Top UK Stocks to Watch: Ocado disappoints despite stellar growth

Top News: Ocado Group grows topline and shrinks losses during pandemic

Ocado Group delivered strong growth from both its online grocery operations and from providing tech and support to partners during the pandemic in 2020, allowing it to post a considerably smaller annual loss.

Ocado Group said revenue from its grocery operations jumped 35% in the year to £2.18 billion from £1.61 billion the year before. Meanwhile, revenue from partners using its technology rose 16% to £670.9 million from £576.5 million, driven by strong growth both in the UK and abroad.

Earnings before interest, tax, depreciation and amortisation was almost 69% higher year-on-year at £73.1 million from £43.3 million. Ocado remained in the red at the bottom-line but the pretax loss narrowed significantly to just £44 million from £214.5 million in 2019.

While the results show a marked improvement from the year before, they did miss expectations for revenue of £2.3 billion and Ebitda of £123.8 million, causing shares to slump in early trade.

Looking ahead, Ocado said the revenue growth its grocery operations can deliver in 2021 will depend on how long lockdown restrictions last, but said it will have increased capacity as it brings three new customer fulfilment centres online. It expects revenue from its UK partners to deliver ‘double digit percentage revenue growth’ and for revenue from international partners to jump around £50 million – a huge jump considering revenue only totalled £16.6 million in 2020.

Revenue this year will also benefit by around £30 million in 2021 from the acquisition of Kindred Systems and Haddington Dynamics. However, Ebitda will remain under strain thanks to coronavirus, investing in capacity and because it intends to spend around £700 million in capital expenditure this year.

Where next for the Ocado share price?

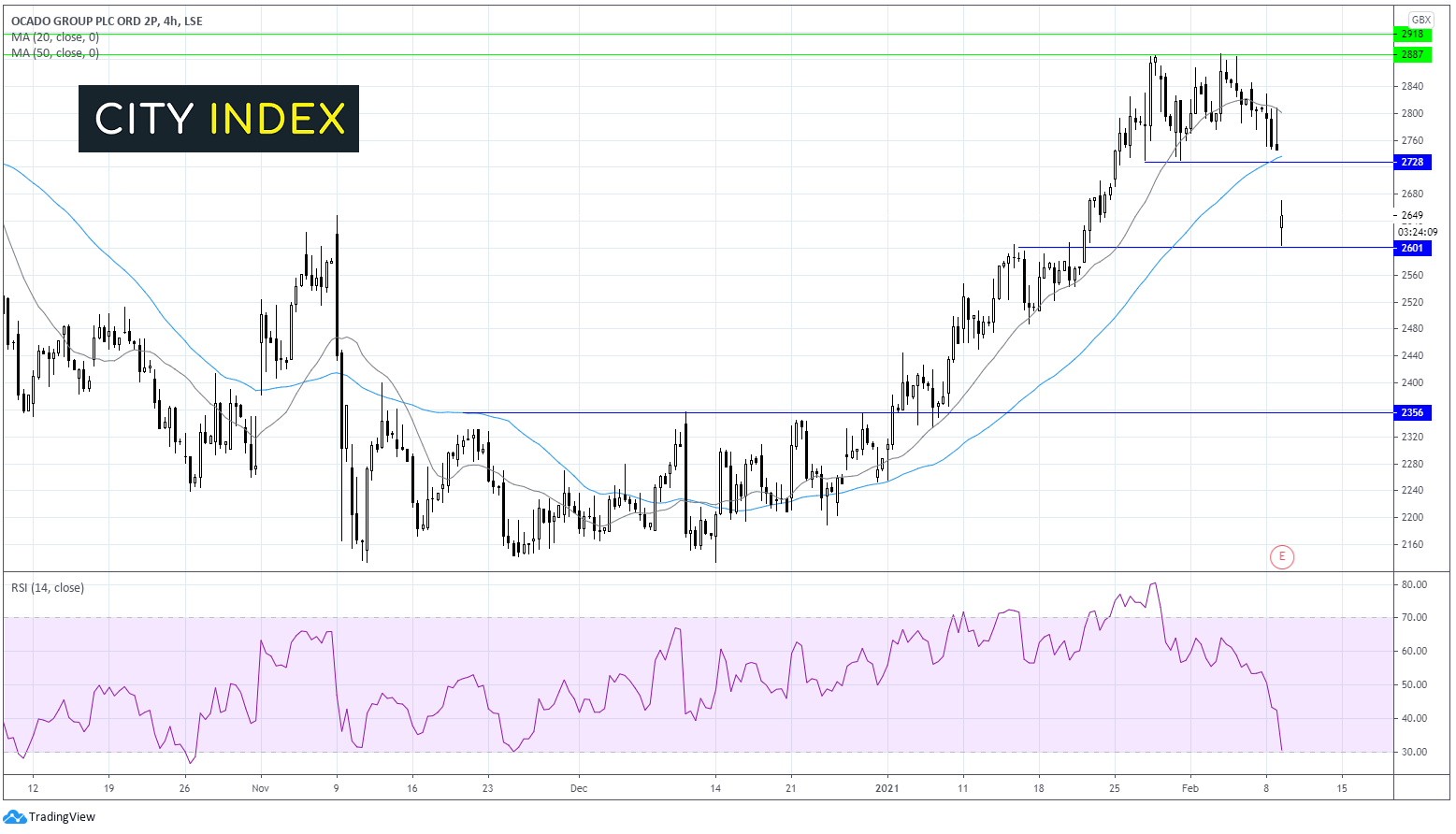

Ocado shares had been on the rise across the start of 2021. However, it failed on several attempts to push past resistance at 2890. Instead trading within a horizontal channel capped by 2890 and 2730 on the lower band.

Today’s 4% drop has seen the price break out of this channel hitting support at 2600. The RSI is teetering on oversold territory suggesting that further losses are unlikely at the moment.

Furthermore, the long wick on the candle shows that whilst the sellers were able to push the price lower, the buyers were able to drive the price back up off the lows. There exists the potential that the buyers strength could continue leading to additional recovery of the price from today’s lows.

The buyers will be looking back towards 2730 the lower band of the channel and the 50 sma.

However, a fall below 2600 could see the selloff gain traction and test 2520 low 20th Jan, prior to 2450 (low 12th Jan, high 5th Jan).

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Halma appoints Louise Makin as new chair

Halma said it has appointed Louise Makin as the new chair of the business.

Makin has joined the board as a non-executive with immediate effect and she will take up her role as chair in July, when existing chair Paul Walker will step down after eight years in the role.

Makin was formerly the chief executive of specialist healthcare firm BTG, where she helped oversee the company grow from being worth just $150 million to $4.2 billion before it was sold-off to Boston Scientific in 2019.

Notably, Makin holds a number of non-executive roles and Halma said she will step down from her position at FTSE 100 peer Intertek this year.

Halma shares were down 0.9% in early trade at 2459.0.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

TUI plunged into the red but has high hopes for summer 2021

TUI was plunged into the red during a tough 2020 thanks to the pandemic, but said there would be ‘significant upside’ if travel restrictions are eased before Easter and that it intends to run at 80% capacity during the busy summer season this year.

Travel restrictions has hammered TUI from every angle. The number of people flying has plunged, cruises have been cancelled, stays at hotels and resorts has unsurprisingly fallen and people have struggled to gather the confidence to book holidays.

TUI said revenue in the three months to the end of December – representing the first quarter of its financial year – fell 88% to EUR468.1 million from EUR3.85 billion the year before.

Earnings were hit across the board and every segment of the business was plunged into the red. Overall, TUI reported an underlying loss before interest and tax of EUR698.6 million compared to a EUR146.7 million loss the year before.

The underlying Ebitda loss was EUR497.6 million, swinging from a EUR189.8 million profit the year before. The overall loss for the quarter swelled to EUR813.1 million from EUR105.4 million.

TUI said the quarterly results reflect ‘minimal operations’ as it hunkers down until travel get back on its feet. The company raised £1.8 billion in its third round of support funding and says it has enough liquidity to bridge the gap until summer 2021, when it hopes the industry will be starting to recover.

Notably, TUI said it expects to operate at 80% usual capacity in the summer 2021 season after 2.8 million people booked trips for later this year. It said average daily bookings were 70% higher in January than they were in December, signalling that people are growing more confident when planning breaks this year. Still, TUI said the uncertainty of the situation means it can not provide financial guidance for the remainder of the financial year.

TUI shares were down 0.3% in early trade at 331.0.

Micro Focus reinstates dividend during turnaround

Micro Focus saw revenue and earnings suffer as expected during the last financial year as it continues with its turnaround plan and booked large impairments, but said it has reinstated the dividend because it has still performed better than expected.

The company, which provides software to businesses, completed the first year of a three-year turnaround programme during the 12 months to the end of October, resulting in lower revenue and earnings.

Revenue in the year fell 10% to $3.0 billion and adjusted earnings before interest, tax, depreciation and amortisation dropped to $1.2 billion from $1.4 billion. Revenue dropped in line with expectations while earnings were ‘toward the upper end of expectations, driven by tight operational cost control and several cost reduction programmes’.

Micro Focus also warned that it booked a huge $2.79 billion impairment to reflect changes in its performance and outlook compared to when it bought Hewlett Packard Enterprise’s software business in 2017. That pushed Micro Focus to a $2.96 billion loss for the year compared to a $1.46 billion profit the year before.

Notably, the impairment has not impacted its ability to generate cash, with operating cashflow remaining flat year-on-year at $1.1 billion, largely thanks to the fact much of its revenue comes from long-term contracts. The company said, thanks to its strong cash performance, that it has reinstated its dividend and will pay a final payout of 15.5 cents per share.

‘We are now 12 months into our three-year turnaround plan and whilst there remains a great deal to do, we have made solid progress in delivery of our key strategic objectives and improvements in operational effectiveness,’ said chief executive Stephen Murdoch.

Micro Focus shares were up 3.5% in early trade at 508.2.

St Modwen Properties ups dividend despite tough 2020

St Modwen Properties has hiked its dividend for 2020 despite seeing its net asset value slump and swinging to a hefty loss during the year.

The company, which invests in and develops various types of properties spanning houses, logistics and land regeneration, said its net asset value per share at the end of 2020 stood at 427.7 pence, down from 484.2p at the end of 2019.

St Modwen sank to an annual loss of £120.8 million from a £49.5 million profit in 2019, causing a loss per share of 54.7p from a 22.8p profit.

‘Our strategy is focused on two sectors, logistics and housebuilding, where structural demand is growing, acknowledging that the economic outlook is uncertain. These sectors make up 78% of our portfolio today and will represent over 90% within three years. In both, momentum is strong, and we have an attractive pipeline to accelerate growth,’ said chief executive Sarwjit Sambhi.

‘As we continue to recycle capital out of low-returning assets, grow our logistics portfolio and build on our high-quality housebuilding platform, we expect this to result in an increase in adjusted EPRA EPS to c. 28 pence and a total accounting return of c. 9-10% in the medium term. Assuming no material disruption in trading conditions, we expect adjusted EPRA EPS for 2021 to be close to 2019 levels,’ the CEO added.

St Modwen shares were up 1.1% in early trade at 398.0.

Bellway builds record number of houses as it eyes improved margins

Bellway said it built a record number of houses during the first half of its financial year and that forward sales have continued to build, as it aims to improve profitability during the rest of the year.

The company said it built 5,656 new homes in the six months to the end of January, a new record for the business and up 6.3% from the 5,321 homes completed the year before. Housing revenue rose 12% as a result to around £1.71 billion from £1.52 billion, having also benefited from a 5.8% increase in average selling prices to £303,200.

Bellway said demand has remained strong, with a 3.3% rise in the private reservation rate during the period to 156 per week from 151. It now has an order book for 5,889 homes worth £1.62 billion compared to just 4,598 homes worth $1.16 billion a year earlier.

As a result of the strong performance, Bellway said it now expects to build 9,800 homes over the full financial year – which would represent a huge 30% year-on-year jump if delivered. It also said it expects its underlying operating margin to improve by ‘at least’ 200 basis points from the 14.5% delivered in the last financial year.

‘Looking forward, we have a sizeable forward order book, which provides a solid platform for the second half of the financial year and beyond. In addition, our balance sheet is strong, with significant cash resource and this provides the group with the necessary resilience and flexibility to respond positively to the evolving economic environment,’ said chief executive Jason Honeyman.

Bellway warned there is still significant uncertainty plaguing the market, citing rising unemployment as one potential headwind in addition to the end of the stamp duty holiday at the end of March 2021 and changes to the Help-to-Buy scheme.

‘Beyond this financial year, Bellway is in a robust position. Its long-term approach, strong operational focus and offering of high-quality homes should enable it to continue meeting underlying market demand. At the same time, our strong financial position and flexible capital structure provides ongoing resilience to respond to any unexpected changes in the economic environment,’ Bellway said.

Bellway shares were up 3.5% in early trade at 3132.5.

G4S says cashflow, revenue and profits remain resilient in 2020

G4S said it continued to deliver a resilient performance in the final quarter of 2020.

The company said revenue in the final three months of the year was in-line with what was experienced during the first nine months of the year and that profit margins ‘held up well’. G4S said it won new contracts with annual revenue worth £3.0 billion in 2020 as a whole, up from £2.5 billion in 2019.

‘Our teams also produced an exceptional commercial performance with new and retained contract wins that have a total revenue value of £5.5 billion. These wins reflect the competitive strength of G4S’s integrated service offerings and provide strong support for G4S’s growth plans,’ said chief executive Ashley Almanza.

It said its net cashflow generation remained strong and that it ended 2020 with net debt to Ebitda within its desired 2.0x to 2.5x range. It said cashflow benefited from the furlough scheme and other tax deferrals worth around £110 million in total. Notably, it expects that to reverse by around £80 million in 2021, but said this will be more than covered by £100 million of disposal proceeds due before the end of March.

G4S shares were trading flat in early trade at 261.1.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade