Top UK Stocks | M&S Shares | Morrisons Shares | AstraZeneca Shares | OSB Shares

Top News: M&S ups expectations as sales surpass pre-pandemic levels

M&S said it expects to deliver profits at the upper end of expectations this year after sales surpassed pre-pandemic levels in recent weeks thanks to pent-up demand and a strong performance from its food halls.

The company said it expects to deliver adjusted operating profit at the upper end of the £300 million to £350 million expected by markets in the current financial year to the end of March 2022. That would be a significant rebound from the £41.6 million profit delivered last year when the pandemic hit its store sales, but still below the £403.1 million profit reported in the 2020 financial year before the coronavirus crisis started.

The news sent M&S shares over 11% higher this morning.

‘Although there has likely been an element of pent-up consumer demand in trading to date, we believe this performance provides strong confirmation of the beneficial effects of the last 18 months "Never the Same Again" changes,’ said M&S.

‘Despite this, there remains substantial uncertainty as to the continued strength of consumer demand, as well as disruption in both supply chains and consequent pressures on costs and margin,’ M&S warned.

That warning comes after the latest data showed UK retail sales declined 2.5% between June and July. M&S said it would provide further details on its outlook when it releases interim results on November 10.

M&S said demand for clothing and homeware has bounced back from last year but were still trailing pre-pandemic levels. Clothing and home sales were up 92.2% in the 19 weeks to August 14 but remained 2.6% below than before the pandemic. International sales were up 39.7% but also remained 5.2% below pre-pandemic levels.

Food continues to be the bright spot for M&S, with sales up 10.8% year-on-year and powering 9.6% above pre-pandemic levels.

Overall, that meant M&S sales were up 29.1% in the 19-week period and 4.4% higher than the same period before the pandemic hit.

‘At the start of the year, continued restrictions across large parts of the M&S store portfolio meant that the trading outlook was highly uncertain. Since then, M&S has seen an encouraging performance providing confirmation that the transformation programme is on track,’ the company said.

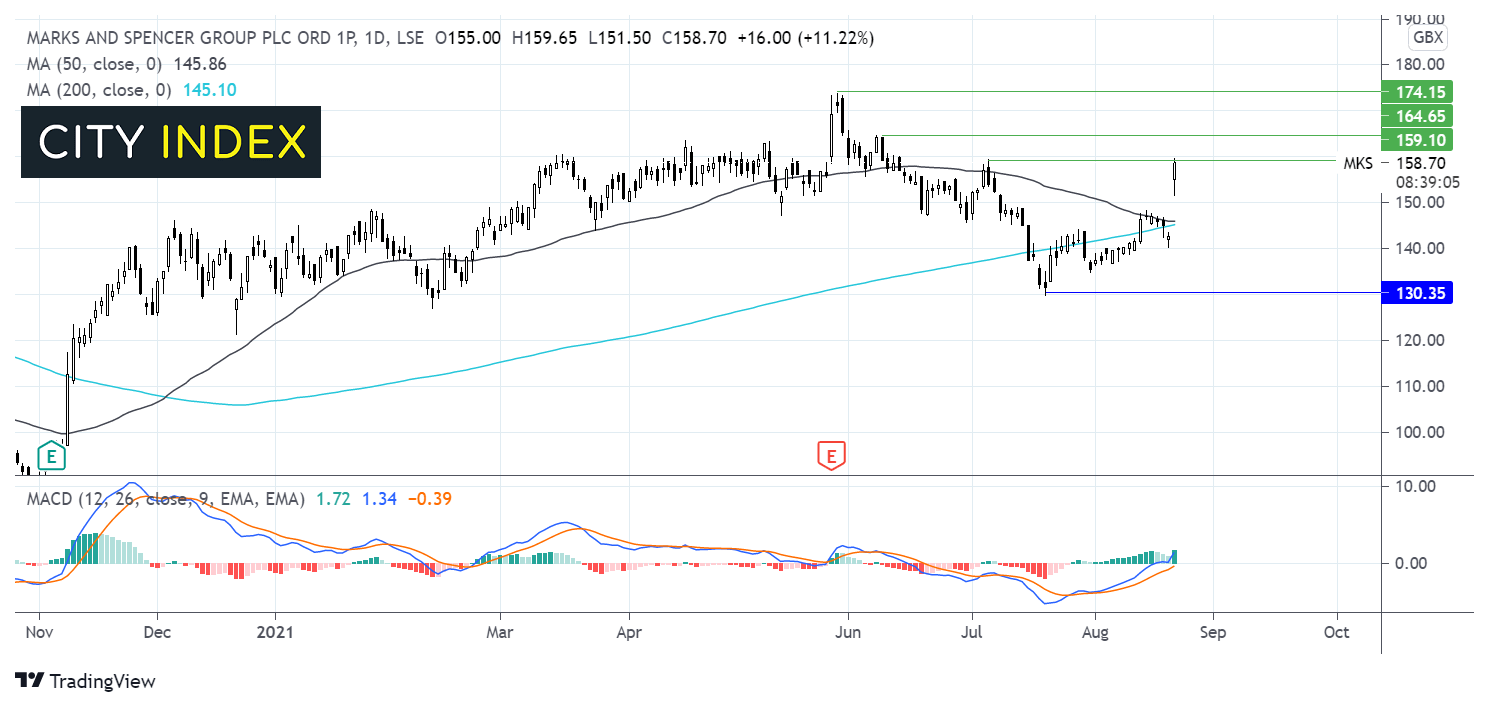

Where next for the M&S share price?

After steadily rising across the end of last year and the start of 2021, the Marks and Spencer share price hit resistance at 174p, the post pandemic high in early June. The price then fell lower to a 5-month low of 130p.

The price rebounded off 130p but struggled to retake its 50 & 200 sma on the daily chart.

Today’s jump higher has boosted the share price over both the 50 & 200 sma. The bullish MACD is supportive of further upside.

Immediate resistance can be seen at 159p the daily high. A breakthrough here could see buyers target 164p the June high ahead of 174p the post pandemic high.

On the flip side, strong support can be seen at 145p the confluence of the 50 & 200 sma.

Morrisons accepts new £7 billion takeover bid

Morrisons announced late yesterday that it has accepted an improved £7 billion takeover offer from Clayton, Dublier & Rice and withdrawn its recommendation for a rival lower offer from Fortress, prompting markets to believe another higher offer could be on the cards.

Morrisons said CD&R tabled a bid of 285 pence in cash. That is at a 60% premium to Morrison’s share price before the bidding war kicked off in June, and considerably higher than its original 230p that valued Morrisons at just £5.5 billion.

More importantly, it is above the latest offer from rival bidder Fortress worth 272p per share. Fortress said last night that it was ‘considering its options’, meaning there is potential for it to outbid CD&R.

Morrisons shares were trading 4.3% higher this morning at 292.0p, suggesting markets see room for an even higher counter-bid to be tabled.

CD&R is being advised by Terry Leahy, the former chief executive of Tesco who has worked alongside Morrisons CEO David Potts and other senior management in the past. He also knew founder Ken Morrison and CD&R said yesterday that it recognises his legacy and the company’s history and culture.

‘CD&R is widely recognised for being a trusted partner to the management teams of the businesses in which it invests and for providing ongoing support to help them innovate, develop, and grow their operations,’ the company said.

Morrisons shareholders are now due to vote on the CD&R deal at a meeting to be held in or around the week commencing October 4. The meeting scheduled to vote on the Fortress deal around the same time has now been adjourned.

‘The Morrisons board believes that the offer from CD&R represents good value for shareholders while at the same time protecting the fundamental character of Morrisons for all stakeholder,’ Morrisons said.

AstraZeneca’s Covid-19 antibody combination proves effective

AstraZeneca has announced that the latest trial of its antibody combination aimed at providing protection from the coronavirus achieved its primary endpoint by demonstrating a ‘statistically significant reduction in the incidence of symptomatic COVID-19’.

The trial is analysing AZD7442, a combination of two long-acting antibodies that could be the first drug that is not a vaccine capable of providing protection from the coronavirus. This is different to its main coronavirus vaccine developed with Oxford university named AZD1222.

The latest Phase III trial of AZD7442 reduced the risk of developing symptomatic coronavirus by 77% compared to the placebo.

‘There were no cases of severe COVID-19 or COVID-19-related deaths in those treated with AZD7442. In the placebo arm, there were three cases of severe COVID-19, which included two deaths,’ said AstraZeneca.

A total of 25 positive cases surfaced during the trial, which involved 5,197 patients in total. Importantly, over 75% of participants have conditions which means they have a reduced immune response to vaccination, suggesting it could be used as an alternative to the vaccines currently on the market.

‘The PROVENT data show that one dose of AZD7442, delivered in a convenient intramuscular form, can quickly and effectively prevent symptomatic COVID-19. With these exciting results, AZD7442 could be an important tool in our arsenal to help people who may need more than a vaccine to return to their normal lives,’ said principal investigator of the trial Myron Levin.

The data will now be submitted to authorities as it looks to secure regulatory approval for AZD7442.

Separately, AstraZeneca announced this morning that Alexion, which it recently merged with in a $39 billion deal, is discontinuing the Phase III clinical trial of Ultomiris in adults with amyotrophic lateral sclerosis.

The decision has been made based on the recommendation of the Independent Data Monitoring Committee after they reviewed the data. It was recommended to discontinue the trial due to a ‘lack of efficacy’.

‘We are disappointed by this outcome and what it means for patients with this devastating disease. We would like to thank the entire ALS community as well as investigators and healthcare professionals who dedicated their time and expertise to this trial. We continue to be confident in the potential of targeting C5 for complement-driven diseases and remain fully committed to our efforts to serve the rare disease community,’ said Alexion’s head of development and safety, Gianluca Pirozzi.

AstraZeneca shares were down 0.4% in early trade this morning at 8687.0p.

OneSavings Bank grows increasingly confident as UK economy recovers

OneSavings Bank saw an uplift in lending, better margins and a rise in profits as the UK economy started to bounce back from the pandemic in the first half of 2021, but warned it remains cautious about the ‘true impact of the pandemic once government support ends’ later this year.

OSB, which predominantly targets the mortgage and specialist lending markets, said gross new lending was up 16% to £2.5 billion in the first half, while its net loan book grew 6% to £20.4 billion.

Improved levels of activity twinned with a better net interest margin of 2.36% versus 2.17% a year earlier helped pretax profit more than double to £221.9 million from just £99.3 million the year before. Margins grew thanks to a lower cost of retail funds and lower average levels of liquidity that had previously built up during the pandemic.

Profits were also boosted by the release of £15.1 million of provisions set aside for potentially bad loans during the pandemic as the economic picture improves and the risk of default reduces.

‘The UK economy showed signs of recovery in the first half, including house price appreciation, and the outlook improved, although we remain cognisant of ongoing uncertainty over the true impact of the pandemic once government support ends,’ said chief executive Andy Golding.

With OSB heavily geared to the property market, there are concerns that a slowdown could occur in the market as government support, varying from furlough to the stamp duty holiday, cease. However, it said landlords are growing more confident and deciding to expand their portfolios or remortgage existing properties, which is helping fuel its loan book.

Plus, whilst it has been following tighter criteria for new lending by reducing the maximum loan to values and size of the loans it dishes out, it said it has started to offer buy-to-let and residential products at higher loan to value that are ‘similar’ to what it was offering before the pandemic hit, which should start to drive further growth as new completions start coming through in early 2022.

‘Whilst we continue to control lending in our more cyclical businesses, demand remains strong in our Buy-to-Let and Residential businesses, where we have recently reintroduced pre-pandemic criteria due to the improving economic backdrop and outlook. The new products will help build our pipeline for completions in the first quarter of 2022,’ he added.

OSB said it is confident it can deliver underlying net loan book growth of 10% in 2021, having risen 6% in the first half, and report a full year net interest margin of around 2.7%. The underlying cost to income ratio in the first half of 26% will also be ‘marginally higher’ compared to the second.

OSB shares were down 0.8% in early trade this morning at 493.4p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade