easyJet sees recovery begin after hefty losses

Low-cost airline easyJet said it will report a wider loss in its recently-ended financial year as the pandemic continues to weigh on the travel industry, but said it has seen a significant improvement in the latest quarter underpinned by uplifts in traffic.

The airline said it expects to book a headline loss before tax of between £1.135 billion to £1.175 billion in the year to the end of September 2021, swelling from the £835 million loss booked last year. Full year earnings will be released on November 30.

‘Based on current travel restrictions in the markets in which we operate, easyJet expects to fly up to 70% of FY19 planned capacity for Q1 FY22. Visibility remains limited as customers continue to book closer to their travel date,’ said easyJet. ‘At this stage, given this continued level of short-term uncertainty, it would not be appropriate to provide any financial guidance for the 2022 financial year.’

That capacity will significantly improve from the 58% reported in the fourth quarter, when it offered 17.3 million seats and carried 13.4 million passengers, resulting in a load factor of 77.3%. For the full year, easyJet carried 20.4 million passengers at a load factor of 72.5%.

That improvement in the fourth quarter was primarily down to domestic flights in the UK and intra-European flights, with traffic equal to 77% of 2019 levels. That compared to UK international traffic equalling just 32% of pre-pandemic levels as travel restrictions weighed on demand. That also meant load factors in Continental Europe of 83% were far better than the 63.2% reported in the UK.

‘While intra-European demand led the recovery over the summer, the recent UK government announcement to remove and relax restrictions and testing has created positive booking momentum into Q1. In response, the airline has added 100,000 seats for Q1, with particularly strong demand for winter sun destinations. easyJet expects capacity to continue to grow throughout FY22 and we will take quick and decisive action to capture additional opportunities alongside planned organic growth,’ easyJet said.

Investors will also cheer the news this morning that easyJet managed to generate £40 million of operating cash in the fourth quarter.

easyJet shares were trading marginally higher in early trade this morning while its peers were trading lower, with British Airways-owner IAG trading 1.5% lower, Ryanair down 1.6% and Wizz Air ticking 1.4% lower.

Where next for the easyJet share price?

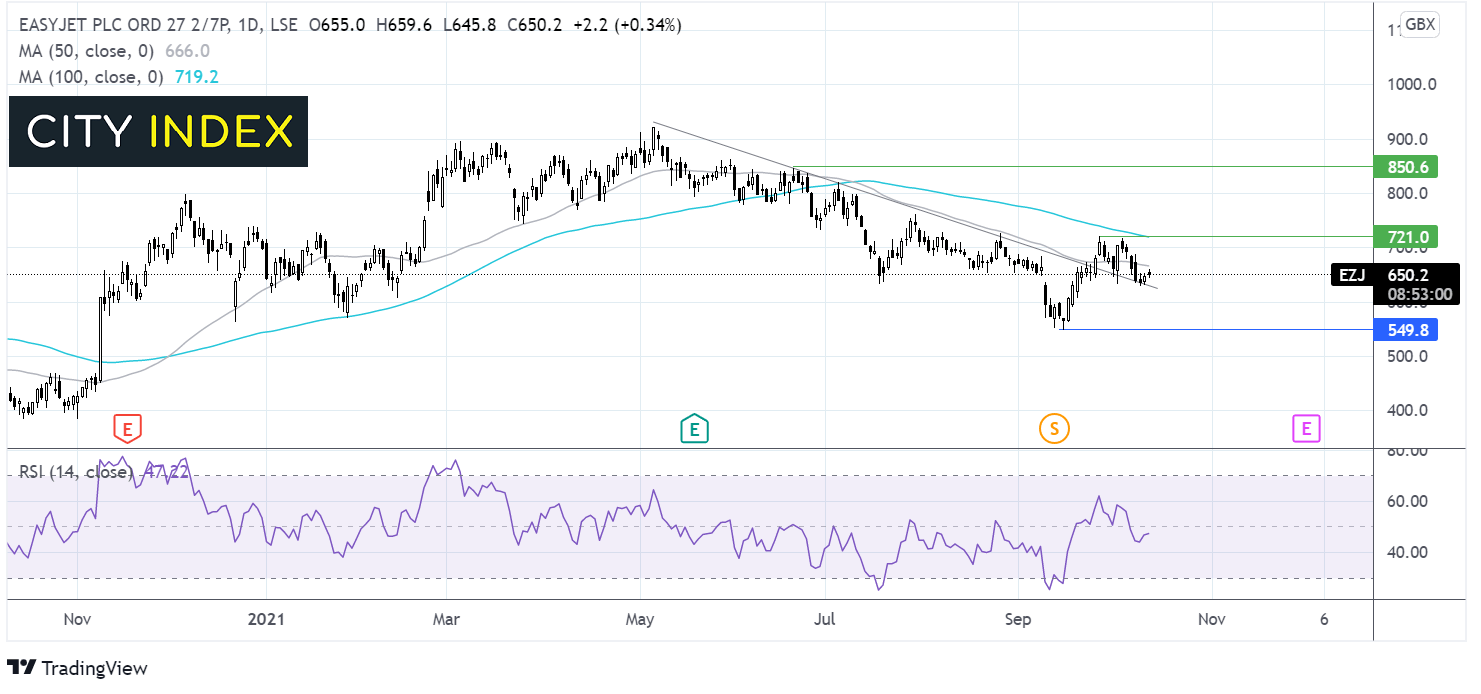

The easyJet share price is extending its rebound from 550p low hit mid-September. The price pushed back above a descending trendline dating back to early May.

The price currently trades above the falling trendline but below its 50 & 100 sma on the daily chart. The RSI is neutral giving few clues away, so it could be prudent to wait for a breakout trade.

Buyers would be looking for a move of the 50 sma at 670p to aim towards 720p the 100 sma and October high. A move above here could see the buyers gain traction.

Meanwhile sellers could look for a move below 625p the falling trendline support to target 550p the year to date low.

Entain growth continues as investors wait for Draftkings bid

Entain said it continued to deliver strong topline growth in the latest quarter and that its physical betting shops had started to recover as investors wait to find out if talks with US peer Draftkings will result in a firm takeover offer being made for the business.

Net gaming revenue rose 4% in the third quarter, marking a slowdown from the 11% growth booked in the first half as it came up against tougher comparatives following the boom in gaming seen in the second half of 2019.

It said all of its major markets apart from Germany delivered a strong performance, particularly in Australia and Brazil. Trading in Germany has been hit by the country’s shake-up of online gaming.

Online net gaming revenue rose 10% at constant currency to mark its 23rd consecutive quarter of double-digit percentage growth. Growth was held back somewhat by Germany which, if excluded, saw online net gaming revenue rise 18%.

Its retail net gaming revenue, which accounts for its physical betting shops such as those under the Ladbrokes and Coral brands, reported a 1% rise in net gaming revenue at constant currency in the quarter. Entain said UK volumes are ‘recovering toward pre-Covid-19 levels’ while activity is ‘steadily improving’ in Europe.

In the US – its key growth market – Entain’s joint venture named BetMGM continued to deliver strong growth and boasts 23% market share across the country in sports betting and iGaming. That has improved from 22% in the first half. BetMGM is the largest iGaming provider in the country and the second largest sports-betting outfit, with Entain said it was ‘challenging for #1 market position’ during August.

‘As we announced on 12 August, our total addressable market is expected to more than triple to over $160 billion. This will be driven by the significant opportunity in the US, where we are now challenging for the number one market position, our growth plans in other new and existing markets, and our strategy of entering into new areas of interactive entertainment,’ said Entain.

Despite the improved performance, Entain said it expects to report annual Ebitda in line with its target range of £850 million to £900 million after raising its goal back in July. If achieved, that would be up from the £843.1 million delivered last year. The firm said any boost in profit from the improvement in trading during the third quarter will be offset by the cost of the licensing process in the Netherlands.

The board has kept quiet since it said it would ‘carefully consider’ an improved takeover offer from US outfit DraftKings worth 2,800p per share, comprised of 630p in cash and the rest in DraftKings shares, and shareholders will be disappointed there was no update on the matter this morning. Draftkings has until October 19 to make a firm offer or walk away.

Dealmaking in the industry is increasing, primarily as companies look to get a head start in the growing opportunity in the US, where more states continue to open up to sports betting. BetMGM is thought to be the jewel in the crown that has caught the eye of Draftkings.

Entain shares were trading 0.1% lower this morning at 2101.0p, considerably below the value of the potential offer from Draftkings.

Stagecoach sees improvement as students return to classrooms

Stagecoach said passenger numbers on its regional bus services has improved thanks to students returning to schools and universities in recent weeks.

The bus and coach operator said journey numbers were equal to 70.1% of pre-pandemic levels in the week to October 2. It said fare-paying journey numbers were equal to 74.4% while concessionary journey numbers were at 60.2%.

‘Commercial sales as a percentage of the 2019 levels are higher than fare paying journey numbers, which is partly attributable to travel patterns during this COVID-19 recovery period, whereby single tickets represent a higher proportion of sales than in 2019, while weekly and monthly tickets represent a lower proportion. We continue to progress a number of ticketing initiatives to reflect the changes we are seeing in travel patterns,’ said Stagecoach.

‘The momentum in passenger journeys and sales reflects a pick up in activity and travel across the UK, and growing confidence to return to public transport. While there remains some uncertainty around how the recovery continues, our outlook for the year ending 30 April 2022 is unchanged from when we announced our full year results in June 2021,’ said chief executive Martin Griffiths.

Stagecoach did not provide firm guidance back in June, but said the financial support provided by the government ‘should ensure we continue to generate positive Ebitda and operating profit for the time being.’ Profitability is set to return to pre-pandemic levels as restrictions ease.

Notably, the UK government’s Covid-19 bus services support grant restart came closed at the end of August and as replaced by a £226.5 million bus recovery grant from the Department for Transport, which will continue to provide support to the industry until March 15, 2022. In Scotland, support is coming from the Covid-19 support grant restart, which has recently been extended until the end of March 2022.

Stagecoach will release interim results covering the six months to the end of October on December 8. The company noted that it is still in discussions about merging with peer National Express but stressed ‘there can be no certainty that any offer will be made.’

Stagecoach shares were down 0.7% this morning at 82.2p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade