Top UK Stocks | THG Shares | Ashtead Shares | Wickes Shares | Kier Shares | Ryanair Shares

Top News: THG to spin-off Beauty arm while separating Ingenuity

THG plans to separate and spin-off THG Beauty into its own public listing, leaving the existing company focused on progressing its Nutrition unit and its Direct-to-Consumer platform THG Ingenuity, which has seen a significant acceleration in demand since striking a deal with tech investor Softbank earlier this year.

THG shares were down 5.8% in early trade this morning.

THG has had a busy six months and is aggressively capitalising on the shift to online shopping by spending big on bolt-on acquisitions to grow its position in the beauty and nutrition markets while pushing THG Ingenuity, its platform used by other brands to establish their own Direct-to-Consumer channel.

THG plans to spin-off THG Beauty sometime next year and said it is still considering what to do with THG Nutrition, which could also be separated.

As for THG Ingenuity, the platform has gained traction since receiving the backing from Softbank earlier this year. THG’s sizeable fundraise earlier this year was underpinned by an investment from Softbank, which has also agreed to take a 19.99% stake in THG Ingenuity after it is spun-out into a THG-controlled subsidiary separated next year.

THG stressed it will maintain control over the THG Ingenuity subsidiary and will have the final decision on any potential IPO of the unit.

The flurry of news came as THG reported interim results covering the first six months of 2021.

THG reported a 42% jump in revenue to £958.8 million and said adjusted Ebitda rose 39% to £81.2 million.

Topline growth was impressive across the board. THG Beauty reported a 56% jump in revenue to £460.8 million, THG Nutrition experienced 27% growth to £328.4 million and THG Ingenuity booked a 40% lift to £85.8 million.

THG Beauty and Nutrition both benefited from the string of new acquisitions THG has made since the start of the year, noting that the likes of Dermstore and Bentley Laboratories are performing as planned.

THG Ingenuity has seen an influx of demand since partnering with Softbank, opening the door to a number of potential new clients. Nine new customers signed up in the first half came from Softbank alone. Other notable wins include Coca-Cola Europacific Partners, Mondelez and JDE Peet.

THG said it remains confident of achieving revenue growth of 38% to 41% over the full year, having raised its ambitions earlier this year, and said adjusted Ebitda margins should be broadly stable year-on-year.

Where next for the THG share price?

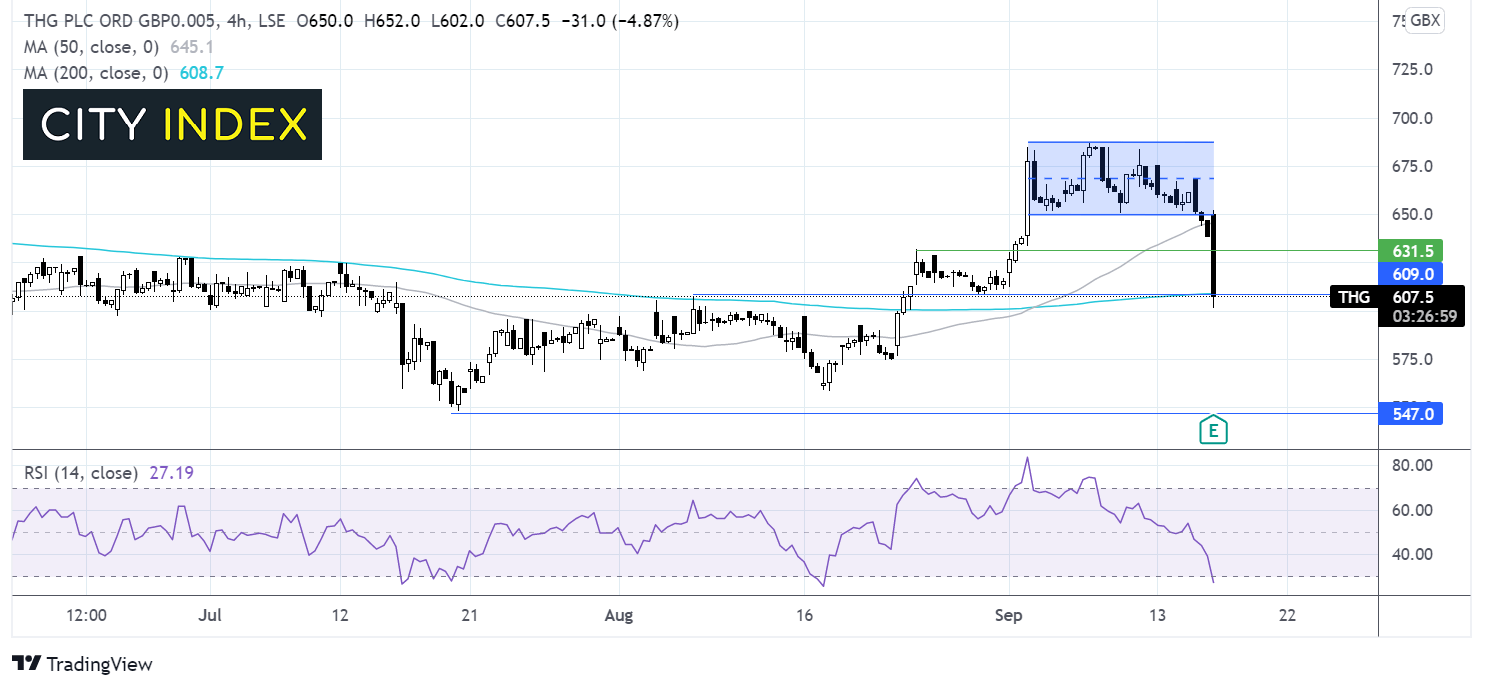

The THG share price has broken out of the holding pattern within which it traded across September.

The price has plunged through the lower band at 650p and is currently testing support at 610p the 200 sma on the 4 hour chart, which is also horizontal resistance turned support, from the August high.

A meaningful move below this level could open the door to 547p the all-time low.

Any attempt at a recovery would need to retake the 200 sma in order to bring 630p horizontal resistance into play and 650p the lower band of the holding pattern.

Ashtead ups growth and cashflow targets after solid first half

Ashtead said it expects to deliver significantly faster growth and better cashflow this year than originally anticipated after beating expectations in the first quarter and making a solid start to the next phase of its long-term strategy.

Ashtead shares were up 3.1% in early trade this morning to hit a fresh all-time high of 6038p.

Revenue rose 21% in the first quarter covering the three months to the end of July to $1.85 billion from $1.50 billion the year before.

‘The group delivered a strong quarter with rental revenue up 22% over the prior year, but more importantly up 12% when compared with the first quarter of 2019/20, both at constant currency. This reflects continued market outperformance across the business,’ said chief executive Brendan Horgan.

Ebitda jumped 24% to $860 million from $685 million. Adjusted pretax profit, which strips out one-off exceptional items, increased 68% to $437 million from $260 million, while reported pretax profit including all items soared 74% to $416 million from $241 million.

This was the first quarter that Ashtead has reported in dollars, having made the switch due to making over 80% of revenue and profits in the greenback. Although analyst estimates were made in sterling, the growth rates Ashtead has delivered far exceed what was anticipated by the markets – which forecast 7.5% revenue growth and an 8.3% rise in Ebitda.

Ashtead has also made solid progress with Sunbelt 3.0 – the next phase of its strategic plan that was launched in April. The central goal is to continue expanding and add a further 298 new locations across North America with the goal of having 1,234 sites by 2024. Ashtead said it spent $123 million making bolt-on acquisitions in the quarter and opened 29 new sites in North America.

‘Our business is performing well in supportive markets with strong momentum. The benefit we derive from the diversity of our products, services and end markets, our investment in technology and ongoing structural change, enhanced by the environmental and social aspects of ESG, enables the board to look to the future with confidence and we now expect business performance this year to be ahead of our previous expectations,’ said Horgan.

Ashtead said it is now expecting rental revenue to rise 13% to 16% over the full year, a big improvement from the 6% to 9% growth originally targeted. It also inched up its capex budget to a range of $2.0 to $2.3 billion from the previous range of $1.9 to $2.2 billion and said it should generate $900 million to $1.1 billion in free cashflow, up from $800 million to $1.1 billion beforehand.

Wickes pays first interim dividend following strong growth

DIY retailer Wickes said it will pay its first interim dividend after delivering strong growth in revenue and profits in the first half, prompting it to become more bullish on its prospects for the rest of the year.

The company reported a 33% jump in revenue in the 26 weeks to June 26 to £812 million, which also came in over 22% higher than pre-pandemic levels as demand to improve homes continues to steam ahead. Its core activities like selling DIY goods saw revenue jump over 35% to £666.7 million while its ‘Do-It-For-Me’ sector – which sees Wickes design and install complete projects like kitchens and bathrooms – reported a 20% rise to £145.3 million.

Notably, DIFM showrooms only reopened in April after having to remained closed during lockdown.

‘Following the re-opening of our DIFM showrooms on the 12 April, ordered sales grew strongly through May and June. Over the summer, DIFM orders have since settled back to be broadly in line with 2019,’ said Wickes.

Adjusted pretax profit soared to £46.5 million from just £14.5 million the year before. At the bottom-line, Wickes escaped the red and booked a £35.7 million profit compared to the £5.5 million loss booked a year earlier.

The improvement prompted Wickes to declare its first interim dividend of 2.1p. Wickes was spun-out of Travis Perkins earlier this year.

Wickes shares were up 2.2% this morning at 239p.

Wickes said its performance online remains strong, with around two-thirds of all sales being made digitally in the period. It also said it was ‘successfully navigating’ the problems being posed by the pandemic and the challenges in the supply chain. However, it did warn the shortage in installers for its DIFM segment means lead times have lengthened, which will result in a higher carry-over of work to its order book into next year.

‘As expected, core performance has moderated as we annualise tough 2020 comparatives, however we continue to see strong year on two year growth driven by notably buoyant demand from local trade and underpinned by our digital capability,’ said the company.

Wickes said it expects to deliver adjusted pretax profit toward the upper end of the £67 to £75 million expected by analysts this year – assuming no more disruption from the pandemic.

Kier Group returns to profit

Kier Group returned to profit in its recently-ended financial year and revealed a significantly stronger balance sheet, putting it on course to deliver its medium-term ambitions.

Kier Group shares were up 2.4% at 128.4p this morning.

Although revenue dropped to £3.26 billion in the year to the end of June 2021 from £3.42 billion the year before, Kier managed to escape the red in the period, returning to a pretax profit of £5.6 million from the hefty £225.3 million loss booked last year.

Kier said revenue was down because it exited a number of low-margin contracts, completed its work upgrading motorways and because of the disruption caused by the pandemic – but said its core business experienced growth.

It also comes after Kier completed its simplification of the group in order to improve cash generation and its balance sheet.

Free cashflow of £93 million represented a marked improvement from the £8 million outflow booked last year, and Kier ended the period with £3 million in net cash. This time last year, Kier had a sizeable net debt position of £310 million. The main drivers of the improvement came from the £350 million raised from selling Kier Living, twinned with £46 million in savings from cutting supply chain financing.

‘The successful capital raise, the recent sale of Kier Living, and the extension of the group's revolving credit facility facility provides Kier with the financial and operational flexibility to continue to pursue its strategic objectives within its chosen markets and will allow it to further enhance and capitalise on its position as a strategic partner to its customers,’ said chief executive Andrew Davies.

‘Current trading is in line with our expectations, and despite inflationary pressures and the impact of increased national insurance contributions, our outlook for the current year remains unchanged. We are now focused on delivering our medium term value creation plan by leveraging our attractive market positions, delivering our high-quality order book and fostering our long-term customer relationships and sector expertise,’ he added.

Kier’s medium-term goals is to deliver £4.0 to £4.5 billion of revenue at an adjusted operating margin of 3.5% whilst also maintaining a sustainable net cash position so it can reinstall dividends with a new policy that will provide 3x cover through the cycle.

Ryanair raises long-term traffic forecasts

Ryanair raised expectations this morning and said it expects traffic to grow 50% over the next five years, up from its previous forecast for 33% growth.

Ryanair shares were up 3% this morning at 1589.8p.

The company, issuing a statement ahead of its AGM today, said pre-pandemic traffic of 149 million passengers is expected to grow to 225 million by March 2026. Previously, Ryanair said traffic would grow closer to 200 million.

Ryanair also confirmed that it will take delivery of 210 B737 Gamechanger aircraft over the next five years, assuming the pandemic does not throw up any more problems for the travel industry. These aircraft will help lower costs and emissions while allowing the airline to accelerate growth as new opportunities arise across Europe as other airlines struggle to survive the pandemic.

‘The performance of the B737 Gamechanger aircraft this summer has exceeded our expectations. Operational reliability, fuel consumption, and lower CO2 emissions have so far exceeded guidelines with very positive passenger and crew feedback to these new, more fuel efficient, quieter aircraft,’ said CEO Michael O’Leary.

‘With these new deliveries, Ryanair will open 10 new bases across Europe this year as we work with airport partners to help them recover traffic & jobs post Covid, and take up slot opportunities that are being vacated by competitor airlines who have collapsed or significantly reduced their fleet sizes,’ he added.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade