Top UK Stocks | Dechra Shares | Avation Shares | HUTCHMED Shares | Petershill Partners IPO | Foresight Sustainable Forestry IPO

Top News: Dechra Pharmaceuticals chairman to leave as earnings rise

Dechra Pharmaceuticals said it has continued to outperform the wider market as it released its latest set of annual results, revealing strong double-digit growth in revenue and earnings and a significant hike to its dividend.

The company, which focuses on pharmaceuticals for the veterinary industry, said revenue rose 21% in the year to the end of June to £608.0 million. That was ahead of the 18% increase that Dechra investors had expected following the company’s last update, and marks a significant acceleration from the 7% topline growth delivered last year.

Dechra said all of its product categories delivered growth during the year and flagged the performance from its Companion Animal Products and Equine divisions as ‘exceptional’, with the two units reporting revenue growth of 25.9% and 25.5%, respectively.

Meanwhile, its Food Producing Animal Products reported 4.7% topline growth while its Nutrition business returned to growth after several years of declines.

Underlying operating profit jumped over 29% to £162.2 million and underlying EPS rose over 19% to 108.14p. On a reported basis, operating profit increased 63% to £84.0 million and EPS grew over 56% to 51.03p.

Dechra hiked its dividend by more than 18% to 40.50p per share from the 34.29p payout made the year before. That came as operating cashflow improved by more than 10% to £141.2 million.

‘As we start the new financial year trading remains strong with the momentum and market penetration seen in the second half of the prior financial year continuing. We have made significant operational improvements by strengthening our infrastructure and by investment in our greatest resource, our people,’ said chief executive Ian Page.

‘Although COVID-19 related travel restrictions have limited acquisition activity, we have still been able to identify and progress numerous strategic opportunities to strengthen our product portfolio and development pipeline. We therefore remain confident in our ability to successfully execute our strategy and in our future prospects,’ he added.

Dechra said its latest acquisitions of Morataz and Osurnia are both ‘performing strongly’, while its newly-acquired marketing rights for Tri-Solfen is already proving successful after being introduced to the Australian market.

Dechra also announced that chairman Tony Rice is stepping down after five years in the position. He will continue in his role until a replacement is found.

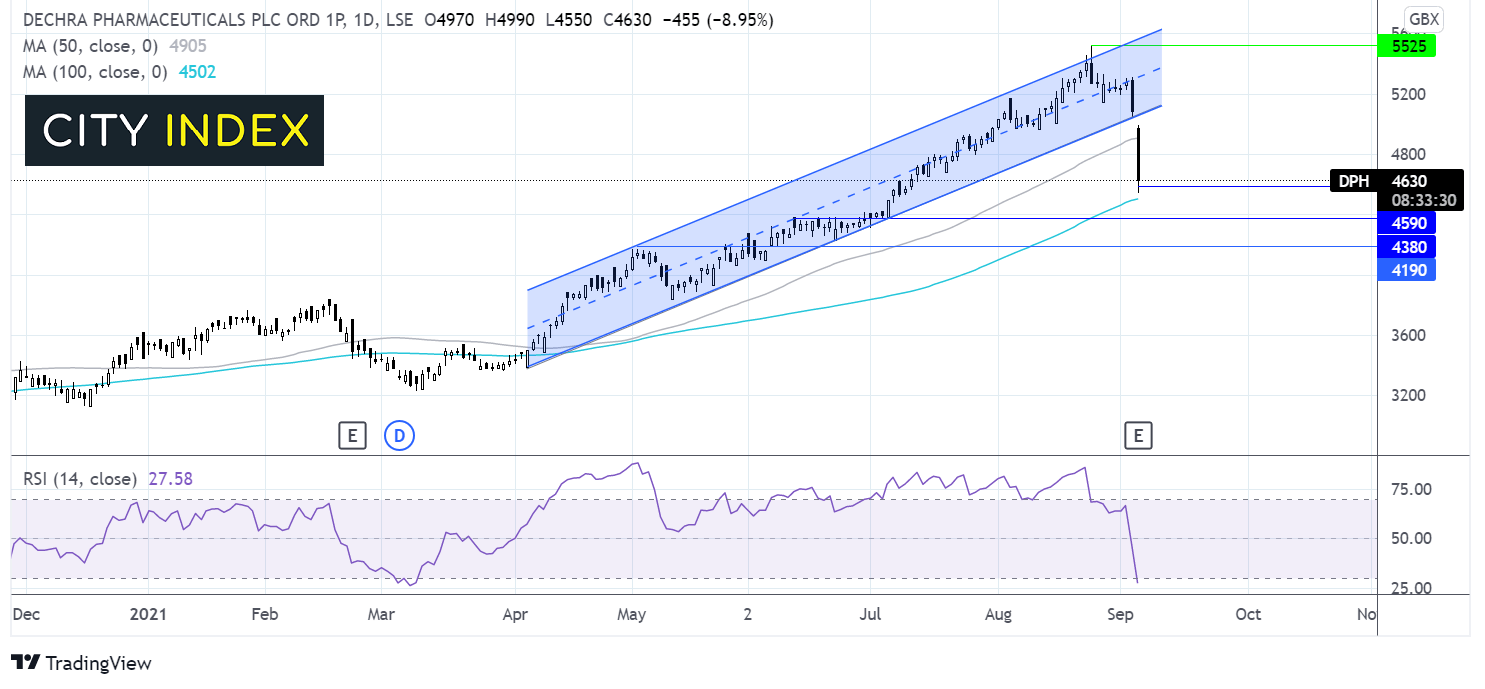

Where next for the Dechra share price?

Dechra Pharmaceuticals was trading in and ascending channel since early April. The share price struck resistance at its all time high of 5525p before rebounding lower.

The share price has broken out of the rising channel, crashing through the 50 sma on the daily chart hitting a low of 4600p.

The RSI has plunged lower although has moved into oversold territory so we could see some consolidation or a move higher to bring the RSI back above 30.

Further downside would need to break below 4505p the 100 sma. Below here horizontal support can be seen at 4390 a level which offered resistance in mid June, followed by 4190 the early May high.

On the upside, any recovery would need to retake the 50 sma at 4885 before looking to move back into the rising channel at 5065p.

Will Chinese investors show appetite for HUTCHMED shares?

HUTCHMED said it will be included in the Stock Connect programmes that link Hong Kong with mainland China, opening up its shares to more investors and traders.

The company’s shares listed on the Stock Exchange of Hong Kong will be included in the Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect programmes starting from today.

‘We are pleased to be included in the Stock Connect programs and that qualified Mainland Chinese investors will now have direct access to our shares through the Shanghai and Shenzhen Stock Exchanges,’ said chief executive Christian Hogg.

The addition comes after HUTCHMED was included in a number of indices, including the Hang Seng Composite Index – which is a key requirement for qualifying for the Stock Connect schemes.

HUTCHMED shares were trading 1.1% higher in early trade this morning at 618p, not far off the 624p all-time high hit in July. The stock has jumped over two-thirds since June 22.

Avation supports restructuring of customer Philippine Airlines

Avation said it is supporting the restructuring of Philippine Airlines after the company filed for voluntary bankruptcy.

Avation currently leases a Boeing 777-300ER aircraft to the airline but has not been able to collect rent since mid-2020. Still, Avation said the aircraft will continue to be leased to Philippine Airlines going forward.

Philippine Airlines has said its creditors, including Avation, are supporting the restructuring and has a ‘high level of confidence that the process will be completed successfully.’

Avation said a successful restructuring will allow it to restart collecting rent on the aircraft. It would also allow it to tweak payments due from the start of September 2020 and charge on a power by the hour basis, while also collecting a promissory note for the existing portion of outstanding rent.

‘The company believes that this is a positive outcome given the current market environment for twin-aisle aircraft. The outcome is that the lease will continue to its original scheduled termination, following an initial period on a power by the hour basis the lease will revert to current market rate fixed rents and maintenance reserves,’ said the company.

Avation shares were trading 1% higher in early trade this morning at 104p, marking its highest level since the middle of June.

IPO News: Petershill Partners and Foresight Sustainable Forestry plot listings

Petershill Partners announced it is considering launching an initial public offering (IPO) in London. The company is a leading investment group that provides exposure to 19 partner firms that have $187 billion worth of aggregated assets under management. Notably, the firms were previously held in private funds managed by Goldman Sachs Asset Management.

Petershill Partners says it will be a standalone business operated by the Goldman Sachs team, which have already overseen the initial investments.

The company said the partner firms are focused on different elements of the alternatives industry, an area that is expected to see 10% CAGR growth between 2020 and 2025. The company said it delivered organic CAGR of 21% in aggregate assets under management between 2018 and 2020 while distributable earnings more than doubled in that period to $310 million in the year to the end of June 2021.

‘Petershill Partners will aim to give shareholders access to the growth and profitability of the Alternatives industry in a new and differentiated model with the alignment of ownership through minority interests in a group of high quality, independent, alternative asset management firms. Shareholders will be able to share in the economics of a highly cash generative company with the primary source of income coming from stable, long-term fee-related earnings that are being generated across a significant number of funds, clients, strategies, sectors and geographies,’ said the company.

Meanwhile, Foresight Sustainable Forestry Company said this morning that it intends to join the Main Market of the London Stock Exchange by issuing up to 200 million new shares at an initial price of 100p each.

The company is an investment firm that puts money into UK forestry assets that is aiming to deliver a net asset value total return of over CPI plus 5% per year on a rolling five-year basis. It said the proceeds of the listing will allow it to sequestrate 4 million tonnes of carbon from the atmosphere through new planting.

‘The company will seek to make a direct contribution in the fight against climate change through forestry and afforestation carbon sequestration initiatives and will seek opportunities to preserve and enhance natural capital and biodiversity across its portfolio,’ said the company.

Foresight Group is the company’s investment manager. It has been involved in the UK and European forestry industries since 2016 and owns or holds the rights over £130 million worth of UK assets and a pipeline of investment opportunities worth over £125 million.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade