Top UK Stocks to Watch: ASOS shares rise as sales and profits surge higher

Top News: ASOS remains confident after beating expectations

ASOS reported stronger than expected growth in the first six months of its financial year as people shopped for clothes online during lockdown, prompting it to raise expectations for the full year.

Revenue climbed 24% in the six months to the end of February to £1.97 billion from £1.59 billion the year before, while adjusted pretax profit more than trebled to £112.9 million from £30.1 million.

That comfortably beat market expectations for revenue of £1.95 billion and profit of £90 million.

ASOS acquired 1.5 million new customers during the period and served 24.5 million in total in the period, and sales grew by double-digits in all regions.

Its new brands that it acquired from Arcadia earlier this year for £265 million, including Topshop and Miss Selfridge, have started well with ‘great early customer momentum’. ASOS said integration costs will now be £10 million, just half its original estimate.

‘We are delighted with our exceptional first-half performance and proud of the work our teams have put in to achieve this. These record results, which include robust growth in sales, customer numbers and profitability, demonstrate the significant progress we have made against all of our strategic priorities and the strength of our execution capability. The swift integration of the Topshop brands and the impressive early customer engagement is also especially pleasing,’ said chief executive Nick Beighton.

ASOS said it is well positioned to capture demand as people refresh their wardrobes as the economy reopens. However, it has cited near-term uncertainty over the prospects for its 20-something clientele and the speed of vaccination programmes.

The company said it had raised its expectations for the full-year to reflect its strong performance during the first-half, but did not provide specific figures. ASOS previously said it was aiming to deliver annual pretax profit of around £141 million.

‘Our expectations for the full year have increased in line with our outperformance in the first half, and our outlook for the second half unchanged despite our incremental pricing investment. We continue to expect the second half to be cash generative, driven by our underlying performance and continued discipline in capital expenditure together with support from our normal working capital cycle,’ ASOS said.

Where next for the ASOS share price?

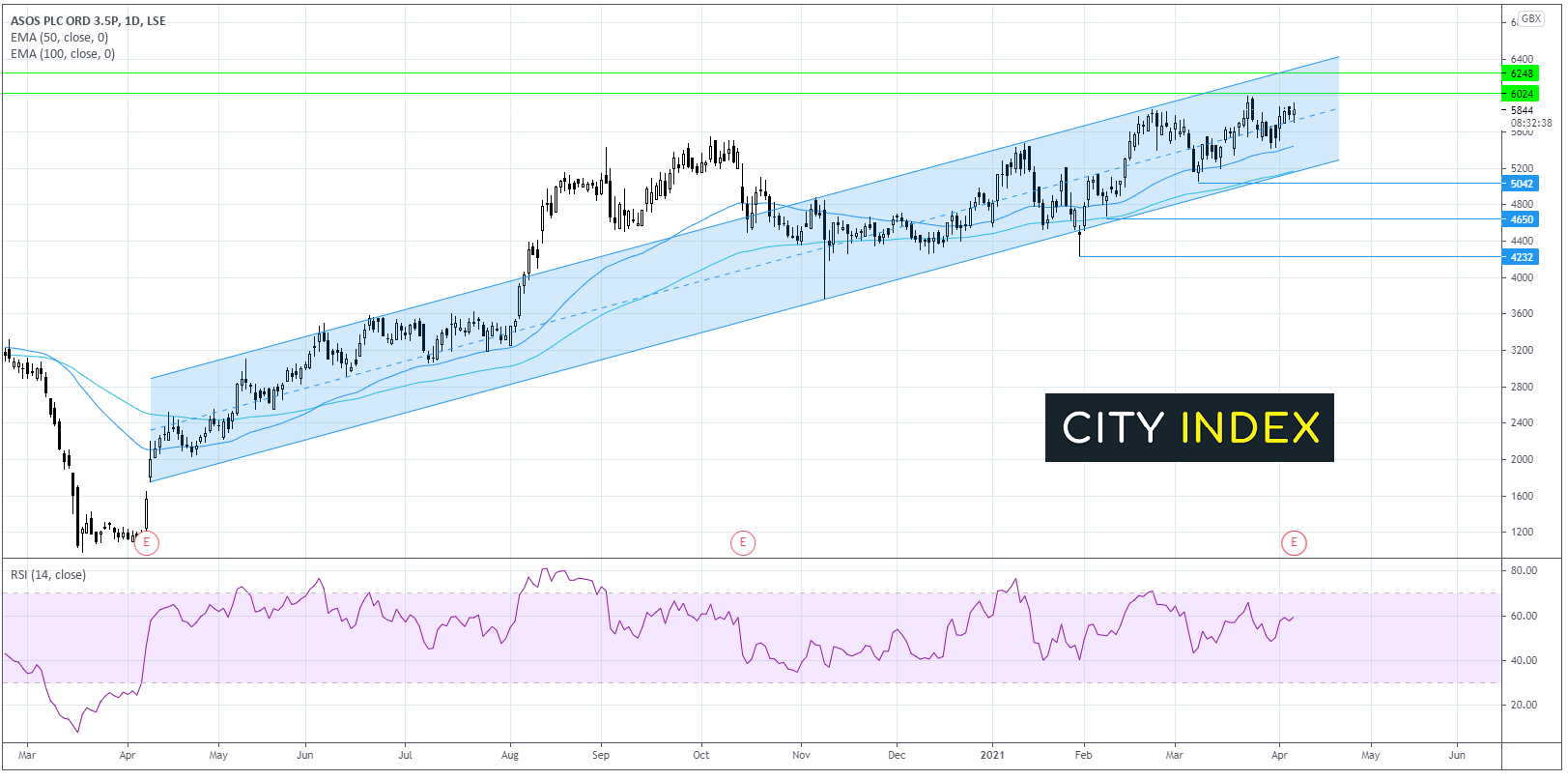

ASOS has traded within an upward trending channel since early April. It trades above its upward sloping 50 & 100 EMA in an established bullish trend.

The RSI is in bullish territory and pointing higher suggesting more upside could be on the cards.

The price is currently finding support along the mid-point of the ascending channel. Bulls will be looking to attack 6025 the post pandemic high reached March 23. Beyond here 6240 high July 2018 could become the next target.

On the flip slide, failure to break above 6025 could see the price slip back towards the mid-point of the ascending channel around 5700. A break below this level could see the 50 EMA come into play at 5420. A move below this level could negate the bullish trend.

Dunelm to beat expectations as online sales jump

Dunelm said it will beat expectations over the full year as its strong performance online continues to offset the lost sales from shut stores as the homewares retailer prepares to start welcoming customers back inside its shops later this month.

Revenue fell 17% in the 13 weeks to March 27 to £236.6 million from £284.4 million the year before. Virtually all of its stores have been operating click-and-collect or have been closed entirely since early January. However, its digital sales more than trebled year-on-year and managed to cover 83% of the lost sales in-store.

The third quarter has been one of the toughest for Dunelm but sales have still grown during the first nine months of the financial year, up 10% to £956 million.

Still, Dunelm warned that it had underperformed the wider market as some of its competitors in the homeware market have managed to remain open because they are classed as essential retailers.

Dunelm intends to reopen the majority of its stores from April 12 and said it hopes to beat expectations for the full year if the coronavirus doesn’t cause any further disruption. That would imply pretax profit will be ‘modestly ahead’ of the £125 million expected by analysts, which would compare to £109.1 million last year.

Dunelm shares were trading 2.5% higher in early trade at 1381.0.

Johnson Matthey raises expectations after strong second-half

Johnson Matthey said it beat expectations in its recently-ended financial year after business picked up during the second-half of the year.

‘I am very pleased with the progress we made, particularly in the second half. As a result, group operating performance for the year is expected to be around the top end of market expectations, alongside continued strong management of working capital,’ said chief executive Robert MacLeod.

The chemical company said it expects to report underlying operating profit for the year to the end of March at the top end of expectations. Analysts currently forecast a profit of £469 million, based on a range between £405 million and £502 million. That compares to the £539 million profit delivered in the previous financial year.

Johnson Matthey also announced that it is reviewing its options for its health business as it looks for ways to maximise returns for shareholders and free up resources to invest in other opportunities, such as battery materials and hydrogen technologies.

The company will release annual results on May 27.

Johnson Matthey shares were trading 5.8% higher in early trade at 3280.0.

Sanne Group raises £80 million in discounted placing

Sanne Group said it has raised £79.5 million through a discounted placing to help it continue buying new businesses and bolster its abilities.

The company, which provides alternative asset and corporate services, said it has issued 12.4 million new shares at 640 pence each to institutional investors. The new shares equal around 8.4% of its existing issued share capital and the price was at a discount to the 668p closing share price before the placing as launched.

‘Acceleration of growth through selected acquisitions is an integral part of the group's strategy and has provided a meaningful contribution to the company's financial performance and strategic development since IPO,’ said Sanne. ‘The net proceeds of the placing will better position Sanne to continue its disciplined acquisition strategy, enhancing the group's financial flexibility and competitiveness.’

Sanne announced it was acquiring North American hedge fund administration business STRAIT Capital Company yesterday.

Sanne shares were trading 1.5% lower in early trade at 658.0.

Segro says rent collection remains strong in 2021

Segro said it has continued to collect the vast majority of rent from its tenants during the initial months of 2021.

The company, which owns and manages warehouse and industrial properties across the UK and Europe, said it has collected 97% of the rent due for the first quarter of 2021 and 89% of that due from the second quarter. Collection rates have improved since this time last year, when Segro had to defer payments for tenants struggling to pay as the pandemic erupted.

Segro shares were trading slightly lower in early trade at 959.2.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade