Top News: Hurricane Ida and rising gas and power prices to hit Shell

Royal Dutch Shell warned this morning that adjusted earnings and cashflow from operations will be hit by around $400 million in the third quarter due to the impact of Hurricane Ida which hit the Gulf of Mexico in August, while soaring gas and power prices are also taking its toll.

The hurricane was regarded as one of the most devastating in the last decade, wreaking havoc on offshore oil production in the hub of the US Gulf of Mexico. Offshore platforms had to be abandoned until it blew over and caused multiple oil spills in the region, while onshore refineries were also significantly disrupted.

Shell said its integrated gas division is expected to deliver 890,000 to 950,000 barrels of oil equivalent during the third quarter while LNG liquification volumes will be between 7.0 to 7.5 million tonnes, with both slightly lower than in the second quarter. Still, it said trading will sequentially improve from the previous quarter but warned cashflow from integrated gas will be ‘significantly impacted’ by the chaotic gas and electricity price environment.

Its upstream division is expected to see production of 2.02 to 2.10 million barrels of oil equivalent per day, having lost around 90,000 barrels of daily output due to the hurricane. That will be twinned with a rise of $100 million to $350 million in underlying operating expenditure compared to the second quarter.

Upstream earnings will also be hit by $300 million to $400 million of well write-offs, with Hurricane Ida to cause another hit of between $200 million to $300 million. However, Shell said the spike in gas prices is not expected to significantly impact earnings.

Elsewhere, Shell said the hurricane will cause a $50 million to $100 million hit to adjusted earnings from oil products, and a $100 million hit to earnings from chemicals.

Where next for the Shell share price?

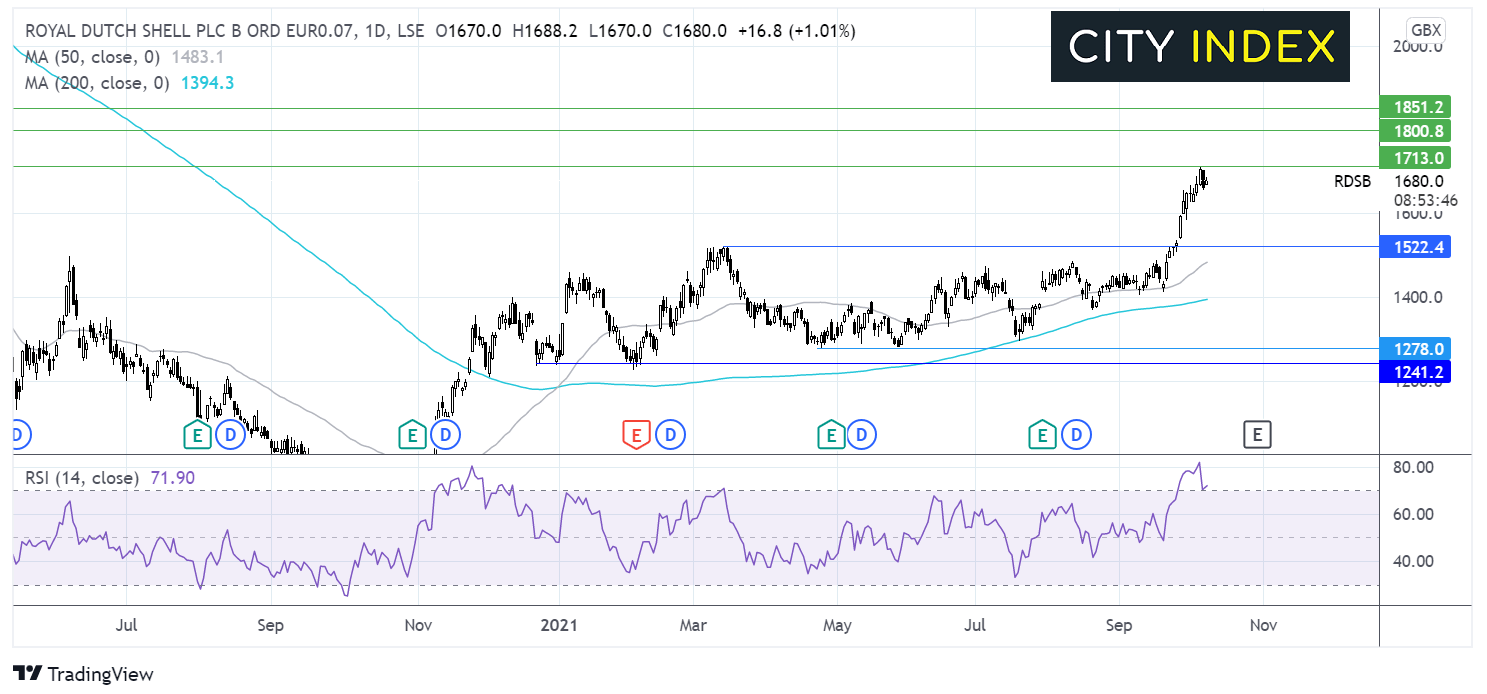

The Royal Dutch Shell share price is extending a breakout, trading at fresh post pandemic highs, after trading in a holding pattern for much of 2021. The price has been capped on the upside by 1520p and on the lower side by 1275p since March.

The breakout which started on September 27 has extended hitting resistance at 1715p the daily high.

The RSI is firmly in overbought territory so there could be some consolidation or a slight move lower from here.

A move beyond 1715p could see the bulls target 1800p round number and 1850p high April 2016.

On the downside support can be seen at 1520p. A break below here could expose the 50 sma at 1475p and the 200sma at 1395p. It would take a move below this level to negate the recent uptrend.

Mondi earnings jump but warns cost increases are intensifying

Mondi said earnings jumped 27% year-on-year in the third quarter as it reaped the reward of higher volumes and prices for its packaging, but warned rising input costs and planned maintenance shutdowns will hit its performance in the fourth.

Mondi shares were up 0.6% in early trade at 1801.5p.

The company said underlying Ebitda in the third quarter came in at EUR388 million, up 27% from the EUR306 million reported the year before and rising 9% from the EUR356 million booked in the second quarter.

It said demand for corrugated packaging and flexible packaging remained strong, with tight supplies facilitating higher prices. Demand for engineered materials remained ‘stable’ and saw volumes grow, while uncoated fine paper volumes and prices also improved.

‘Mondi delivered a strong performance in the third quarter with higher average prices across the business and strong volume growth year-on-year, against a backdrop of sharply higher input costs. Throughout this period of high demand, we remained focused on ensuring security of supply and high-quality service for our customers,’ said CEO Andrew King.

Mondi said input costs were significantly higher in the quarter. Compared to last year, Mondi said energy, resin, transport and chemical costs all experienced large increases. Plus, although recycling rates remained ‘mostly stable’ in the period, it warned they started to increase as it entered the fourth quarter. It said it expected the spike in European energy costs to continue in the fourth quarter.

The fourth quarter will also suffer from planned maintenance work. Scheduled maintenance knocked EUR30 million off underlying Ebitda in the third quarter but this is expected to rise to EUR70 million in the fourth.

‘Demand remains strong and we are implementing price increases across the business that will support the recovery of ongoing inflationary pressures. While in the short term the fourth quarter will be impacted by recent input cost increases alongside planned maintenance and project-related shuts, the Group remains well-placed to deliver sustainably into the future, supported by our leading offering of sustainable packaging solutions, integrated cost-advantaged asset base and culture of continuous improvement,’ said Mondi.

Carnival moves toward ambition to be fully operational by spring

Carnival said Carnival Cruise Line will have 90% of its US-based capacity operational by February as it gradually restarts cruises, helping achieve its ambitions to have all of the unit’s US operations back up and running by the spring of 2022.

Carnival Cruise Line, the largest of the company’s nine brands, will have 17 of its ships in operation before the end of 2021, followed by Carnival Sunshine launching in January and Carnival Liberty restarting in February.

That will mean just three of the unit’s ships will be offline by the end of February 2022, having cancelled cruises through February on the Carnival Ecstasy, Carnival Paradise and Carnival Sensation. It also said this morning that cruises scheduled in Australia during February on the Carnival Splendor and Carnival Spirit have been cancelled.

"Our restart plan continues to excel across all metrics, and we are looking forward to completing the restart of the fleet in the new year,’ said Christine Duffy, president of Carnival Cruise Line.

Carnival has previously said it wants to be fully operational across all of its brands again by spring 2022.

Carnival shares were up 1.4% this morning at 1673.5p.

Workspace Group says London is coming back to life

Workspace Group said London has started to come back to life as people gradually return to offices, delivering improved utilisation and occupancy figures and a rise in new enquiries.

Workspace shares were up 1.8% this morning at 813.0p.

The flexible office space provider said there was a ‘significant increase’ in the number of customers returning to offices in the second quarter of its financial year, with utilisation peaking at 56% of pre-pandemic levels before the end of September. Plus, interest from potential new customers has also improved in the second quarter with an average of 935 enquiries and 138 new lettings secured per month throughout the period.

It said it managed to collect 97% of all rent due in the quarter, which is well ahead of the collection rate reported last year. Like-for-like rent roll improved 2.1% during the first six months of the year to £87.3 million, driven by improved occupancy levels and more stable prices.

LfL occupancy rose 2.7% in the first half to 85.6%, having bounced back from the 81.9% low seen in March 2021 when the pandemic erupted. Meanwhile, LfL average rent per square foot edged up 0.3% in the second quarter to £35.50, having dropped 2.3% in the first.

‘It's great to see London coming back to life, and our latest utilisation and occupancy figures show that London's SMEs are leading the way back to the office and are optimistic about the future. These are positive signs of momentum and further proof that our truly flexible offering is resonating in the evolving working world,’ said CEO Graham Clemett.

‘The pandemic has made people appreciate that not all offices are created equal. More than ever, the right office space in a great location with strong sustainability credentials and flexibility really matters to our customers and their employees. We're perfectly positioned to benefit from this shift and we're very excited about the future as we continue to expand our property footprint across London,’ he added.

CMA drops investigation into British Airways and Ryanair

The Competition & Markets Authority said it will not pursue IAG’s British Airways and Ryanair to refund customers that were prevented from flying while Covid-19 travel restrictions were in place because of a ‘lack of clarity in the law’.

The CMA launched an investigation back in June over concerns they had broken the law by failing to offer refunds to customers that could not legally take their flights during lockdown, with British Airways offering vouchers or the opportunity to rebook, while Ryanair only allowed customers to rebook their flights.

‘After a thorough examination of relevant law, and the evidence it had gathered during its investigation, the CMA has concluded that the law does not provide passengers with a sufficiently clear right to a refund in these unusual circumstances to justify continuing with the case,’ the regulator said.

‘Consumer protection law sets out that passengers are entitled to refunds when an airline cancels a flight, because the firm cannot provide its contracted services. However, it does not clearly cover whether people should be refunded when their flight goes ahead but they are legally prohibited from taking it,’ the CMA added.

The CMA said, as a result, it can not justify prolonging the investigation ‘given the length of time it would take to reach an outcome in the courts and the uncertain outcome.’ It has therefore decided to close the investigation.

Ryanair shares were up 2.1% this morning while IAG shares were trading 0.8% higher.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade