Top News: Greggs shrugs-off supply chain woes and ups guidance

Greggs said it expects to deliver better full year results than previously anticipated despite warning that the pressures on the supply chain and a shortage of workers is starting to bite.

The high street baker said like-for-like sales were 3.5% higher in the third quarter than in the corresponding period in 2019, before the pandemic hit. That was driven by strong demand in August, when it saw an uptick in demand as people took staycations and travelled more domestically, which Greggs said continued in September with LfLs up 3% in the four weeks to October 2. It has also continued to grow the number of stores providing deliveries, with 943 shops now shipping food to customer’s doors.

‘Greggs has not been immune to the well-publicised pressures on staffing and supply chains and we have seen some disruption to the availability of labour and supply of ingredients and products in recent months. Food input inflation pressures are also increasing; whilst we have short-term protection as a result of our forward buying positions we expect costs to increase towards the end of 2021 and into 2022,’ Greggs warned.

‘Operational cost control has been good and the strong sales performance in the third quarter gives us confidence as we move into the autumn. Subject to any unexpected COVID disruption we expect the full year outcome to be ahead of our previous expectations,’ Greggs added.

Analysts are currently expecting Greggs to report annual revenue of £1.19 billion, up 47% from the £811.3 million delivered in 2020 and 2.6% above the £1.16 billion booked in 2019, according to data from Refinitiv, while Greggs is expected to bounce back to a £137.0 million profit from the £13.7 million loss booked last year – which was the first it ever suffered since going public.

Greggs shares were up 3.2% in early trade this morning.

The improved outlook came as Greggs prepares to hold a Capital Markets day today, where it will outline its new ambitions to double revenue over the next five years to £2.4 billion in 2026.

Greggs has opened 68 net new stores this year with ambitions to get that figure up to 100 before the end of the year. Greggs said it is accelerating the rate it opens new stores to around 150 per year from 2022, with a view that it could expand from 2,146 stores at present to over 3,000 over the coming years. It plans to boost utilisation of its stores by extending trading into the evening, building-out its delivery and online offerings, and continuing to rollout its mobile app.

Where next for the Greggs share price?

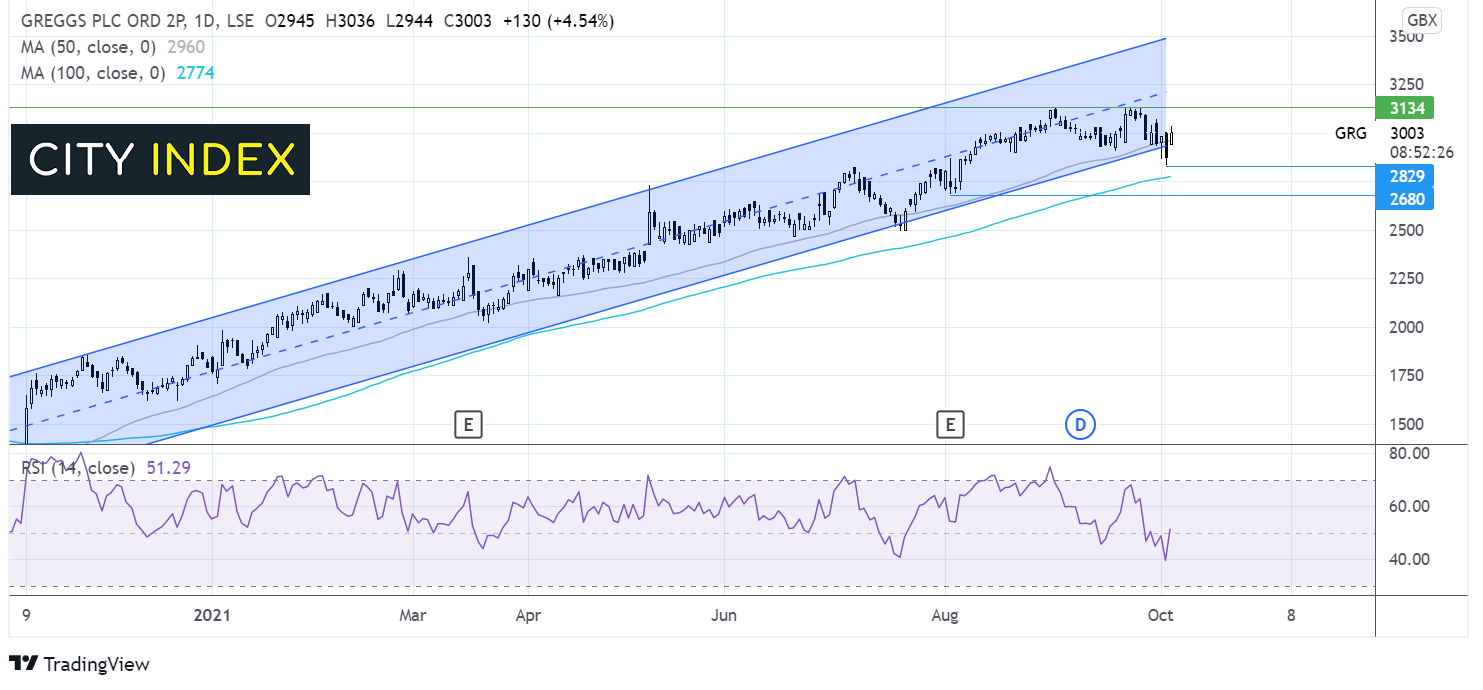

The Greggs share price has been trading within an ascending channel since early November. The price briefly spiked out of the rising channel and below the 50 sma on the daily chart. The RSI is offering few clues at neutral.

Today the jump in the price is seeing the 50 sma and the lower band of the rising channel resistance tested. Should the price manage to hold these levels, bulls could gain traction and look back up towards 3135 and fresh all time highs.

Failure to meaningfully move above these resistance points could see the price rebound lower and test yesterday’s low of 2835p ahead of the 100 sma at 2770p.

AstraZeneca seeks FDA approval for Covid-19 drug

AstraZeneca has asked the US Food & Drug Administration to grant emergency use authorisation for its antibody therapy that can prevent people from catching Covid-19, according to reports.

The application has been made based on data from a late-stage clinical trial involving over 5,000 people that showed it could reduce the risk of catching Covid-19 symptons by 77%. AstraZeneca believes it could prove key to helping protect people that can’t have a vaccine.

AstraZeneca is thought to be in discussions with the US government about an order. Authorisation of the drug would be a big win for AstraZeneca considering its Covid-19 vaccine is not yet approved in the US, despite being widely-used in other countries.

AstraZeneca shares were up 0.2% this morning at 8867.0p.

Melrose warns of uncertainty spawning from chip shortage

Melrose Industries said its Automotive and Powder Metallurgy divisions are both feeling the widely-reported pressures on supply chains, but said both units will still deliver a significant improvement in margins compared to last year when the pandemic severely disrupted the business.

Melrose shares were down 2.2% in early trade this morning at 168.1p.

The turnaround specialist, which buys, improves and sells-on businesses, has found its portfolio particularly vulnerable over the past 18 months as it focuses on Aerospace, Automotive and Powder Metallurgy – all of which suffered heavily since the start of the pandemic.

Still, things have improved this year. Merose said the Aerospace division reported 16% growth in revenue during the three months to the end of September compared to the year before. Melrose said its restructuring efforts are delivering improved results and that the pace of the improvement should accelerate during the second half of the year.

Meanwhile, the disruption to supply chains serving the automotive industry has had a knock-on effect on Melrose’s Automotive and Powder Metallurgy businesses.

‘At present the timing and duration of these constraints is uncertain, but recently the consensus view is that they have lengthened. There are a number of scenarios possible, but it is likely these are below previous expectations,’ Melrose said.

Melrose said underlying demand for its Automotive business is strong as near-term schedules from customers are above pre-pandemic levels, but said its customer’s plans are being scuppered by the limited supply of semiconductors. It said this was the cause of the in month cancellation rate rising from a normal 1% to 20% to 25% during the first quarter.

‘These industry supply issues are very difficult to plan for, or predict, and both businesses are working with their customers to best manage this challenging situation,’ Melrose said.

‘The Automotive and Powder Metallurgy divisions would nevertheless both still be able to deliver a full year margin of approximately twice that achieved last year should the supply for light vehicle production this year more closely resemble 2020 COVID-19 levels (ie approximately 76 million vehicles), as some industry bodies now assume. This shows the clear benefit from the restructuring projects being delivered especially as there is much less governmental help for the industry this year compared to last,’ Melrose added.

Melrose said it is leaving its guidance unchanged despite the disruption, underpinned by the ongoing restructuring. It said all of its businesses are ‘focused on the recovery of their costs and will take whatever actions are necessary to do so’.

Plus, all its businesses continue to generate positive cashflow, which has been further boosted from the recent $285 million sale of Nortek Control. Melrose said it will unveil its plans to return capital to shareholders next March, depending on market conditions at the time.

ICG Enterprise sees portfolio breach the £1 billion mark

ICG Enterprise revealed its portfolio hit a milestone valuation of over £1 billion in the first half of 2021 and that it remains on course to grow its dividend by 12.5% this year.

The private equity investor said it ended July with net asset value per share of 1,523 pence and a total return of 11.1%, slightly underperforming 12.6% total return delivered by its benchmark, the FTSE All-Share Index. ICG’s share price total return in the period was 13.7%.

ICG shares were up 1.2% this morning at 119600.0p.

ICG said its portfolio returned 14.9% at local currency and that the overall value rose to £1.01 billion at the end of July from £765.0 million a year earlier and from £949.2 million at the start of February.

‘Growth was broad-based, underpinned by strong performance of our investments across the portfolio as well as by realisation activity. Realisations continue to be at a significant uplift to carrying value. This is a testament to our focused investment strategy and the quality of the portfolio we have actively constructed,’ said ICG.

The company booked £175 million worth of disposal proceeds in the period, marking significantly higher proceeds compared to the average seen over the last five years. In turn, ICG made £133 million of new investments in the period.

ICG declared a second quarter dividend of 6p, taking the total for the year so far to 12p. ICG said it plans to pay at least 27p in dividends over this year as a whole, which would mark a 12.5% increase from the last financial year.

‘Looking ahead, we continue to see a strong pipeline of exciting opportunities to generate attractive risk-adjusted returns. I am therefore confident we remain well placed to deliver further long-term shareholder value,’ said Oliver Gardey, ICG’s head of private equity fund investments.

FW Thorpe ups dividend as profits grow

FW Thorpe delivered impressive growth during its recently-ended financial year, prompting it to raise its dividend, but warned shortages in the supply chain are causing some issues.

FW Thorpe shares were up 1.2% this morning at 441.0p.

The designer and manufacturer of lighting systems said revenue rose 4% year-on-year in the year to the end of June 2021 to £117.9 million from £133.3 million. Adjusted pretax profit that strips out one-off charges jumped 16.5% to £18.6 million while reported pretax profit at the bottom-line soared 26.3% to £20.1 million.

‘A high proportion of the growth is attributed to Thorlux Lighting, but there were notable performances too from TRT Lighting, exceeding £10 million revenue for the first time, and Solite and Portland Lighting, recovering well from reduced levels last year, and truly solid performances from the Dutch contingent, especially Lightronics, having to cope with the near-total destruction of its manufacturing facility early in autumn 2020,’ said chairman and CEO Mick Allcock.

Lightronics suffered a devastating fire in September 2020 and reported pretax profit was boosted by £1.6 million of insurance claims.

It said Philip Payne’s market that targets high-end hospitality venues and offices in Central London remains depressed due to the pandemic, with no large-scale orders being made in the period, but said a ‘solid year of battening down the hatches and controlling costs resulted in a subdued but profitable year overall.’

FW Thorpe said it will pay a final dividend of 4.31p, up from 4.20p last year, and complimenting that with a special payout of 2.20p. Notably, that is the first special payout to be made since 2016.

‘Whilst still carrying some increased manufacturing costs, all companies are capable of producing increased revenue in the coming year. As mentioned earlier, the group as a whole commenced the new year with a good order book, especially at Thorlux Lighting,’ said Allcock. ‘There remain some difficulties, though, caused by component supply shortages, some capacity restraints and ongoing COVID-related disruption.’

FW Thorpe also revealed it has bought a majority stake in Electrozemper SA, which trades as Zemper and makes emergency lighting luminaries in Spain.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade