Top UK Stocks | Next Shares | SSP Shares | AstraZeneca Shares | SSE Shares

Top News: Next ups profit guidance as sales growth accelerates

Next raised its guidance for the fourth time in the last six months this morning after making a better-than-expected start to the second half, driven by customers returning to its stores since they reopened in April.

Next shares were up 2.7% in early trade this morning and hovering near all-time highs hit earlier this year.

Full price sales were up 8.8% compared to pre-pandemic levels and 62% higher than last year when demand was heavily hit during lockdown. Notably, Next said full price sales growth has accelerated to 20% in the last eight weeks – well ahead of the 6% rise expected in the second half.

That came as Next revealed revenue rose to £2.11 billion in the six months to the end of July from £1.33 billion the year before, when sales were hit because stores were closed. Next posted a pretax profit of £346.7 million compared to the £16.5 million loss booked last year. Profit was also 5.9% ahead of 2019. Basic EPS of 226.8p turned from a 9.0p loss last year and also came in 8.5% higher than before than pandemic.

The topline narrowly missed the £2.17 billion forecast by analysts but EPS was better than the 219.18p forecast.

The better-than-anticipated start to the second half prompted Next to raise its guidance for the full year yet again. It is now aiming for full price sales to grow 10.7% from pre-pandemic levels this year.

It said it is now expecting to deliver annual pretax profit of around £800 million rather than its previous goal of £764 million. Basic EPS is expected to rise 9% from pre-pandemic levels this year to 516.9p.

Next said it is expecting to generate around £348 million in surplus cash over the full year and said it would make a decision on any further dividends toward the end of the year, having made a 110p special payout in July worth £140 million. Next previously said it was looking to return around £240 million to shareholders this year. Ordinary dividends will not return until the next financial year, Next confirmed.

Where next for the Next share price?

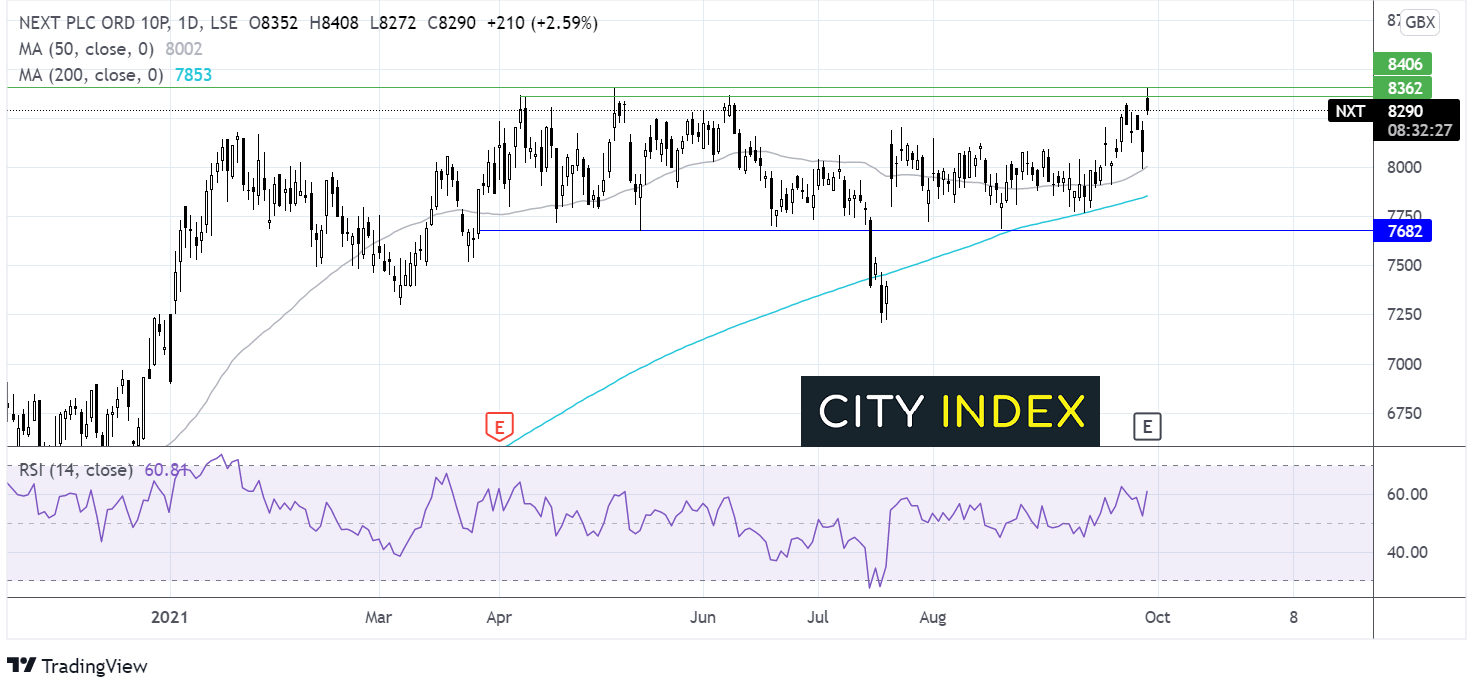

The Next share price has been relatively range bound across the past six months. The price has been capped on the upside at 8360p and 8405p and on the lower band by 7682p.

The upbeat results has propelled the stock higher, briefly spiking to 8408p a fresh all time high. The RSI is supportive of further upside. A move above 8408p is needed for fresh all time highs.

Any move lower could find support at the 50 sma at 8000 also a key psychological level. It would take a move below the 200 sma at 7840p for the sellers to gain traction.

SSP Group eyes breakeven as sales run at half of pre-pandemic levels

SSP Group said it expects to breakeven in the second half of its financial year as it slowly bounces back from the pandemic, but warned it is now expecting a slower recovery in sales next year and that inflation and a shortage in labour threatens its comeback.

The company, which runs a number of food and beverage outlets such as Upper Crust across travel hubs like airports, saw a collapse in demand as travel was brought to a halt during the pandemic and SSP is not expecting to return to pre-pandemic levels of business until 2024 at the earliest.

SSP said it is benefiting from the steady recovery in passenger numbers. Revenue in the third quarter to the end of June was equal to 27% of pre-pandemic levels but that is expected to improve to 47% in the fourth quarter to the end of September. That levels out for second half revenue to come in around 37% of 2019 levels, SSP said.

Notably, SSP said revenue ran about 53% of 2019 levels in the last week, signalling that things are continuing to improve.

SSP said the improvement in sales and tight control over costs means it will deliver positive Ebitda in the fourth quarter, allowing it to be ‘broadly break-even’ at the Ebitda level in the second half. It added that is expects to generate £60 million to £80 million in free cashflow in the second half.

‘The second-half performance reflects the disciplined management of the re-opening programme, a simplified operating model with a lower and a more variable cost base, including reduced or waived minimum guaranteed rents, and lower overheads. In addition, the group has been successful in accessing further, significant, short-term government support in a number of countries in Continental Europe , reflecting the continued impact of the pandemic on the travel sector,’ said SSP.

Still, SSP is cautious when looking into the new financial year to the end of September 2022 as it navigates new challenges such as rising costs and a shortage in workers.

‘The pace of the recovery remains uncertain, and as a consequence, our current planning assumption is for a slightly slower recovery in sales during the 2022 financial year. Whilst we anticipate a return to Ebitda profitability in FY2022 (on an underlying, pre-IFRS 16 basis), the out-turn will depend on a number of external factors including the pace of the recovery, higher input cost inflation, the impact of labour availability and the extent of government support schemes. Reflecting this, our expectation for profit conversion on reduced sales in 2022 compared to 2019 continues to be at the upper end of a range of 25-30%,’ said SSP.

SSP shares were down 2.2% this morning at 283.5p.

AstraZeneca to buy potential treatment for light chain amyloidosis

AstraZeneca said it has exercised its option to buy Caelum Biosciences in order to get its hands on CAEL-101, a potentially revolutionary treatment for people suffering from light chain amyloidosis.

AstraZeneca shares were up 2.7% in early trade this morning at 8692.0p.

The rare disease sees misfolded amyloid proteins build up in organs throughout the body to the point of causing significant organ damage that can be fatal. AstraZeneca said around 20,000 people across the US, France, Germany, Italy, Spain and the UK live with the disease.

CAEL-101 is currently undergoing phase III clinical trials and being combined with the existing standard of care.

‘With a median survival time of less than 18 months following diagnosis, there is an urgent need for new treatments for this devastating disease. CAEL-101 has the potential to be the first therapy to target and remove amyloid deposits from organ tissues, improve organ function, and, ultimately, lead to longer lives for these patients,’ said Marc Dunoyer, CEO of Alexion.

AstraZeneca completed its acquisition of Alexion earlier this year. Alexion struck a deal with Caleum and made a minor investment in the firm back in 2019, but had an option to buy the remainder of the company. AstraZeneca has now decided to exercise that option. An initial $150 million will be paid with potential for a further $350 million to be paid once certain regulatory and commercial milestones are met.

SSE earnings to fall after lack of wind hits output in first half

SSE said it is expecting earnings to fall in the first half of its financial year as it revealed a dramatic fall in renewable energy power generation as the wind failed to blow its turbines.

SSE shares were down 0.4% this morning at 1589.0p.

The company said the operational performance of its renewables division was hit by market volatility and unfavourable weather conditions that caused a 32% fall in output in the period to September 22. It said this represents an 11% shortfall on its forecast for total output over the full year.

‘This shortfall was driven by unfavourable weather conditions over the summer, which was one of the least windy across most of the UK and Ireland and one of the driest in SSE's Hydro catchment areas in the last seventy years,’ SSE explained. ‘Performance was also affected by the requirement to buy back hedges in volatile markets.’

SSE said it is expecting to deliver adjusted EPS of 7.5p to 10.0p in the six months to the end of September, down from the 11.9p delivered last year. SSE said it remains confident about the rest of the year due to its business mix.

‘SSE's very deliberate mix of economically regulated and market-based businesses provides resilience against seasonal variability. The operational issues we've faced in the first half are, by their nature, time-limited and the key months of our financial year are still to come,’ said finance director Gregor Alexander.

It also confirmed that it plans to pay a full-year dividend of 80p plus RPI inflation. It said it will make an interim payout of 25.3p based on RPI of 3.75% that will be paid in March 2022.

SSE also announced that it has entered the Japanese offshore wind market through a deal with Pacifico Energy. The pair will create a joint company to pursue opportunities in the space. SSE Renewables will acquire an 80% stake in an offshore wind development platform developed by Pacifico Energy for a total of $208 million, of which $30 million is deferred.

SSE said this will allow it to acquire a number of early-stage offshore wind development projects in Japan that, together, will have capacity of around 10GW. The two most advanced ones have already secured grid access.

That move comes after SSE completed a £2.7 billion disposal programme to focus more on renewables and being an electricity provider. It said it plans to provide an update on how to accelerate growth when it releases its interim results in November.

‘We look forward to updating the market with an ambitious new investment plan that will optimise the SSE Group's options and opportunities in the transition to net zero, and to partnering with the UK Government as Principal Partner of COP26 in Glasgow,’ SSE said.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade