Top UK Stocks | BHP Shares | Just Eat Shares | BT Shares | Genuit Shares | Bank of Georgia Shares

Top News: BHP strikes transformational deal as results improve

BHP Group said it has struck a deal with Australia’s Woodside Petroleum to merge their respective oil and gas operations in order to create a new energy powerhouse as it released annual results that revealed a surge in profits and a record dividend for shareholders.

BHP shares were up over 9% this morning at new all-time highs of 2480.5p.

BHP confirmed it was in talks with Woodside yesterday and this morning confirmed the pair will merge their petroleum portfolios to create a new business that will be among the top ten independent energy producers in the world.

BHP’s oil and gas operations will be folded into Woodside, which will issue new shares in the company that will be distributed to BHP shareholders. The deal is structured so BHP shareholders will own 48% of Woodside once completed, with existing Woodside shareholders owning the other 52%.

The new Woodside will be the largest energy company listed in Australia and be in the top ten producers of LNG. The pair expect to deliver $400 million worth of annual synergies, helping free up capital to invest in projects and exploration work.

‘Bringing the BHP and Woodside assets together will provide choice for BHP shareholders, unlock synergies in how these assets are managed and allow capital to be deployed to the highest quality opportunities,’ said BHP.

Combined with BHP’s assets, Woodside will be producing over 200 million barrels of oil equivalent per day. Around 46% of that will be LNG, 29% will be oil and condensate and the rest will be gas. BHP’s core petroleum operations in Australia will join that of Woodside, which will also expand by adding BHP’s oil and gas projects in the Gulf of Mexico and Trinidad & Tobago.

The deal is expected to close in the second quarter of 2022.

BHP also released annual results covering the 12 months to June this morning, revealing a much-improved performance thanks to the rebound in commodity prices.

Revenue surged to $60.81 billion in the year to the end of June from $42.93 billion the year before, driven by a recovery in commodity prices, particularly for the likes of copper and iron ore.

Operating profit increased to $25.90 billion from $14.42 billion and pretax profit grew to $25.60 billion from $13.51 billion.

The improved performance prompted BHP to pay a record final dividend of $2 per share – equal to $10.1 billion in total. That will mean BHP is returning over $15 billion to investors over the full year.

BHP ended June with net debt of just $4.1 billion compared to over $12.0 billion a year ago.

The company also announced today that it has given the green light to the $5.7 billion Jansen Stage 1 potash project in Canada, marking its entry into a new market that it believes can create long-term value for shareholders. It said the project is in one of the best potash basins in the world and could operate for up to 100 years. The project is set to produce 4.35 million tonnes of potash per year and start producing material in 2027.

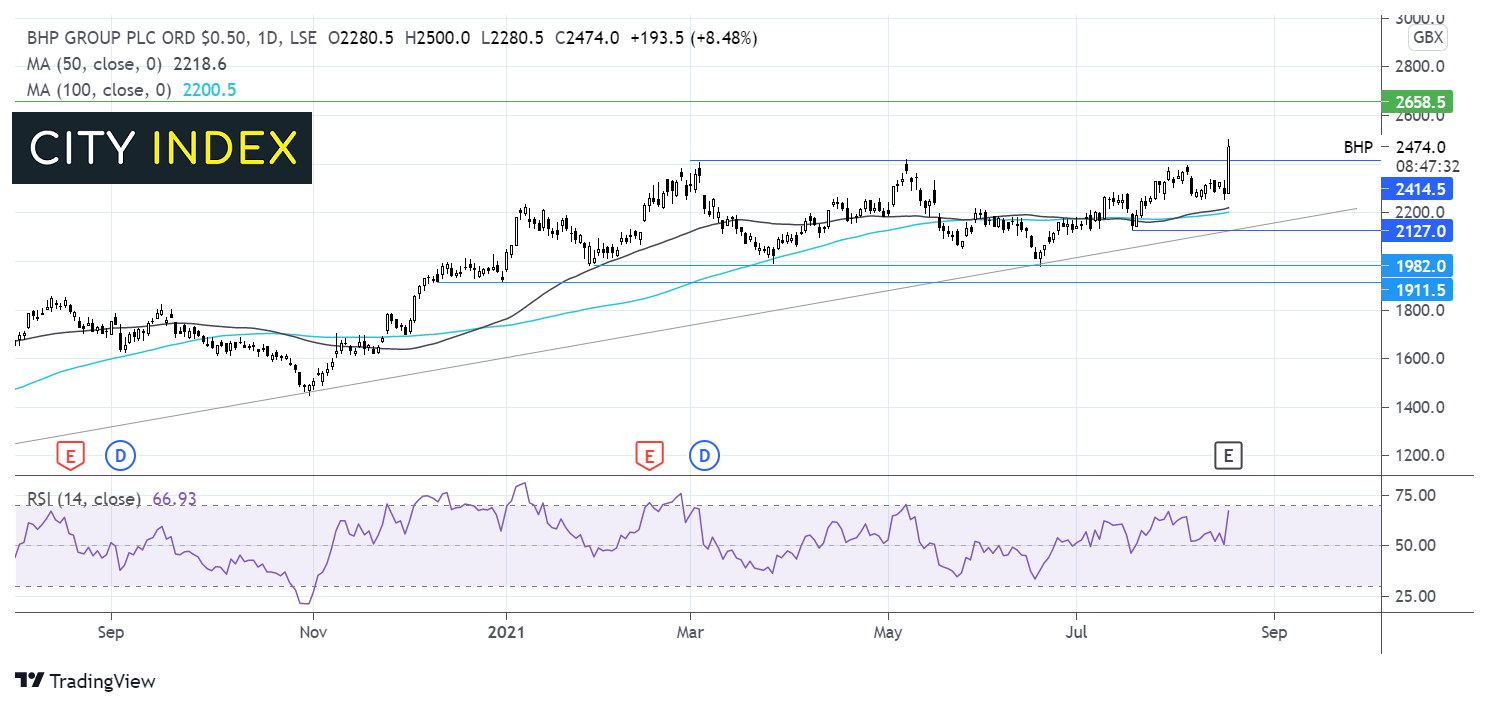

Where next for the BHP share price?

BHP has shot over 8% higher on the open pushing through its recent high of 2420p.

The share price has extended gains above its ascending trendline dating back to mid-March last year, and above its 50 & 100 sma on the daily chart – showing an established bullish trend.

The RSI is supportive of further gains whilst it remains out of overbought territory at 70. Buyers are targeting the all time high of 2650p reached in April 2011.

Immediate support can be seen at 2420p the previous year to date high and 2200p the 50 and 100 sma. A break below 2120p, the ascending trendline support and mid-July swing low could negate the current near term uptrend. It would take a move below 1987p for sellers to pick up momentum.

Just Eat Takeaway says losses have peaked and profitability will improve

Just Eat Takeaway said losses peaked in the first half of 2021 as it ramped-up investment and prioritised gaining market share over its competitors, but said profitability should steadily improve going forward.

Revenue rose 52% in the first half of 2021 to EUR2.6 billion from EUR1.8 billion as orders jumped 51% in the period. The UK remained its largest market in terms of revenue and saw growth of 81% in the period, while the acquisition of Grubhub means the US is now its second biggest market with revenue up 33% year-on-year.

Just Eat booked an adjusted Ebitda loss of EUR190 million, sliding into the red from the EUR205 million profit the year before. The company said this was down to a significant increase in investment in its key markets, predominantly in rolling-out its delivery operations, marketing, and pricing. Although costly, Just Eat Takeaway said it was starting to deliver market share gains in the likes of the UK and Australia.

In the UK, Just Eat Takeaway said it added a record number of 58 million orders to 135 million orders in the period, which it said was the ‘highest absolute growth in the sector’ and ‘double the absolute growth pace of its competitors’.

More importantly, Just Eat confirmed that adjusted Ebitda losses peaked in the first half, meaning profitability should now steadily improve going forward.

‘Improved profitability will be driven by the growth and increased scale of the business, flexibility from the widening price gap, product and technology improvements, operational efficiencies, as well as fee caps which are expected to partly fall away going forward,’ the company explained.

Those fee caps cost Just Eat Takeaway EUR142 million in the first half but have started to drop off, although they are still being used in some regions where restaurants are still struggling due to restrictions.

Just Eat Takeaway reiterated its full year expectations for order growth of 45% excluding its US brand Grubhub, with gross transaction value of between EUR28 billion to EUR30 billion. Including Grubhub, adjusted Ebitda margin should be around the minus 1% and minus 1.5% mark.

‘In the first six months of this year, Just Eat Takeaway.com continued to invest significantly, predominantly in the historically underinvested legacy Just Eat countries. Our consumer base, restaurant selection and order frequency have strongly increased, which will lead to improved profitability going forward,’ said chief executive Jitse Groen.

Just Eat Takeaway shares were trading 0.3% lower in early trade this morning at 6166.5p.

BT Group appoints Adam Crozier as new chairman

BT Group said it has chosen who it wants to succeed chairman Jan du Plessis when he steps down later this year, picking seasoned veteran Adam Crozier.

Crozier will be well known to many London investors considering he is currently chairman of hotel and restaurant operator Whitbread, online fashion brand ASOS and data and consultancy firm Kantar Worldpanel. He is also a non-executive at Sony Corp.

ASOS confirmed this morning that Crozier has handed in his resignation and will leave his role on November 28, adding that it is searching for his replacement.

BT Group shares were down 1% this morning at 173.6p, while ASOS shares were down 2.6% at 3818.0p.

He has become known for helping turn businesses around including broadcaster ITV and Royal Mail.

‘After a thorough and comprehensive process to ensure we identified the very best candidate to lead BT, Adam is the unanimous choice of the board. He has significant experience in leading public company boards, developing teams and managing stakeholders and brings a strong transformational and operational track record in large-scale executive roles,’ said BT’s senior independent director Iain Conn.

Crozier will become a non-executive director and chairman designate from the start of November and formally take up the role at the start of December, when du Plessis will officially retire.

Genuit Group says profits to surpass pre-pandemic levels in 2021

Genuit Group said its performance over the full year will be better than previously expected after delivering strong revenue and profit growth in the first half, encouraged by a recovery in its end markets and boosted by a string of acquisitions.

The company, formally known as Polypipe, said revenue jumped in the first half to £295.6 million from £173.6 million. That was partly flattered by weak comparatives from the year before when the pandemic hit, but was also well ahead of the £223.3 million booked in the first half of 2019 before the pandemic erupted.

That was partly driven by three acquisitions in the period of Adey, Nu-Heat and Plura. Genuit said two of the businesses have performed as expected while Adey has outperformed since being acquired.

Profits also surpassed pre-pandemic levels. Operating profit jumped to £36.3 million from just £6.2 million the year before and £35.2 million back in 2019, while pretax profit soared to £33.8 million from just £2.3 million last year and £31.4 million in the first half of 2019.

Genuit Group said it has decided to reinstate its interim dividend with a 4.0p payout, level with what it was paying before the pandemic hit. That came as it returned to generating positive underlying operating cashflow of £15 million compared to a £22.7 million outflow last year.

Genuit said the market outlook in the UK for the second half is ‘generally encouraging’ thanks to strong demand in certain pockets of the construction market, especially in residential. However, it warned that it is becoming harder to secure the labour it needs and that cost inflation is rising thanks to higher prices for raw materials and transport costs. Still, although it said it was taking action to mitigate this, it said this posed ‘some risk’ to its financial performance for the rest of the year.

‘Trading has started well in the second half, and the board now expects that underlying operating profit for the full year will be ahead of previous management expectations,’ said Genuit Group.

Back in May, Genuit Group said it was aiming to deliver underlying operating profit of £80 to £88 million over the full year. That would mark a bounce back from the £42.2 million delivered in 2020 and surpass pre-pandemic levels from the £78.1 million profit booked in 2019.

Genuit shares were up 0.8% in early trade this morning at 649.0p.

Bank of Georgia bounces back but warns of more uncertainty

Bank of Georgia said profits surpassed pre-pandemic levels in the second quarter as the economy started to rebound once restrictions were lifted, but warned uncertainty lingers over its outlook now that the government has reintroduced rules this month to battle a surge in cases.

Bank of Georgia shares were up 1.4% in early trade this morning at 1533.0p.

Operating income rose 39.8% year-on-year in the second quarter to GEL335.0 million, driven by higher interest income, fees and commissions. That, combined with a milder rise in operating costs of 15.8% and an improved cost of risk meant net operating income surged 79.2% to GEL222.9 million.

Pretax profit jumped 80.9% to GEL222.8 million from GEL123.2 million and profit at the bottom-line increased 76.3% to GEL202.2 million from GEL114.7 million.

The second quarter benefited as Georgia started to reopen its economy in March 2021, having plunged the country back into a partial lockdown back in November following a rise in coronavirus cases. Still, the restrictions on travel and the lack of tourism has placed pressure on the country’s GDP, which has continued to decline this year after contracting over 6% last year.

But the bank said the economy swiftly gained traction once restrictions were removed, with the economy performing much better than expected in the second quarter as a result. Real GDP is forecast to have come in at 29.8% in the second quarter, more than enough to offset the contraction seen in the first quarter.

‘Robust growth in remittances and exports, and a faster than expected rebound in tourism, along with fiscal stimulus, have supported the recovery. Notably, the economy already surpassed the pre-pandemic level as the estimated real GDP growth compared to the second quarter and the first half of 2019 was 12.6% and 5.7%, respectively,’ said the bank.

Remittances were up over 40% in the first half of 2021 and over one-third higher than pre-pandemic levels, and exports have also surpassed what was seen in 2019. Tourism is still way below pre-pandemic levels but is rebounding.

But the threat posed by the pandemic remains, with Georgia having suffered a severe rise in cases over the last two months, prompting rules to be reintroduced by the government, which has caused uncertainty going forward.

‘Although vaccination rate is currently low, immunisation progress has significantly accelerated since end of July, which is encouraging, and the government has sufficient vaccine doses secured for 2021. The COVID-19 pandemic still remains one of the key uncertainties in our growth outlook and is a risk factor to derail the recovery, unless more than half of the population is vaccinated by the end of the year. High inflation and the possibility of further tightening of the monetary policy rate by the NBG may also have a significant impact on the growth outlook,’ the bank warned.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade