Top UK Stocks | Go-Ahead Shares | easyJet Shares | Ferguson Shares | Close Bros Shares | Moonpig Shares

Top News: DfT to seize control over Southeastern rail from Go-Ahead Group

Go-Ahead Group said the Department for Transport has decided not to renew the company’s Southeastern franchise when it expires next month, leaving it to be run by an Operator of Last Resort.

The news sent Go-Ahead shares down 10.2% in early trade this morning.

The company said it was ‘naturally disappointed’ by the decision. Go-Ahead admitted that ‘errors have been made in relation to the franchise’ and said it has repaid £25 million to the DfT as a result. An independent review was launched by Go-Ahead and its partner Keolis UK last month to look into the matter.

The Operator of Last Resort will take over the service on October 17.

‘It has always been this group's intention to provide the best possible public transport, and to work in partnership with the government and related agencies. We recognise that mistakes have been made and we sincerely apologise to the DfT. We are working constructively with the DfT towards a settlement of this matter,’ said chairman Clare Hollingsworth.

The DfT said the decision had been made following a ‘serious breach’ of the franchise agreement, stating it had not declared over £25 million of historic taxpayer funding that should have been returned. It said more investigations are underway and that more penalties will be considered if necessary.

‘On the basis of the available evidence, we consider this to be a significant breach of the good faith obligation within the franchise agreement and will not be extending a further contract to LSER. The government believes it is essential that there is public trust in operators, who should prioritise the very best for passengers. Given the government’s commitment to protecting taxpayers’ interests, this decision makes clear we will hold private sector operators to the highest standards, and take swift, effective and meaningful action against those who fall short,’ said the DfT.

The severity of the matter means Go-Ahead will not release its full year results covering the year to July 3 tomorrow as planned. A new date will be announced shortly. Go-Ahead said trading has been in-line with expectations.

Go-Ahead also revealed that chief financial officer Elodie Brian is stepping down after 13 years with the company. He leaves with immediate effect and an external appointment in the form of Gordon Boyd – who has held senior financial positions at the likes of Drax and Capita – has been made while the hunt for a permanent successor is undertaken.

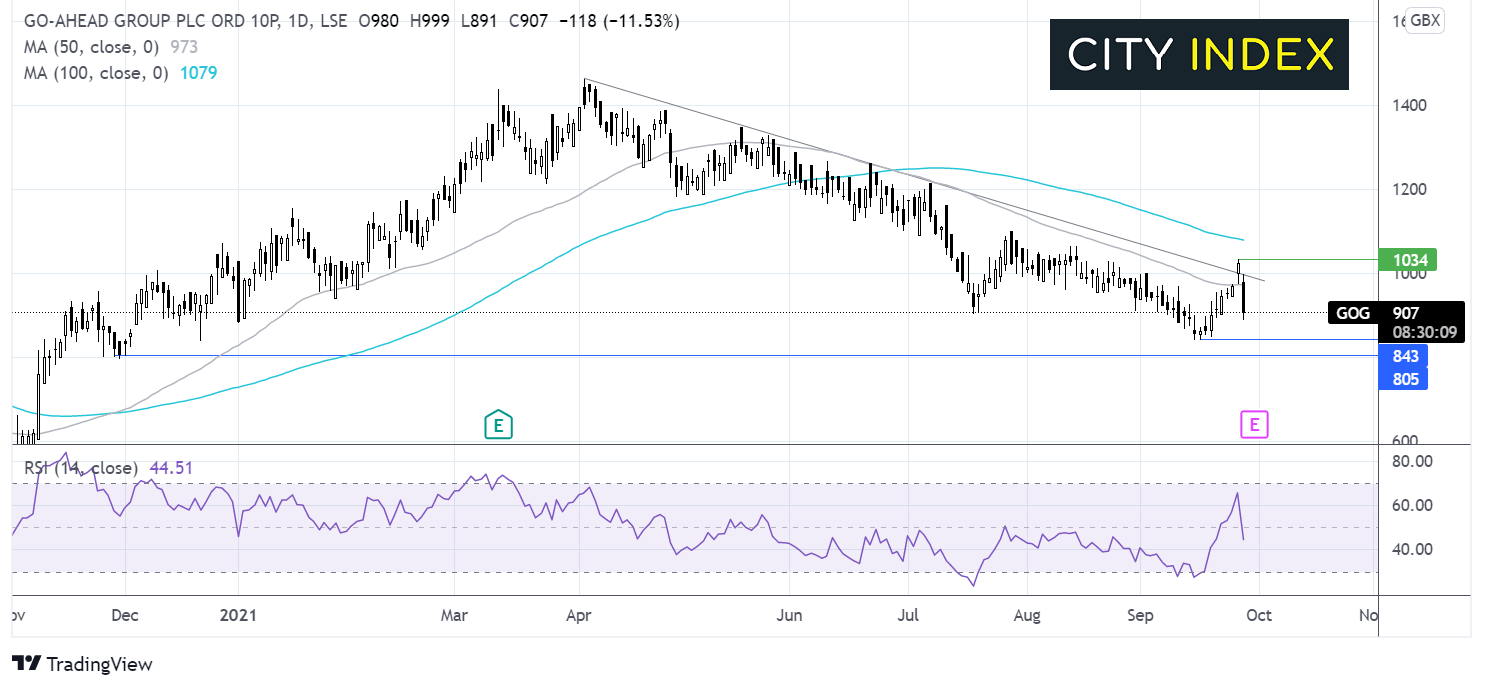

Where next for the Go-Ahead share price?

After reaching a post pandemic high of 1463p in early August, the Go-Ahead share price started trending lower.

The price trades below its falling multi-month trendline, and despite a brief spike higher is back below the 50 sma.

The RSI has moved into bearish territory suggesting further losses could be on the cards.

Immediate support can be seen at 845p the September low. A b real below this level could see 805p come into play a level last seen in December last year.

Any recovery would need to retake 1000p the round number and the falling trendline resistance. Beyond here 1065p yesterday’s high becomes the target.

easyJet sees high take-up of £1.6 billion rights issue

Low-cost airline easyJet said it has received acceptances from investors for 93% of the new shares being offered through a £1.2 billion rights issue that was launched earlier this month to help it bounce back from the pandemic.

The 31-for-47 rights issue will see 301.3 million new shares issued for 410.0 pence each. Acceptances closed yesterday and existing investors took up 280.2 million of the new shares on offer. Underwriting banks will now try to find buyers for the remaining 21 millions shares.

easyJet shares were down 3.2% in early trade this morning at 686.2p.

‘The success of this capital raise, thanks to great support from investors, will enable easyJet to strengthen its balance sheet and accelerate its post-COVID 19 recovery plan. Importantly, it will position us to take advantage of strategic investment opportunities across our markets which will arise as we move into this period of recovery from the pandemic,’ said CEO Johan Lundgren.

‘easyJet has been disciplined and decisive in maintaining a strong balance sheet, managing our fleet and network while looking after our customers. This will allow us to emerge from the pandemic with renewed strength, positioned as a structural winner in this rapidly evolving sector,’ he added.

The rights issue was designed to shore-up the balance sheet whilst the airline industry recovers from the pandemic, but also give easyJet the firepower needed to capitalise on any opportunities that arise. The rights issue is also unlocking a new $400 million debt facility.

Ferguson hikes dividend and launches buyback after successful year

Ferguson said growth has accelerated after reporting significantly higher revenue and profits in the recently-ended financial year, prompting it to up its dividend and launch a new buyback, but said it expects growth to slow going forward.

Ferguson shares were up 1.4% this morning at 10,665.0p.

The distributor of plumbing and heating products said revenue in the year to the end of July rose 14.3% to $22.79 billion, coming in ahead of the $22.61 billion forecast by analysts.

Ferguson said its gross margin improved from last year as it managed the cost inflation hitting several industries, supported by a tight control of costs.

‘We are mindful that the recent tailwinds from inflation on gross margins could moderate but for the full year ahead we expect operational improvements to broadly offset headwinds from inflation in the cost base,’ said Ferguson.

Pretax profit jumped over 46% to $1.89 billion from $1.29 billion, but came in below the $2.07 billion forecast by analysts. EPS rose almost 58% to 674.7 cents from 427.5 cents.

Ferguson declared a final dividend of 166.5 cents, taking the total dividend for the year to 239.4 cents, marking a 15% increase from last year. That is being complimented by a new $1 billion share buyback that was approved today.

Ferguson sold off its UK business earlier this year, leaving it focused on North America, which prompted it to establish a US listing on the New York Stock Exchange back in March. Importantly, investors will vote on whether it should switch its primary listing from London to New York in the Spring of 2022.

‘The group started the new financial year with strong momentum, with organic revenue growth at similar levels to Q4 2020/21. We expect a year of good growth overall but we anticipate a tapering in the second half on tougher prior year comparatives,’ Ferguson said.

Organic revenue was up 23.6% higher year-on-year in the fourth quarter, signalling that growth has accelerated. Notably, gross margins also improved year-on-year in the final quarter, despite seeing an 8% rise in the cost of commodities and finished goods.

Smiths Group expects growth to accelerate after selling Smiths Medical

Smiths Group said it is poised to accelerate growth after it completes its restructuring that is seeing the firm offload its medical division to leave it focused on its core industrial technology business.

The company announced earlier this month that it had struck a deal to sell Smiths Medical, which makes medical devices and specialises in infusion systems and vascular access, to ICU Medical for $2.7 billion on a cash-and-debt free basis. Today, that deal has become binding.

An initial cash payment of $1.85 billion will be made and a further $100 million could be paid based on how ICU Medical’s share price performs going forward. Importantly, Smiths Group will receive 2.5 million new shares in ICU Medical that will give the London-listed firm around a 10% stake that, based on current prices, is worth around $500 million.

The deal is expected to be completed in the first half of 2022. Smiths Group said it is looking to return a substantial sum to shareholders while balancing the investment needs of the business. About 55% of the proceeds, equal to some £737 million, will be dished out to investors through a buyback.

The sale leaves Smiths Group focused on its industrial technology businesses like John Crane, Smiths Detection, Flex-Tek and Smiths Interconnect. Still, the drastic change has prompted the board to review its future strategy, with an update to be provided at a capital markets day sometime in November.

The news came as Smiths Group posted annual results for the year to the end of July. Revenue was down 2% over the year at £2.40 billion but improved as the year went on, with sales coming in flat in the second half and returning to growth in the fourth quarter. Operating profit from its remaining continuing operations grew 7% to £372 million.

Smiths Group is paying a 37.7p dividend for the year, up 8% from the 35.0p payout made last year.

The company said markets are continuing to recover and that there is good momentum in its order book. Revenue growth should return to pre-pandemic levels in the new financial year.

Smiths Group shares were up 3.4% this morning at 1413.5p.

Close Bros ups dividend after bouncing back from the pandemic

Close Bros said it has hiked its dividend after delivering an improved performance during its recently-ended financial year.

The company, a merchant banking outfit that provides the likes of loans, deposits, securities trading and wealth management services, saw adjusted operating profit soar 88% in the year to the end of July to £270.7 million from just £144.0 million the year before.

Reported operating profit that includes one-off exceptional costs also rose 88% to £265.2 million.

Adjusted profits from its Banking division more than doubled year-on-year, driven by 11% growth in its loan book, better margins and a large reduction in impairments. Its net interest margin expanded to 7.7% from 7.5% and its bad debt ratio dropped to just 1.1% from 2.3% last year.

Meanwhile, its Asset Management division delivered a 16% rise in adjusted profits after seeing net inflows of 7% and managed assets grow by 24% to £15.6 billion.

Winterflood delivered an ‘exceptionally strong trading performance’ in the year with adjusted profits up 27%, but said activity has slowed over the last few months.

‘We have delivered a strong financial performance in the year and made the most of the opportunities arising as the economy recovers from the effects of Covid-19. I am grateful for our colleagues' hard work and commitment over the year, which has allowed us to continue to support our customers and clients in spite of the ongoing challenges. We are encouraged by the improvement in the economic outlook, although the trajectory remains uncertain,’ said CEO Adrian Sainsbury.

The company said it has hiked its dividend for the year by 50% to 60.0p from 40.0p, reflecting its strong performance in the year and the confidence it has going forward.

Close Bros shares were down 1.6% this morning at 1550.5p.

Moonpig shares rise after it raises guidance

Online card and gifts firm Moonpig said demand has remained strong despite the fact its rivals have been able to reopen stores, prompting it to raise its guidance for the rest of the year.

The company said it now expects annual revenue in the year to the end of April 2022 to be between £270 million to £285 million. That has been raised from the original target of £250 million to £260 million, but will be markedly lower than the £368.2 million revenue delivered in the last financial year, when sales more than doubled as online shopping boomed during lockdown.

Moonpig shares were up 2.3% this morning at 367.6p.

‘Trading in the year to date has been strong. Frequency remains elevated following a limited change in consumer mobility through the summer, despite the lifting of lockdown restrictions,’ said Moonpig.

‘As people return to offices and conditions normalise, the data we collect on customer behaviour will provide important insights. At the current time, our view on underlying growth trends, and our medium-term growth and margin targets, remains unchanged,’ the company added.

Moonpig said it has stepped up investment since the start of the financial year, putting money behind promotional activity to encourage more app downloads.

AstraZeneca sees Saphnelo approved in Japan

AstraZeneca said Saphnelo has been approved in Japan to treat adult patients with autoimmune disease systemic lupus erythematosus.

Saphnelo will be used on patients who do not respond well to existing treatments.

The approval has been based on the latest data from a number of trials that demonstrated Saphnelo ‘experienced a reduction in overall disease activity across organ systems, including skin and joints, and achieved sustained reduction in oral corticosteroid (OCS) use compared to placebo, with both groups receiving standard therapy’.

‘Compared with other rheumatic diseases, there are limited treatments available for systemic lupus erythematosus and outcomes remain poor for patients in Japan and around the world. Through our own local experience with anifrolumab in clinical trials, we have observed impressive efficacy and improved patient outcomes,’ said Yoshiba Tanaka, a professor at the University of Occupational & Environmental Health where trials are being conducted.

AstraZeneca shares were down 0.4% this morning at 8522.0p, building on the 3.1% loss booked yesterday.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade