Top News: Tesco raises guidance and launches share buyback

Tesco said it delivered faster growth than anticipated in the first half as it continued to outperform its rivals, prompting the UK’s largest supermarket chain to raise its guidance for the full year and launch a new share buyback.

Tesco shares popped 5.4% in early trade this morning to hit their highest level since August 2018.

Revenue rose 5.9% in the first half to £30.4 billion from £28.7 billion last year, coming in slightly ahead of the £30.3 billion expected by analysts. Retail sales were 2.3% higher than last year and some 8.4% above pre-pandemic levels seen in 2019. Tesco outperformed its rivals in the UK and benefited from a sharp recovery for wholesaler Booker, which has seen demand bounce back since hospitality and other venues started to reopen back in April.

Adjusted operating profit jumped over 40% to £1.45 billion from £1.03 billion and also beat the £1.38 billion expected by analysts. Tesco said higher sales in the UK and Ireland and lower costs related to Covid-19 drove profits higher, partly offset by the business rates relief it enjoyed last year.

Pretax profit at the bottom line more than doubled to £1.14 billion from just £551.0 million the year before.

‘We've had a strong six months; sales and profit have grown ahead of expectations, and we've outperformed the market,’ said CEO Ken Murphy.

The company said it is now expecting to deliver annual adjusted operating profit of £2.5 billion to £2.6 billion this year. That would mark a significant rise from the £1.82 billion in profit delivered in the last financial year and be broadly in-line with the £2.53 billion booked in 2019 before the pandemic hit.

‘Although we do not yet know how the external environment and consumer behaviour will evolve in the second half, we have assumed that some of the elevated sales fall away and that we will continue to invest in our customer offer,’ Murphy said.

Tesco kept its ordinary dividend flat from last year at 3.2p per share, but said this is being complimented by a new £500 million share buyback that will be completed over the next 12 months. That came as Tesco unveiled a new capital allocation framework that will see Tesco introduce a progressive dividend going forward targeting a payout of around 50% of annual earnings.

Tesco said it will now use a simpler measure of net debt to Ebitda to understand its leverage, targeting a range of 2.8 to 2.3 times, with that coming in at 2.7 times at the end of the first half. It said annual capital expenditure will remain between £900 million to £1.2 billion per year going forward.

Net debt at the end of the half sat at £10.2 billion, down 18.5% from £12.5 billion a year earlier. That came as free cashflow from its retail operations rose over 93% to £1.54 billion thanks to higher profits, lower pension contributions and a £400 million boost from the phasing of capex.

Tesco said it is aiming to deliver retail cashflow of £1.4 billion to £1.8 billion per year going forward.

Where next for the Tesco share price?

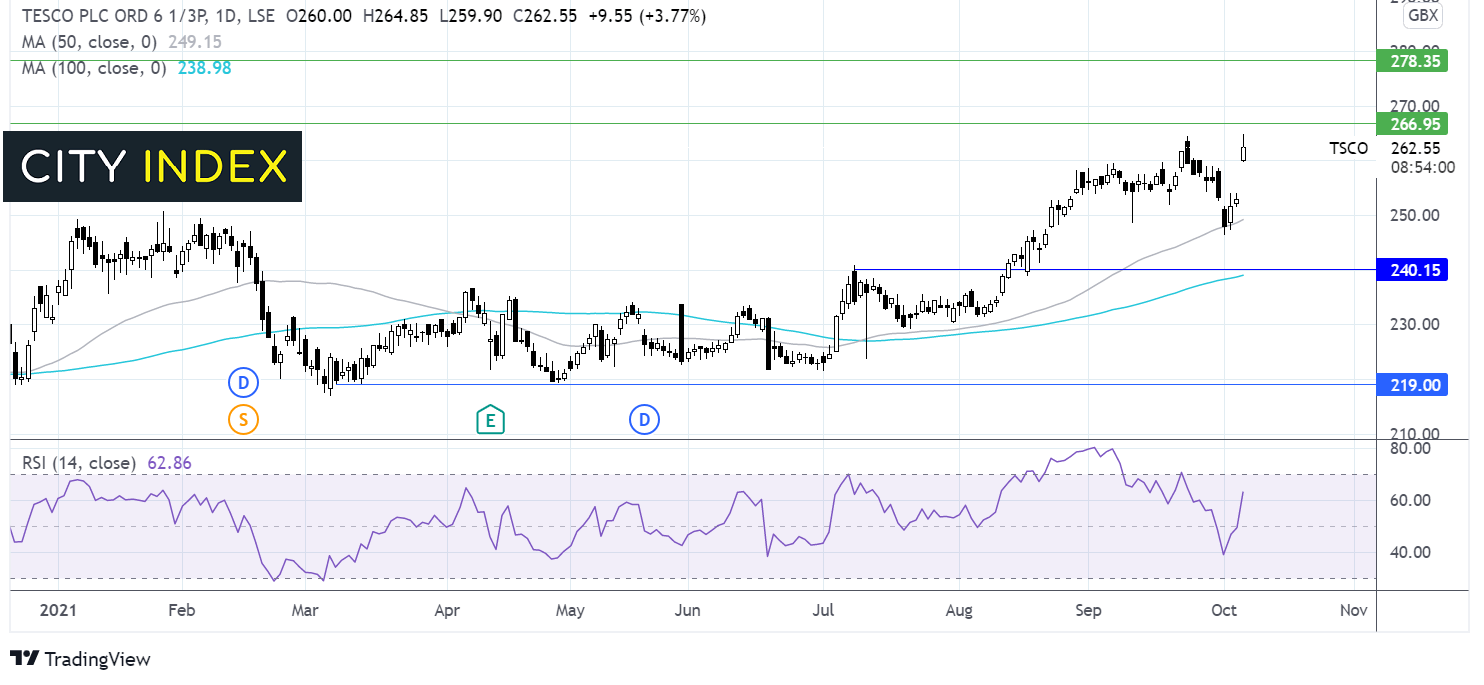

The Tesco share price has been in consolidation mode across most of 2021 capped by 220p on the downside and 240p on the upside.

The price broke out of this range in mid-August, advancing to a high of 264p on September 23. The price rebounded lower from here before finding support on the 50 sma.

Today’s jump higher has seen the share price retest 264p. The RSI is supportive of further upside whilst it remains out of overbought territory.

Beyond 264p, resistance can be seen 267p and then 278p the low April 2014.

On the flipside the 50 sma acts as a key support at 250p, it would take a move below here to negate the near-term uptrend. Below here 240p the horizontal support and 100 sma comes into play.

Lookers ups profit guidance

Lookers said profits will be ‘materially ahead’ of expectations in 2021 after it performed better than anticipated in the third quarter.

Lookers shares were up 5.4% this morning at 64.1p.

The company said the UK new car market declined 31.1% in the third quarter to the end of September but said it still managed to outperform the wider market, with UK new car market registrations down 34.4% in the period. The declines have been partly caused by the widely-reported shortage in semiconductor chips, which Lookers said ‘continued to place increasing pressure throughout Q3 on the supply and availability of new vehicles, with used vehicles in strong demand as a consequence.’

Still, like-for-like used unit sales were down 16.9% year-on-year in the third quarter after coming up against tough comparatives from last year when demand boomed as people opted for solo forms of travel.

‘This was more than offset by unprecedented margin retention driven by ongoing strong customer demand and improvement to the group's stock management processes,’ Lookers said.

Meanwhile, revenue from aftersales proved more resilient and came in just 3.5% lower than last year.

‘The group has a strong new car order bank which is above normalised levels. However there remains material and increasing uncertainty as to the availability of these vehicles which is dependent on specific brand and model related factors. The group continues to work closely with all its OEM brand partners and customers to minimise the impact wherever possible, which is now widely expected to continue into next year,’ said Lookers.

‘Notwithstanding this considerable uncertainty for the final quarter of the year, given the strength of performance in the period, the board now expects underlying profit before tax for 2021 to be materially ahead of its previous expectations,’ it added.

Analysts are currently expecting Lookers to report underlying pretax profit of £66.6 million in 2021, which would be up from £14.1 million in 2020 and just £4.2 million in 2019.

Topps Tiles delivers record revenue and ups expectations

Topps Tiles said it delivered record revenue in its recently-ended financial year, driven by strong demand for home improvement since the start of the pandemic, prompting it to raise expectations.

Topps Tiles shares were up 2.5% this morning at 64.6p.

The tile retailer said revenue in the 53 weeks to October 2 rose to £227.5 million from just £192.8 million the year before. The record performance is impressive considering that it was hit by lockdown restrictions for one quarter of the year.

It said its retail businesses performed well during the final quarter of the year, with like-for-like sales up 3% year-on-year. Still, LfLs in the fourth quarter were still up 21.7% from pre-pandemic levels and that accelerated from the 18.5% two-year growth booked in the third quarter.

Its commercial business has also started to bounce back as the commercial sector reopens. Topps Tiles said it believes it has outperformed the market with sales up 15% during the year.

‘As a result, adjusted profit before tax is now expected to be slightly above consensus forecasts for the financial year,’ said Topps Tiles.

‘As previously disclosed, the board expects to reinstate dividend payments at the end of the year, with a final dividend payment relating to the whole financial year, rather than just the second half,’ Topps Tiles said.

Imperial Brands remains on course to hit expectations

Tobacco giant Imperial Brands said it will meet expectations when it releases annual results next month, revealing that both revenue and earnings grew.

The company, releasing a pre-close update ahead of publishing its annual results on November 16, said revenue is expected to grow 1% on an organic, constant currency basis during the year to the end of September, driven by higher tobacco prices.

Meanwhile, growth in adjusted organic operating profit is expected to be in-line with the mid-single digit constant currency growth the company targeted. This improvement has been driven by reduced losses from its next-generation products such as heated tobacco and an increase in profit from its distribution arm. That offset lower profit from its core tobacco business as a result of increased investment, a £90 million hit from lower profits in Australia, and £50 million in litigation costs in the US. It said foreign exchange rates will provide a 3% headwind to annual EPS.

Imperial Brands said tobacco volumes have been in line with expectations and that it gained market share in terms of cigarette volumes.

‘The net effect of the COVID-19 travel restrictions and changes in consumer buying patterns has been a small mix benefit, although this is beginning to reduce as restrictions are lifted and is likely to unwind further in FY22,’ Imperial Brands said.

Meanwhile, its next-generation products saw revenue in the second half come in largely level with the first as it rejigs its focus to countries that offer the best potential for sustainable growth.

‘In line with our strategy, we have launched market trials for our heated tobacco proposition in the Czech Republic and Greece, as well as a trial of an improved consumer marketing proposition for our vapour product, blu, in Charlotte, North Carolina. We will be monitoring the consumer response to these trials over the coming months and will update on progress during 2022,’ said the company.

Imperial Brands shares were down 1.5% this morning at 1532.8p.

TUI launches rights issue as trading improves

TUI said it is raising EUR1.1 billion to help strengthen the balance sheet as it reported a continued improvement in bookings over recent months.

The travel company is raising the funds through a fully-underwritten capital increase that will see it offer 523.5 million new shares to existing investors, which will be able to subscribe to 10 new shares for every 21 existing shares they hold.

TUI shares were up 0.5% this morning at 329.3p.

The company said its largest shareholder Unifirm Holdings, which owns 32% of TUI, has supported the plan and will take up all of its rights.

TUI said the funds will help bolster the balance sheet and give it more firepower so it can ‘maximise long-term opportunities’. It will bump-up its cash and available facilities to EUR4.5 billion from around EUR3.4 billion at present. TUI plans to reduce the amount drawn from its KfW revolving credit facilities to just EUR375 million from around EUR3.0 billion.

‘The offering will enable us to take a significant step forward, increasing our ability to take advantage of the business opportunities resulting from the easing of Covid-19 restrictions. It will provide us with a capital structure more appropriate for more normal operating conditions,’ said CEO Friedrich Joussen.

TUI also provided a trading update for the year to the end of September that revealed demand has continued to steadily improve in recent months. It said over 2.6 million customers took a TUI holiday during July and August, up from just 1.3 million in the same period a year ago, while its Summer 21 programme reported 5.2 million bookings – up from 3.9 million at the end of the third quarter. It said Summer 21 bookings in Germany and Netherlands had been above pre-pandemic levels seen in 2019 in recent weeks.

‘This reflects the higher level of confidence in departure in our Continental European markets with load factor improvement in the last two to three weeks before departure evident of the short-term booking trend and pent-up demand for our holidays,’ said TUI.

Still, TUI said it flexed capacity during the peak summer period to just 50% to 60% of normal levels due to ‘subdued UK bookings’.

‘For peak summer period to date (July to October), we have so far operated a capacity of 42% for July and 48% for August. In contrast to our Continental European markets, UK departures have remained largely subdued since our last update, with a nearly unchanged traffic light system limiting the return of popular destinations such as Turkey, Egypt and the Dominican Republic. As a result, we now expect to operate a capacity for peak summer period (July to October) of between 50% and 60%,’ TUI said.

Looking forward, it said Winter 21/22 bookings in the UK were ‘trending strongly’ since the last update to travel restrictions earlier this month. Bookings at this stage are equal to 54% of what was delivered in the 18/19 Winter season but average selling prices have jumped 14%.

‘With travel restrictions now largely lifted for short and medium-haul winter destinations in our key markets, and supported by the increasing vaccination rates of the EU and UK adult population, we expect a wider return to international travel this Winter 2021/22. Subsequently we expect capacity will be significantly better than the previous Winter 2020/21 season and we would at this stage plan to operate between 60% to 80% of a normalised programme, with long-haul destinations expected to recover more slowly,’ TUI said.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade