Top UK Stocks | BHP Shares | Ultra Electronics Shares | Lloyds Shares | Future Shares

Top News: BHP considers merging petroleum business with Woodside

BHP Group said it is conducting a strategic review of its petroleum business and considering merging it with Australia’s Woodside Petroleum as it looks to exit fossil fuels and boost returns for shareholders.

Media reports over the weekend suggested BHP was facing pressure from investors to reduce its exposure to fossil fuels. BHP has already sold-off some of its coal assets and exited from its US shale operations back in 2018.

Its petroleum business is currently anchored in Australia and the Gulf of Mexico, and its exposure to oil has always made BHP standout from its mining peers. BHP produced around 102 million barrels of oil equivalent per day last year, less than half what it was producing three years earlier.

‘BHP confirms that we have initiated a strategic review of our Petroleum business to re-assess its position and long-term strategic fit in the BHP portfolio. A number of options are being evaluated,’ said BHP in a short statement this morning.

‘One option is a potential merger of the Petroleum business with Woodside Petroleum Ltd and a distribution of Woodside shares to BHP shareholders. We confirm that we have been in discussions with Woodside. While discussions between the parties are currently progressing, no agreement has been reached on any such transaction,’ BHP added.

The news comes ahead of BHP releasing annual results on Tuesday, with Woodside expected to release results the following day.

Analysts estimate BHP’s petroleum assets could be worth somewhere in the region of $13 billion to $15 billion.

Where next for the BHP share price?

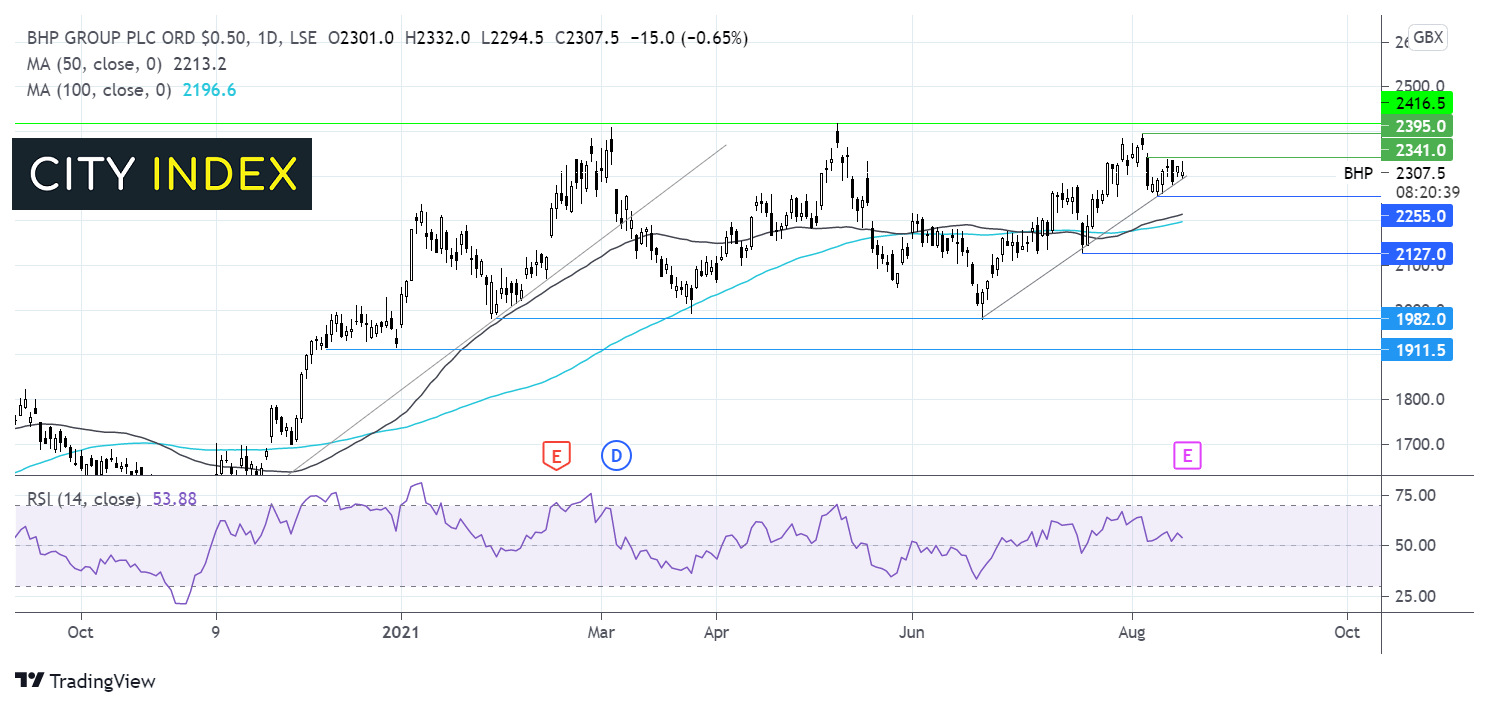

BHP Group share price has been trading rangebound across most of 2021. The share price has rallied from 1980p a low struck in mid-June to a recent high of 2400p in early August. It is trading above its ascending trendline dating back from mid-June. It trades above its 50 & 100 sma on the hourly chart, the 50 sma recently crossed above the 100 sma in a bullish signal. Meanwhile, the RSI is providing few clues, sitting at 50 mid-point.

Support can be seen on the ascending trendline at 2290p. A break below this level at 2255p the August 9 low and 2200p the 50 & 2190 the 100 sma. A break below here could negate the near term up trend. A move below 2127p could see the sellers gain traction. A move below 1982 could signal a break out trade with support seen at 1918p.

On the upside, a move above resistance at 2340p could see the buyers target 2395p the August 4 high. A move above 2416p could see a breakout to the upside.

Ultra Electronics accepts £2.6 billion takeover offer from Cobham

Ultra Electronics said it has recommended a £2.57 billion takeover offer from Cobham after the firm bumped up its valuation since talks started last month.

This morning, Ultra Electronics said it has accepted an offer worth £35 per share in cash plus a 16.2 pence dividend to be paid in September. That marks a 63% premium to Ultra’s share price before talks opened last month, when Cobham tabled an initial bid of £28 per share before being rebuffed.

Ultra Electronics shares surged 4.5% in early trade this morning to £33.12, having hit a new all-time high soon after the opening bell.

The deal, if approved by shareholders and regulators, will create a leading powerhouse in electronics used for critical systems used by the likes of US and UK defence departments.

Cobham was previously listed in London until it was taken private by Advent International in a £4 billion deal last year.

Cobham said it has recognised the importance of Ultra to the UK’s national security, and said it has agreed to offer legally enforceable commitments to the government in order to protect the business and ensure it can fulfil its obligations under existing contracts.

‘We believe Cobham and Ultra's complementary capabilities delivering mission critical technology will be significantly enhanced through the combination of the two groups, enabling the development of higher performance solutions for our customers,’ said Shonnel Malani, chairman of Cobham.

‘We recognise the important role that a combined Cobham and Ultra will play in 'five-eyes' defence and are committed to protecting the continuity of supply to the UK and our allies. We look forward to working with HM Government, and other relevant stakeholders, to agree legally binding commitments which safeguard Ultra's contribution to the UK economy and national security,’ Malani added.

New Lloyds chief executive takes charge

The new chief executive of Lloyds Banking Group, Charlie Nunn, has officially taken up his role and will lead the bank from today.

Nunn is taking over after Antonio Horta-Osorio resigned earlier this year following a decade with the bank and took up a role at Swiss bank Credit Suisse. Nunn is joining Lloyds after a nine-year stint at HSBC, where he most recently held the role of running its wealth and personal banking operations.

Nunn will be paid a basic salary of £1.12 million per year and a fixed share award worth £1.05 million per year, with flexible funding provided up to 4% of his basic salary. If all goes to plan, Nunn could be awarded shares worth up to 140% of his basic salary.

Nunn is expected to provide a boost to Lloyds in two key areas – wealth management and its digital operations, both of which are thought to be priorities for Lloyds going forward.

William Chalmers, who has been in the CEO seat on an interim basis for the last three-and-a-half months, will now revert back to his role as chief financial officer.

Lloyds shares were trading 0.8% lower in early trade this morning at 46.02p.

Future buys media subscription business Dennis

Future, the media organisation boasting brands from Amateur Gardening to Cycling Weekly, said it has purchased a leading consumer media subscription business named Dennis for £300 million.

Future shares soared 5.3% higher in early trade this morning at 3892.0p, marking a new all-time high for the stock, which has more than doubled in value since the start of 2021.

The deal will see Future add The Week news brand in the UK and the US to its portfolio plus MoneyWeek, Kiplinger, Science & Nature, IT Pro, Computer Active, PC Pro, Minecraft World and Coach.

Together, those titles reach around one in three Americans online, with Dennis making just over half of its revenue from the states.

Future said it is not buying titles including Viz, Fortean Times, Cyclist and Expert Reviews – all of which will be retained by the current owners of Dennis.

Future plans to use its technology to help push the brands online and explore the ecommerce opportunities they offer. The wealth titles such as Kiplinger and MoneyWeek will also expand its already sizeable portfolio of titles in the UK and the US, while ‘knowledge’ titles like The Week will also provide a significant boost to subscriber numbers.

Importantly, Dennis generates around 75% of its revenue from subscriptions.

Dennis reported revenue of £104.8 million in 2020 and Ebitda of £20.0 million, having grown by 12% and 14% from the year before, respectively. Growth has continued, with revenue up 16% during the 12 months to the end of June 2021. The company currently has gross assets worth £210.0 million.

Future said the additions will boost earnings in the first full year of ownership, and the firm believes it can deliver £5 million worth of annual cost savings.

Future is paying the £300 million using a £600 million debt facility that it secured last month, but said it plans to ‘rapidly de-lever’ once the deal is completed.

‘I am delighted to announce the acquisition of a high-quality portfolio of Dennis' trusted brands that will accelerate our strategy, enhance our content capabilities and bring additional geographical and vertical revenue diversification, whilst materially increasing the proportion of recurring revenues across the group,’ said chief executive Zillah Byng-Thorne.

‘The materially earnings enhancing acquisition is highly complementary to our longstanding 'US first' mindset and provides an attractive opportunity to scale our recently created 'Wealth' vertical, whilst diversifying our presence in our 'Knowledge' and 'B2B Pro Technology' verticals,’ he added.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade