in 2019.

Morgan Sindall said it was ‘well set for growth in 2021’ with a growing order book and said the positive momentum will mean it will deliver results ‘materially ahead of previous expectations and slightly ahead of that delivered in 2019’.

‘Despite the differing challenges each division faced, the group has continued to make strategic and operational progress. Again, we have an improved cash position and have further strengthened our balance sheet, allowing us to make the right decisions and actions for the long-term benefit of the business. Our strategy remains the same, based on organic growth and operational improvement in markets geared towards future demand for affordable housing, urban regeneration and infrastructure and construction investment,’ said chief executive John Morgan.

Morgan Sindall shares were up 13.3% in early trade at 1692.0.

Spectris pushed to a loss but hopeful as momentum builds in 2021

Spectris said adjusted profits plunged by one-third in 2020 as a result of lower revenue and tighter margins, but said momentum built as it entered 2021 and that strong cash generation has allowed it to raise its dividend.

The company, which provides tools and software used for precision measurements, said revenue dropped 11% in 2020 to £1.33 billion from £1.63 billion in 2019. That, combined with a tighter operating margin of 13% versus 15.8% the year before, caused adjusted operating profit to plunge by one-third to £173.6 million.

On a reported basis, its operations were loss-making and caused Spectris to turn to a £23.3 million operating loss from a £84.3 million profit. The pretax loss was £4.1 million compared to a £259.3 million profit in 2019. The losses were caused by impairments booked against assets it has now sold off.

‘Although sales were down notably, I am pleased with our underlying margin performance in the circumstances, which was helped by the swift actions taken and the continued execution of our profit improvement programme. At the same time, we were able to protect jobs and the core capabilities of our businesses, while also continuing to execute our strategy, with the divestment of Brüel & Kjær Vibro and Millbrook being notable achievements,’ said chief executive Andrew Heath.

Spectris raised its dividend for the year by 5% to 68.4 pence from 65.1p the year before, and launched a £200 million share buyback programme.

‘Cash generation was extremely strong and the balance sheet was further strengthened. This enabled us to reverse the temporary cost measures, returning staff to full pay, reinstating full-time working for the majority of employees and repaying the salary sacrifice. It also meant we were able to increase the final dividend and today announce a £200 million share buyback programme,’ said Heath.

‘The stronger order intake in the last three months of 2020 provides momentum for the first quarter of 2021 although, clearly, much uncertainty remains and we expect the immediate economic backdrop to remain challenging. However, the actions taken last year position the Group well for any market recovery in 2021. The cost base has been reduced and capability retained, creating a strong operating leverage opportunity and balance sheet optionality. We will maintain our approach, acting with purpose, and being values-led, to deliver long-term, sustainable financial health,’ the CEO added.

Spectris shares were down 3.7% in early trade at 2998.5.

Grafton Group hit by lockdown but enters 2021 on better footing

Grafton Group said its 2020 results were hit by the initial lockdown but said a strong recovery in the second half of the year gives it confidence about the future.

The building materials and DIY retailer said revenue fell 6.1% in 2020 to £2.50 billion from £2.67 billion the year before. This was mostly down to the fact its branches were closed during the first half when initial lockdown measures were introduced.

Adjusted operating profit fell 5.6% to £193.3 million from £204.8 million while adjusted pretax profit fell 7.4% to £166.4 million from £179.6 million. Grafton Group said this beat its expectations and that there was a ‘strong recovery’ in profitability during the second half, when adjusted operating profit jumped 47%.

On a reported basis, operating profit was down 19.3% in the year to £159.7 million while pretax profit was down 23% to £132.7 million.

Grafton Group slashed its dividend for the year by almost 24% to 14.5 pence from 19.0p in 2019.

‘Grafton today is a stronger, more resilient, more digitally and sustainability savvy business than it was before the outset of the Covid-19 pandemic. That evolution reflects not just the commitment and hard work of our colleagues and the agility and resolve of our businesses in a challenging year, but also our multi-year transformation and investment journey principally targeting the more resilient construction sectors of repair, maintenance and improvement, underpinned by an improved customer proposition across all of our businesses,’ said chief executive Gavin Slark.

‘We are very encouraged by the group's strong performance through the second half of last year and while we remain cautious about first half revenue trends in our markets in light of Covid uncertainty, we expect to make further progress in the current year and are confident that our 11,000 colleagues will continue to deliver for our customers. We finished last year in an excellent financial position that provides a strong platform for the future growth and development of our Group,’ Slark added.

Grafton shares were down 1.1% in early trade at 974.8.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade