Top UK Stocks | Prudential Shares | SSE Shares | Redde Northgate Shares | Keywords Studios Shares | Wilmington Shares

Top News: Prudential looks to bolster Asian investor base

Prudential has unveiled plans to raise cash by issuing new shares in Hong Kong as it looks to grow its shareholder base in Asia and improve liquidity of its shares.

The company had said it was considering raising new equity after it completed the demerger of its US business earlier this month. Prudential has now decided to raise up to 5% of its issued share capital, equal to up to 130.8 million shares, in Hong Kong, and said it could issue up to another 32.7 million new shares depending on demand.

The final price is expected to be determined this Saturday, but will be capped at HKD172. At that price, Prudential is planning to raise around HKD22.5 billion, equal to around $2.9 billion.

The new shares are expected to start trading on the Main Board of the Hong Kong Stock Exchange on Monday October 4.

Prudential currently has a primary listing in both London and Hong Kong, with secondary listings in Singapore and New York.

Prudential said the proceeds of the share offer will be used to improve its financial flexibility by redeeming $2.3 billion of high-interest debt. The remaining funds will be invested in Asia and Africa, where Prudential believes the long-term growth potential is the greatest. Prudential is aiming to increase its customer base in the two regions from 17 million today to 50 million by 2025, according to reports from Bloomberg.

‘The board believes that there are clear benefits to the group and to its shareholders as a whole from increasing its Asian shareholder base and the liquidity of its shares in Hong Kong and intends to take these factors into account in the allocation of the placing,’ said Prudential.

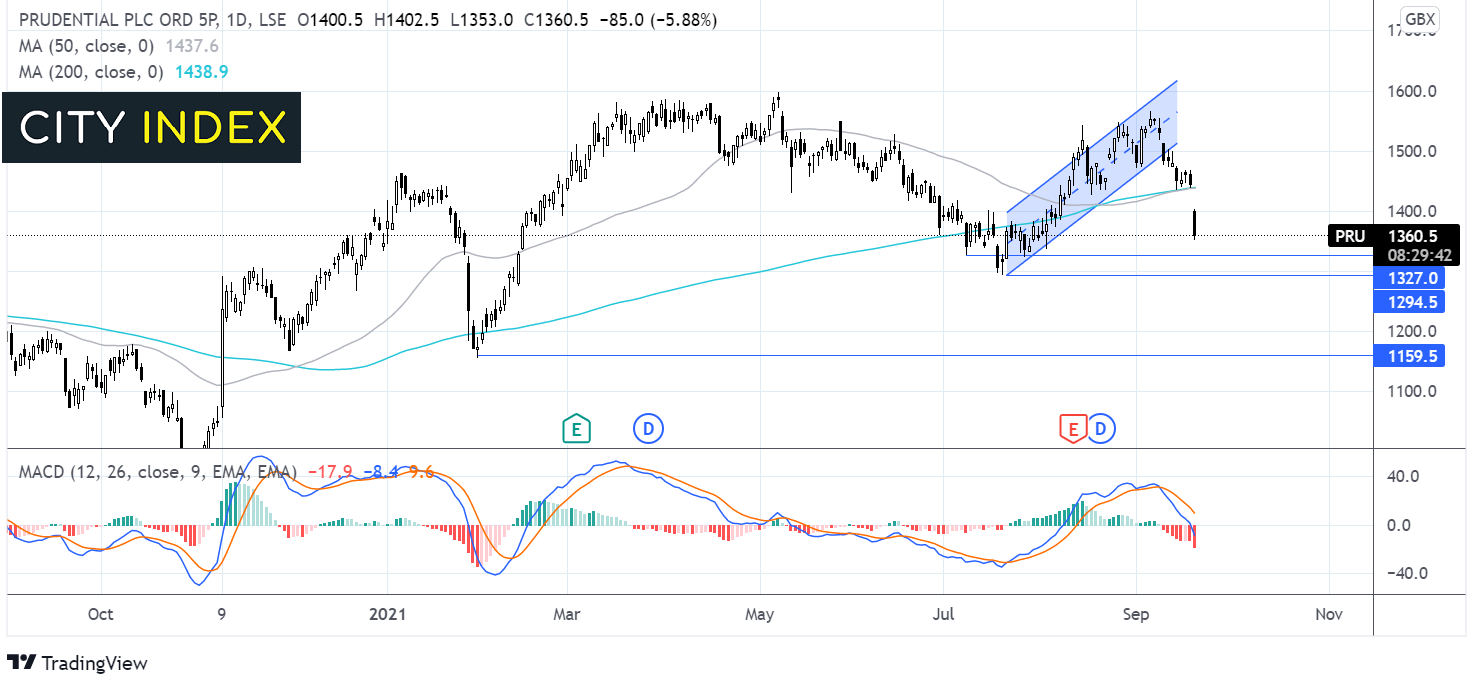

Where next for the Prudential share price?

The Prudential share price had been trading in a rising channel since late July. Earlier this month the price broke out below the channel before finding support on the 50 sma.

The breaking down of the 200 &50 sma combined with the bearish MACD is keeping seller’s hopeful of further downside.

Immediate support can be seen at 1330p the July 8 low, ahead of 1292p the July low. A break below here could open the door to a deeper selloff.

Any recovery in the share price would need to retake 1440p the confluence of the 50& 200 sma which could prove a tough nut to crack.

Energy crisis: stocks to watch

The weekend has been dominated by news of an energy crisis, driven by a surge in wholesale natural gas prices and threatening several major industries.

A perfect storm of rising demand and constrained supply has sent wholesale gas prices soaring, prompting concerns as the UK enters Autumn and approaches Winter. Demand is on the up as the seasons change and the economy continues to recover from the pandemic, whilst supplies are proving inflexible thanks to low gas storage, high carbon prices and delivery disruption.

The immediate sector to watch is utilities. A combination of rising wholesale prices and the price cap that protects millions on standard variable tariffs means many simply cannot cope with the market conditions right now.

The government is now holding emergency talks to help smaller suppliers from collapsing, but some have already faltered. This should cut competition for the bigger and more established players like Centrica’s British Gas, which was down 1.1% this morning at 50.53p. However, it could also mean fewer deals are available for price comparison sites like Moneysupermarket.com, which was down 3.7% this morning at 231.5p.

The problems will have a notable knock-on effect for other industries, such as the meat market. Industry representatives have warned that there is a shortage in the carbon dioxide that is used to stun animals before slaughter and to package meat products. Traditionally, this CO2 is produced as a by-product of fertiliser, but many plants have had to close or halt production due to the rise in gas prices. Sky News reported that there is now a 60% shortage of CO2 in the UK as a result, and said those in Europe are also struggling. This will put the likes of sausage maker Cranswick (down 1.9%) and casing maker Devro (down 1.1%) under the spotlight today.

SSE says there is no plan split up the business

Meanwhile, SSE released a statement this morning that said ‘there has been no decision to break up’ the business.

A number of media reports surfaced last week that suggested SSE was facing increasing pressure to spin-off its renewable energy division to leave it focused on being one of the country’s largest electricity suppliers. That comes after activist investor Elliott Advisors built up a sizeable stake in the company.

‘There has been no decision to break up the SSE Group. The board remains fully focused on strategic choices which will drive shareholder value from the wealth of net zero opportunities the company is creating,’ SSE said in a statement this morning.

SSE said both its businesses have great growth potential and compliment one another. It said it was ‘building more offshore wind than any company in the world, expanding internationally, and investing in the low-carbon electricity infrastructure that society needs.’

‘We have been making excellent progress with our clear net zero-aligned strategy, centred on electricity networks, renewables and other carefully chosen businesses that help provide the low-carbon electricity infrastructure that government and wider society requires. SSE is the UK's national low-carbon energy champion, delivering for both our shareholders and society and we look forward to updating investors on our plans to accelerate growth and create value in due course,’ said chief executive Alistair Phillips-Davies.

SSE shares were down 0.2% this morning at 1636.0p.

Wilmington restarts payouts after tough year

Wilmington reinstated its dividend and said it remains encouraged by current trading after successfully digitising its business during the pandemic, allowing it to deliver a resilient performance in a tough year.

Revenue came in flat year-on-year at £113.0 million in the year to the end of June and organic growth increased 3%. The company suffered when lockdown prevented it from providing face-to-face training or holding events, but it swiftly acted to digitise its products, demonstrated by the fact revenue excluding events from both its Information & Data and Training & Education divisions improved year-on-year.

Adjusted pretax profit – its headline earnings measure – was up 27% to £15.0 million thanks to a focus on cutting costs and improving efficiency by shifting its business online. Still, it reported a loss before tax at the bottom-line of £2.0 million, having sunk from a £6.4 million profit last year.

The performance prompted Wilmington to reinstate its dividend after suspending payouts during the pandemic. It will pay a final dividend of 3.9 pence, taking the total payout for the year to 6.0p.

‘We have continued to refine and embed our digital capabilities across the business. This reflects our ambition to create a fully digital enterprise whilst retaining the flexibility to offer our customers face-to-face and hybrid solutions,’ said CEO Mark Milner. ‘These strong results with profitability up 27% demonstrate the continued and growing demand for our information and data products, despite the disruption caused by the pandemic.’

‘We are now at an inflexion point with a simplified portfolio and are well positioned to address large and growing markets which are increasingly online,’ he added.

Wilmington said it was encouraged by trading in the first two months of the new financial year and said revenue and profits were both in line with expectations.

Wilmington shares were down 1.7% this morning at 220.1p.

Redde Northgate builds momentum with new contracts

Redde Northgate said it has signed a number of new contracts for its mobility platform, building on the momentum delivered this year.

‘Since our last update on 7 July, the business has signed a number of new, sizeable, multi-year contracts for services from our mobility platform which will go live in mid calendar year 2022. These new contracts draw on products and services from across the group and underline the value of our unique and unrivalled growing mobility solutions platform which we believe can be scaled significantly,’ said the company.

That last update was when Redde Northgate reported annual results for the year to the end of April 2021, revealing revenue and underlying profits both jumped more than 50%.

The update came ahead of Redde Northgate’s annual general meeting later today. It said it will report interim results for the six months to the end of October sometime in early December.

Redde Northgate shares were up 2.1% this morning at 430.5p.

Keywords Studios appoints new chief executive

Keywords Studios said Bertrand Bodson will take over as the company’s new chief executive at the start of December.

Keywords Studios shares were down 2.2% in early trade this morning at 3032.0p.

The company, which provides support and services to the video game industry, has been searching for a new CEO since Andrew Day brought forward his retirement plan back in June.

Bodson is joining Keywords Studios from global healthcare giant Novartis, where he has been chief digital officer since 2018 and led the company’s digital transformation. Previously, he has also worked as chief digital and chief marketing officer at Argos, part of Sainsbury’s, helping lead the integration of the catalogue store into the UK supermarket chain.

Bodson is currently a non-executive at Tesco and Wolters Kluwer.

‘Bertrand brings an ideal skillset to leading our ambitious, international business given the breadth of his experience in shaping and executing growth strategies and engendering strong cultures at some of the world's leading businesses. This expertise will be invaluable as we continue to grow across multiple territories to cement our position as the 'go-to' provider of scale within our industry, globally,’ said chairman Ross Graham.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade