Top UK Stocks | IAG Shares | Foxtons Shares | Draper Espirit Shares | Accsys Shares | Pennon Shares | Ryanair Shares | EasyJet Shares

Top News: Airline stocks under spotlight amid potential traffic light change

Airline stocks are in play this morning amid reports that the UK is set to make major changes to the rules for international travel later today.

Prime minister Boris Johnson said on Monday that the government was considering simplifying the current traffic light system and looking at ways of making the testing requirements less burdensome for people returning to the country. There have also been suggestions that PCR tests could be scrapped in favour of cheaper lateral flow tests in order to bring prices down. Fully-vaccinated travellers could also no longer be required to take tests when travelling.

Reports also suggest that green and amber lists could be combined into one new category, splitting nations into those that are low-risk and those that are on the red list, which the government is also keen to slim down.

There are over 60 countries on the red list at present. The Times reported Turkey will be taken off the red list in time for the school half-term this October, while other countries like Mexico, Pakistan, South Africa and Argentina are also rumoured to be potential candidates to be taken off the red list.

Airline shares rallied yesterday on the news. Ryanair and easyJet both closed up 7.5%, IAG rose 3.8% and Wizz Air gained 5.1%.

This morning, airline stocks continued to find higher ground, although some were soaring higher than others. IAG shares were trading up over 4%, Ryanair was up more than 2%, while Wizz Air and easyJet were experiencing smaller gains in early trade this morning.

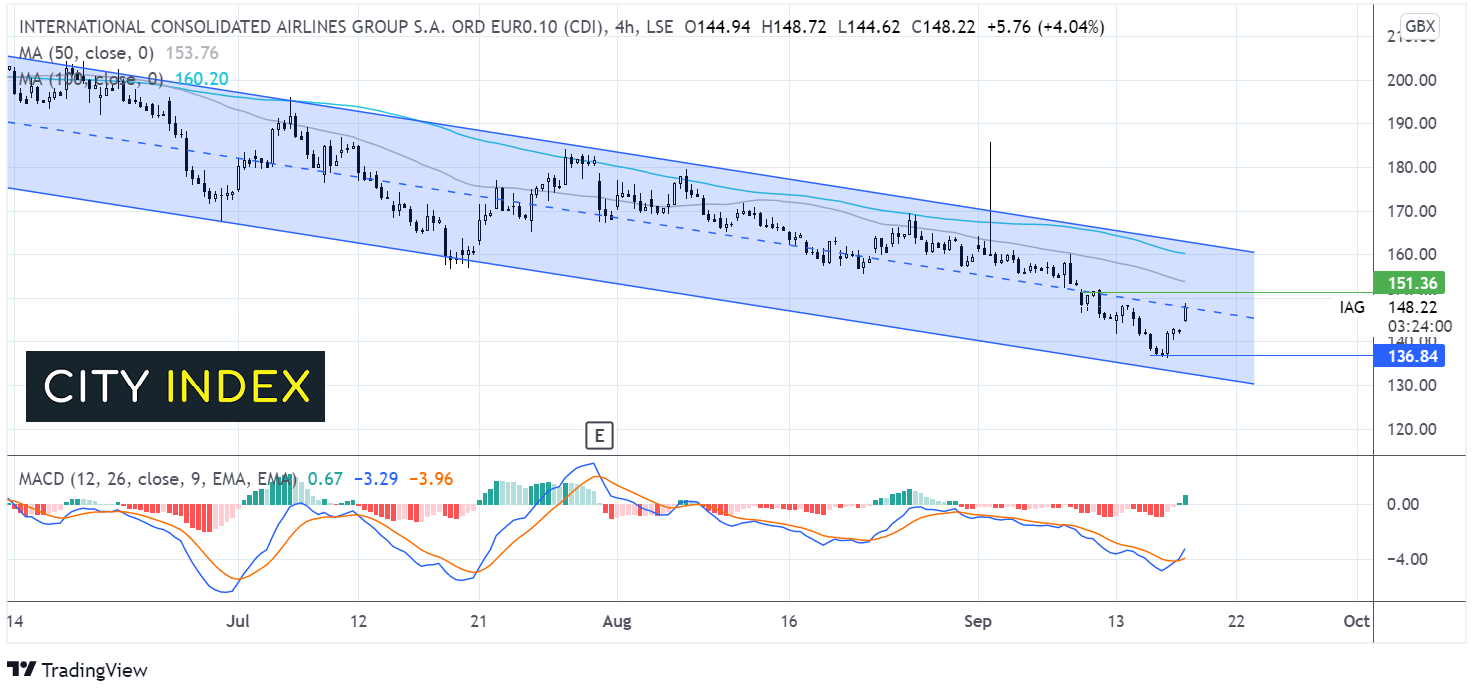

Where next for the IAG share price?

The IAG share price has been trading within a descending channel since early June. The price hit support at 136p earlier in the week and is rebounding for a second straight session.

Whilst the trend is still clearly bearish, the bullish crossover on the MACD is keeping buyers optimistic.

A move above horizontal resistance at 150p is needed negate the near term down trend. This could open the door to 153p the 50 sma on the 4 hour chart and 160p the 100 sma and a level which capped gains in early September. A move above here could change the longer-term bias and see buyers gai traction.

Failure to retake 150p could see the share price head back towards 137p the weekly low.

Foxtons appoints Nigel Rich as new chairman

Estate agent Foxtons has announced Nigel Rich will become the company’s new chairman at the start of next month, replacing Ian Barlow as he retires.

Rich has over 50 years’ experience working with listed businesses in the UK and overseas. He will be most well-known for being the chairman of warehouse operator Segro between 2006 to 2016. Rich has also been chairman of estate agency Hamptons International, Exel, CP Ships and Xchanging in the past, and held non-executive positions at the likes of ITV and Harvey Nichols.

Currently, Rich is non-executive chairman of Urban Logistics REIT and a senior independent director of AVI Global Trust.

‘I am delighted to take on the chairmanship of Foxtons, a leading and well-known London estate agency. As the UK, including London, recovers from the economic effects of the pandemic Foxtons is well placed to take advantage of the resurgent activity in the residential market. I look forward to working with the management team to accelerate Foxtons' recovery and returns to shareholders,’ said Rich.

Rich will be paid £150,000 per year, of which £50,000 will be paid in shares based on the market price at the time.

Foxtons shares were trading 0.4% higher this morning at 52.2p.

Draper Espirit sees uplift in investments during 2021

Venture capital firm Draper Espirit revealed it has seen a significant uplift in value of its investments in tech provider Form3 and online car retailer Cazoo as it announced it has continued to deploy money into new and existing investments.

The company, which invests in fast-growing digital technology businesses, said it has continued to see an acceleration in the number of opportunities in the market, prompting it to invest £130 million since the start of 2021. That has been deployed in eight new investments and six follow-on investments.

This included an additional £25 million being invested in Form3. That was made as part of a wider $160 million funding round by the company that was led by Goldman Sachs and also drew investments from other investors including Lloyds Banking Group, Barclays and Mastercard. FORM3 was founded in 2016 and has emerged as a leading provider of payment technology that is used by banks and fintechs to underpin their critical payments infrastructure. The latest funding round means Draper Espirit’s stake in Form3 is worth around £58 million. Stripping out the latest £25 million investment, the company’s stake has increased in value by around £23 million from its last valuation back in March.

It also included a further £15 million investment in CoachHub as part of a $80 million funding round this month. The company runs a talent development platform that allows companies to create personalised coaching programmes for their workforces, underpinned by the use of artificial intelligence that connects users to certified coaches.

‘Our recent activity has demonstrated the strength of our portfolio and our investment team, and we have been able to participate in follow-on rounds in some of the more established businesses in our portfolio, such as CoachHub and Form3,’ said CEO Martin Davis.

Meanwhile, Draper Espirit said its investment in Cazoo is now worth around £37 million, up from just £26 million back in March, after the online car retailer listed in the US through a SPAC deal. Cazoo raised $1 billion as part of the deal and ships cars to people’s homes across the UK and Europe.

‘Cazoo's IPO is further evidence of this, as in only three years, it has established itself as one of the most significant players in the European used car market. As we recover from the pandemic, the technology sector continues to go from strength to strength and we are well positioned to continue to support the most promising companies,’ said Davis.

Draper Espirit shares were trading 0.6% higher in early trade this morning at 1049.0p.

Accsys Technologies benefits from higher volumes and prices

Accsys Technologies said it delivered solid sales growth of its wood products over the last five months, driven by higher volumes and prices, as it continues to rapidly expand with the view of increasing output five-fold over the coming years.

Accysys shares were trading 1% higher in early trade this morning at 156.5p.

The company’s core products are the Accoya and Tricoya real solid woods, which it markets as a benchmark for material performance, finish and sustainability. Accoya wood is used to create everything from windows and doors to decking and cladding, while Tricoya is an improved alternative to MDF panels.

Accsys said revenue from Accoya jumped 31% year-on-year in the five months to the end of August to EUR40 million. That is also 22% higher than pre-pandemic levels and includes a 10% jump in sales of Tricoya, the company said.

That was the result of an 18% increase in volumes twinned with higher average selling prices.

Accsys said the higher prices reflects a mix of strong demand and rising raw material costs, which have been cited by a number of industries in recent weeks and months. Accsys said inventory levels of wood remained low in the period due to the challenges in the supply chain, and said this is expected to remain the case for the rest of its financial year.

It also said the integration of the Accoya Color assets that it purchased in the UK earlier this year is ‘progressing well’, having produced its first batch of colour products during the period.

Accsys ended August with EUR8.3 million in net cash, having improved from the EUR12.2 million net debt position at the end of March. The balance sheet has strengthened following the equity raise back in May, with funds being used to invest in raising capacity in the UK and the Netherlands.

In the UK, Accsys is constructing a new Tricoya plant in Hull and that should be up and running by July 2022. In the Netherlands, it is expanding an Accoya plant in Arnhem with the aim of having that operational within the first three months of 2022. It should have around 33% extra capacity at Arnhem once that work is complete.

Meanwhile, Accysys is also advancing its joint venture in the US for Accoya with Eastman Chemical Corp. The pair are yet to make a final investment decision on building a new Accoya plant in Tennessee that would replicate what it already has at Arnhem. The pair hope to have the plant constructed by the middle of 2023.

‘Looking ahead, we remain confident in delivering on full year expectations and underpinned by the clear market opportunities for our high-performance wood products, we continue to progress towards our ambitious 2025 fivefold increase in production target,’ said CEO Rob Harris.

CMA to investigate Pennon’s purchase of Bristol Water

The UK’s Competition & Markets Authority said it has launched an investigation into Pennon Group’s acquisition of Bristol Water to evaluate whether the deal has lessened competition in the market or adversely affected the UK’s water industry.

Pennon completed its acquisition of Bristol Water earlier this year for £814 million, or £425 million when Bristol Water’s debt is included. Pennon, which already owns Southwest Water, added Bristol Water’s 1.2 million customers as a result. Pennon said it was keen to improve the business to deliver ‘enhanced resilience and water security’ to customers.

However, this morning the CMA said it was now looking at whether the deal ‘has resulted, or may be expected to result, in a substantial lessening of competition within any market or markets in the United Kingdom for goods or services.’

It is also concerned that the merger makes it tougher for Ofwat to compare the handful of water companies operating in the UK.

The CMA has invited comments from interested parties by October 1.

Pennon shares were largely unmoved by the news in early trade this morning, trading broadly flat at 1246.5p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade